前言:这篇文章想记叙一下自己基于周期的思考,之所以不想把之称为一个“思考框架”,是不希望“框”和“架”这样的名词限制这种思考的延续,同时框架给人一种既成的感觉,然而世界的变化让思考无法一劳永逸。即便是一种框架,亦随时间和事件的出现不断自我变更和完善。这里不用“进化”一词,系因不同的思考适应不同的市场环境,不存在一种形态优于另一种形态 — 这种思想本身也是禁锢的(因为禁锢了回溯的可能,而回溯的前态可能在某一种市场环境下更有效)。总之,希望抵达的,是试图保持灵活,但又提纲挈领。

我很欣赏卡尔波普尔和他的批判理性主义,这种偏好延续至今,也影响自己的投资生涯。投资是艺术,是科学,而其科学的部分,是人类认知中总体不可降解了的假设(conjecture/hypothesis),是创造性想象出来为解决具体历史-文化背景下的问题的,因此也不存在一尘不变。所以,逻辑上,没有经验测试层面上可以实证(positive)确认某科学理论的,但反例的存在可以证伪—在投资中,这种反例在市场中的演绎往往是最出色的投资者的命门,因此个人投资者的认知,必须从动态的视角不断完善和迭代。

何为周期

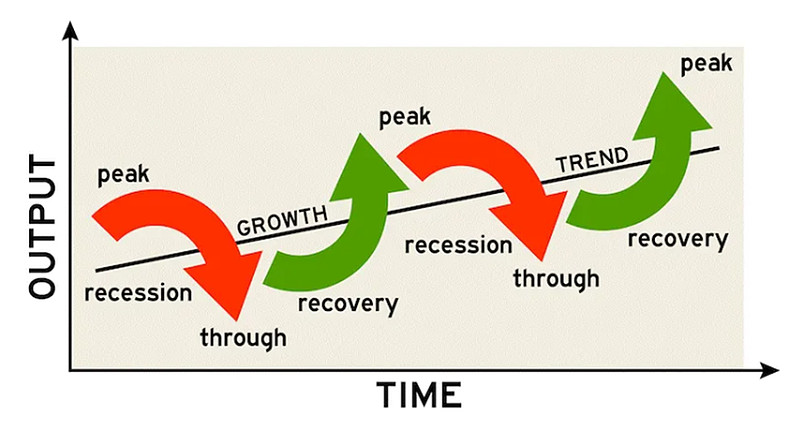

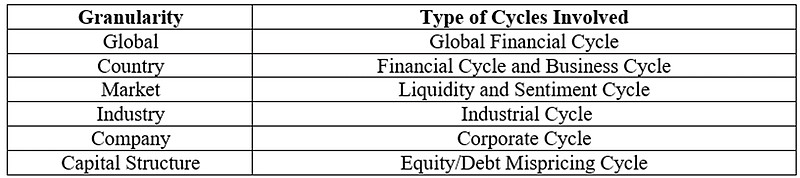

周期的类型有很多种,上面列举的定义,大多数投资者理解起来不会有困难。

宽泛地说,周期就是金融行业的潮汐,因为资金的涌入和流出而潮起潮落,随之带动资产价格的波动,而这种波动,可能产生价格与价值的偏差,让海滩边的拾贝人有利可图。

从投资者的角度,我感兴趣的是流动性与情绪驱动的市场周期,工业周期,企业自身的周期,和资本结构定价偏差造成的资产结构套利周期。国家层面的大下行周期是一个杀伤范围很大的风险,但不意味着行业,企业,资本结构,和市场角度没有机会。

为何周期

每一个投资者的成熟过程而言,本身都是一个不断寻觅和迭代适合自己的投资范式的过程,各种方法之间无所谓高下,只要能形成一个完备的逻辑体系即可。

周期对我这样一个从小爱读《红楼梦》,爱背“好了歌”的人来说很直觉,很亲切,而我自己的博士项目做的就是商品周期的研究,而且这套方式在过去几年的重复使用中不断为我攫取了极高的投资回报,便自然变成了我的工作假设(working hypothesis),直到反例的出现,不断完善该体系。

我本身是一个喜欢极为广泛地涉猎各个领域的人,而不喜欢钻到几个细分里面去。不喜欢深研某一个或几个行业给我从前的就业选择造成了很大的障碍(因为大多数基金喜欢招专才),但我相信与其自愿地将自己献祭到某个基金,变成资本社会的一颗螺丝钉,去被剥削,那还不如自己掌握大成的方法,去做那个“剥削者”。这种“专才”的打法,几乎限制了从业者必须把自己框定在某个行业,因此超额收益也必然与该行业强相关。

使用“周期”逻辑的好处在于不需要对任何一个行业有执着 — 事实上,每个我涉猎的大型周期性机会,都是行业的资深投资人士被闷杀在里面形成的机会。这种机会当然需要甄别,最好的就是去聆听该行业内资深人士的正反方观点,然后作为一个没有仓位的人去做判断。

但现在管基金,就没有办法使用,毕竟“空仓干等”只是个人投资者的权利。这种情况下,采用的修补方式就是广泛散布仓位到各个行业,预期在没有断层/周期性机会的情况下小幅跑赢,甚至小幅跑输指数,在大断层情况下,如惊涛骇浪下出现大幅波澜的浩瀚海洋,去向低洼地做集中突破,一如粟裕在十大战役中,动态移动积极寻找战机。

