2017 / 9 / 24

以下评论是我为一个潜在的未来的老板写的投资建议,推荐的标的是LILA/LILAK。约翰马龙是一个我特别喜欢的企业家,如果我自己以后创业,马龙的风格就是我未来想要当作楷模来模仿的。马龙在73年放弃了华纳集团Steve Ross的高薪聘请,接管精疲力竭的Bob Magness手上的TCI,临危受命,并让这个企业的股价到1997年被ATT收购时翻了933倍,年化收益达到近30%。直到91年他分拆出自由媒体(Liberty Media)并持有较多股份之前,他一直都拿着整个行业中薪酬最低但表现最好的首席执行官。在有线电视运营领域,马龙是个"教父",而他自己更喜欢"有线牛仔"(Cable Cowboy)的称呼。马龙持有运筹学的博士,年轻时曾在贝尔实验室工作过。目前的马龙更像一个投资组合管理者,之前持有DirecTV和Starz的股份,至今仍然持有探索频道(Discovery Channel),甚至连猫途鹰(Tripadvisor)的股东中都有他的身影。如他自己所说,他自己是一个策略家,一个能不断达成交易的人,一个资产组合的管理者(而不是一个运营者)。他在2010年接受一段采访时谈到时代华纳和Comcast的成长空间,7年过去,全部言中,包括时代华纳被收购一事。我个人持有LILAK多头仓位,三年之内没有卖出打算,三年内目标价格在51-63美元/股之间,年化收益在24.2%到31.6%之间。这篇文章,希望对有缘者有所启发。

$自由全球(LBTYA)$ $Liberty Global plc - Class A Ordinary Shares(LILA)$ $时代华纳时代华纳(TWX)$

LILA is a tracking stock for the Latin America operations of the Liberty Global. LILA provides cable services (TV, broadband internet and phone) along with wireless services in Chile, Puerto Rico, Panama, the Bahamas, Jamaica, Trinidad and over a dozen other smaller islands across the Caribbean. LILA is the leading service provider in all of these markets, we will discuss their competitors shortly. Through its acquisition of CWC (which gives them access to 18 Caribbean countries), they also own the largest undersea fiber optic cable in the region.

LILA does not only provide cable, but actually combines cable with wireless, thus forming the so called "quad play" (home telephone, broadband, TV, and mobile services). Previous triple-play consumers usually stick with their provider for 4-5 years, a quad-play subscriber usually stay for 8 years on average. In addition, the cost to sign up a new triple play-vs quad-play customer is similar, the return to LILA on their quad-play marketing spending is significantly higher.

There are two key features that characterizes the industry that LILA operates in, and both relates to "economies of scale". Firstly, being the leading service provider with incremental growth through acquisitions, LILA can leverage the large number of its subscribers to ask for lower prices for transmitting content and channels. Secondly, the subsidiaries it possesses are horizontal, allowing it to cut overhead and duplicate expenses as LILA acquires more players. The industry is characterized by first mover advantage, where the first ones that lay down cables tend to form a near-monopoly local status. Its two alternative competitors are DSL and optic fiber. Optic fiber is expensive to lay down despite of its much faster speed, and through acquriing CWC, LILA has skin in this game. DSL has lower transmission efficiency and quality compared to cable. One potential disruption to the industry is streaming, but we will discuss this in the risk factor.

Valuation:

The market is currently undervaluing LILA for two reasons. Firstly, it acquired CWC at a lofty EBITDA valuation multiple of 12x, but it turns out CWC has been engaging in aggressive accounting, so LILA has to restate its performance. Market punished LILA harshly by almost halving its stock price, made it fall from $40/share at the announcement of acquisition to a low of $19/share earlier this year. Secondly, LILA is a tracking stock of the operations of Liberty Global in South America, therefore its financial statement information revelation is convoluted. Its various subsidiary has the typical Malone touch of opacity and incomprehensibility, making investors hesitant to invest heavily in it.

The market, I believe, also has limited information regarding the way LILA, like all Malone family cable companies, operate. Malone maintains a constant ratio of debt to operating income before depreciation and amortization (OIBDA). As OBIDA grows, he takes in more debt, so as to minimize tax expenses. The extra debt along with the free cash flow is used to buy back shares.

