10/30/2023

以下所有,不作投资建议。写得比较急,粗略/简约之处,望读者见谅。欢迎有建设性的讨论 ![]()

Dear XXX san:

Allow me to address your question(s) in three parts:

The first part discusses rate hikes and yield curve inversion;

The second part I want to tell you how I got attracted to and become an investor in Citizens;

The last part discusses why I was probably early and what I plan to do with the stake (and why).

Part I:

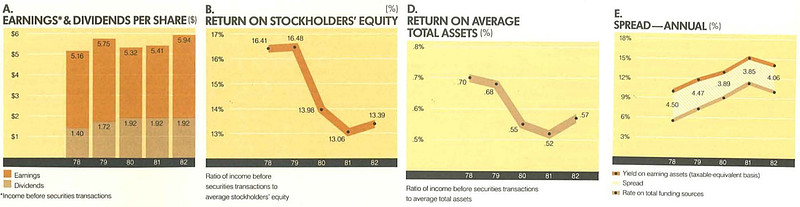

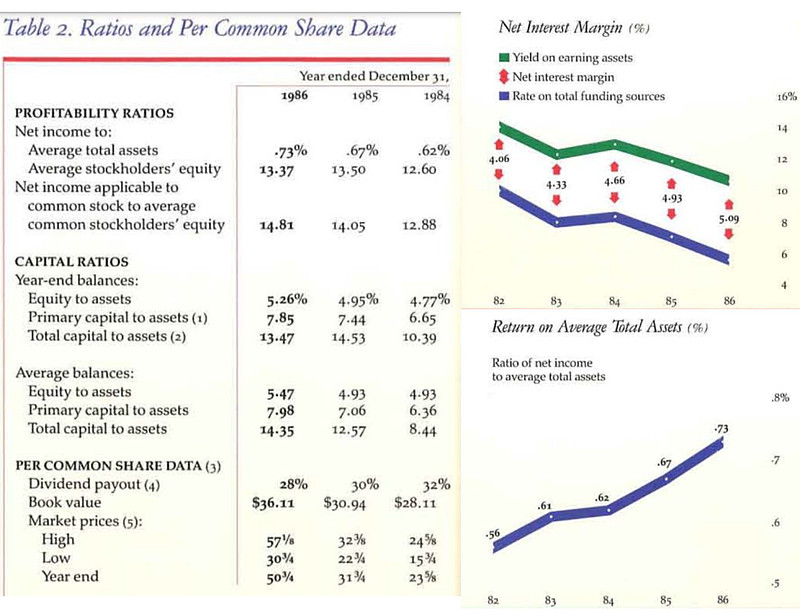

Before I invested in these regionals, I actually read Wells Fargo's annual reports all the way back into the 70s and 80s (it was a bona-fide regional bank back then, mostly operating in California)

This is from 1982. Yes, their NIM, ROE, ROA were all compressed. It was also operating with massive leverage -- unthinkable in today's terms.

However, when rate declines, the NIM quickly expanded, while ROA, ROE, and profitability skyrocketed. In the next 15 years, this stock will become a 10x. Coupled with its 7% dividend yield, that translates to a 22.5% annualized return.

Of course, the question would be: is the current rate hike cycle ending?

My guess is -- it is. The recent memo from Howard Marks which I circulated earlier discussed this well. Bill Ackman also just closed his short on long-term treasury. Inflation is heading down big-time within a year, and this quarter delinquency further increases. Public debt of $32 trillion simply cannot support a run-away scenario for rates. The entire tax revenue of the US is $4.4 trillion while if we have 10% interest rate it'd be $3.2 trillion additional interest expense within 3 years and I'm not sure how the government is going to sustain that.

Last bit -- just like the market missed the rate curve inversion and pushed these things to north of 2x price to tangible book back in 2021 and later found itself egregiously mistaken, is the market unmistakably accurate in its assessment of the yield curve at this moment? If the market has not been pessimistic, is it possible for the regional banks with strong credit qualities to trade at these levels in the first place?