另一个使用“周期”的好处,在于其对于资本市场存在必然性,她必定会在某个时点,在某处发生,无论是哪一种周期,她都是资本市场发展过程中必然出现的产物,就如同每天早上太阳会升起,每年的春天会回暖一般。而大下行周期中,只要对一个行业有一定的理解,选出好的公司,难度并不大,因这类机会,往往变得显而易见。

以下介绍几个自己亲历过的周期性机会。

行业与情绪周期

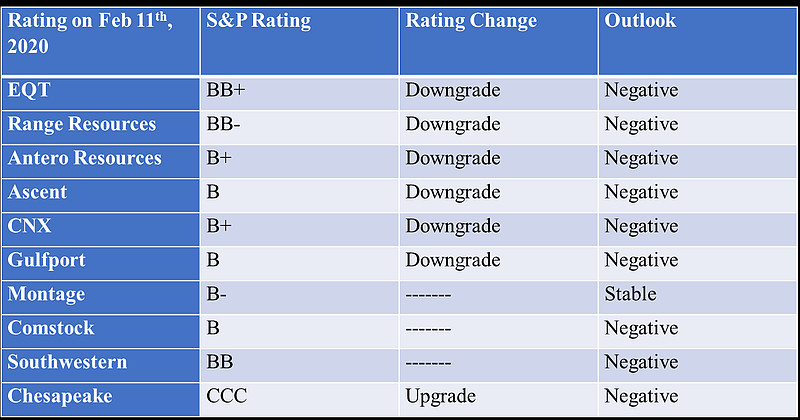

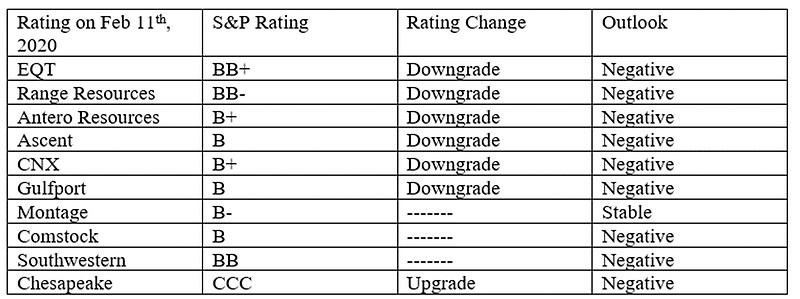

2020年2月11日,由于前一年的暖冬,天然气价格已经回到了1995年的价位,标普全球系统性降低了所有天然气生产厂家的评级。

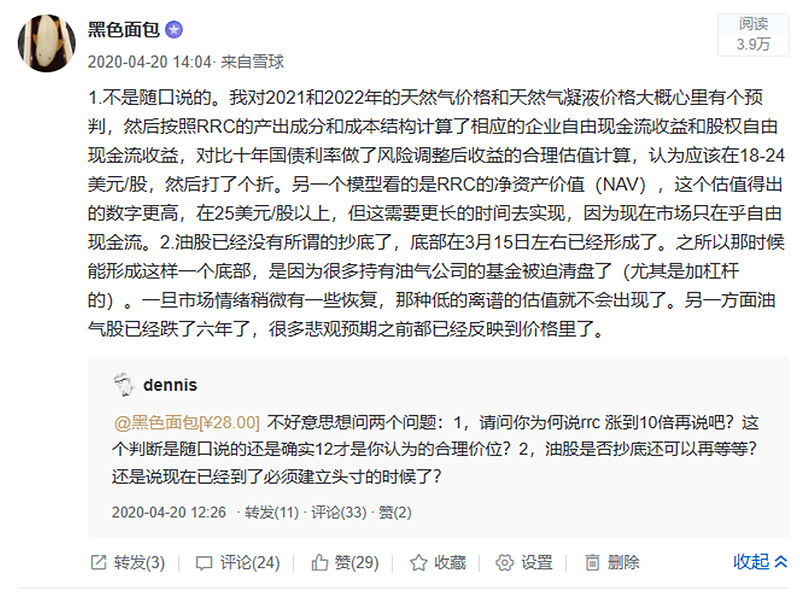

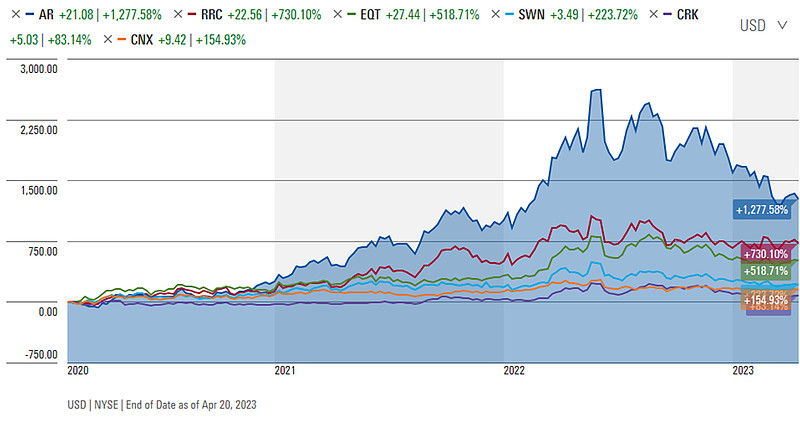

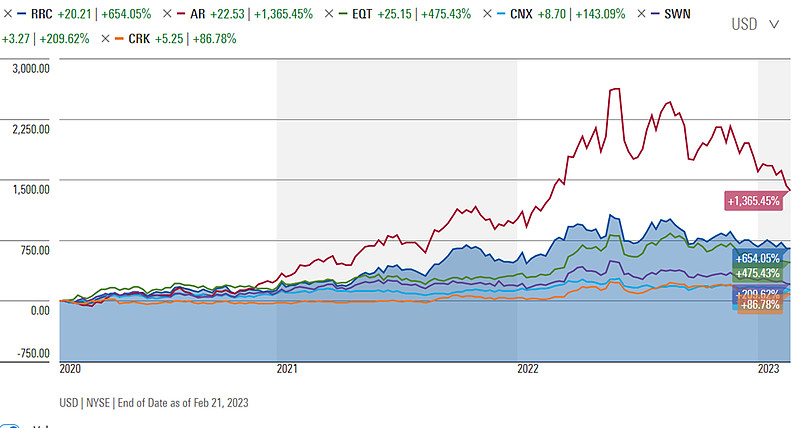

随之而来的新冠更是重创了该行业,许多能源封闭式基金被迫清盘。因此这是一个行业周期叠加情绪/流动性周期的案例。然而事实上,由于页岩油厂家关井,造成了1/3的天然气供应(伴生气)收到阻碍,后来天然气价格飙升,这些公司的股价也有极好的涨幅。

