$香港电视(01137)$【撕开隐秘的价值】

做价值投资,追求获得阿尔法Alpha收益,总是寻找被市场低估的股票,需要“大胆想象”和“谨慎求证”。富有想象力,才能洞见投资标的公司三年、五年后的图景,需要足够的信念,才能相信光明,做时间的朋友,阿尔法收益才能慢慢见效。谨慎求证,需要我们有深度思考的能力,才能看透黑暗,从企业的成长空间、成长模式、成长能力和成长效率去解构公司和理解公司,控制投资风险。

1137这个票,我们坚持长期跟踪,认真读取公司历年的财务报告,努力去解读其中的奥妙。

根据我们的模型测算,我们有三个核心观点(☞☞★详细分析,请您阅读本帖下半部英文内容★)分享如下:

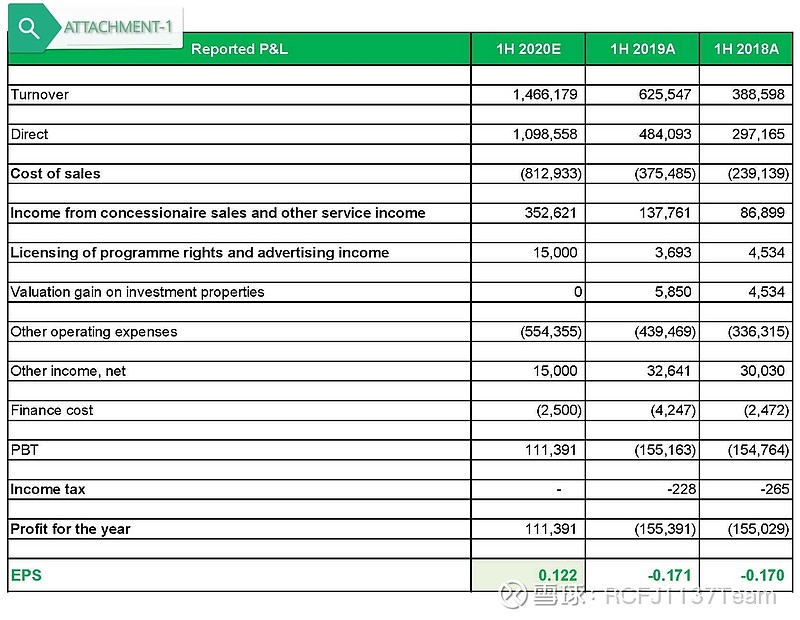

【1】关于1H2020半年报,我们预测财务表现是:

=>> GMV,27.46亿港元;

=>> 营业额,14.66亿港元;

=>> EBITDA,1.57亿港元;

=>> 净利润,1.11亿港元;

=>> EPS,0.122港元;

=>> 经营现金流,超过2亿港元。

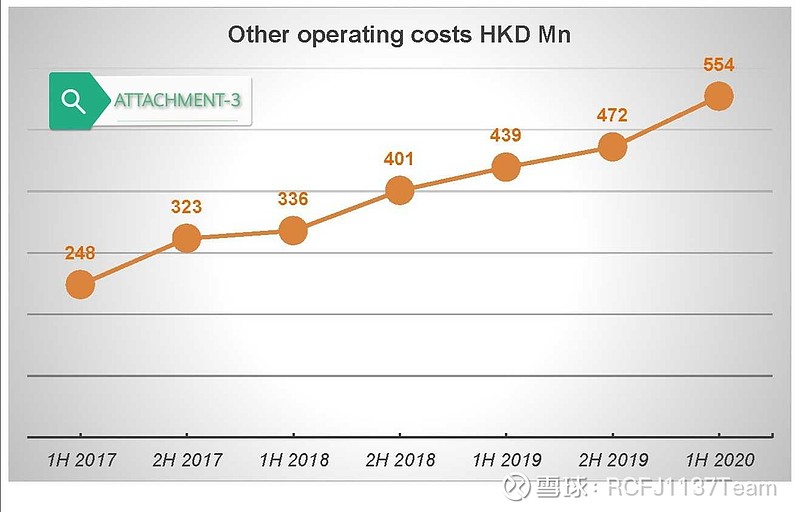

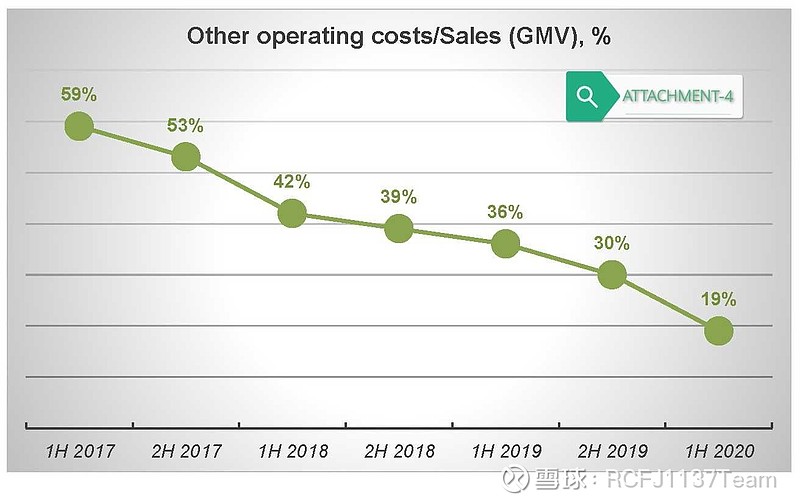

【2】HKTVmall业务模型,极具规模效应,虽然伴随业务量GMV快速增长,“其他经营支出”也持续攀升,但是相关费用开支对于整体业务收入的占比却是呈现下降趋势,参看附件图表3-图表4,(“其他经营开支”科目包括:“履约交付”、“电商运营与支持”、“市场营销”、以及“非现金科目”)。