Part II:

CFG was bought by RBS in 1988 during a period when foreign banks thought the US banking industry is attractive. Since RBS acquired CFG, they expanded it with 25 acquisitions. More than 2 decades later, like many of its peers, RBS decided to exit the US market cuz the business in the US is competitive and they lack scale. They split off CFG and had an IPO of the company at $21.5/share at ~1.1x P/TBV (tangible book value). Since then, CFG has come a long way.

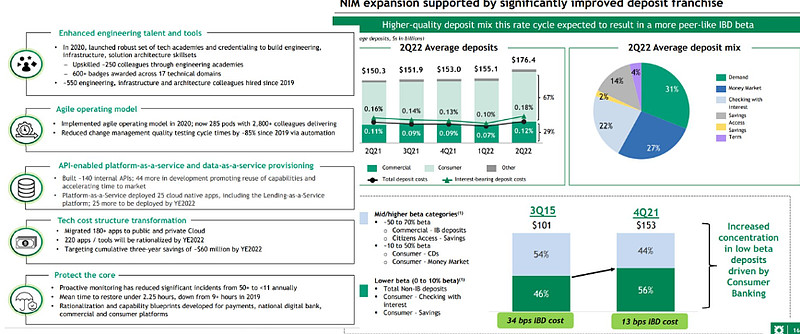

As an independent company, it focused on its business, invested heavily into technology (left side, one of the first bank to migrate to the cloud and develop their own application programming interface for open banking initiatives), and expanded into its consumer banking segment which is lower beta (namely the rise in deposit interest goes up as a smaller % of rate increase)

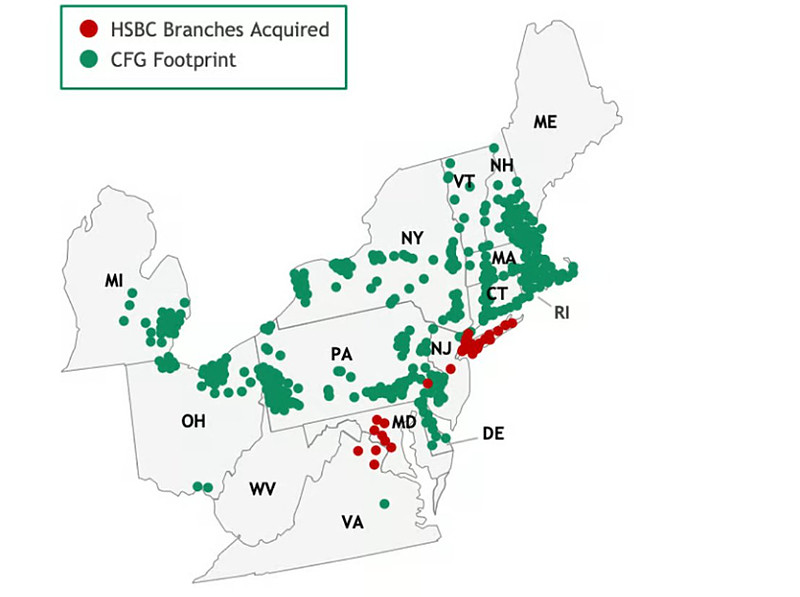

The bank proves to be a shrewd capital allocator, acquiring HSBC's NYC branches' $9 billion deposit for $180 mm. This translates to a 2% deposit premium ($180mm/$9bil). This is a very attractive price in a prosperous (yet also competitive) neighborhood. Similar transactions are typically at 4-7% deposit premium in 2019 when they did the acquisition. After the GFC (great financial crisis) of 08-09, deals were ~2%. So they got a good franchise at depression level valuation. Not bad.

Unliked Silicon Valley Bank or Signature Bank, it managed its duration well. The HTM (held to maturity) and AFS (available for sale) securities losses were small (~5% of tangible book, alternatively, before adjustment for these losses they have a tangible book value of $27.8/share, and with those adjustments they're still $26.5/share), demonstrating again their shrewd capital allocation skill.

