最近看了一下光学设备,激光原件和系统领域的一些机会。疫情期间这些公司的业务增长不错,但后来放缓了,加上供应链问题积压库存要释放,且行业在高峰期几个比较大的玩家或多或少都有一些高价收购不及预期,所以最近这个行业的主要玩家下跌都比较多,所以知识性地积累和探索了一下。1). $Coherent(COHR)$ 2). $MKS仪器(MKSI)$ 3). $Lumentum控股(LITE)$ 4). nLight/LASR 5). IPG Photonics/IPGP

看到Coherent的留言板还挺热闹的,国内似乎也有覆盖,所以贴一下这篇文章自己零散写的一些分析,抛砖引玉。如果有对这个行业了解的朋友,欢迎留言/私信联系交流 ![]()

![]()

2023/09/13

Core Thesis

Given the secular tailwind behind virtually all II-VI’s operating segments, along with favorable business models of its Industrials and Instrumentation segments, II-VI should be a profitable growth story. Given the constant share price decline since its acquisition of Coherent, and in particular the recent 30%+ drop after its earnings release, lots of pessimism seems to be priced into the stock. The valuation of the business, under a base case scenario, seems to imply ~26% of upside, while the asymmetry between bull/bear case gains/losses seems to be attractive. Therefore, II-VI is possibly at least a “one-night stand” candidate. However, given the lackluster capital allocation record of the management team and the less-than-ideal incentive structure, II-VI will need to prove itself worthy of a “marriage” with intelligent long-term investors.

II-VI as an Operating Entity

In this report, I define the currently trading as COHR as II-VI, and the Coherent Laser company that II-VI has acquired as Coherent so as to avoid confusion in referring to the two. I define a “one-night stand” situation similarly as a soggy cigar butt where the stock is cheap and one takes advantage of its cheapness for a ride and then sell; a “marriage” situation refers to a situation similar to what Charlie Munger calls a compounder, where the investor buys and holds a company for the long term.

The company develops and manufactures many of their products based on their ability of conducting metal-organic chemical vapor deposition and molecular beam epitaxy reactors, automated computer numeric control optical fabrication, high-throughput think film coaters, nano precision metrology, and custom engineered automated furnace controls for crystal growth processes. It sells these products to their end customers by employing a direct sales team of more than 600 of employees, and also through third-party representative across the globe.

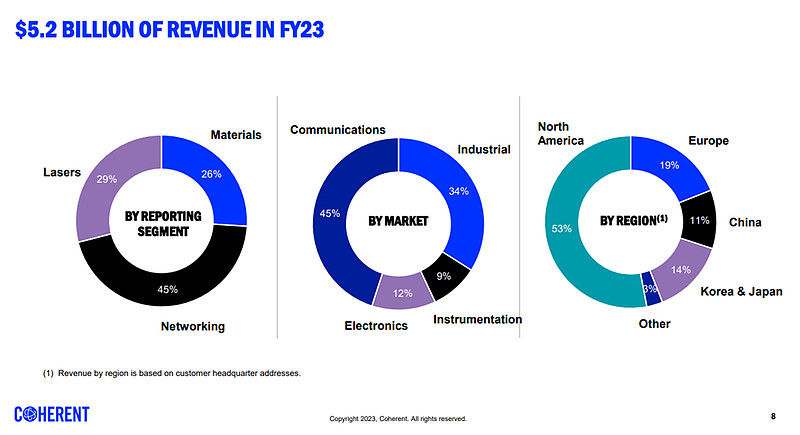

The end markets of II-VI are the following: Communications, Industrial, Instrumentation, and Electronics. I will briefly describe these end markets and their corresponding characteristics, as I believe these are the most relevant drivers of II-VI’s business fundamentals and growth.

Communications:

The company sells transmitters, receivers, transceivers, pluggable amplifiers, configurable line cards, transponders, and active optical cables. It also sells 980 nm pump lasers as key enablers of erbium-doped fiber amplifiers to boost the power of optical signals in fiber-optic cables for high-speed signals to be transmitted over long distances. Its end customers include Ciena Corporation (whose customers are in term AT&T, Verizon, Sprint, and etc), Fujitsu Network (leader in broadband transmission systems), NEC Corporation, Nokia Corporation (telecommunication infrastructure), and cloud service providers such as Alibaba, Tencent, Cisco, Dell, and Extreme Networks. For these optical components, the market has been consolidating, and II-VI, Lumentum, Broadcom, Accelink, and Sumitomo commands 55% of the market. Despite the consolidating competitive landscape, it is a tough arena because the buyers are large with strong bargaining power, while products are made to international standards with limited opportunities for differentiation, therefore premium pricing is difficult. 5G might accelerate revenue growth in this segment, but I remain suspicious regarding its profitability. This segment constitutes almost half of II-VI’s revenue.

Industrial:

The company sells laser optics and solutions for the industrial market, and I believe this segment is more moat-worthy than the Communications segment for the following reasons. Firstly, the products oftentimes are consumables, allowing the company to leverage its vast installment base to generate sustainable and recurring revenue. For instance, the ZnSe optics and components (where the name II-VI was derived because Zn is II and Se is VI) has 50 years of critical deployment that enable high-power CO2 laser systems because of their inherent low loss at around the 10-micron wavelength. These optics need to be replaced periodically because of tear-and-wear and sometimes literally blow-ups due to cracks under high temperature, which is not uncommon at all for laser systems. Secondly, the products are less standardized and are often mission critical while their costs are but a fraction of the total apparatus, resulting in consumers focus more on quality, suitability, on time delivery and technical support, rather than price. For instance, the company supplies laser chips and other critical components and subsystems that enable many functions within fiber lasers which are mostly high power, expensive, and used under industrial settings. The failure of laser chips, which can impede the input optical power to the beam delivery systems that direct the output optical power to the target can lead to disruption of production processes and can be highly expensive to the customers. Thirdly, some end customers in the industrial segment are not normal market operators, but are governmental agencies such as the defense sector that mostly focus on functionality rather than cheapness of product. For instance, II-VI’s missile warning, electro-optical targeting, and imaging systems are deployed on virtually every US fixed wing and rotary platform, and given these products’ quality and functionality directly affect national safety and soldiers’ lives, the buyers are less likely to switch to a less-familiar, less well-known supplier solely based on price or even minor improvement of differentiation. Overall, due to the three above-mentioned reasons, I deem the Industrial segment as one of the most moat-worthy among the four segments of the business. Because of varied applications and industrial niches, end customers wield less power, while market structure is also more fragmented. For instance, defense customers are Lockheed Martin and Raytheon, while semiconductor capital equipment customers include KLA Tencor, Nikon, and ASML.