A fair value of LILA can be reached by analyzing the speed of growth for its OIBDA per share and capital appreciation due to multiple expansion. Currently LILA has a market cap of $ 4.4 billion, subtracting its minority interests (40% in Liberty Puerto Rico and some in CWC, Viva, as well) and $500 million cash it currently hoards, LILA has a net debt of about $5.6 billion. Together it has a EV of $10 billion, and a EBITDA of $1.27 billion, rendering its multiple at 7.87x. Back in 2010, when stuff is cheap everywhere, EBITDA multiple for the European cable operations that Malone bought had a multiple of 8x, and recently it has been trending upwards due to low interest rates, with the most recent (namely CWC) being 12x. Assuming interest rate rises in the next several years (I believe it’s hard for it to go up much given what’s happening in Europe), and lets be conservative and assume even with relatively high growth the multiple is 10x, that pushes the per share fair value to $31.76/share.

The management has guided OBIDA growth at 8% and FCF growth at 3% for next several years. Let’s do two types of valuations, one assuming the management is right, the other assuming the management is over optimistic, and we apply a 40% discount to whatever their guidance is.

Optimistic Scenario:

OBIDA grows at 8%, debt is $6.1 billion, market cap is $4.4 billion, so 8% debt increase leads to 11.1% (6.1/4.4*8%=11.1%) of share repurchase. FCF grows at 3% to purchase shares, so in total share repo constitute 14.1% share count reduction on an annual basis. So OBIDA per share grows at 25.7% per year [Calculated as: (1*1.08/(1-0.141)-1)*100%].

Pessimistic Scenario:

OBIDA grows at 6.4%, debt is $6.1 billion, market cap is $4.4 billion, so 6.4% debt increase leads to 8.87% of share repo. FCF grows at 1.8% to purchase shares, so in total share repo constitutes 9.67% share count reduction on an annual basis. So OBIDA per share grows at 17.8% per year.

So till 2020, the optimistic scenario, the fair value of per share price is $63/share, the pessimistic scenario gives a per share price of $51.9/share. The optimistic scenario gives a CAGR of 31.6%/year, and the pessimistic scenario gives a CAGR of 24.2%/year.

Another reference that one can use in assessing future return is looking at Malone’s track record. From 1973 to 1997, John Malone maintained a 29.6% CAGR as the chieftain of TCI, which was subsequently sold to AT&T. Malone bought Ascent Capital (ticker: ASCMA) between Oct 2012 and Nov 2012, which he sold in Oct of 2013. He bought at around $54-60, and sold at $93, netting over 50% over a year. This was a $7 million stake. Malone bought Liberty Media (LMCA) in June of 2013 at $129.3 for $2 million. Tracking all the spinoffs, Malone’s investment yields 80% so far vs. a market return of only about 30%, and again Malone achieved a roughly 22% of annualized return for his investment.

In July, he made his biggest purchase in the recent years by buying $20 million of LILA. I calculated the average price he bought the stock, which is $23.24. The currently price is at a 7.8% premium to his average purchase price. Given John Malone’s uniquely superb historical performance, the current share price seems attractive. In addition, one of Buffett’s two lieutenants, Ted Weschler, bought LILA at an average price of about $34/share roughly a year and a half ago, and has not sold a single share. Ted accomplished a 20%+ CAGR during his 11 years of investing as a one-man band before he joins Berkshire. Although other investors’ moves should not be taken as a guidance for our own purchasing behavior, such moves might serve as a useful reference point after independent research and logical deductions have already been made.

Last but not least, Liberty Global (ticker: LBTYA) decides to spin out LILA completely by the end of this year. This will be a catalyst in two senses. Firstly, LILA will have an independent management that is more focused, and has more financial and operational leverage in steering LILA in a more self-optimizing direction without the constraints from the parent. Secondly, LILA’s independent financial statement filing will allow for more clarity regarding its financial and strategic standing, providing more transparency, attracting previously uncertain investors. John Malone’s move in July is potentially a way (so typical of his) in taking advantage of a vast information asymmetry in harvesting investment gains.

Risk Assessment:

There are three major risk factors in this investment.

