我曾在多年前读过一次霍华德·马克斯的《投资最重要的事》,当时年少无知,觉得这都是老生常谈的东西罢了,但今年偶然重读了两次,结果意外地“真香”......我甚至认为,这本书堪称是现代的《聪明的投资者》,真正做到为价值投资理论大厦添砖加瓦,不论老手还是新手都能从中得到很多启发。对我来说,这本书解答了几个纠缠我多年的困惑。

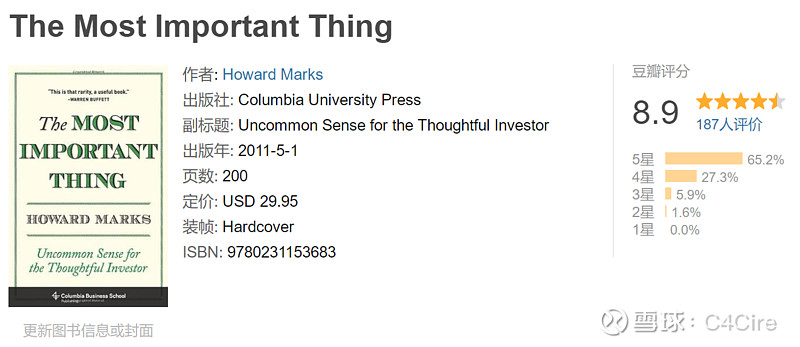

九月份的时候我曾做过一次摘录,(没看过的球友可以戳这里《投资是一场“输家”游戏》),但读的时候总觉得哪里怪怪的(当时没意识到翻译有问题)。很偶然的情况下,我接触了该书的英文原版《The Most Important Thing》,读完更加震惊——霍华德许多很精彩的论述,居然在翻译手中扭曲了,有些甚至就是错误的!(几个翻译错误例子可以戳这里《《投资最重要的事》中的一些翻译问题》)

尽管本身英语水平不高,我还是耐着性子读完了这本英文书,也做了一些摘录。这些摘录原本是给自己看的,是我认为比较能警醒我的语句,所以收录得比较简略。如果有兴趣的球友可以看看。

强烈推荐对霍华德有兴趣的朋友,看完中文版记得去看看原版书。

另,如果接下来有时间,我会和考虑和 @花剌子模之旅 同学一起整理《投资最重要的事》中的N个重要翻译错误,整理这些错误不是为了怼出版社,而是想还原霍华德的思想,中文版真的把霍华德的水平降低了很多。

P.S.这篇摘录是我对着纸质书敲出来的,难免有错误之处,还请各位球友见谅。最后吐槽下,我原来的PDF做得色彩斑斓,结果雪球的文字只有黑色,大家只能看得会辛苦一点了。

Introduction

1."Experience is what you got when you didn't get what you wanted."

2.Good times teach only bad lessons: that Investing is easy, that you know its secrets, and that you needn't worry about risk. The most valuable lessons are learned in tough times.

3 The Most Important Thing Is Value

1.There's no bright-line distinction between value and growth; both require us to deal with the future. Value investors think about the company's potential for growth, and the "growth at a reasonable price" school pay explicit homage to value. It's all a matter of degree.

However, I think it can fairly be said that growth Investing is about the future, whereas value Investing emphasize current-day considerations but can't escape dealing with the future.

2.Value is my approach. In my book, consistency trumps drama.

3.It's hard to consistently do the right thing as an investor. But it's impossible to consistently do the right thing at the right time. The most we value investors can hope for is to be right about an asset's value and buy when it's available for less.

4.The bigger the discount, the bigger your margin of safety. Too small a discount and the limited margin of safety no real protection at all.

5.In fact, you'll often find that you've bought in the midst of a decline that continues. Pretty soon you'll be looking at loss. And as one of the greatest investment adages reminds us, "Being too far ahead of your time is indistinguishable from being wrong."

4 The Most Important Thing Is The Relation between Price and Value

1.Establishing a healthy relationship between fundamentals-value-and price is at the core of successful Investing.

2."Well bought is half sold." ……If you've bought it cheap, eventually those question will answer themselves.