Instrumentation:

Laser systems exhibit the following characteristics: 1. Collimated output with Gaussian beam mode leads to high spatial resolution imaging; 2. Ultra-short pulses for high repetition rate & real-time studies of molecular & sub-cellar dynamics; 3. Wavelength tunability leads to selective excitation of different chromophores; 4. Higher powers at wavelengths ranging from UV to mid IR. These characteristics altogether made laser systems uniquely suited to be employed as analytical instrumentation for biotechnology, medical analyses, semiconductor manufacturing, and scientific endeavors. These end market not only grow rapidly, but also exhibit similar positive characteristics like those mentioned in the industrial segment that leads to potential differentiation and favorable pricing. Again, due to niche applications, less standardization, and less concentrated buyers’ power, I consider this segment, similar to industrial, to exhibit more shareholder friendly economic features.

Electronics:

This part of the business includes consumer electronics, automotive, and wireless market. The VCSELs, VCSEL array, and optical filters leverage II-VI’s 6-inch GaAs platform for consumer electronic 3D sensing embedded in Virtual Reality (VR) and Augmented Reality (AR) applications. Other related products are wafer-scale optics, diffraction gratings, thermoelectric coolers, and substrate for sensing. In the auto market, the company is a leader in SiC substrates for power electronics that improve the energy efficiency of electric and hybrid-electric vehicles. Power electronics based on SiC enable systems to achieve significantly improved power utilization and conversion efficiencies, lower operating temperatures, and reduced thermal loads, leading to increased driving ranges or reductions in required battery capacity for a given range, ultimately resulting in a significant cost reduction. The company’s semiconductor lasers, optics, and materials can be leveraged for LiDAR systems that play an instrumental role for autonomous driving. The thermoelectric coolers manufactured by the company are used to enable LiDAR systems to operate with optimal performance and efficiency. Despite secular growth behind these end markets, I view this as less moat-worthy because consumer electronics have short lifecycles therefore constant capital expenditure from II-VI’s side to keep progressing with prevailing technologies, while the automotive OEMs require annual price reduction from the suppliers, exerting downward pricing pressure on players such as II-VI. These markets also lack concentration, exacerbating II-VI’s inferior bargaining power against juggernauts such as Apple, Infineon, Ford Motor, and Infineon.

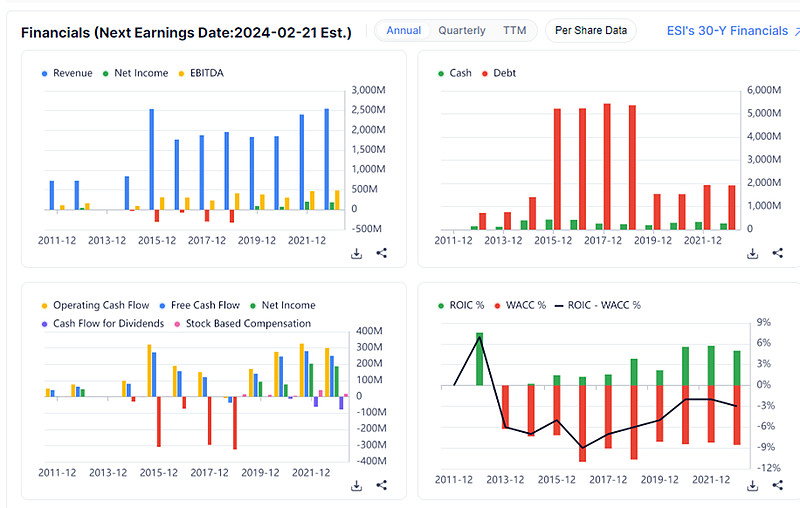

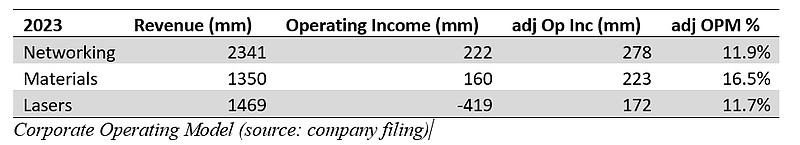

The company does not break down the details based on end markets and last year’s GAAP numbers are rife with amortization, charge-off, impairment, among other one-time, noncash items. Based on the reporting segments, we can see that Materials command the highest adjusted operating margin. It includes OEM and system integrators of industrial, medical, and personal comfort; laser end users who require replacement optics for their existing laser systems; semiconductor capital equipment; industrial laser components; consumer tech applications, automotive manufacturers, machine vision, biomedical instruments, fiber lasers OEM equipment and subsystems, and so on.

II-VI as a “One Night Stand”

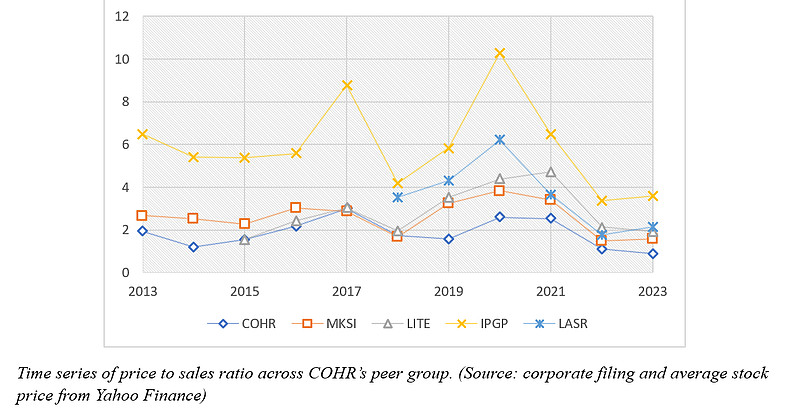

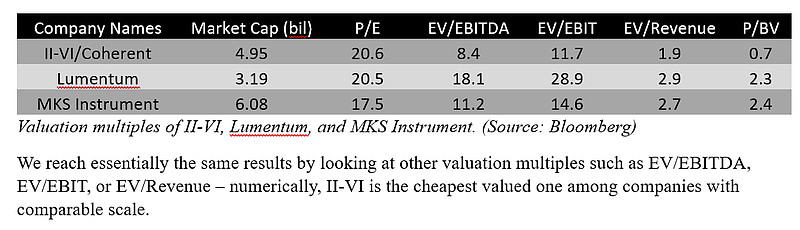

With the caveat that the peer group has different end markets, varying degrees of leverages, and varied levels of profitability as a result of the former two, two things stand out: 1). II-VI is at its cheapest valuation in terms of price to sales compared to itself over the last decade; 2). Although its price to sales ratio roughly tracks MKS Instruments and Lumentum, the ratio diverged downward after its 2019 acquisition of Finisar and then its 2021 acquisition of Coherent, and now is firmly the “cheapest” based solely on this metric.