当几个周期叠加共振的时候,其能够产生的超额回报,可以非常惊人。这也是我作为个人投资者的最后/决胜一战。

流动性周期

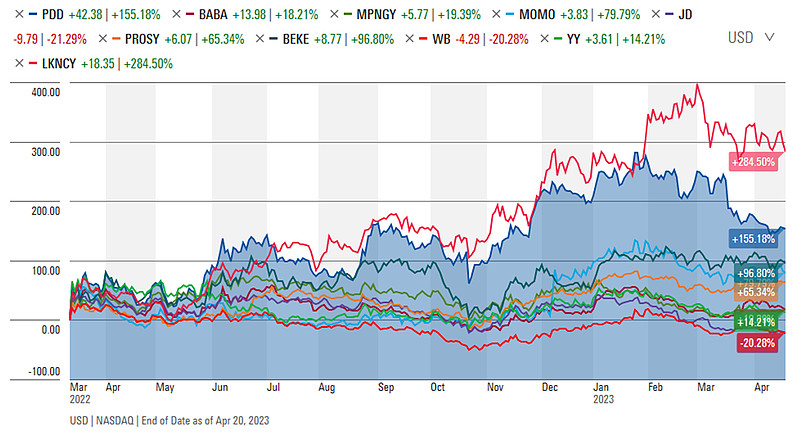

2022年3月,我们知道不少投资中概股的基金都被迫减仓,那种流动性稀缺呈现的机会,也给予了很好的获利契机。由于这个板块里的标的具有异质性(彼此的行业重叠度有限,不像天然气行业那么均质),因此表现有差异。

事实上,我在参与这个周期的过程中,也选中了一些“狗”,比如微博,欢聚时代,但由于拼多多和贝壳的出色表现,因此作为一个集合,最后业绩仍非常出色,尤其是在美股大跌的情况下,该板块为我提供了源源不断的弹药(现在基本没有中概的持仓了)。这里不对称的赔率成为了获利的关键。

不过,当时判断资金抽离导致竞争减少,变成一个行业资本周期的预判没有实现,比如年初京东准备开打价格战,国内的几个龙头继续卷。因此这本质上只是一个流动性周期的机会,流动性周期结束,周期逻辑也就结束了。当然,如果竞争减缓,股东回报增厚,自然是另一个故事,这也是投资需要动态评估的部分。

企业与资本结构周期

企业周期,每一个公司都会经历。就像人一样,企业有上升,有回调,有衰退,也会时不时犯错,比如优等生考了一次不合格,在市场的外推逻辑下被低估,从而出现事件性的买入机会。