Joel: "Many value investor are not good at knowing when to sell (and many sell way too early). However, knowing when to buy cures many of the mistakes resulting from selling too early.

3.All bubbles start with some nugget of truth.

5 The Most Important Thing Is Understanding Risk

1.Paul: I would go so far as to say that the risk of permanent capital loss is the only risk to worry about.

2."There's a big difference between probability and outcome. Probable things fail to happen-and improbable things happen-all the time."

6 The Most Important Thing Is Recognizing Risk

1.Risk means uncertainty about which outcome will occur and about the possibility of loss when the unfavorable ones do.

2.High risk, in other words, comes primarily with high prices .

3.The great risk doesn't come from low quality or high volatility. It comes from paying price that are too high. This isn't a theoretical risk; it's very real.

7 The Most Important Thing Is Controlling Risk

1..Risk control is invisible in good times but still essential, since good times so easily turn into bad times.

2.The road to long-term investment success runs through risk control more than through aggressiveness. Over a full career, most investors' results will be determined more by how many losers they have, and how bad they are, than by the greatness of their winners. Skillful risk control is the mark of the superior investor.

8 The Most Important Thing Is Being Attentive to Cycles

1.Rule number one: most things will prove to be cyclical.

Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.

2.Cycles are self-correcting, and their reversal is not necessarily dependent on exogenous events. They reverse (rather than going on forever ) because trends create the reasons for their own reversal.

3.Ignoring cycles and extrapolating trends is one of the most dangerous things an investor can do.

9 The Most Important Thing Is Awareness of the Pendulum

1.Stocks are cheapest when everything looks grim.

2.Joel: This means markets will always create opportunities, whether now or later. In markets with few opportunities, it's Important to be patient. Value opportunities will eventually present themselves, usually after no more than a year or two.

3.There are a few things of which we can be sure, and this is one: Extreme market behavior will reverse.

10 The Most Important Thing Is Combating Negative Influence

1.Most people possess the intellect needed to analyze data, but far fewer are able to look more deeply into things and withstand the powerful Influence of psychology.

2.Munger:"Nothing is easier than self-deceit. For what each man wishes, that he also believe to be true."

3.The desire for more, the fear of missing out, the tendency to compare against others, the Influence of the crowd and the dream of the sure thing-these factors are near universal.

4.Comparing your lot with theirs is a very corrosive process-albeit natural-and will put a lot of pressure on you.

11 The Most Important Thing Is Contrarianism

1.There's only one way to describe most investors: trend followers.

2.Joel:Extreme circumstance(or, more accurately, opportunities) occur more often than seems reasonable. You never catch the bottom or the top of these situations, and that's where the pain and degree of difficulty come in!

3.Without enough time to ride out the extremes while waiting for reasons to prevail, you'll become that most typical of market victims: the six-foot-tall man who drowned crossing the stream that was five deep on average.

Joel: In the long run, the market gets it right. But you have to survive over the short run, to get to the long run.

4.You must do things not just because they're the opposite of what the crowd is doing, but because you know why the crowd is wrong.

5.But that triggered an epiphany: skepticism and pessimism aren't synonymous. Skepticism calls for pessimism when optimism excessive. But it also calls for optimism when pessimism is excess.

12 The Most Important Thing Is Finding Bargains

1.The tendency to mistake objective merit for investment opportunities, and the failure to distinguish between good assets and good buys, get most investors into trouble.

13 The Most Important Thing Is Patient Opportunism

1.The market's not a very accommodating machine; it won't provide high returns just because you need them.

2.You'll do better if you wait for investment to come to you rather than go chasing after them.

3.There's no penalty for omitting losing investment, of course, just rewards. And even for missing a few winners, the penalty is bearable.

4.Klarman: Still, calibration is Important. Set the bar too high and you might remain out of the market for a very long time. Set it too low and you will be fully invested almost immediately; it will be as though you had no standards at all.

5.You simply cannot create investment opportunities when they're not there.

14 The Most Important Thing Is Knowing What You Don't Know

1.The more we concentrate on small-picture things, the more it's possible to gain a knowledge advantage.