Does it make sense?

The bulls would argue that II-VI is substantially undervalued, possibly for the following reasons:

1. The company’s various segments have exposure to secular growth industries, whether it’s 5G, 3D printing, 3D sensing (AR/VR), power electronics with applications in electrical vehicles, life sciences and biotechnology. Based on research done by Bain Capital, the projected CAGR for II-VI’s end markets on a blended basis is 7.4% for the next 4 years. [1] A sanity check would confirm this – assume inflation of 3%, real GDP growth of 2%, and given the company operates in GDP+ areas, if we assume an additional 250bps above GDP growth, we arrive at 7.5% CAGR, roughly inline with Bain’s research results/projections.

2. The company is cashflow generative, and with free cashflow dedicated to reduce leverage, the equity should start to trade incrementally higher as the risk of financial instability recedes.

3. The end market of the business covers data center, telecom, consumer electronics, semiconductor, health care, defense, and aerospace – such a wide range of end markets provide diversity and hence stability in terms of its revenue and profit.

4. The company demonstrated strong executional acumen given that it revised its synergy target to $200 mm after its acquisition of Finisar (previously $150 mm). It would be likely that the company hits its $250 mm synergy for the Coherent deal in the next 36 months as well.

5. The restructuring, which costs $150mm to $200mm, will result in $200mm ~ $300mm cumulative savings from 2023 to 2025, and will maintain an annual saving of $100mm ~ $125mm by FY 2025.

6. Last but not least, the company has scale economies that is not fully priced by the market. The R&D expenditure of II-VI has more than twice of its closest peer, and its possession of more than 3,000 patents in growth areas evince its indisputable leadership position on a going forward basis.

These qualitative assessments have to be validated in a quantitative fashion.

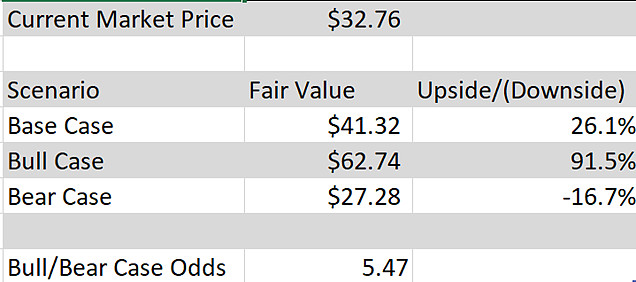

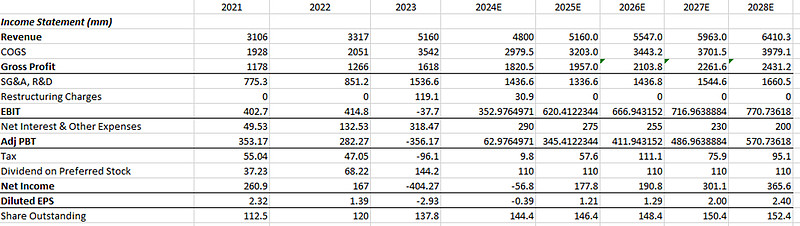

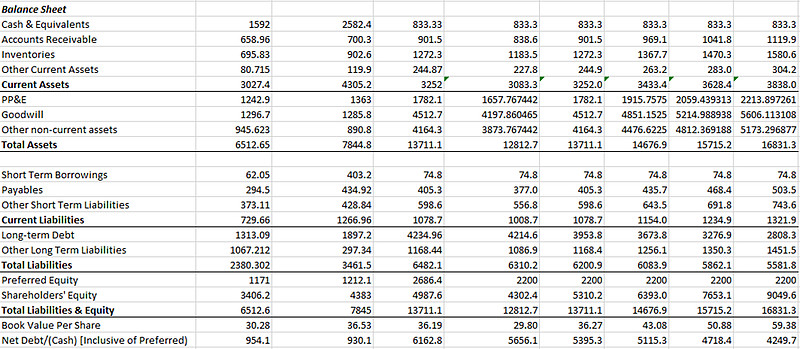

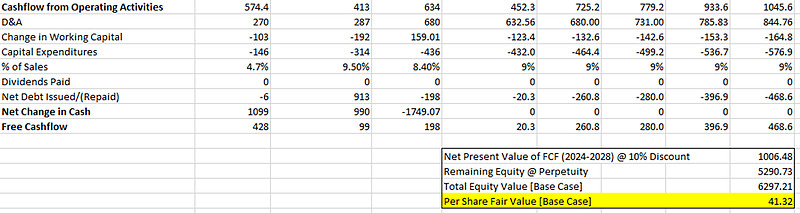

In the following, I will run three scenario analyses – bullish, base, and bearish. One can find the detailed model for the Base Case in the Appendix section.

The Base Case assumes II-VI is able to grow with its end market at 7.4%/annum for the next five years, and then tapers to a GDP growth scenario with a 10% discount rate. It assumes the company is able to achieve $200mm of synergy for the Coherent deal, and successfully executes its restructuring initiative. For next year’s revenue, I take the mid-point of management’s guidance at $4.6 billion, and add $200mm to give credit to management team’s “several hundred million dollars of additional revenue” related to AI Datacom demand, and I assume the extra revenue assumes similar margin characteristics as the rest of the business. I further assume the free cashflow will be directed toward debt paydown, and given even the bull case result is lower than the $85/share of conversion price for the Bain Capital investment, I assume the convertible preferred will stay on the balance sheet throughout the explicit forecast period.

The Bull Case assumes II-VI is able to grab market share and grow faster than its end market at 10%/annum for the next five years, then tapers to a GDP+ growth scenario of 6% growth with a 10% discount rate. The 7% growth gives the company credit, on a cross-cycle basis, for not only to grow organically, but also to acquire attractive targets either through cash or through moderate leverage and then quickly de-lever its balance sheet. It assumes the company is able to achieve $250mm of synergy for the Coherent deal, and successfully executes its restructuring initiative.

The Bear Case assumes II-VI loses market share, first growing at 5% per year for the next five years, and then taper off to a 4% perpetual growth scenario with a 10% discount rate. It assumes the company is only able to achieve $200mm of synergy for the Coherent deal, and is unsuccessfully in executing its restructuring initiative, achieving only $75mm of annual savings by FY 2025.

Based on the aforementioned assumptions, the base case fair value is 26.1% higher than the current market price, indicating that the market possibly overreacted to the company’s disappointing guidance after the most recent earnings call. Meanwhile, the bull/bear case upside/downside odds is 5.47:1, indicating that by taking on limited downside risk, the investor may harvest sizeable gain.