Firstly, geopolitical instability. Puerto Rico has seen population decline, and the aforementioned developing countries potentially lacks rule of law and democracy. However, LILA has a diversified portfolio of countries, and its Chile venture is arguably one of the fastest growing in Latin America. Humanity moves forward. China does not have democracy but a modicum investment there in the 1990s (say bu a house in Pudong, Shanghai) can easily enable one to retire by 2010. Of the past 5,000 years, betting against human progress is almost always a mistake. I am bullish on the ability of the Latin American people's ability in figuring out a better way moving forward and improve their own lives.

Secondly, streaming service technological disruption and "cord cutting". While this is a real risk for media and telecom companies, it is less threatening to broadband companies, whose broadband service will actually get a boost through streaming. In the 2nd quarter financial statement of 2017, LILA indeed sees 5% organic growth of broadband service. Fixed broadband penetration in the US is around 85%, whereas in the markets LILA operates in, the penetration rate is only about 40%, meaning there is significant growth potential. The CAGRs for penetration growth from 2011 to 2016 for NA and Europe are 1.8% and 2.9% respectively, while Latin America and Caribbean region has grown at 6.9% CAGR over the same period. John Malone is known for his sagacity in hedging, characterized by a sentence he likes saying:"We throw a harpoon to every passing boat". He is one of the best business men the world has ever seen. The current CEO of Liberty Michael Fries is a 25-year-long veteran at Liberty, and knows well the operational and management gists of Malone. People tend to look at businesses as if they are static, as if when a disruption comes they will not be able to react but can only sit there and wait death. This is totally wrong. Liberty has reinvented itself multiple times since the 1970s of TCI up until this point, and there is no serious threat of its disappearing any time soon.

Thirdly, competition with other service providers in those localities. Few companies are ever as competitive as the Liberty family. Reading the "Cable Cowboy", one easily become amazed at how vigorously competitive (sometimes even cantankerous) John Malone is, and how many rivals he has beaten to death. This is the benefit of investing along with a capable manager. As Warren Buffett aptly puts, under such scenarios, investors should simply "give the way and applaud". We can also look a bit deeper into the various operations.

1. LILA's Chile operation is VTR, and is dominant in the space owing to its leading HFC network. Movistar's (its competitor) broadband business, relying predominantly on DSL delivered through copper lines, pales in comparison to VTR's. Future data needs ought to drive more share VTR's way. Given their bundling increased broadband share should contribute to growing share in pay TV and mobile as well, espectially given the less attractively bundled offering of their competitors.

2. LILA's Puerto Rico operation is Liberty Puerto Rico, and it is the only real HFC network broadband internet provider. Its competitor is Claro, which provides DSL services much inferior to its own. LILA's low end offering is over 100x faster than Claro's. It is also the market leader in Pay TV as well.

3. LILA's Caribbean sea operator is CWC. It acquired Columbus International, which has the strongest HFC network and so frequently exhibit the best broadband offerings in the region. Its major competitor Digicel is currently struggling with too much leverage, offering CWC the opportunity to get more market share from its competitor.

彩蛋:马龙对AT&T收购Time Warner的评论

(网页链接)

AT&T收购Time Warner有三个主要的好处:

第一:AT&T能够收购的标的有限,如果想要保持高额分红又想通过收购实现多元化经营,必须选择能够产生足够自由现金流的企业,而Time Warner恰好是这样的一个标的(16年自由现金流5美元/股)

第二:AT&T在全国拥有40%的terrestrial network,尽管需要Upgrade,但仍能保证DSL的质量;他拥有DirecTV,因此可以提供DBS服务;他拥有ubiquitous cellular network;而通过收购Time Warner,能够向上延伸到内容领域。T-mobile(ticker: TMUS)可能说我们提供streaming而不需要占用你的数据,这种行为可能对现有的数据供应商造成伤害,因为数据供应是这些玩家目前的主要增长板块。现在T-mobile进来了,那好,没事,我不和你争数据的事情,你要和我打数据的廉价战来取得市场份额,没问题,但是我有content,你从content上赚不到一分钱,content是我的。这样看来,内容变成了一种数据供给领域竞争中的对冲。数据方面损失的营业额,可以通过内容方面赚回来。

