这个老外假设了一个极端情况,就是所有抵押的资产全部不要了,这样放弃31个建筑可以减少71亿负债,还剩14个建筑对应24亿资产价值和15亿负债,再加上7亿的现金,差不多还剩16亿的净值。当前市值13.5亿,有一个15%的折扣。

当然,如果是情况2的话,做梦也会笑醒。。。

作者:

Summary

I have estimated two scenarios (based on conservative assumptions) in which MAC is forced to hand back its "non-recourse" properties at varying degrees.

If MAC defaults on all of its non-recourse loans, there would still be a 14% discount to the NAV.

If MAC hands back just the lower quality malls, the outstanding NAV discount would land at 75%.

It is vital for MAC to conservatively manage the liquidity reserves and successfully negotiate the covenant terms with the existing lenders. The more MAC hands back, the more value it looses.

MAC is a perfect investment for value investors, who believe in the market eventually correcting any deviations from the underlying intrinsic value.

Relatively recently, I wrote an article about The Macerich (MAC) highlighting key six things to consider before going long: Macerich: 6 Reasons Why I Have Become Less Optimistic

Below is a short recap of the potential "red-flags":

Extreme leverage

Reduced CapEx when the need for that is the highest

Hardships in divesting some of the non-core assets

Tenants facing extreme challenges

The second wave of the virus

Accelerated secular changes (i.e. headwinds)

Now I will take the analysis one notch deeper and try to understand the embedded intrinsic value of MAC. The underlying assumption of the analysis is that MAC is forced to hand back some of its properties that have been financed with a non-recourse type of borrowing.

In my opinion, the conclusions below are highly applicable for value investors, who believe in intrinsic value and who think that sooner or later the market will stimulate the convergence to the underlying value. In addition, investors who assign a relatively large probability of MAC failing to negotiate more relaxed covenants after the current extension period (ca. 1 year), should benefit from these findings.

The Approach

I have developed two different scenarios which presume that MAC fails to comply with the existing covenants and thus is required to divest some properties to reduce the sky-high leverage. The catalysts for such action are not essential here. Although, in my opinion, the two most obvious are (1) permanently subdued rents, which render the debt-service impossible (2) the return of the virus, which imposes a gigantic cash drain and leads to failure of proper debt-service.

Before jumping into the two scenarios, it is important to understand the debt structure of MAC. Effectively, MAC has 31 non-recourse loans which account for ca. 84% of the total obligations. Then there are 14 properties for which there are no collateralization in place. Lastly, MAC has 13 non-core buildings (e.g., offices, properties under development). However, these non-core buildings comprise about 6% of the total GLA and less than 4% of the total NOI.

In total, as of March 31, 2020, MAC had $8.7 billion of debt from which $1.5 billion was attributable to the unsecured bank loans (credit facilities) and the rest to non-recourse loans.

The following are the main assumptions driving the calculus of the two scenarios (please note, I have tried to be VERY conservative in my calculations to attain a wider margin of safety and to partly account for the prevailing economic uncertainties when it come to the mall space):

I have completely eliminated the non-core properties from the analysis. First, MAC does not provide a NOI break down on them; second, the associated NOI is insignificant (less than 4%); third, I want to be conservative. Nevertheless, from the Q1, 2020 earnings conference call, it could be inferred that MAC tried to sell a decent chunk of the non-core assets and expected to receive $300 million. This estimate does not cover all 13 buildings and thus implies that the actual value could be much higher.

In the 8-k forms MAC provides a breakdown of 5 property groups in terms of the generated NOI. Group 1 generates the highest NOI, and Group 5 the lowest. MAC has not given an exact NOI figure for each property, but rather disclosed a % of total NOI generated by each group. I have taken a pro-rata approach for estimated what % of NOI could be assigned to each individual property. For example, Group 1 includes 10 properties and accounted for 32.9% of total NOI in 2019. This means that each property under Group 1 generates 3.29% of NOI.

In calculating the property values, I have assumed reduced future NOI by 10% (from the 2019 metrics).