Therefore, by combining the bull theses and the quantitative valuation, it seems that COHR trading at $32.76/share might be a reasonably good opportunity for investors. Lots of pessimism seems to be priced in, while grim assumptions seem to indicate limited downside risks. Catalysts for value realization may include: 1). Better than expected synergy numbers; 2). Free cashflow directed towards consistent debt paydown, lower leverage results in equity multiple rerating; 3). Better than expected revenue growth for FY24; 4). Better than expected profitability figures.

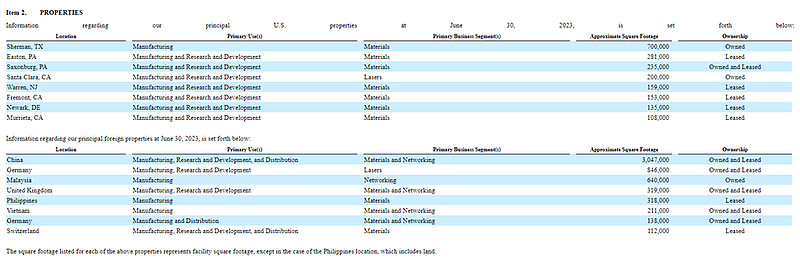

One tail risk factor that I’d like to point out is II-VI’s extensive exposure to Chinese manufacturing, research, and development.

II-VI’s properties. (Source: 2023 10K of COHR)

Based on II-VI’s most recently filing, on a consolidated basis, it has 7,602,000 square feet of manufacturing, research, development, and distribution properties on a global basis. Out of this, 40% locates in China, including its lucrative Materials segment. Should an extreme event happen, such as China invades Taiwan and the West retaliates in a similar fashion as it treated Russia, that could make our bear case analysis too optimistic. Although I believe it is unlikely, one should at least be salient of the possibility of such a black swan event.

II-VI as a “Marriage”

One of the five Key Business Strategies of II-VI is to identify and complete strategic acquisitions and alliances. Therefore, to have a “marriage” with the business, or to be a long-term shareholder who entrusts capital to the management team waiting for intelligent capital allocation and continuous compounding, one has to be confident of the management team’s incentive structure and capital allocation acumen. The management team’s track record does not inspire confidence.

In early 2021, Lumentum came out with a half stock, half cash offer to purchase Coherent at a price of $240/share, stating there is a $150 mm synergy, to which Coherent accepted. II-VI quickly followed suite and proposed to acquire Coherent at $240/share in a half stock, half cash deal, arguing for a $180 mm synergy. MKS Instrument came out with another half stock deal at a price of $260/share. It has clearly become a bidding war. Lumentum further hiked the price to $283.12/share, to which II-VI responded with a $281.2/share, substantially raising the cash portion to $170/share because of a slumping stock price, pegging Coherent’s valuation at $7 billion. II-VI hiked their synergy target twice, first time hiking it to $200 mm on Feb 12th, and then to $250 mm on Mar 11th – this is nuts – one just don’t get $70 mm of extra synergy within 2 months by juggling some spreadsheet items – the management team has clearly lost its head and wanted to win the bidding war at the cost of shareholders.

Back then, II-VI had a $9 billion dollar market cap with $600 mm existing debt, so the combined entity sports an enterprise value of $17 billion dollar. At the moment, II-VI has a 5 billion market cap, $3.6 billion net debt, and $2.15 billion of convertible preferred shares, leading to an EV of ~$10.75 billion. In other words, essentially the entire valuation of Coherent has been wiped out in the last 2 years.

We can also look at the deal from the perspective of relative valuation. In 2016, Coherent announced acquisition of Rofin-Sinar, one of the world’s leading developers and manufacturers of high-performance industrial laser sources and laser-based solutions and components for $32.50/share with a valuation of $942 mm, and a 41.7% premium to its market price. The company generates $520 mm of revenue, so the price to sales multiple of the acquisition is 1.8x. This was a big acquisition given that Coherent’s revenue back then were less than $900mm per year.

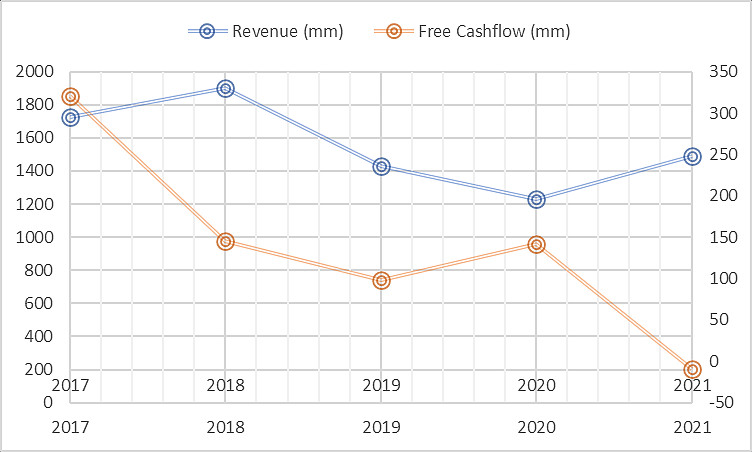

Revenue and Free Cashflow of Coherent from 2017 to 2021 before being acquired by II-VI. (Source: Company Filings)

II-VI paid 50x Coherent’s 2020 free cashflow and 5x Coherent’s 2021 revenue to acquire something Coherent acquired in 2016 at a steep 60%+ discount. The multiple II-VI paid also compares unfavorably with recent deals made by its peers. MKS Instrument acquired Atotech for $5.1 billion and Atotech had a TTM revenue of $1.5 billion, resulting in a 3.4x price to sales ratio, considerably lower than II-VI’s paid P/S multiple of 5x.

This acquisition also ladened the company with debt. Most of company’s debt are floating rate, reflecting a poor judgment on the management’s side in anticipating interest rate risks. The $850mm Term Loan A has a LIBOR + 1.75%~2.50% interest rate, and the $2,800 mm Term Loan B has a LIBOR + 2.75% interest rate. The convertible preferred financing of $2.2 billion from Bain Capital has not been cheap either, pegged at 5.00% annual dividend payment (first 4 years pay-in-kind). Note the convertible financing has an interest rate commensurate with the company’s $990 mm senior notes due in 2029, which also yields 5.00%/annum. I guess Bain Capital really knows how to make deals.