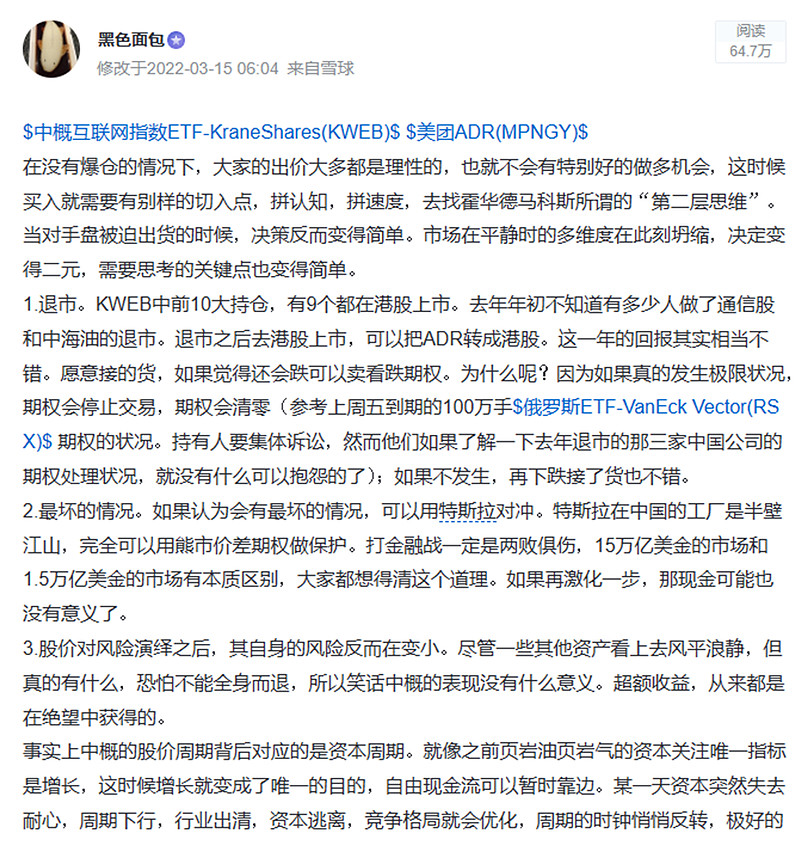

SRG是一家房地产信托公司。2021年5月21日,球友问到这个公司的时候,我看不到流动性好转的迹象,因此选择的是不参与。但2022年3月,公司明确表达想要探索战略其他方案(strategic alternative),因此整个逻辑也发生了变化 — 从自由现金流估值变成了清算价值。

这个公司值多少钱,很多市场参与者心里是清楚的。因此对我而言,这个决策就是一个查理芒格所谓的"cinch"。由于这时候我已经是投资组合管理者(PM)了,因此在保守原则下,尽管我对SRG的清算价值估值在15美金以上,但我还是采用通过优先股的方式参与,因为除了给我10%左右的买入年化分红与上升空间之外,还因其安全性,给了我重仓的选择权。同时,通过比价,我发现SRG-PA的年化收益当时在75%左右(算上分红),而正股的收益在150%左右,但这个收益预估是高度不确定的,且由于伯克希尔的20亿美金的债务形成了巨大的压迫性杠杆,从风险调整后收益角度SRG-PA的综合回报率更好。事实印证了这一判断 — 当时市场在不同的资产结构上犯了错。

行业与资本结构周期

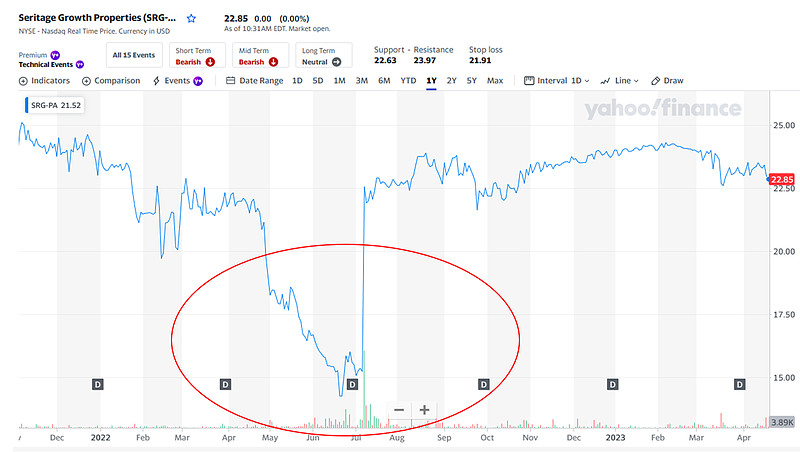

2022年以来美联储不断加息,造成部分银行的持有到期与待售类权益大幅下跌,包括阿莱恩斯银行(Western Alliance)。

但这次周期性的利用,是有瑕疵的,我会分析我的问题。

3月10日星期五,WAL盘中因硅谷银行被接管的连带溅射伤害,直接砸到了32美金。公司在中午出了公告:

这是很简单的算数,即所有流动性可以覆盖所有的非FDIC受保存款。WAL不存在关门的可能。我迅速建立了一个2%左右的头寸,一个半小时内这个公司的股价都在逡巡,看得我和一名佛州的银行基金经理一头雾水,后来飞速拉升,到盘尾收在了49美金/股。当时我以为自己做了一笔很好的交易。

周末,签字银行(Signature Bank)也被接管,恐慌蔓延,WAL盘前下挫到了13美金/股,早上一路跌到了7美金/股。我的一名投资人发给我一个消息,说这个公司被耶伦点名了。那时候我已丧失加仓的勇气,系因什么都不知道,信息上没有优势。公司发了公告澄清,股价当天翻了四倍,一个早上被我心理清零的公司突然又回来了。

这次运用周期逻辑的主要还是仓位上的问题 — 因为尽管WAL是一个2%的头寸,但我还有其它的银行仓位,因此当持仓板块遭到重创,很难再在没有信息的优势下大幅集中兵力再战。

不过,资本周期层面的机会让我翻盘。

既然我知道从流动性角度WAL不会倒,那么其优先股,和SRG的案例一样,就应该是很好的投资机会。当优先股也从一周前的位置下挫60%+的时候,这就是送钱。后来几天我也假装客户多方对WAL的储蓄开户情况进行了求证,发现大量FRC和SVB流出的资金去了WAL那里(因为FDIC可以担保25万美金的存款),更加让WAL-PA价格的错配变得明显。那两天的天量,让我可以很快将之变成我们的第一大持仓。

仅仅一个月出头,优先股就已经翻倍了,同期还吃了26美分的分红(按买入价大概是3%左右的季度红利)。

周期逻辑的软肋

周期的本质是均值回归,而这种均值回归的思路,必然会导致三类短板。对这些风险和短板的了解,一定程度上也可以消弭他们对这种操作思路造成的不可逆伤害。

第一,放过冲浪型企业。很多企业可以长盛不衰,或者说,其超额收益可以延续十余年甚至数十年,而周期的思路会导致抓不住这类企业,造成昂贵的“机会成本”。对于这一点,我是选择主动放弃的。尽管我听过很多了不起的抓住长牛的故事,比如李国飞总先是万科再是腾讯几百倍的回报,但客观地说,我现在看到的是他在阿里和平安上的严重误判。如果他那样洞若观火的投资人都不能集中投资连续抓住长跑冠军,我凭什么觉得我可以?我选择“守拙”,用笨办法,帮我的投资人,赚我看得懂的钱。