第三:AT&T的内容可能变得更值钱。AT&T不可能单独stream HBO,其他的通信企业也会提供streaming,那么这就提高了HBO的价值。CNN也是时代华纳旗下的常青树,没有人胆敢拒绝承载CNN。尽管TNT和TBS等network的价值不是那么高,但是马龙认为未来会走cross-bundling的路线,bundle会变小。AT&T作为传输商的领头羊出来保护bundling,也是给其他传输商提供一个榜样作用,起到领军作用。bundle变小,但AT&T仍然会把其他服务项目添加到这些bundle中去。bundle变小是会造成观众变少以及广告收入减小,但这将意味着订阅成本的增加。【这里我有些不确定的是,流媒体的发展会不会导致完全点播式的商业模式,让bundle的商业模式全然消失?】

若要转载,请注意注明出处。

2023年2月5日:

转眼都快要六年了,回头看看之前写的,真的是差之千里,不光是关于LILAK的有大量的预算偏差,就连Malone当时对ATT收购华纳传媒的分析也是差了十万八千里,后来我们知道,ATT把华纳传媒的牛人都给赶跑了,华纳传媒也越做越差;然后马龙自己旗下的探索频道收购了华纳传媒,又没做仔细尽职调查,把自家股票砸沉了。那时大概就能看出马龙对这个生意的喜爱,只是华纳传媒偏偏是个晦气的种,嫁到哪里哪里遭殃…

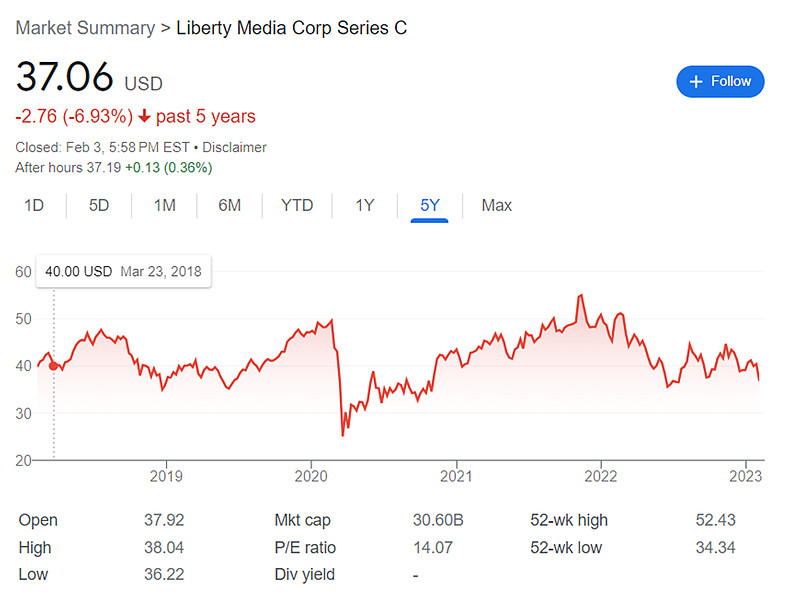

我们可以看到Liberty Media这个公司过去六年也没有什么回报,更不要说Liberty Global和LILAK了,整个马龙旗下的基本没啥拿得出手的东西。

如果过去七年那么低的利率都没有股东回报,未来利率大幅上扬,这种重杠杆的商业模式怎么跑得通?

但是Formula One可以算一个很不错的亮点了:

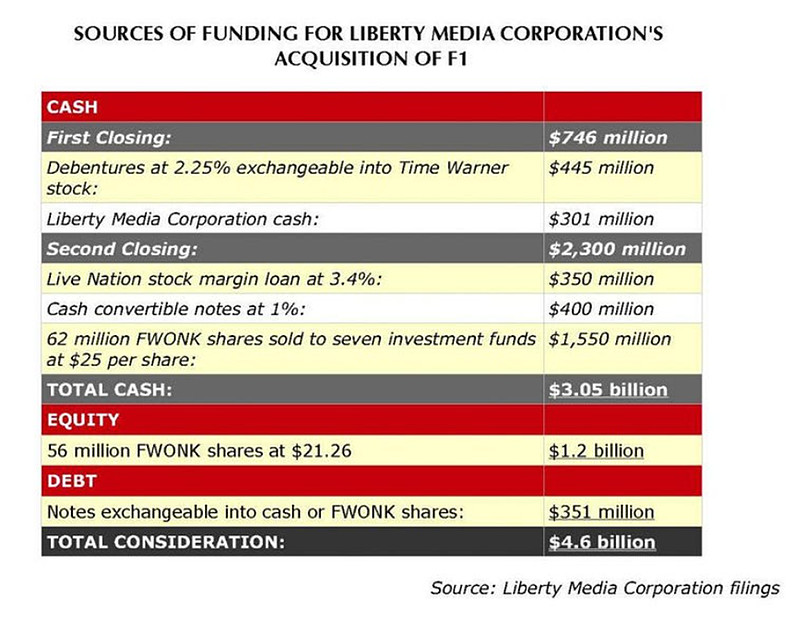

过去五年是翻了一倍,而2016年的时候Liberty是用了45亿美金左右拿下来的。事实上,Liberty只动用了3亿美金的现金,其他的全部都是负债!