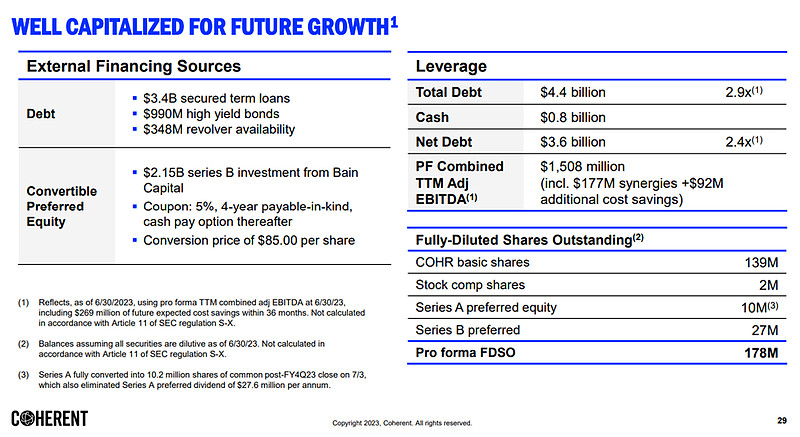

What’s a bit more hilarious is the management’s presentation of their net leverage.

In a small line of footnote (1), they argued the pro-forma TTM combined adj EBITDA at 6/30/23 includes $260 million of future expected cost savings within 36 months. This gave me a good laughter. Their “adj” EBITDA figure has already excluded share-based compensation and restructuring costs, and now they’re adding future expected cost savings into the calculation of their net leverage… Maybe they should have a slide that tells us their future price to earnings ratio to make the current valuation more appealing?...

The behavioral weakness evinced by this acquisition does not give me confidence in Dr. Vincent D. Mattera Jr and his team. Reading their public filings and conference call transcripts, I do not seem to find the management team introspectively and critically look at this acquisition, despite they have started possibly a prolonged non-cash impairment charge for intangible assets since the latest quarter. There are still $4.5 billion dollar of goodwill sitting on their balance sheet, and this figure is greater than their total shareholder equity. Impairment is non-cash, but it at least shows one the silliness of past acquisition.

I do not think the management team has learned anything from this pyrrhic victory, and I do not expect things to change given the information I have at hand.

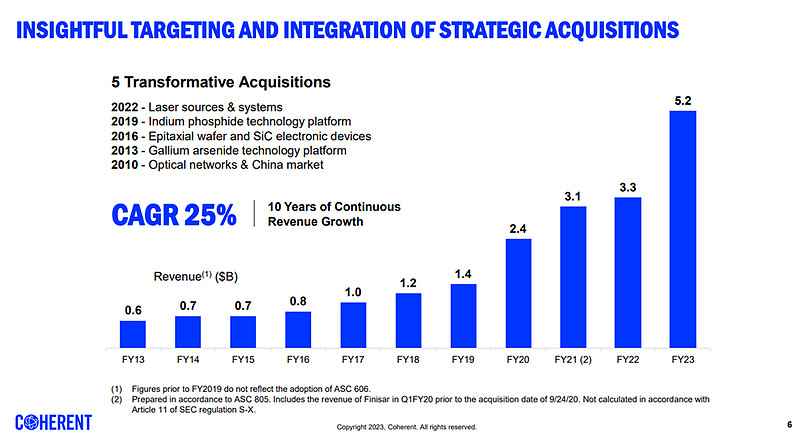

By touting their 25% of revenue CAGR in the last 10 years, they failed to mention the corresponding dilution, added leverage, and deteriorating free cashflow margin.

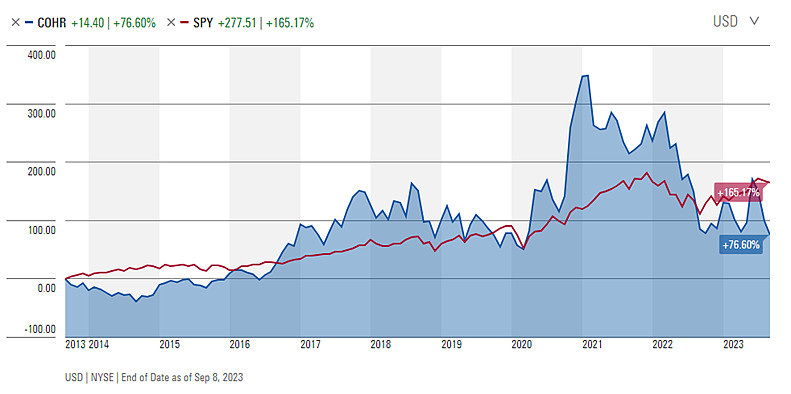

The management team did not seem to be introspective or critical of either their close to 100% underperformance vs S&P500, or the fact that their stock, on an absolute basis, did not even double and advanced only by 76% in the past decade despite its top line grew by 760%.

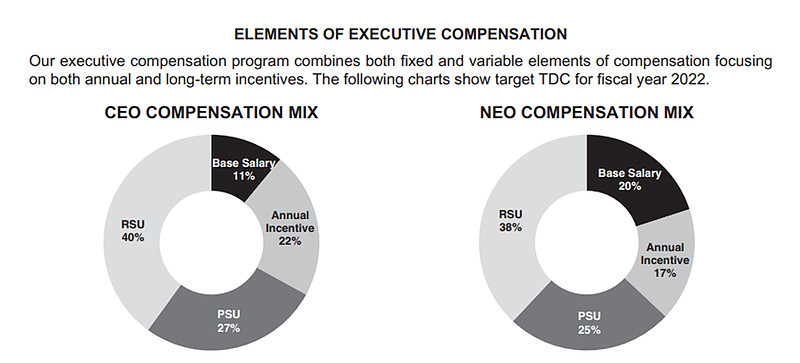

The focus of shareholder value, unit economics and the calculation of return on invested capital are nowhere to be found in their proxy statement.