【3】公司在8月5日晚间公告了7月份的经营表现,非常性感,这结果与我们7月26日在“雪球1137讨论室”分享的判断一致,GMV、客单值、每日单量、MAU、ARPU,电商运营核心指标全部创造历史新高。我们根据模型测算,7月份单月的净利润达到5600万港元,相当于1H2020上半年净利润总额的50%,真香。

作为香港本地最大的互联网零售平台,2020年将是HKTVmall兑现规模化盈利、新业务快速落地、生态版图扩张的新周期元年。

我们只能努力把握大概率的方向,并以此制定适合个人财务条件的投资策略,太细节的短期预测,何必劳神去猜测,所谓股神都是传说。

On 30 June, HKTV announced that they will make a profit for the first half of the year of not less than HKD 90 million excluding government subsidies of around 16 million. This means that the company will announce a net profit of not less than 106 million for the first half.

Below you can find our forecast for how the company will announce its earnings based upon previous years' presentation format:

( ATTCHMENT-1)

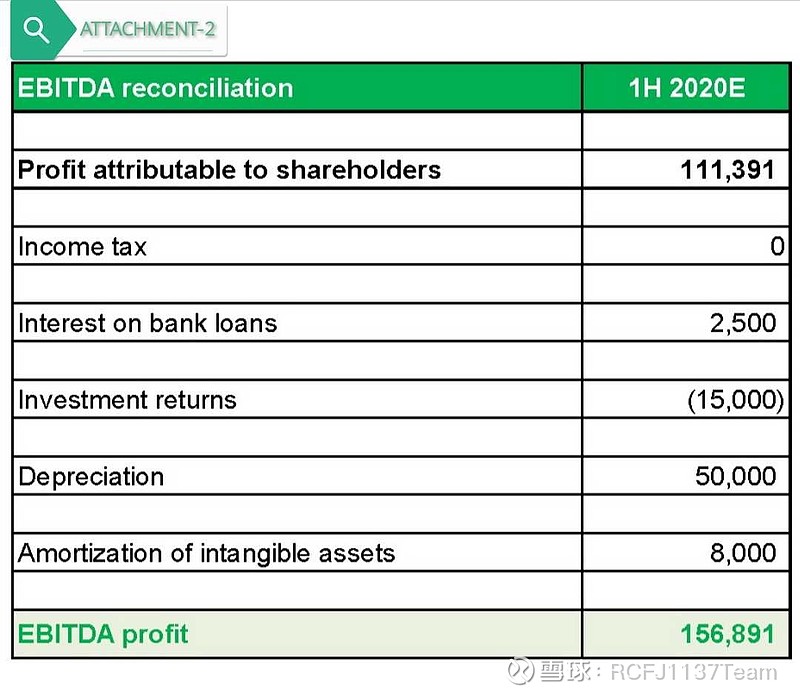

The EBITDA reconciliation will likely look as follows:

( ATTCHMENT-2)

Based upon our calculations the first profitable month was February 2020, consequently it took exactly 5 years to reach profitability as the HKTVMall business was officially launched in February 2015. We think it 's fair to say that the time needed was very short, particularly in light of the strategy the company embarked on when it decided to organize its own distribution system rather than relying on third parties for deliveries, which was the norm within the industry at that time. Furthermore, the company decided early on to develop its self-owned 020-stores which led to additional up-front investments and a higher cost-base, but which are now indispensable with the sharp increases in orders which the company would be unable to handle without the help from the 020-distribution system.. Since its launch, the fixed costs have risen to an annualized level of HKD 1.1 bn in 2020 based upon our estimates for the first half of the year. As a percentage of sales (GMV), total operating expenses have gradually been falling down to a level of 19% in 1H 2020. This means that the business displays very significant economies of scale. Other operating expenses are semi-fixed costs, which will have to increase over time to accommodate a larger business, but which are within the company's control and which change only gradually from month to month. Roughly 50% of the operating expenses are linked to fulfilment (logistics and delivery), 25% to e-commerce support (salaries) and the balance split between 020 and marketing and non-cash items.

Development of other operating costs:

( ATTCHMENT-3&-4)

The exceptionally sharp drop in other operating costs as a percentage of sales (GMV) shows that there are very significant economies of scale in the business. In other words each incremental increase in sales (GMV) leads to a disproportionally high increase in net profits. In the future, it is likely to get even better when the company ramps up its financial and food delivery businesses, both which we estimate will not need any significant capex and thus ride on the already established infrastructure which is largely paid for.

As an example of the company's potential, we can present our estimate of the company's profit in the month of July. The company announced that the sales (GMV) amounted to 620 million, assuming that the margin in July was the same as in the first half of the year (23.8%), the company generated a gross profit of 148 million (620*0.238). Our estimate is that other operating costs amounted to 554 million during the first half of the year, which equals monthly other operating costs of 92 million. Excluding financial profits, the estimated net profit for the month was 56 million (148-96=56), which is roughly half of the net profit in the first half of the year (113 million) and an annualized net profit of 672 million. This shows how sensitive the profitability is to an increase in revenue (GMV) and how quickly the company can become very profitable now that the break-even point has been surpassed. We estimate that the break-even point was reached at an annualized sales (GMV) of 4.75 billion.

The chart and statistics can be found in the attached file.

【 风险提示: 市场不完美,预测有偏差,投资有风险。】

【免责声明: 上述内容和观点,仅为记录我们的学习,分享我们的心得,不构成所述证券的买卖价格,在任何时候均不构成对任何私人投资建议。对依据或者使用本文章所造成的一切后果,作者均不承担任何法律责任。】