As someone who enjoyed using First Republic's services, you may be delighted that they acted in a contrarian fashion again and poached 50 experienced private banking professionals from the old First Republic and launched their own Private Banking segment (5 cents of this quarter's earnings were offset by private banking startup costs). In the long term, I think serving wealth clients is the way to go, and coincides with the bank's emphasis on developing close client relationship.

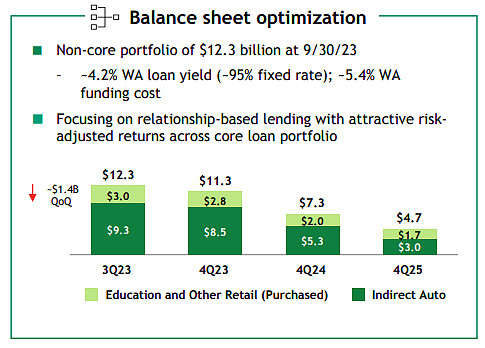

They do not build empires -- in the contrary, they are exiting auto lending because poor profitability and indirect client relationship. I like companies that are willing to walk away from low return businesses.

Last but not least, it's dirt cheap. Their tangible book value by Q3 2023 was less than $28/share. At the current price of $24/share, they're trading at 0.86x tangible book value. Their long-term ROTCE (return on tangible capital employed) target is 16-18%. Even if they are not able to achieve that, and settles around 10-12%, that translates to 11.62%-13.95% annualized return to equity holders -- hardly a bad return. You mentioned their book ROE numbers do not look attractive -- I would point out that their book has $8.3 billion of goodwill and intangibles from the original split-off and later acquisitions (such as the acquisition of HSBC). I would further point out they're trading at 0.47 price to book. Even if we use their book ROE of 8.8%, we're paying less than half of book value, and 8.8%/0.47 = 18.7% -- not bad either.

Part III:

Banks are really tough to invest in because there are so many facets associated with them and missing/misjudging one can lead to adverse outcomes. My clients and I are suffering from a ~10% paper loss from this name because I underestimated the market's reaction to their entrance into a bunch of interest rate swaps (but to the management's credit, they clearly telegraphed this in the last several quarters so the market wasn't probably paying sufficient attention…). Roughly 20% of their loans (mostly commercial loans) are hedged out into 2025... and beyond a 5% interest rate these swaps will be money-losing propositions... The market is understandably frustrated by this... Now that I'm under the water the next question would be -- should I sell? I think 15% discount to tangible book for a strong regional franchise that has a reasonably decent investment track record, coupled with a 7% dividend yield as I am waiting, does not make it a reasonable decision to exit at this point. After the swaps roll off, private banking/wealth management grow, and the Fed tapers off their rate hike, this 7x PE (earnings is depressed) stock may have substantial room to rerate upward. If it goes to $40 (Jan 23 price) by 2028, then I get a 18.3% annualized return. Risks? They have a 10.5% CET I ratio, very limited unrealized losses, conservative lending practices, so I think credit risk is limited even if we enter a mild recession. Given liquidity risk already dissipated (and deposit actually increased sequentially albeit at a slightly higher funding cost), I think this is far-away from a distressed scenario.

Now, are there better options? I actually like M&T bank better on a risk-adjusted basis. They don't have the swap headwinds, managed unrealized losses even better, are managed by a star team led by Rene Jones, one of the best bankers alive who masterminded the tremendously accretive deal of Wilmington Trust acquisition during the GFC (he was the CFO back then, working with Bob Wilmer), currently trading at <1.2x price to tangible book (due to CRE fear, which I think is overblown, at least for M&T bank — fingers crossed I'm right), and has a remarkable track record (the only bank that maintained and then hiked dividend during the GFC). The bank has been a 100x from 1980s to 2007, and has been flat to down from 2007-2023 despite its tangible book value close to tripling over that time period. I think it's ready for the next move up to permanently kiss goodbye to the low $100s level. My clients and I hold M&T bank as one of our largest holdings.