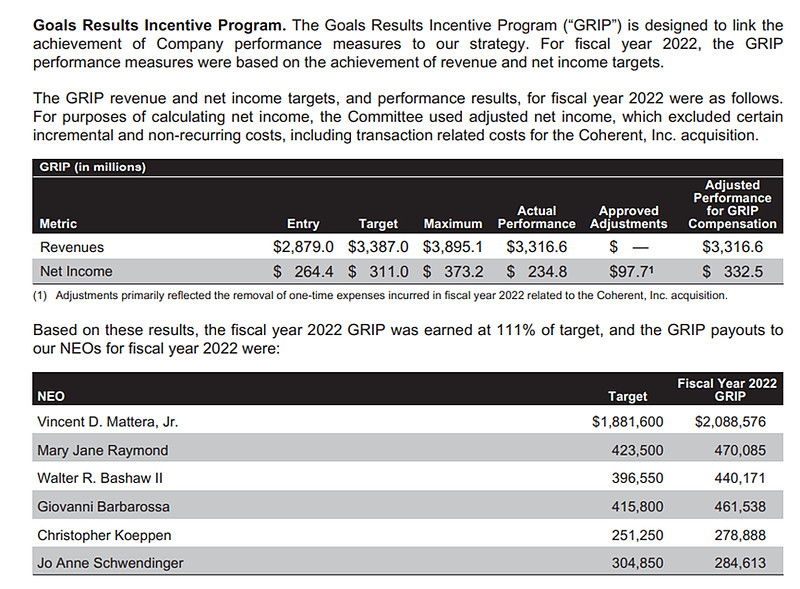

RSUs are vested over a three-year period regardless of performance, and annual incentive is half contingent on revenue growth – no wonder its focus on presenting revenue growth in their slide deck – sadly, revenue along is insufficient to drive superior shareholder return. Oh, and the board uses “adjusted net income” to hit the target. Last year, they added back 30%+ of their target through “approved adjustment”. Guess it’s easier to be done with Chairman and CEO being the same person.

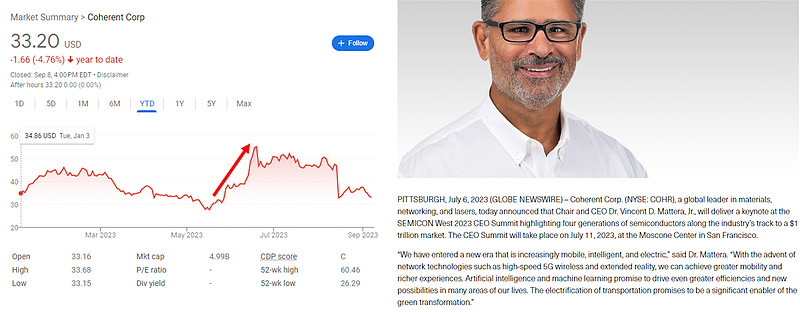

Further, the stock had a nice run after NVIDIA reported growth above analysts’ consensus and guided for explosive AI/ML growth.

Dr. Mattera wasted no time to hype up the stock further with talks of “entering the new era”. The reality begs to differ. The company reported another quarter of disappointing revenue and earnings growth, and the guidance does not seem to reflect the “new era” rhetoric that Dr. Mattera effusively articulate. The 2024 fiscal year revenue guidance ($4.5-4.7 billion) is a negative YoY growth of 12%, worse than market’s consensus of low single digit guidance ($5.1 billion). This revenue guidance is inclusive of the 800G transceiver in guidance that the company prides on. The non-GAAP EPS guidance of $1.00-1.50/share is substantially lower than the market’s anticipation of $2.95/share.

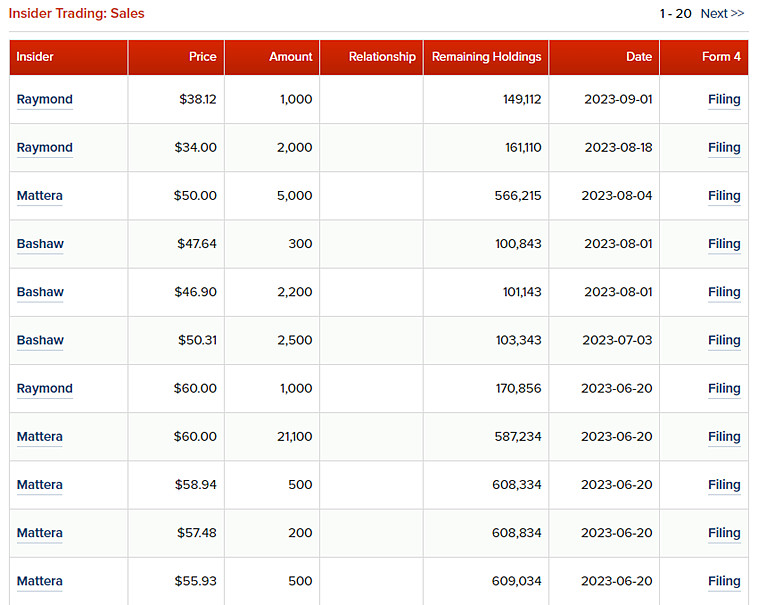

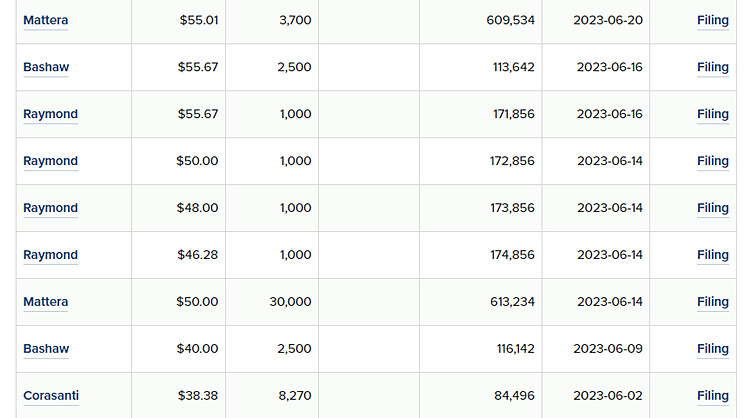

The insiders themselves do not seem to subscribe to the “new era” theory, and instead have opted to continuously unload their shares since the AI hype pumped up the stock. Of course, Dr. Mattera is one of the most vigorous sellers. (Please see the seller’s list in the following page)

I have to say that the management’s behavior over the past 3 years do not win my trust – the stock might be in for a trade, but it simply does not come close to my standard of entrusting my clients’ capital with on a long-term basis. If I were to trust the management team again, I hope to see the following changes:

1. The separation of Chairman and CEO to make sure the board is more independent.

2. The board needs to impose an incentive structure that focuses substantially more on return on invested capital, per share unit economics, and free cashflow generation, rather than top line growth regardless of the price.

3. An internal reflection of overpaying for Coherent, and an internal memo detailing how to avoid such dilutive capital allocation decisions on a going forward basis. Coming up with an extra 40% of synergy within two months is unacceptable – I’d like to know what went wrong, and how future efforts are going to be made to prevent such “spreadsheet finance”.

4. The company’s view towards leverage, in my view, is dangerous. The best multi-industrial names are under-levered. Ametek has a $35 billion market cap but only $2 billion debt, Illinois Tool Works has a $72 billion market cap but only $6 billion debt. If the company keeps employing a levering-up and then de-lever strategy, I fear ultimately there will be an unfortunate timing and an industrial downturn wipes out the shareholders.