(PS: 我最近在看一家区域性银行,和阿里是差不多同一时间上市的。即便最近银行板块跌成渣渣,但其上市以来算上分红的年化回报仍然有6.7%,而阿里呢?你猜你猜。)

第二,均值不回归,即林奇所谓的“一片漆黑之前,总是最黑暗的"(It's always the darkest before pitch black)。利用周期本质是逆向的(contrarian),而集中逆向+自信的错误就可能毁掉一个投资人的一生,我们见过很多类似的案例。菲利普费雪曾经对此说,逆向的时候最好有很高的正确的置信度,而不是为了逆向而逆向。汽车出现时马车股都很便宜,但后来,他们(马车公司)都消失了。因此,逆向之前要非常清楚均值回归的底层逻辑,比如天然气未来十年需求还会增长,中国的经济还会增长,美国还会需要银行体系且该体系目前看不可能被分布式金融(DeFi)颠覆等等。没有办法比你的对手盘更好地驳斥自己的观点,就不配拥有这个观点。

第三,介入过早/对周期长度的误判。我介入能源行业,就早了两年。所幸后来等到了一个超级周期,同时那时本金小不断有资金补入,因此最后的收益非常可观,但未来在基数很难不断被补充的情况下,集中性地过早介入,就意味着极大的机会成本。就像卡拉曼所说的,“在这个行业,早就是错”。目前我想到的应对方式,尤其是从资管角度,首先是仓位上限的控制,可以给一个更高的集中度(比起市场指数的比例)但一般不超过市场的3x,比如金融行业占比10%,集中度再高也不超过30%,没有什么比活下来更重要,尤其是对于长期主义的选手;其次是行业的分散和对冲,这对于做多空的选手来说并不难,放弃一部分收益,为了追求更小的风险;最后是对资产结构的运用—一般而言在大下行周期里即便是做资产结构中保守的部分,也可以取得很好的回报,比如Antero Resources的三年到期债券曾经卖到过30c/dollar(票面价值的30%),SRG-PA和WAL-PA都是很好的例子(目前金融行业仍有一些不错性价比的类似资产)。

以上一些思考,权作抛砖引玉式的分享,愿对读者有些许启发。

————————————————————————————————————

附录:

周期一直是我在研究的一个方向,我也读了大量的学术领域的文献,这些文献给我提供了很好的数据,逻辑,和统计意义上的支撑。虽然和实操的关联有限,仍是我感兴趣的方向,将一些综述成果放在附录,供有需要的读者参考:

Cycles are certain to happen, although less predictable at times. Despite its less of predictability, cycles, in my view, are easier to take advantage of than predicting sustainable growth. Some of the best investment opportunities I have encountered have been cyclical plays, and the best of the best are those with resonating cycles – namely multiple cyclical patterns creating a resonating trough. To better understand cycles is to better prepare oneself for the inevitable, and to better take advantage of such inevitabilities.

Granularity

Table 1: The Granularity of Cycles and the Type of Cycles Involved.

Global Financial Cycles

The importance of the Global Financial Cycle to countries (especially emerging ones) have been argued by scholars. For instance, Rey (2013) argues that “there is a global financial cycle in capital flows, asset prices, and in credit growth. This cycle co-moves with the VIX, a measure of uncertainty and risk aversion of the markets”.[1] Passari and Rey (2015) wrote: “large gross cross-border flows are moving in tandem across countries regardless of the exchange rate regime, they tend to rise in periods of low volatility and risk aversion and decrease in periods of high volatility and risk aversion, as measured by the VIX… There is a global financial cycle”. [2]

Nevertheless, by analyzing foreign direct investment (FDI), portfolio equity investment, portfolio debt investments, and bank credit as capital flows and VIX, VSTOXX, IVI, and VDAX as proxies for global financial cycles, Cerutti et.al (2017) failed to find a correlation. Without considering endogenous domestic responses to global financial cycles, their results suggest that the global financial cycles explains only a small fraction of the variation in capital flows, then more idiosyncratic phenomena necessarily explain capital flows. [3] My guess is domestic responses partially mitigate such global capital flows, but more research needs to be done to tease out the effect of standalone global financial cycles. In addition, the authors did not investigate the impact of global financial cycles on domestic asset prices or credit, which are critical subjects of capital allocators -- these directions need further analyses as well. Based on existing literature, we know relatively little about the true impact of global financial cycles on domestic.

As a practitioner, based on my personal experience, I believe global capital cycles exist, although they can oftentimes be overwhelmed by country-specific idiosyncratic development. It would be interesting to conduct statistical tests on this subject.