可以看一下,Liberty只拿出了3.01亿的现金,其他要不就是用时代华纳的股票抵押,要不就是用LYV的股票抵押,还对包括红杉基金内的7个投资公司发了15.5亿美金的新股。

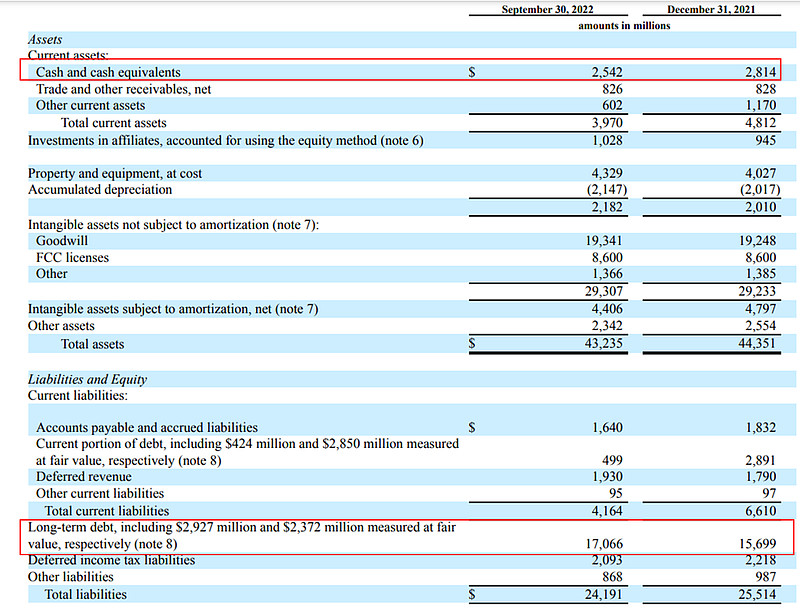

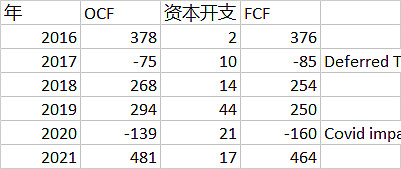

FWONK那时候一共是45亿美金左右的负债(算上可转换债务3.51亿美金),账上7亿美金的现金。过去六年Liberty大幅提升了FWONK的经营现金流,2022年的前三个季度OCF总额已经达到了417mm。我们回头看,2016年的自由现金流收益达到了7-8%,那时候其实是个很好的买入时点,只是大多数人可能都没有看懂这门生意。

F1是一个叫Bernie Eccelestone的人在1950年创立的。那时候已经有飙车族喜欢在周末聚在一起,但没有人想规范地把这个体育运动或爱好做成一个标准的赛事。Bernie让这些人去找FIA,但他们没人愿意听。于是Bernie去了,把整个赛事规范化,把体育运动做成了一门生意。只是他也有他的局限,比如在伦敦的住宅里办公,整个过程都只有一个销售员,在广告和赞助方面几乎就没有下任何功夫。他后来把主要权益都卖给了CVC资本和火,CVC想在新加坡于2012年以100亿美金的价格让F1上市,失败之后把控股权益在2016年卖给了Liberty Media。

F1是一个极好的生意,他在全球有4亿个粉丝,在2021年全球有17亿次累计收看。对比起来,NFL有1亿粉丝而且都是美国的,超级联赛(Premiere League)只有3亿粉丝,而且首先是对自己区域的球队感兴趣,而不完全是一个全球性的兴趣点。NFL每个粉丝变现50美金,超级联赛每个粉丝变现16美金,而F1只能变现5美金/粉丝,因此Liberty买下F1,能够实现的最大价值增强,就是通过巨大铁粉(而且这些粉丝都很有钱!)基数上的变现。