Before the above happen, I believe COHR is only suited for a “one-night-stand”.

(Insider selling. Source: Insider Monkey)

Appendix: Valuation Model [Base Case]

[1] Source: 网页链接

Disclosure: we hold a toe-position in COHR and MKSI, and have no intention of buying or selling within 72 hours.

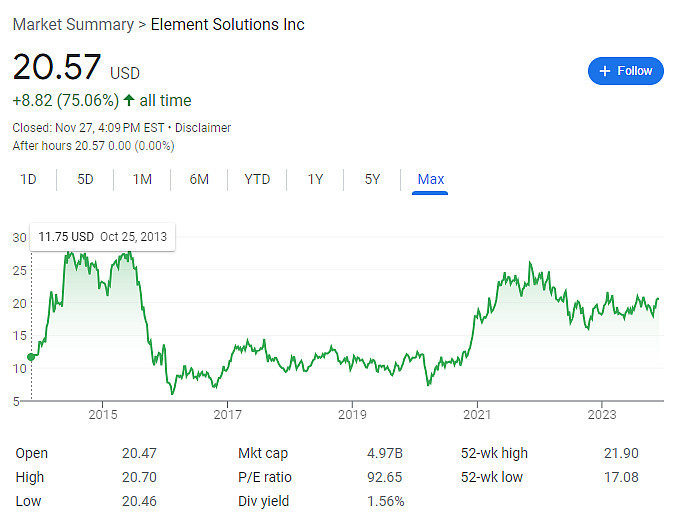

2023/11/27

2013年,一个由Martin Franklin和Nicolas Berggruen创立的叫做Platform Acquisition Corp ("PAH")的SPAC,作价18亿美金(~8亿美金是债务)收购了成立于1923年的特殊化学品公司MacDemid。Martin Franklin是一个英籍企业家,生于1964年10月31日,曾是Nomad Foods Limited的创始人和董事长。但他最为人津津乐道的,还是2000年买了9.9%的Alltrista,然后变成激进投资者,占了董事席位,在2001年9月变成董事长和CEO,到2016年卖给Newell时,收获了50x的回报。

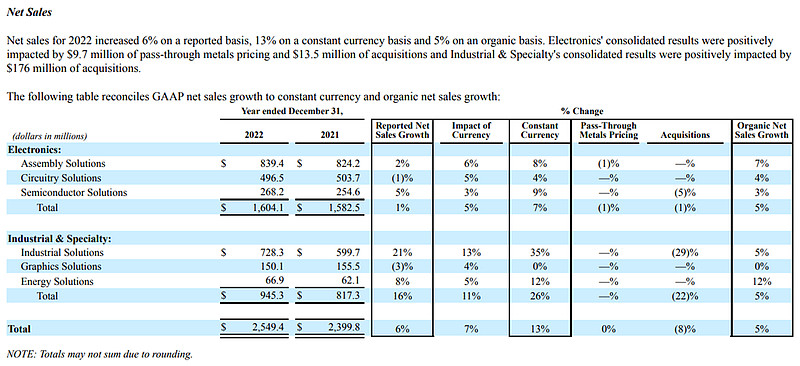

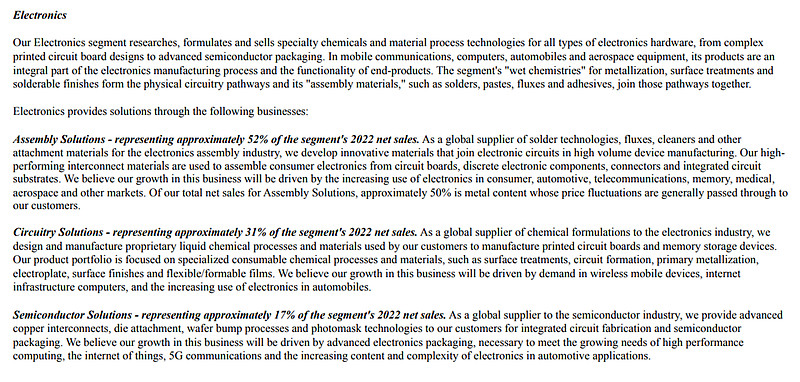

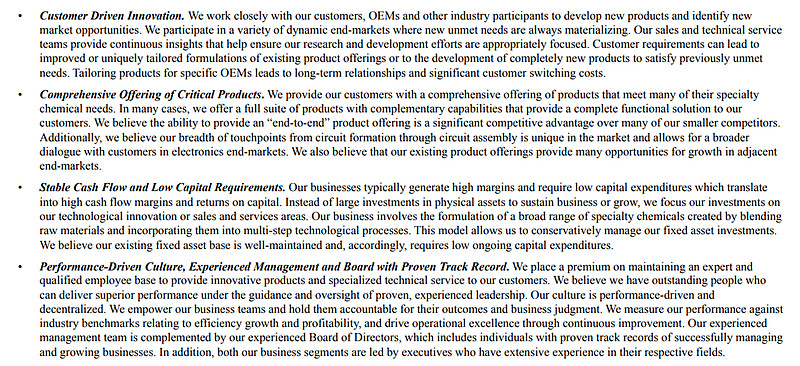

电子产品占营收63%,工业和特殊品占营收比例37%,聚焦多样化的终端市场,有吸引力的细分市场,同时基本都是耗品,因此营收重复性和可靠性很高。

由于成本占终产品价值比例的1%,但对技术支持和产品表现具有决定性作用,因此具有任务关键性。两个板块的毛利率去年差不多都是37%左右,调整后EBITDA基本都是20%左右。

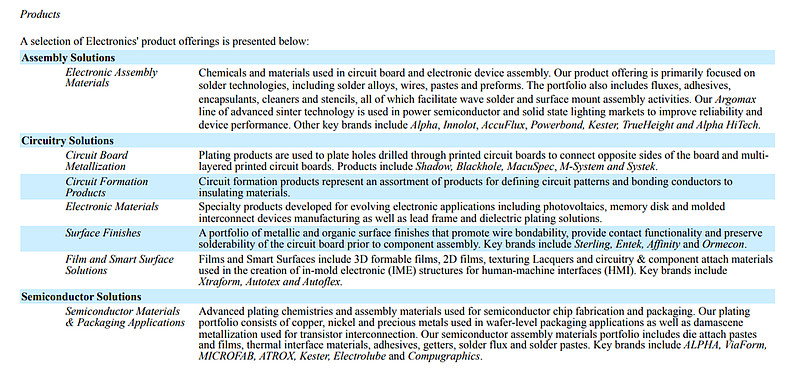

电子产品种的组装解决方案40%的生产成本是金属采购成本,随着价格波动,但能传递给终端消费者。终端市场包括消费者电子,汽车(尤其是电动车),信息通信,记忆芯片,医疗器械,航空等。该部门提供焊接料技术(solder technologies),溶剂(fluxes),清洁剂(cleaners),模板(stencils),和其他粘接材料。

