原文地址:SeekingAlpha

作者:

Summary

Two months ago I wrote about MAC arguing that it has sufficient liquidity reserves to withstand the crisis for at least a year while keeping the recently reduced dividend.

Now I still consider MAC an attractive long-term investment, but my level of bullishness has gone down.

If you factor in the extreme leverage, reduced CapEx right when it is needed the most and the hardships in divesting non-core assets, MAC can really go either way.

Add the facts about struggling tenants, reasonable probability of facing second wave of virus and the accelerated secular changes, the future outlook does not look rosy at all.

The reason why I am not recommending to short MAC is the proven track record in handling the GFC and the top-tier asset quality trading at steep discount to NAV.

There is no doubt that Macerich (MAC) is one of the most popular REITs among retail investors and, especially, in the Seeking Alpha platform.

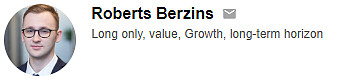

The sky-high dividend yield (before COVID-19) in combination with a portfolio packed with widely known trophy properties have been the main elements of attraction. The most recent performance of MAC's share price has potentially evoked a more intense interest in the Company.

Source: YCharts

Two months ago I wrote an article about MAC "Testing The Solvency Risk Of Macerich" in which I argued that MAC has enough liquidity to survive ca. 2 years without suspending the common dividend. Broadly speaking, I was bullish and thought that MAC was a sound bet for a long-term investor.

Since then, we have had access to a myriad of Q1 earnings and hard data on the direct consequences from the virus. In addition, we are gradually recognizing the long-term negative effects caused by the virus (e.g., secular changes).

So, by factoring in the recent data and the future prospects of retail, my level of bullishness towards MAC has decreased. I still consider MAC a good bet for a long-term investor, who has the stomach to withstand gigantic share price swings. However, the size of position has to be seriously reconsidered so that it constitutes only a tiny portion in the overall portfolio.

Below I will try to encapsulate six things (in no particular order) about MAC which make me worried. Put differently, these aspects should be thoroughly assessed and taken into account before going long on MAC.

1 - Extreme leverage

I know that it really does not make too much sense looking at the book values for REITs, but the fact that MAC has one of the highest debt ratios not only in the retail sector but across the whole REIT universe is not a positive sign.

If we look at debt-to-EBITDA coverage, which introduces a cash flow perspective, the picture is more or less the same. As per the latest data published by NAREIT, MAC had debt-to-EBITDA ratio of 9.8x which both in absolute and relative terms is VERY high number for this metric.

To strengthen the argument, let's compare the 2019 FFO-to-Interest expense ratio between MAC and Simon Property Group (SPG), which is commonly viewed as the safest mall REIT.

In 2019 MAC generated $537 million in FFO and incurred a total interest expense of $217 million. The ratio lands at around 2.5x.

Similarly, SPG generated $4.2 billion in FFO and recognized interest expense of $789 million, that translates to 5.3x.

The indebtedness of such a level puts MAC on a very thin ice. If the economy cracks again or few large tenants go belly up, the chances are VERY high that the next chapter for MAC is chapter 11.

2 - Reducing CapEx when the need for that is the highest

An excerpt from 8-k (Q1, 2020):

The Company's redevelopment pipeline has been significantly reduced for the remainder of 2020. The Company anticipates spending $60 million in the last three quarters of 2020 on redevelopment, which represents a 60% reduction in previously estimated 2020 redevelopment expenditures for that period of time.

The fact that MAC has significantly cut its CapEx spending should definitely help preserve liquidity and service the outstanding debt.

However, the long-term implication of that might be severe. This is the time when secular changes in consumer habits have been accelerated. To remain competitive, malls have to continuously adjust and repurpose their properties. Especially now, when the large clothing and luxury chains are increasingly falling out of favor. The currently vacant areas have to receive a notable size of CapEx to adjust them to the services for which there is a somewhat reasonable future demand.

There is no doubt that malls will require extensive CapEx programs to remain in vogue. If they do not respond timely and proactively, the consequences could be deadly. The question is what opportunity cost MAC has incurred by postponing the necessary CapEx and whether it will be able to keep up the investment pace given its debt-saturated balance sheet.

3 - Hardships in divesting some of the non-core assets

Going into 2020, MAC planned to divest $300 million of its non-core assets. Q1, 2020 revealed that MAC is really struggling with this. It did not record any asset sales during Q1, 2020.

An excerpt from conference call (Q1, 2020); Tom O'Hern:

Jim, we've been in discussions with our partner to sell to them and that was pre-COVID-19. And then, once the entire market got volatile say mid-March, they decided to hold off. And additionally, we like the asset.

It is extremely hard to get an attractive bid for the properties, especially in retail. The uncertainty about the future is clearly holding off many buyers.

Think of it - relatively soon MAC will have to sit and negotiate with its lenders about the covenants and the structure of loans. It is very likely that part of the deal will include selling some properties to reduce debt. If there is a prolonged recession or worst second wave of virus, MAC would have to give these properties away for pennies. It could perhaps satisfy lenders and be enough to pay down debt, but there will not be anything meaningful left for the equity holders.

4 - Tenants facing extreme challenges

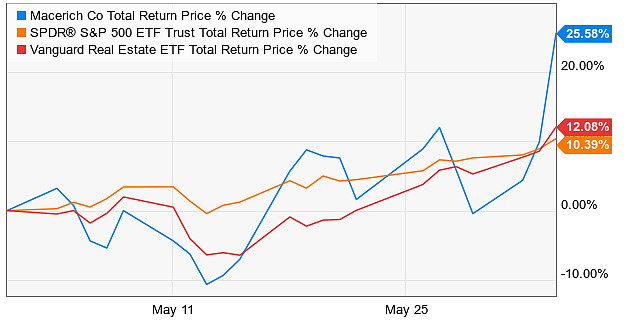

Take a look below on how the largest 3 anchors are suffering (and consider that the market is a forward looking machine):

Source: YCharts

The risk of MAC finding these boxes (and obviously the others as well) completely empty is not too distant. In these economic conditions it is very challenging to find replacements. The bargaining power is certainly at the tenant side right now which implies potentially lower rents.

5 - The second wave of the virus

Here, it is important to appreciate the probability of experiencing a comeback of the virus that might turn out to be as lethal or even worse than the COVID-19.

For sure, if such a nuclear event happens everything is going to plunge. Equities, commodities, bonds, real estate etc. Yet, the retail sector specifically will be in the frontlines. While let's say Vanguard Real Estate ETF (VNQ) might fall 30%, it would not be too far stretched to assume more than 60% of market cap loss among retail REITs.

So, in case of more lockdowns and heavier social distancing measures, MAC entails a high probability of not only suffering major drawdowns, but to incur a permanent loss of capital. The sky-high leverage and the potential inability to sell assets are the key reasons for that.

6 - Accelerated secular changes (i.e. headwinds)

The virus has sped up certain structural changes that were slowly but steadily influencing our lives - most conspicuously, profound digitalization and remote work.

The fact that many people have been forced to order groceries online and buy clothing, electronics and other things online does not bode well for retailers.

Namely, there is a high chance that many pre-virus mall customers have finally tested the digital means of shopping and got used to the comfort. Even if we assume that, say, 10% of the mall customers have permanently changed their consumption patterns and thus no longer visit the malls as frequently as in the past, many retailers could go bankrupt. This is because before the virus margins for many retailers were already tight at single digits.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.