Financial Cycles & Business Cycles

Minsky (1982) and Kindleberger (2000) define financial cycles as the self-reinforcing interactions between asset prices, risk, risk taking, and financing constraints. Some authors go as far as arguing that all recessions in the US since 1985 had financial origins. [4] Financial cycles can be proxied by using bandpass filters with frequencies from 8-32 years to extract medium-term cyclical fluctuations in real (inflation-adjusted) credit, the credit-to-GDP ratio, and real property prices, which are averaged to derive a composite measure of the financial cycle. [5] In addition, another powerful predictor of recession risk is the debt service ratio (DSR), defined as interest payments plus amortization divided by GDP. Drehmann et al (2021) find a strong link between debt accumulation and subsequent debt service, which in turn has a large negative effect on growth. Financial cycles can be described by the joint behavior of leverage and the DSR. [6] More importantly, scholars have found that for a panel of advanced and emerging market economies, financial cycle measures have significant forecasting power both in and out of sample, even for a three-year horizon, outperforming the term spread in nearly all specifications.[7] Business cycles become more fragile when financial booms develop, and typically one financial cycle entails two to three business cycles. However, even this study which employs global panel data focuses only from 1985 on. The authors noted structural differences for the 40 years before 1985 and after, and as practitioners we know a continuous easing of interest rate has been a structural theme for the last 40 years – are we entering a new paradigm with inflation and rates both stepping higher? Will the results produced by this study stand in the new paradigm? How would DSR, financial cycle, and business cycle interact before 1985? These questions remain unanswered by extant literature.

Industrial Cycle and Sentiment Cycle

Scholars have found that firms tend to compete more aggressively in financial distress; the intensified competition in turn reduces profit margins, pushing themselves further into distress and adversely affect other firms. The feedback imposes an additional source of financial distress costs incurred for raising leverage, which helps explain the negative profitability-leverage relation across industries. Owing to the contagion effect, in a decentralized equilibrium, leverage is excessively high from an industry perspective, compromising industry’s financial stability.[8] This is particularly true for the shale gas industry pre-pandemic – the producers were levered, and when gas price was under pressure, they produced more natural gas to ride down the cost curve, further depressing gas price, reducing free cashflow, and resulting in greater leverage. This model perfectly describes the down-leg of the last natural gas (and oil) cycle – the mechanism behind the evolution of that industry closely follows Chen’s prescription.

Table 2: S&P Ratings, Rating Changes, and Outlook for various natural gas producers at the trough of the last cycle.

However, the model does not address the upcycle. Despite the prevailing contagion which culminated in a near-death experience for the natural gas patch in the US, the producers ultimately dropped enough rigs on a concerted effort, and natural gas price rebounded after Covid hits. In other words, with the contagion reaching a certain degree, from an industrial cycle point of view, the cycle cannot march any lower. Firms start to collaborate tacitly, and the tides start to turn, leading to remarkable upside potential. A more complete model wants to capture the entirety of the industry cycle under a single parsimonious framework.

Picture 1: Performance of public, standalone natural gas producers after they hit the low on Feb 11th, 2020.

Much of the price volatility is also driven by the sentiment cycle, which vastly exaggerates the industrial cycle. This is where Ben Graham believes one can exploit market inefficiencies through mispricing resulted from excessive emotions. Stambaugh et al (2012) find that long-short strategies that exploit the anomalies exhibit profits consistent with this setting. First, each anomaly is stronger (its long-short strategy is more profitable) following high levels of sentiment. Second, the short leg of each strategy is more profitable following high sentiment. Finally, sentiment exhibits no relation to returns on the long legs of the strategies.[9] This confirms Jim Chanos’ practical observation that historically the alpha on the short side has been as high as 15% in the last two decades, and has been even higher prior to that. Recently, however, he observes that the alpha on the short side has substantially diminished as a result of excessive liquidity by the Federal Reserve. Therefore, it will be interesting to reexamine Stambaugh’s work and extend it to consider the interaction between the alpha of the long-short strategy and market liquidity.

Corporate Cycles and Capital Structure Cycles

It has been well documented that there are arbitrage opportunity between a same company’s equity and debt given limited liquidity which results in limited arbitrage between equity and credit markets. Short horizon pricing discrepancies across firm’s equity and credit markets are common and that an economically significant proportion of these are anomalous, indicating a lack of integration of these two markets. [10] Even for the US market, scholars has found and documented a nontrivial but imperfect integration between its stock and corporate bond markets. [11] Chen et al. proposed a metric named the debt-equity spread defined as the difference between actual credit spread and equity-implied spread. The actual credit spread is calculated from observed bond prices, while the equity-implied credit spread is computed using equity market information through the lens of a standard structural credit risk model. When a firm’s equity is valued highly relative to its debt, the equity-implied credit spread tends to be low relative to the actual bond spread, resulting in a higher DES. High-DES firms tend to have more negative growth forecasting revisions (analysts being too optimistic in extrapolation of high growth), are more likely to issue equity and retire debt (Confirming Ma (2019)), and have more insider equity selling. The results are also stronger among smaller, less liquid, and more difficult-to-short stocks and bonds. [12] This could lead to highly interesting opportunities to climb the capital structure ladder for the investors, and thereby selecting the best risk-reward among various types of financial instruments associated with the same company.