Hope it helps to some degree and look forward to discussing more either through email or during our next meeting,

Best,

XXX

Oct 24th, 2023

Disclosure: We are long $美国制商银行(MTB)$ and $Citizens(CFG)$ . We have no position in $富国银行(WFC)$ .

—————————————————————————————————————-

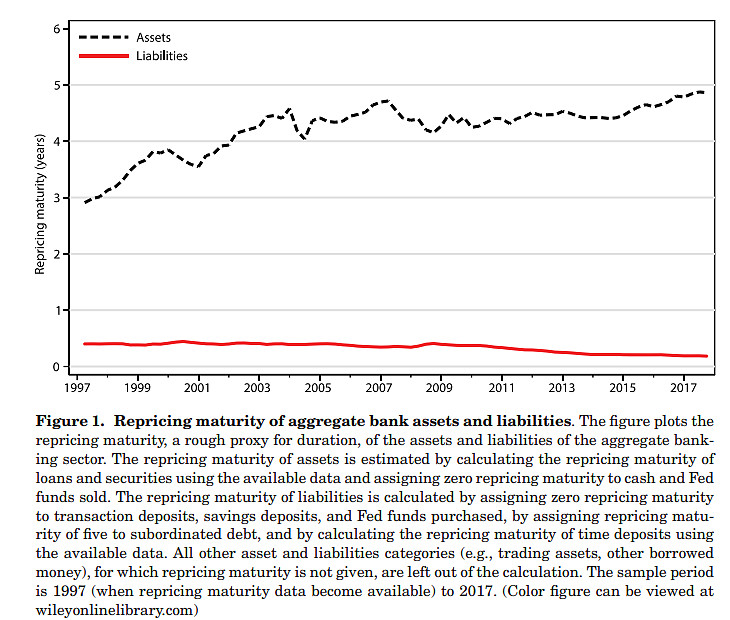

在大多数人看来,银行具有久期错配的问题,因为存款很多都是活期的,贷款久期比较长,一来一去必然会有匹配上的问题。但事实是,这种观点得不到经验数据的支撑。

单独看期限结构(Repricing Maturity)似乎确实如此(有久期错配的问题)。

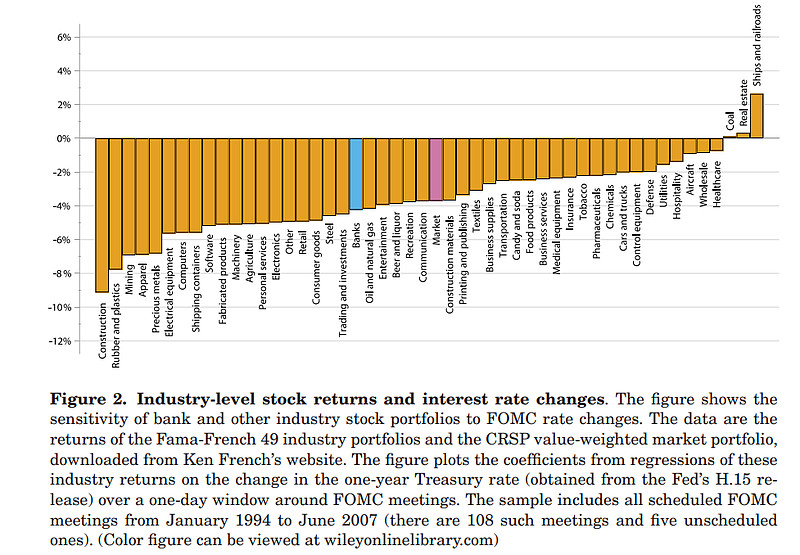

但行业层面股票回报和利率关系的数据来看(94年-07年),银行的回报对于利率的敏感性属于居中的(不过这个数据要打个问号,因为这13年银行股一直是牛市)。

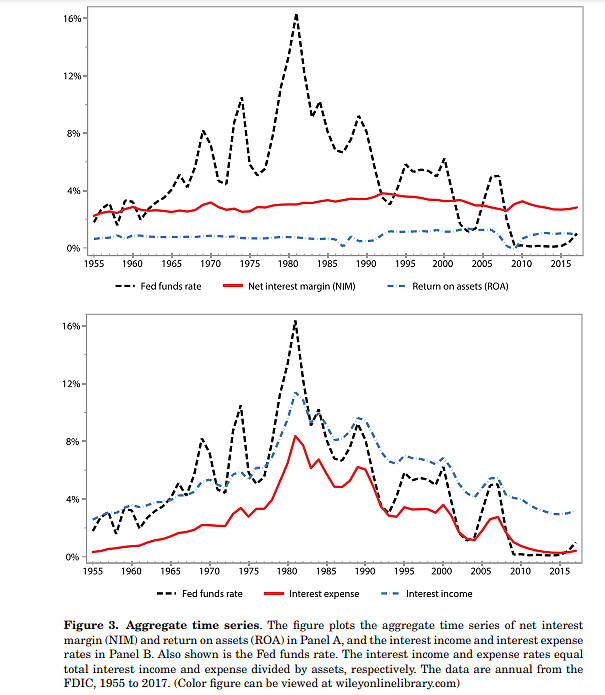

更有说服力的数据是55年到17年这60年间的净息差 — 无论练出准备金数字怎么变,净息差的数字一直在2.2%-3.8%之间,异常稳定,这里的NIM对利息增加的敏感度在-0.11%。