每年,F1都会在22个不同国家,举办22场赛事。从营收角度看,一共有三个主要板块,分别是赛事推广费,即当地合作伙伴负责举办这个活动,建立娱乐和赛道设施,这个不到1/3。FIA对于赛道设施的要求是非常高的,除了意大利Monaco发源地不要钱,其他地方都是1000-2000万,在发展中国家可以达到3000万美金,而且有时候花费更多,推广方反而可以获得更高的利润率,比如通过更高的票价和一些独特的资源渠道。Liberty刚拿下FWONA的时候有19场/年,现在2022年做到23场。但基本做到25场/年就封顶了,因为要运送整个车队及相关成员需要大量的时间和经历和金钱,不光是那些赛手,还有15,000个工程师,赛车和引擎等等一系列的东西,并不是一个线性的事情,而是边际成本急剧增加的,而且不想要品牌被稀释,本身也不能做太多场,因此这块营收和利润的增量是有限的【NASCAR是一个反面教材】;然后是广播和转播的营收,比如在美国是通过ESPN,这个不到1/3,这个主要是通过3-5年的广播合约来锁定,每过5年需要重新谈一次,而且每年有价格上涨机制。广播包括付费电视和免费电视,免费电视主要是为了去吸引新客户。当Liberty刚拿过来的时候只有Pay TV,Liberty则拓展了免费电视和OTT领域,而且引入先进的技术,比如F1 TV Pro,可以让用户全方位视角360度随意去调整观看的角度。这些广播电视最大的竞争对手是流媒体,比如亚马逊Studio拿到了NFL的播放权,普遍被称为流媒体对有线电视和广播电视最后一道防线(即体育)的强势攻坚;最后是赞助和广告,大概1/3,这部分成长空间是最大的。上面说了Bernie根本不在乎这些,因此原来广告商分类只有22场全赞助和区域赞助这两类,你把小车上面广告停在赛场就可以了,因此不会有科技合作方或软饮合作方。这部分有很大的空白,而这也刚好是Liberty擅长做的事情之一,去大大增加本地和全球的广告商,毕竟这是一个客户基数如此大的全球性赛事;然后其他项目大概是15%,利润率最低,主要是VIP座专区的售票,和F2和F3的一些互动的营收,还有用波音747运送整个车队的营收等等。

对于赛手来说,最重要的是怎么准备车和自身,怎么去应对每小时飙车300千米的巨大压力,怎么应对侧重力,压重力,如何训练自己的肌肉,这里可以做到非常精确,其CEO经常说的,“就像是下国际象棋一般”,需要极好的多维度平衡。除了赛手,还有15,000个工程师用最尖端的信息和智力去推科技研发,以前前三大车队每年的花费可以高达6亿美金,新加入的车队需要巨大的学习曲线和好几年的必败经历(而且参赛就要花大钱在科研上,所以BMW后来退出了)才可能有机会角力中原。

目前有10个车队,最好的是红牛,法拉利,和梅赛德斯。事实上,AMG Mercedes就是通过这个赛事火起来的,每年砸4亿美金的钱,但收获的广告价值却可以达到10亿美金!法拉利更是几乎所有的市场营销成本都砸在F1上了,而另一方面因为砸钱太多而退出的BMW的M系列就偃旗息鼓了,足见该赛事对OEM的重要性。第二梯队的是莱诺,迈凯伦,和阿斯顿马丁;第三梯队的就相对弱一些。这些车队会和F1,FIA达成一个每几年协商一次的Concorde Agreement,2021年的协议规定了每年花费的上限是1.4亿美金,不能再高。这么做其实是很机智的。以前在Bernie的体系下,是一个零和游戏,所有玩家打价格战砸钱,谁都赚不到;现在通过这种上限要求可以吸引更多玩家(比如据说保时捷就想要加入),让这些新来的也可能好好玩,而既有的玩家因为这个生态体系让所有人利益捆绑更加一致(他们可以赢的概率依然很大,而且有很多会员费第一年进来需要交给已经有了的车队,并且整个赛事知名度增加对于他们的广告效应也是有很大帮助),因此整个市场都很看好这个新的agreement,最近股价估值很高,部分也是这个原因。