Some of the most dangerous yet also most lucrative opportunities exist due to debt overhang, and a deeper understanding of the interaction between macroeconomic risks and agency problems is critical. Scholars have found that firstly, recessions are times of high marginal utilities, which means that the distortions caused by agency problems during such times will affect investors more than in booms; secondly, corporate spreads are strongly countercyclical, thus for a given investment opportunity, the transfer from equity holders to debt holders in a typical procyclical firm tends to concentrate in bad times. [13] In their benchmark case, the debt overhang costs for a low leverage firm peak at less than 0.5% of the total firm value without macroeconomic risk, while these costs peak at 2.7% or 3.6% in booms and recessions, respectively, in the presence of macroeconomic risk. For a high leverage firm, the debt overhang costs peak at 5.1% without macroeconomic risk, while these costs peak at 8.5% or 10.7% in boom and recessions, respectively, with macroeconomic risk. The impact of macroeconomic risk on debt overhang depends on the cyclicality of cash flows from assets-in-place and growth opportunities. More cyclical cash flows from the assets-in-place increase the probability that the firm will underinvest during recessions, when marginal utilities are higher, thus amplifying the impact of macroeconomic risk on the agency cost of debt. The effect of more cyclical cash flows from growth opportunities is ambiguous. On the one hand, more cyclical cash flows from growth opportunities increase the probability that firms will underinvest during recessions. On the other hand, the cost from delaying investment in recessions is lower. In our calibrated model, either of the two effects may dominate. What we can infer from this, is that light capital businesses have lower agency cost of debt.

However, their result is not conclusive. Other researchers have found that compared with firms that are mainly composed of invested assets, firms with growth options have higher costs of debt because they are more volatile and have a greater tendency to default during recession when marginal utility is high and recovery rates are low. Their model matches empirical facts regarding credit spreads, default probabilities, leverage ratios, equity premiums, and investment clustering. Firms with growth options are more likely to default in recessions than those without growth options and thus should have higher credit spreads. [14]

More work is clearly needed to reconcile such contradicting views.

However, what an investor can learn from this is that macroeconomic risks provide high expected return for higher leverage firms that do not default. That is a big “if”, which leads to the necessity of understanding the interaction between liquidity, default, and macroeconomic cycles. In addition, an apt metaphor of investing in equity vs. bond is – investing in equity is investing in a call option that shares the upside of the business; investing in bond is shorting a put option on the assets and fundamentals of the business betting the business does not fail. The agency cost issue tells us that equity holders and bond holders are oftentimes pitted against each other with varying incentive structure that should be heeded when we invest in different layers of a company’s capital structure.

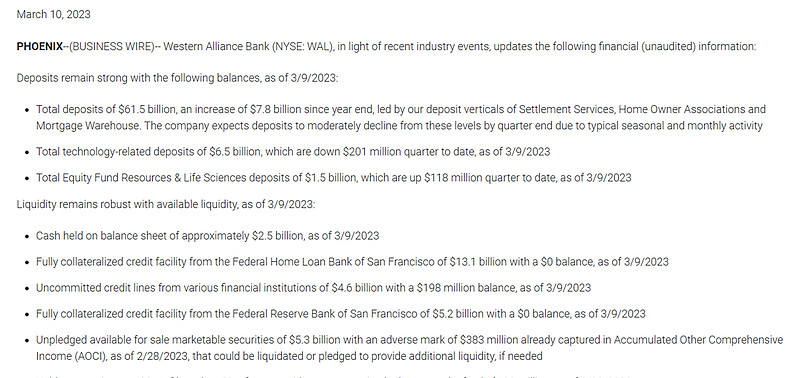

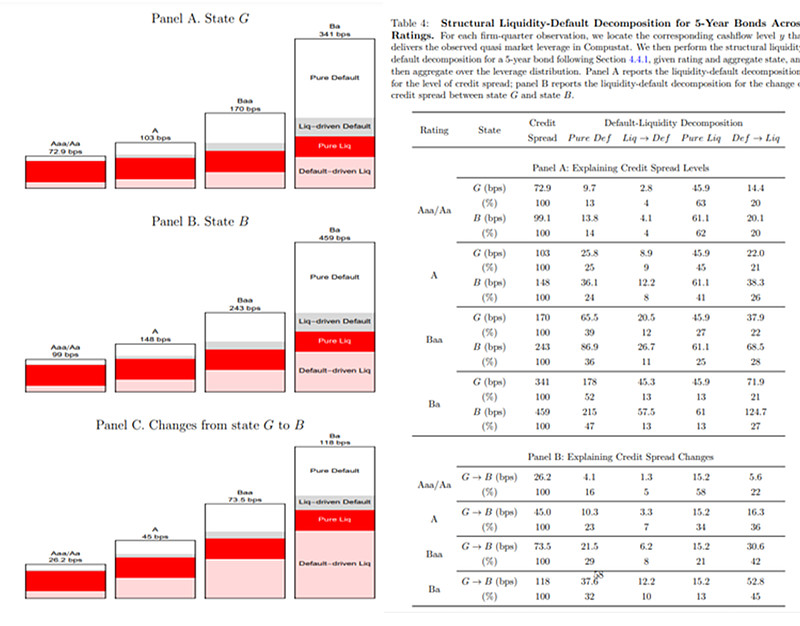

Longstaff, Mithal, and Neis (2005) calculates liquidity risk by subtracting Credit Default Swap (CDS) swap yield from bond yield, because CDS prices mostly reflects the default risk because of their relatively liquid secondary market. [15] There are two types of interaction terms, namely the “liquidity-driven default” and the “default-driven liquidity” components, capturing the endogenous positive spiral between default and liquidity. While the latter is easier to understand, the former, namely “liquidity-driven-default”, is driven by the rollover risk mechanism in that firms rely on infinite-maturity debt financing will default earlier when facing worsening secondary market liquidity. [16] Chen et al. (2018) found that these interaction terms are quantitatively significant across all ratings. They account for 25-30% of the total credit spread of Aaa/Aa rated bonds and 35-40% of the total spread of Ba rated bonds across the two aggregate states. They account for 27% of the spread increase for Aaa/Aa rated bonds and 55% of the spread increase for Ba rated bonds as the economy switches from a normal state into a recession. [17]

Picture 2: Structural liquidity-default decomposition for 5-year bonds across ratings.