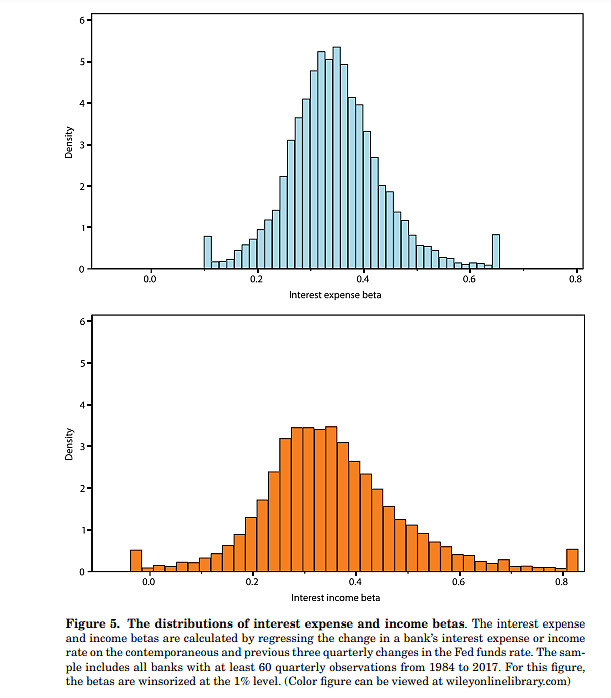

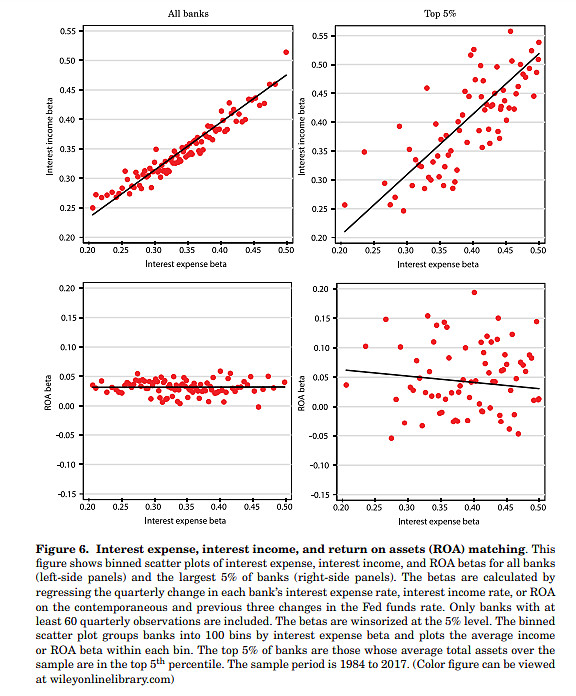

实证结果是,银行的利息成本β和利息收入β出奇地一一对应,就好像银行自己具备调整的能力。

当然数据往细处挖,你会发现有些银行的两个β对应得并不好,NIM敏感性凸出,但正负都有,按照整个行业看(也就是监管者得角度),是比较均一的。当然,硅谷银行引发出一系列问题—即我这里的传染效应(contagion)怎么办?监管者真的可以忽略牵一发动全身的细枝末节吗?

