“In the lithium market, demand continues to grow at record rates, and total market demand should be over 20% more in 2018 than seen last year. Average prices during the first three months of this year surpassed US$16,000/MT given a tight supply and demand balance. We believe that this price pressure will continue throughout the first half of the year.”

Mr. De Solminihac continued by saying, “Given this lithium demand growth, we plan to increase our capacity in Chile in three different stages and continue with the developments of our projects in Argentina and in Australia. As previously disclosed, during 2018 in Chile, we have been working to expand our production from 48,000 to 70,000 MT, with a total capex of US$75 million. We expect this additional 22,000 MT of capacity to be operating by the end of this year. The second stage of the expansion in the Salar de Atacama, in which we will increase production from 70,000 to 120,000 MT (previously 100,000 MT), will be completed in the next 18 months with a total investment of US$200 million. Finally, we will add an additional 60,000 metric tons of capacity to our operations, investing around US$250 million to increase our capacity from 120,000 MT to 180,000 MT. We expect this third stage to be online by early 2021. We believe that with demand growing close to 20% this year and next year, the market will be able to absorb this additional supply. However, we reiterate that we are constantly reviewing market conditions; our strategy is to have the installed capacity to react to the market demand.”

“在锂市场,需求继续以创纪录的速度增长,2018年的市场总需求应该比去年增长20%以上,超过去年的水平。由于供求平衡紧张,今年前三个月的平均价格超过16000美元/吨。我们认为,这一价格压力将在今年上半年持续下去。”

德索米尼哈茨先生接着说:“鉴于锂的需求增长,我们计划在三个不同阶段增加我们在智利的能力,并继续发展我们在阿根廷和澳大利亚的项目。如前所述,2018年在智利,我们一直在努力将产量从48000公吨扩大到70000公吨,总资本支出为7500万美元。我们预计,到今年年底,这额外的22000兆吨的产能将投入运行。在Salar de Atacama扩建的第二阶段,我们将把生产量从7万吨增加到12万公吨(原10万公吨),将在今后18个月内完成,总投资额为2亿美元。最后,我们将增加60000公吨的运力,投资约2.5亿美元,将我们的运力从12万公吨增加到18万公吨。我们预计这一第三阶段将于2021年初上线。我们相信,在今年及明年需求增长接近20%的情况下,市场将可吸纳这额外的供应。然而,我们重申,我们一直在审查市场状况;我们的战略是建立对市场需求作出反应的装机能力。”

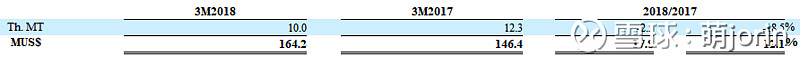

Revenues from sales of lithium and derivatives totaled US$164.2 million during the three months ended March 31, 2018, an increase of 12.1% compared to US$146.4 million for the three months ended March 31, 2017.

Demand growth in the lithium market continues to be strong, and we expect it to surpass 20% during 2018, mainly driven by a 54% growth in the battery market for electric vehicles. . During the first quarter, supply did not keep the same pace, and therefore market conditions remained tight and prices increased significantly during the first three months of year, totaling an average of approximately US$16,400/MT.

Given the strong demand, we will work to increase our total capacity from 48,000MT to 180,000 MT in the next three years, investing a total of US$525 million in Chile, mainly in chemical plants in Antofagasta. The first stage of this investment, US$75 million, will bring our capacity from 48,000 MT/year to 70,000 MT/year this year. As a result, we believe our 2018 sales volumes in the business line should reach approximately 55,000 MT as we ramp up the current production. These additional sales volumes should be seen during the second half of 2018.

On April 10, 2018, the new lease payment structure as described in our conciliation agreement with CORFO became effective.

Gross profit for the Lithium and Derivatives segment accounted for approximately 61% of SQM’s consolidated gross profit for the three months ended March 31, 2018.

在截至2018年3月31日的三个月里,锂及其衍生物的销售收入总计1.642亿美元,较截至2017年3月31日的三个月的1.464亿美元增长12.1%。

锂电池市场的需求增长依然强劲,我们预计2018年将超过20%,主要是受电动汽车电池市场54%的增长推动。在第一季度,供应没有保持同样的速度,因此市场条件仍然紧张,价格在前三个月大幅上涨,平均约为16400美元/吨。

鉴于需求强劲,我们将努力在今后三年内将总容量从48 000公吨增加到18万公吨,在智利投资总额为5.25亿美元,主要用于安托法加斯塔的化工厂。这项投资的第一阶段,7500万美元,将使我们的能力从4.8万公吨/年增加到今年的7万公吨/年。因此,我们相信随着目前产量的增加,我们2018年的业务量将达到55000公吨。这些额外的销售量将在2018年下半年出现。

2018年4月10日,我们与CORFO的调解协议中所描述的新租赁付款结构生效。

在截至2018年3月31日的三个月里,锂和衍生产品部门的毛利约占SQM合并毛利的61%。

整体锂和衍生品产量下滑18%,销售额增加12%,这个差额应该就是碳酸锂的涨幅。

SQM的一季报,海外碳酸锂价超过16400美元了,折合10.47万人民币,涨了不少。哈哈,看跌锂价的人呢,出来走两步?

SQM这扩产的资本支出,低的令人发指,第一步,扩产22000吨,才7500万刀,第二步,扩产50000吨,2亿刀,第三步,扩产60000吨,2.5亿刀。简直就是丫的印钞机

对天齐锂业的老蒋,只有两个字,佩服