One of the best ways to adapt to various cycles is to pick the right capital allocator at the helm of the company that an investor is interested in. Since the financial crisis of 2008, scholars have found companies cut their investments and payouts in bad times and issues equity in good times even without mediate financing needs, underscoring their salience of the potentiality of financing-window closing as a result of a downward financial cycle. In addition, firms raise capital when their perceived probability of financial conditions worsening. [18] Nevertheless, the aforementioned study along with other studies produce results that challenge recent evidence of the importance of valuation cycles in driving financing waves. In other words, scholars found a positive correlation between equity issuance and stock repurchase waves. [19] An explanation of buy-back at high valuation is that improved financing conditions raise stock prices and lowers the precautionary demand for cash buffers, which in turn can result in more stock repurchases by cash-rich firms. A majority of firms do not seem to allocate capital optimally, and when companies raise cash for the near term, the primary motive is to prevent themselves from running out of cash. Actually, 62.6% of them would run out of cash in a year, and 81.8% have subnormal cash balances. These equity-issuers are primarily not growth firms, and those companies that fail to issue stocks exhibit poor future performance down the road.[20] These studies showcase the importance and the difficulty of becoming partners with great capital allocators given that it seems to be a rare talent.

References:

[1] H. Rey, “Dilemma not Trilemma: the Global Financial Cycle and Monetary Policy Independence,” Proceddings 2013 Fed. Reserv. Bank Kansas City Econ. Symp. Jackson Hole, pp. 285–333, 2013.

[2] H. Rey and E. Passari, “Financial Flows and the International Monetary System,” Econ. J., vol. 125, pp. 675–698, 2015.

[3] E. Cerutti, S. Claessens, and A. K. Rose, “How Important is the Global Financial Cycle? Evidence From Capital Flows,” BIS Work. Pap., 2017.

[4] S. Ng and J. H. Wright, “Facts and Challenges from the Great Recession for Forecasting and Macroeconomic Modeling,” J. Econ. Lit., vol. 51, no. 4, pp. 1120–54, 2013.

[5] M. Drehmann, C. Borio, and K. Tsatsaronis, “Characterising the Financial Cycle: Don’t Lose Sight of the Medium Term!,” BIS Work. Pap., p. 284, 2012.

[6] M. Drehmann, M. Juselius, and A. Korinek, “Going with the Flows: New Borrowing, Debt Service and the Transmission of Credit Booms,” SSRN Electron. J., vol. 24549, 2021, doi: 10.2139/ssrn.3168448.

[7] C. Borio, M. Drehmann, and F. D. Xia, “Forecasting Recessions: the Importance of the Financial Cycle,” J. Macroecon., vol. 66, 2020.

[8] H. Chen, W. W. Dou, H. Guo, and Y. Ji, “Feedback and Contagion through Distressed Competition,” NBER Work. Pap., 2023.

[9] R. F. Stambaugh, J. Yu, and Y. Yuan, “The Short of It: Investor Sentiment and Anomalies,” J. financ. econ., vol. 104, no. 2, pp. 288–302, 2012.

[10] N. Kapadia and X. Pu, “Limited Arbitrage Between Equity and Credit Markets,” J. financ. econ., vol. 105, no. 3, pp. 542–564, 2012.

[11] M. Sandulescu, F. Trojani, and A. Vedolin, “Model-Free International Stochastic Discount Factors,” J. Finance, vol. 76, no. 2, pp. 935–976, 2021.

[12] H. Chen, Z. Chen, and J. Li, “The Debt-Equity Spread,” SSRN, 2022.

[13] H. Chen and G. Manso, “Macroeconomic Risk and Debt Overhang,” Rev. Corp. Financ. Stud., vol. 6, no. 1, pp. 1–38, 2017.

[14] M. Arnold, A. Wagner, and R. Westermann, “Growth Options, Macroeconomic Conditions, and the Cross Section of Credit Risk,” J. financ. econ., vol. 107, no. 2, pp. 350–385, 2013.

[15] F. A. Longstaff, S. Mithal, and E. Neis, “Corporate Yield Spreads: Default Risk or Liquidity? New Evidence from the Credit Default Swap Market,” J. Finance, vol. 60, no. 5, pp. 2213–2253, 2005.

[16] Z. He and W. Xiong, “Dynamic Debt Runs,” Rev. Financ. Stud., vol. 25, no. 6, pp. 1799–1843, 2012.

[17] H. Chen, R. Cui, Z. He, and K. Milbradt, “Quantifying Liquidity and Default Risks of Corporate Bonds over the Business Cycle,” Rev. Financ. Stud., vol. 31, no. 3, pp. 852–897, 2018.

[18] P. Bolton, H. Chen, and N. Wang, “Market Timing, Investment, and Risk Management,” J. financ. econ., vol. 109, pp. 40–62, 2013.

[19] A. K. Dittmar and R. F. Dittmar, “The Timing of Financing Decisions: An Examination of the Correlation in Financing Waves,” J. financ. econ., vol. 90, no. 1, pp. 59–83, 2008.

[20] H. DeAngelo, L. DeAngelo, and R. Stulz, “Seasoned Equity Offering, Market Timing, and the Corporate Cycle,” J. financ. econ., vol. 95, no. 3, pp. 275–295, 2010.