历史数据表明,两个β对应得很好,整个行业看关联度为0.81,看头部10%银行关联度基本就是1了。

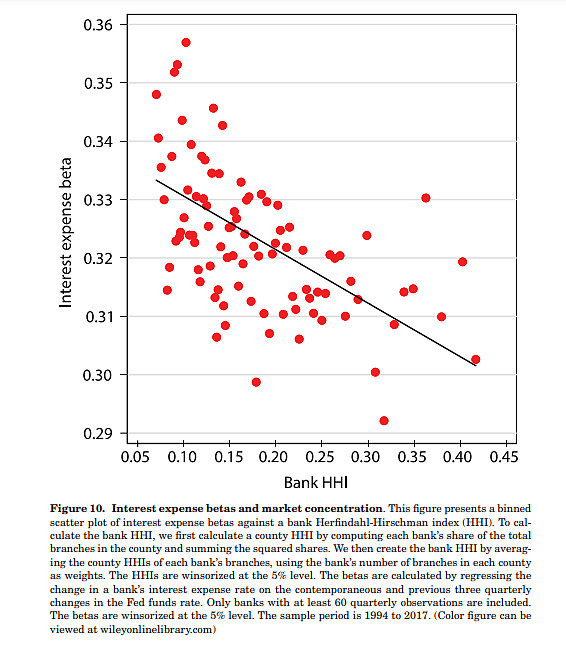

当一个银行的区域市场份额越大,其利率成本β就越低(客户粘性越强)。

零售部分的β和利率成本β高度相关,进一步影响银行的资产端配比和利息收入β的匹配。

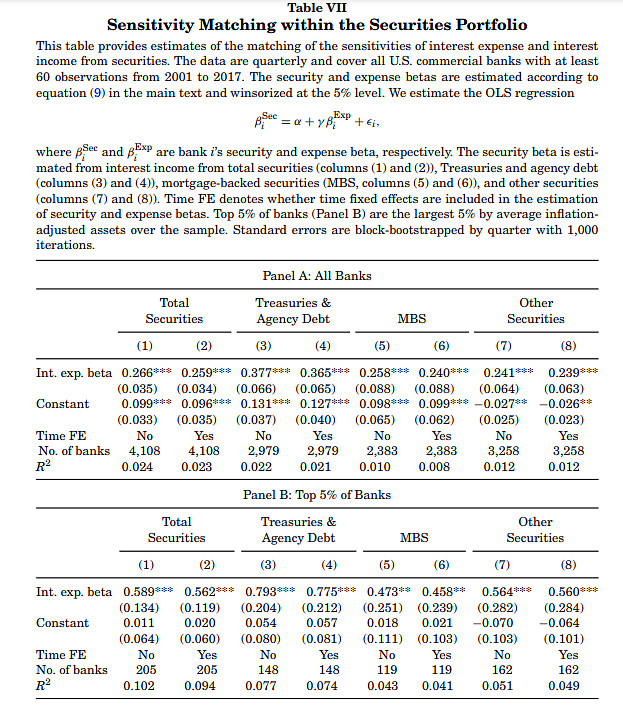

人们可以说,贷款利息收入β和成本β的正相关,是因为客户粘性好(区域市占率高)的银行,相应地也更能找到好的贷款机会去放贷,但上述结果表明,在没有分层(放贷容易或困难)的证券利息收入β和成本β之间也存在统计显著的正相关,这说明银行资产和负债端的β匹配是有意为之。成本β越低的公司,越能持有收入β低(也就是久期长)的证券类资产(证券类资产的平均久期8.4年,贷款为3.8年)。但这里就是有意思的地方,你可以说硅谷银行在出事之前是成本β低的公司因为储户都是大佬,对利率不是那么敏感,成本β低,所以银行更敢拿久期长的证券类资产(因此收入β低,因为利率涨了对这个证券组合影响也小),后来因为未兑现损失出了偿付能力问题(Solvency issue,调整损失后股权清零了,没法兑现亏损变卖证券了),一下子成本β飙升了(久期急剧缩短),倒闭了。流动性问题和久期错配其实是两个问题:浮动利率债券没有利率风险(因为久期无限接近零)但可能有流动性风险(如果债券的发行数量很少的话);反过来长久期的国债可能有利率风险但没有流动性的问题。

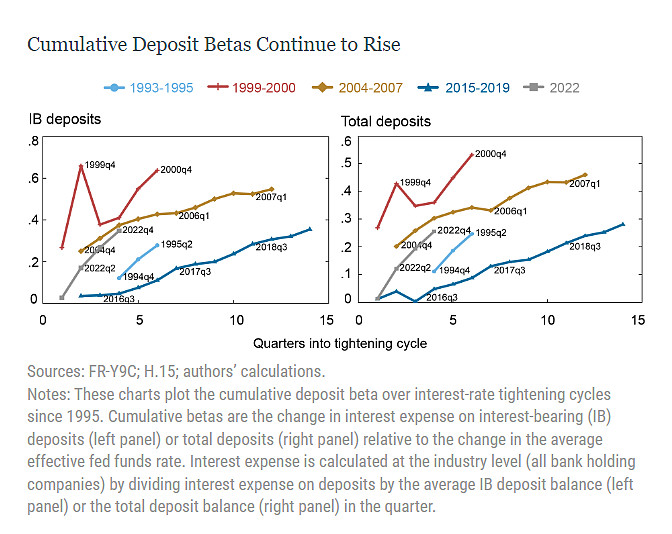