迈凯轮原来就是一个赛车队,但后来开始拓展到oem板块,完成了整合。很多家族买成了赛车队,然后家族的子嗣(儿子)就变成了赛手,比如迈凯伦和威廉姆斯。

F1的成本主要就是和参赛团队去分享收入,其依据即为Concorde协议。F1是一个非常轻资产的生意,65%的成本都和参赛团队分掉了。当时Liberty就是看中了这个生意是一个现金流产生能力非常强劲的生意,而且固定成本很少(轻资产),这一点我们在新冠疫情期间看到了,成本控制能力很强,可持续盈利能力也很强。那一年营收从20亿变成了11亿,但OCF只下滑了5亿美金。Liberty知道这个生意的变现做得很差,因此除了上面说到的F1 TV Pro之外,还开发出电子体育游戏来吸引更加年轻的人群,通过给游戏公司提供授权,并用季度赛事的形式去推订阅模型,还给年轻的获奖者到F1去现场做仿真(simulation),在这个人群中推广兴趣和关注。最后,Liberty要求所有的赛手完全且绝对地移除之前的社交媒体限制,允许他们有Instagram和Twitter,与粉丝在线上互动,增加两者之间的纽带。

从这一系列变化中我们可以看到,当你有一个很强的品牌,并且有一大批忠诚的粉丝时,你可以有很多很多变现的机会。不光是F1如此,如果我们看法拉利也是如此,他可以从跑车切入SUV;保时捷也是如此,他还可以做保时捷牌的衣服,潜能可以非常大。又比如像烈酒品牌Jack Daniels,可以围绕这个品牌的威士忌去衍生各种产品比如RTD(即饮)类产品等等。

LILAK比起来就是一个差很多的资产 — 第一,杠杆很高,容不得经营上的差池,几次飓风和地震不幸接二连三,这个生意就很窘迫;第二,没有品牌效应,就是一个商品性的产品,同质化很高,所以竞争对手在KKR的支持下有更多资金杀入其市场,之前投资不足客服体验不行的弱点很快就暴露;第三,经营现金流产生能力很差,剔除掉SBC之后,整体的FCF盈利能力很弱,前几年更是没有FCF的,这和第五点资产轻重是相关的;第四,没有粉丝基数,因此也就没有其他的变现渠道,想象空间很小,而当地艰难的地缘政治环境又让并购整合举步维艰,这也是为什么过去五年LILAK和FWONA之间的表现有如此天壤之别;第五,商业模型本质,FWONA是轻资产模型,几乎不需要资本投入,其实就是一个协调机制,让整个赛事符合FIA规定,然后和参赛团队分钱并为参赛团队提供一个很好的变现和增加粉丝的机会,而LILAK完全是重资本行业,苦活累活脏活一大堆,飓风把波多黎各摧残后还需要挨家挨户地去维修有线电视。

低杠杆强品牌轻资产大客户基数强现金流的,往往是好生意!

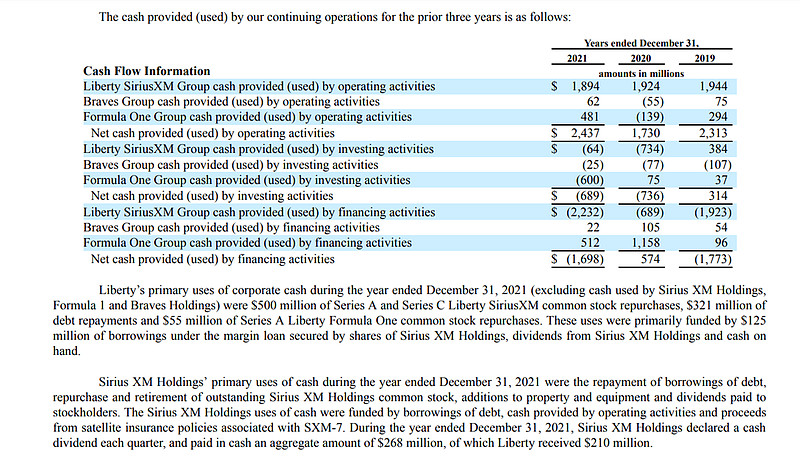

我们在下图里面可以看到过去几年F1的现金流情况。

在下面这张表中我们可以看到2021年公司的现金流和资本开支情况,其中资本开支几乎就是不存在的,才只有OCF的4%左右…