2.Paul :Be very careful with your own forecasts and even more careful with those of others!

3.Its adherents generally believe you can't know the future; you don't have to know the future; and the proper goal is to do the best possible job of investing in the absence of that knowledge.

4.One key question investors have to answer is whether they view the future as knowable or unknowable.

5.Investing in an unknowable future as an agnostic is a daunting prospect, but if foreknowledge is elusive, investing as if you know what's coming is close to nuts.

"It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so."

16 The Most Important Thing Is Appreciating the Role of Luck

1.The investment world is not an orderly and logical place where the future can be predicted and specific actions always produce specific results. The truth is, much investing is ruled by luck.

2.We should spend our time trying to find value among the knowable - industries , companies and securities - rather than base our decision on what we expect from the less-knowable macro world of economies and broad marker performance .

3.Given that we don't know exactly which future will obtain , we have to get value on our side by having a strongly held , analytically derived opinion of it and buying for less when opportunities to do so present themselves .

4.We have to practice defensive investing , since many of the outcomes are likely to get against us . It's more important to ensure survival under negative outcomes that it is to guarantee maximum returns under favorable ones .

5.To improve our chances of success , we have to emphasize acting contrary to the herd when it's at extremes, being aggressive when the market is low and cautious when it's high .

17 The Most Important Thing Is Investing Defensively

1.In contrast , investment results are only partly within the investors' control , and investors can make good money - and outlast their opponents-without trying tough shots.

2.The bottom line is that even highly skilled investors can be guilty of mis-hits , and the overaggressive shot can easily lose them the match. Thus, defense-significant emphasis on keeping things from going wrong-is an important part of every great investor's game .

3.Rather than doing the right thing , the defensive investor's main emphasis is on not doing the wrong thing .

4..The first is the exclusion of loser from portfolios . This is best accomplished by conducting extensive due diligence , applying high standards , demanding a low price and generous margin for error and being less willing to bet on continued prosperity , rosy forecasts and development that may be uncertain .

The second element is the avoidance of poor years and ,especially , exposure to meltdown in crashes .

5.Low price is the ultimate source of margin for error .

6.If we avoid the losers , the winner will take care of themselves .

18 The Most Important Thing Is Avoiding Pitfalls

1.Relying to excess on the fact that something "should happen" can kill you when it doesn't . Even if you property understand the underlying probability distribution , you can't count on things happening as they're supposed to . And the success of your investment actions shouldn't be highly dependent on normal outcomes prevailing ; instead, you must allow for outliers .

2.When there's nothing particularly clever to do , the potential pitfall lies in insisting being clever .

20 The Most Important Thing Is Reasonable Expectations

1.It's essential to understand that "cheap" is far from synonymous with "not going to fall further ".

2."The perfect is the enemy of the good."

Perfection in Investing is generally unobtainable; the best we can hope for is to make a lot of good investments and exclude most of the bad ones.

3.We give up on trying to attain perfection or ascertain when the bottom has been reached. Rather, if we think something is cheap, we buy. If it gets cheaper, we buy more. And if we commit all our capital, we assume we'll be able to raise more.

4.Rather, our disinterest in market timing means-above all else-that if we find something attractive, we never say, "It's cheap today, but we think it'll be cheaper in six months, so we'll wait." It's just not realistic to expect to be able to buy at the bottom.

21 The Most Important Thing Is Pulling It All Together

1.Thus ,the investor's time is better spent trying to gain a knowledge advantage regarding "the knowable": industries, companies and securities. The more micro your focus, the greater the like hood you can learn things others don't.

2.None of us should expect to be immune and insulated from them. Although we will feel them, we must not succumb; rather, we must recognize them for what they are and stand against them. Reason must overcome emotion.

$福耀玻璃(SH600660)$ $格力电器(SZ000651)$ $伯克希尔-哈撒韦A(BRK.A)$

广告:这是个人公号:CxEric的读书与投资笔记,微信号是:cxericreading。

公号会分享读书收获和感想,顺带交流价值投资。阅读微信更方便的朋友可以关注该号,偏好雪球阅读的朋友只关注雪球就好。