这里想说的核心是,储蓄的久期并不是那么短的 — 只要客户还在你那边,那这个储蓄的久期就可以很长,因为客户不出大问题,一直会在你那边。这一点我们和银行家确认过。银行内部会对客户生命周期(久期)进行建模,最关键的是压力下的久期坍缩(stress scenario)。一种解释方法是通过储蓄特许(deposit franchise)这个概念来切入 — 储蓄特许这个东西是投资银行的人认为一个银行最宝贵的东西,如果一个银行有一个很强大的储蓄特许,那就可以给很高的溢价,比如Cullen Frost现在还卖2xP/TBV,因为CFR几十年在德州的经营吸引了大量当地的小企业主作为长期的合作伙伴,储蓄特许很强大。储蓄特许如何维护?需要不断地投入资本,即市场成本,技术成本,服务成本,线上软件成本,线下网点和设施的成本,这些成本随着规模,有些是可以均摊下降的,有些随着通胀/利率上涨,总体来讲相对固定,可以说是银行在支付固定的“利息”,而随着利率增加,因为银行维护了很好的储蓄特许,客户对储蓄的利率要求不会同步增加(行业的储蓄β大概在0.31%),也就是说,银行是在“收获”浮动利率(即联邦利率减去相对稳定的储蓄利率),“支付”固定利率(即投入资本开支维护储蓄特许)。也就是说,银行进入了一个支付固定,收获浮动的掉期合约里(Swap Contract),而这个合约是正久期的,叠加一个基本没有久期的储蓄基数,就是进入了一个正久期的状态,这个正久期去匹配正久期的负债,是银行在积极管理和匹配的东西。硅谷银行的问题就在于,在利率不断上涨的情况下,储蓄β不断增加。这个周期央行加息非常快:

导致储蓄β是历史上最陡峭的一次(~0.40 in Q1-Q2, 2023)。储蓄β高就意味着揽储成本上升速度快,这就破坏了储蓄特许的掉期合约,正久期的局面被打破,久期错配被暴露出来,所以区域银行会那么惨 — 而区域银行事发以后,宇宙大行反而变成了香饽饽,他们的揽储成本根本没有上升,也就是说储蓄特许的掉期合约仍然在,所以大行今年的表现远远好于区域性银行,这是从久期匹配的角度去看这个问题。那么当加息尾声,揽储成本稳定后,这个掉期合约回来了,这时候净息差又因为两边久期匹配而稳定下来,这就是区域银行盈利能力和估值向上重估的理论基础 (我英文部分的第一版主要就是在讲为什么我判断加息尾声了)。

01/24/2024

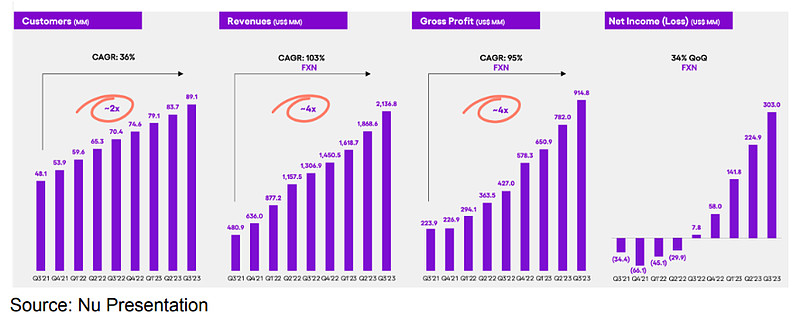

Nu Bank may be a decent bank. The bank's financial numbers (gross margin) is depressed because of IFRS9 requiring them to provision for everything upfront (rather than throughout the loan's lifetime). Merchants require payments within 30 days (rather than 2 days like the US) while the customers of the bank typically have a 26-day average payment cycle, leading to positive cash cycle and extremely high ROE. The founder, David Velez is a Stanford MBA who got lots of his inspiration from Nigel Morris, the founder of Capital One who compounded earnings before taxes at 32%/year during his ten year tenure. It has the broadest host of tech talents in Brazil, and these individuals started with the beta-version of credit services, gradually expanding into personal loans, investments, insurance, and deposit accounts, accumulating 89 million customers, reaching half of the Brazilian adult population (total population is 210 million), and starting to 1) lower funding costs through NuAccount, their deposit accounts; 2) cross-selling among various cohorts, leading to per account monthly revenue marching from $10 to $25 and will possibly arrive at $35 as they cross-sell more (every customer uses 4 products at Nu Bank, which is a world record). Because of its tech platform characteristics, operating expense as a percentage of revenue will rapidly decline, and it's projected to earn $.43/share in 2024. Considering their entry point of $4/share back in 2022, it was almost a steal -- you need to look forward to see how cheap it is.

Since they have followed Capital One as an example, they focus tremendously on extracting customer insights through extensive interactional data from their credit expenditure and to arrive at more complete customer profiles with better priced risk. In other words, like Capital One, they try to find mispriced risk and pounce on it, leading to higher yield on their credit than their peers, while not having to charge excessive fees or interest expenses like their legacy oligopolistic peers, leading to considerably higher customer retention rate and a staggering 80-90% organic customer acquisition rate at an average cost of acquisition of only $7/customer. In addition, to get their debit card, the customers need to have a referral, which is a tactic Nu Bank employed to 1) generate a sense of scarcity; 2) manage risk through customer endorsed referral. The bank is likely to grow EPS at ~50% in 2025 to $0.63/share. David has entered the giving pledge and will donate his rewards if the stock hits $18/share before 2026 to family philanthropic trust.

Another thing that marvels me is their RIDICULOUSLY low efficiency ratio (even with SBC adjustments) -- shows us the power of being a tech platform that epitomizes capital-light as part of its operating philosophy.

Seems like the Berkshire Hathaway team hits a jackpot yet again!