电路解决方案提供独家液体化学品流程和材料用来生产PCB和记忆储存设备,中端市场驱动主要是互联网基础设施,消费者电子,和联接汽车(connected vehicles)等。

半导体解决方案包括高级铜线互联(copper interconnects),芯片贴装(die attachment),覆晶封装技术(wafer bump processes),和光掩模版(photomask),用在集成电路制造和半导体封装上,用的材料包括铜,镍,和贵金属。这里的终端市场成长驱动来自于高端电子产品封装用语高性能计算,IoT,5G通信,和汽车应用中不断增加的含量(content)以及电子产品的复杂度增加等。以下是具体产品细分。

工业和特殊品主要研发,配置,和出售特殊化学品和流程科技,比如无电镀镍(electroless nickel),金属电镀(metal plating),和清洗产品,加强表面性能,保护磨损和撕扯,改善工业流程(包括一个小分支提供废水处理和回收工厂的解决方案)。这里包括用来保护和装饰金属和塑料表面的化工系统,帮助打印图像到灵活包装材料的化工品耗品(终端是包装品和商业打印),以及用在水下海上能源勘探和挖掘的液压控制液体(hydraulic control fluids)。

公司的几个核心战略包括客户驱动的创新,全套提供关键性端到端的产品(这些小竞争对手没有办法提供),稳定的现金流和低资本需求(公司主要通过化学成分配比/Formulation,而不是重化学品/heavy chemicals — chemicals produced & handled in large lots and often in a crude state,比如硫酸,碱类,盐类等等,所以资本相对重化工来说很轻),以及表现驱动的文化,有经验的管理层和董事席。

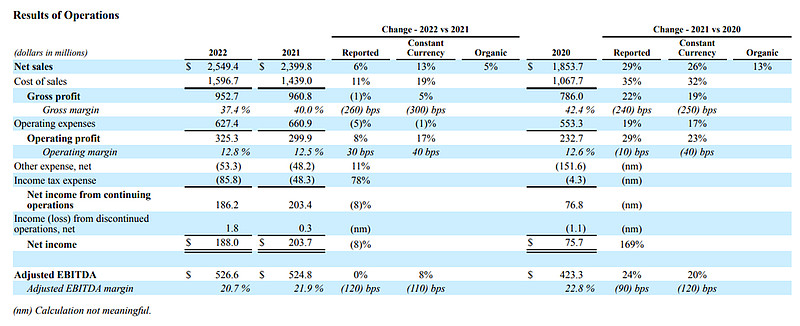

公司去年的调整后EBITDA是5.27亿美金。

净负债为16.2亿美金,所以净负债/调整后EBITDA为3.1x,周期性行业,不算低。50亿美金的市值,企业价值66.2亿美金,EV/adj EBITDA为12.6x,也完全不便宜。

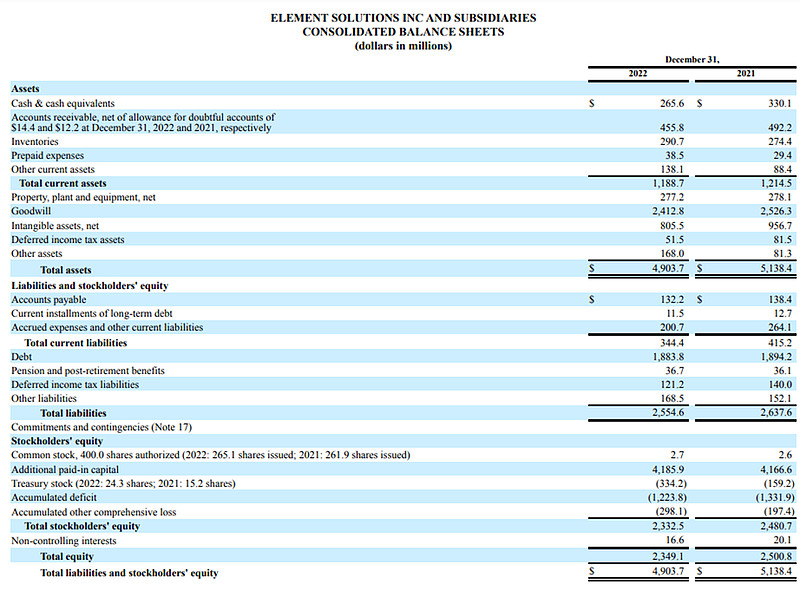

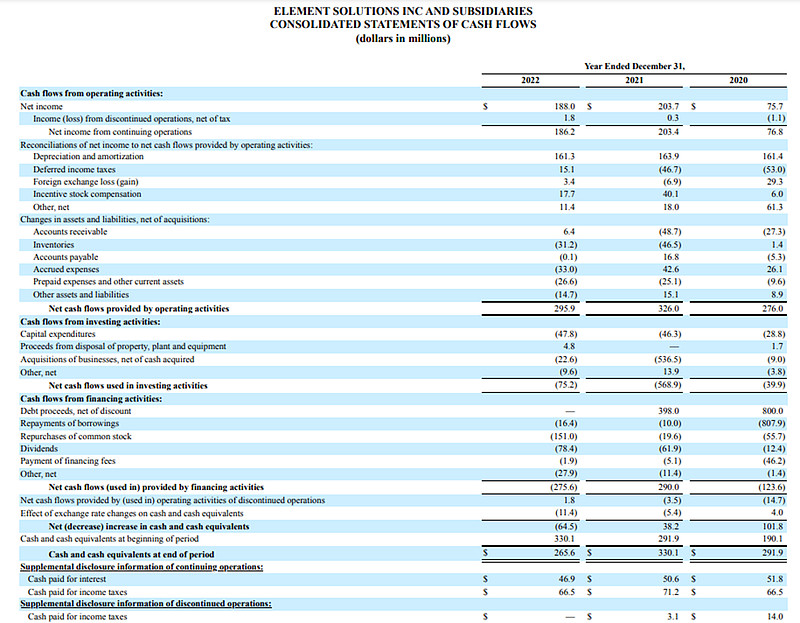

以下为企业的现金流表:

公司市值大概50亿美金,大概2x的市销率,自由现金流2.5亿,也就是20x的自由现金流乘数,5%的自由现金流收益,公允定价,现价不算是个好deal。