Property cap rates I have taken from the latest CBRE U.S. cap rate survey (H2, 2019). For Group 1 and Group 2, I have assigned "high-street" cap rate; for Group 3 "neighborhood/community - A" cap rate; for Group 4 "neighborhood/community - B" cap rate; and for Group 5 "neighborhood/community - C" cap rate. The CBRE's cap rates reflect the pre-virus conditions, which is before the lowered rates by the FED and, of course, before the huge economic shock. It is hard to predict what changes these effects could make for the H1, 2020 numbers, as one provides some tailwind and the other a clear headwind. In my calculations, I have assumed by 10% higher cap rates than the ones shown in the latest survey. For example, in the CBRE H2, 2019 survey the "high-street" cap rate stood at 4.78%, but the actual cap rate factored in the Group 1/2 property valuations is by 10% higher - 5.25%.

The Results

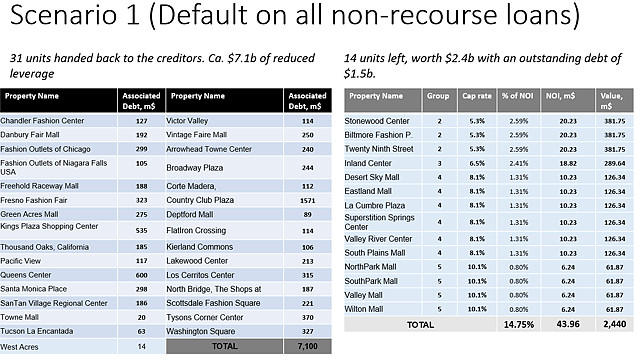

Source: SEC 8-k filing, May 12, 2020

The first scenario assumes that MAC defaults on all non-recourse loans and is thus required to hand back the corresponding properties. By doing so, MAC would reduce its outstanding debt by ca. $7.1 billion.

As a result, MAC would be left with 14 core-properties (worth ca. $2.4 billion) and $1.5 billion of unsecured debt. If we add up the $735 million of cash on hand that MAC had as of March 31, 2020, the total MAC's net asset value lands at ca. $1.6 billion.

In the context of the current market cap of ca. $1.4 billion, this implies a 14% discount to the NAV.

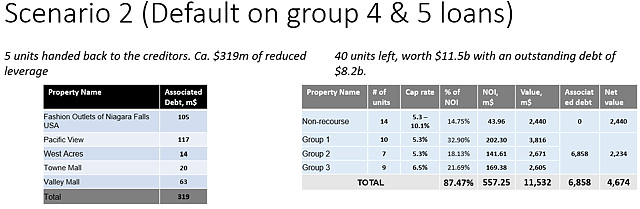

Source: SEC 8-k filing, May 12, 2020

Now, let's say that the macro and industry-specific conditions are not so severe and MAC can more or less manage its debt. But because of the very tight debt coverage ratios and small margin of safety in the covenant coverage, MAC decides to default on its Group 4 and Group 5 properties (the ones, which are "non-recourse"). The rationale for this choice could be that these properties do not generate meaningful rents relative to the other properties, require a sizeable capex to enhance the cash flows or have significantly lower growth prospects.

Under Scenario 2, MAC would give away 5 properties and reduce the outstanding debt by ca. $319 million.

As a result, MAC would still hold 40 properties (worth ca. $11.5 billion) and carry $8.2 billion of debt. The NAV value, in this case, lands at ca. $4.7 billion, and including the cash reserves, it increases to ca. $5.4 billion.

Compared to MAC's current market cap, this results in a 75% discount to the NAV.

The Bottom Line

There are a couple of takeaways from this.

First, MAC trades at significant discount to the underlying NAV.

Second, the more loan defaults MAC accepts, the more value it loses. It will be critical for MAC to manage the liquidity reserves properly and reach a positive agreement with the existing lenders (i.e. covenants) until we return back to a state of normalcy.

Third, the probability is very low that the Management accepts any potential bid from Simon Property Group (SPG) that does not provide an enormous upside for the MAC's investors. The recent insider buying confirms that the Managements has noticed the massive NAV discount as well.

Finally, for you to go long MAC, you should believe in the notion of market correcting any dispersion from the underlying intrinsic value. If you do not and think that the market has become flow-driven in which the passive money prohibits a real price discovery, you should avoid the Company. Otherwise, the chances are high that you will get burned just as many "Tesla" shorts.

If you liked this report, please scroll up and click "Follow" next to my name to not miss future articles.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.