$Doordash(DASH)$ 22q1

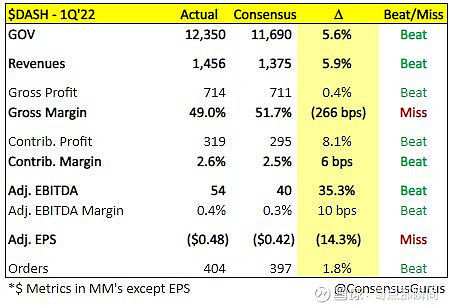

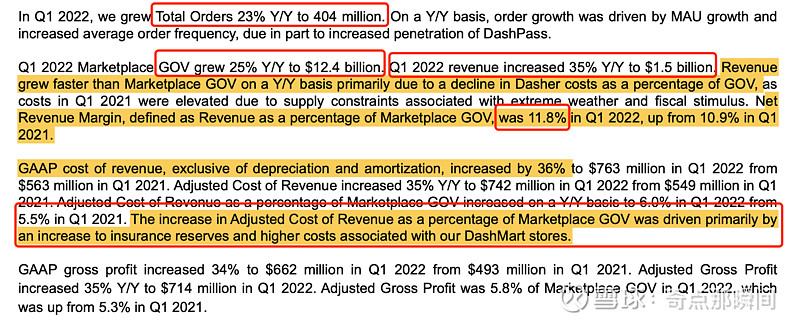

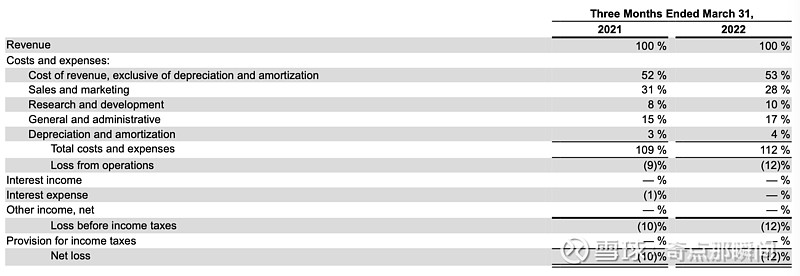

Order 23%, GOV 25%, Revenue 35%.

Q1 2022 was our largest quarter for new consumer acquisition since Q1 2021, and Dasher supply remained healthy throughout the quarter.

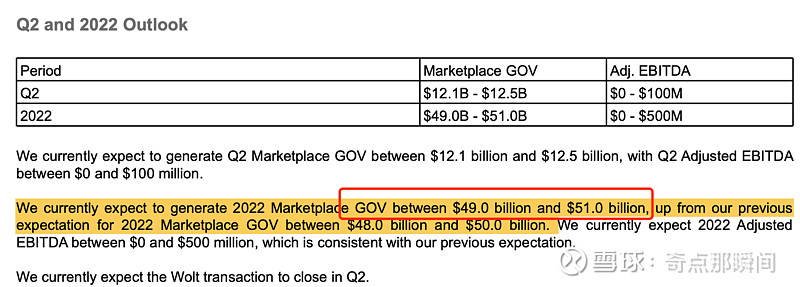

指引:

营收如果take rate 12%,就是6b,22% yoy。

业务分析:

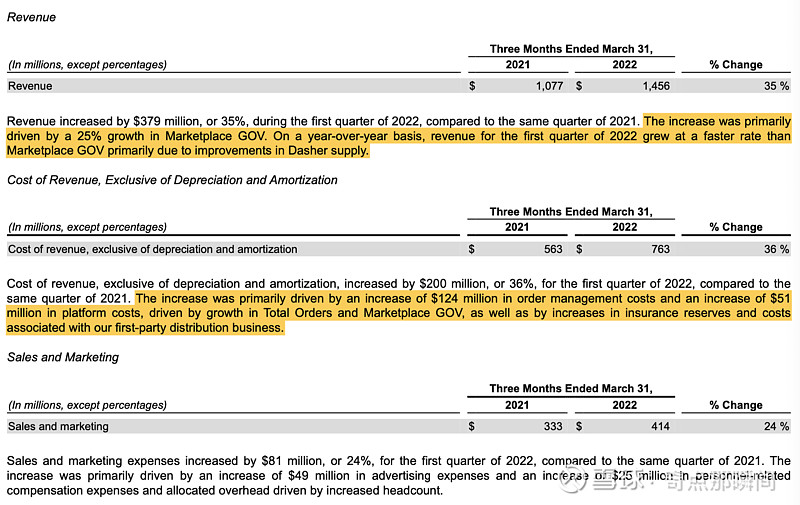

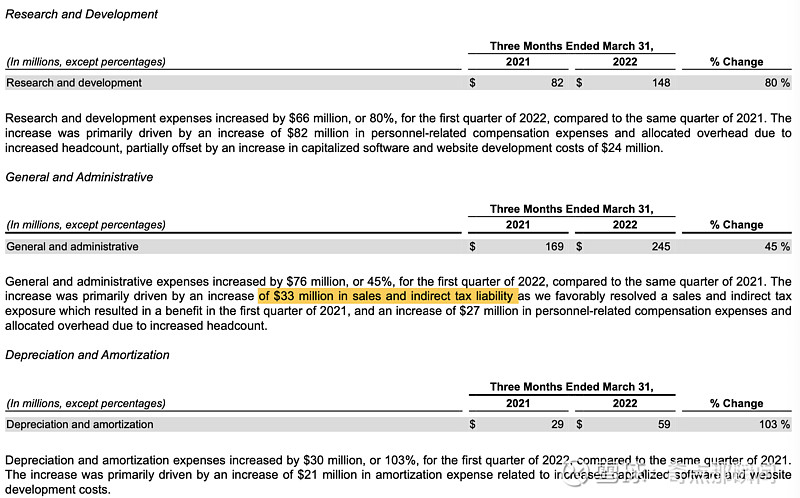

变动的原因,10q里面写的清楚,不展开

电话会议:

doordash的使命

Our aspiration is to build the largest global local commerce business. And we want to do that by building two assets.

We want to build the largest local commerce marketplace where we're bringing everything inside the neighborhood to you.

And we also want to build the largest local commerce platform where we're giving tools to the physical businesses so that they each can become their own digital powerhouses.

doordash 市占率(55%-60%+)和渗透率:

Restaurants in the U.S. is $800 billion.I mean if you look at grocery and convenience, they add to over $1 trillion in the U.S. 美国餐饮大盘

I mean if you look at this opportunity globally in the restaurants category in the U.S. where even as the market leader, only 6% of total restaurant industry sales. =》外卖占美国餐饮大盘的10%+

投资哲学:

先做retention和order frequency,然后做ue,然后scale

But the investment philosophy remains the same where there's a maniacal focus on building the best-in-class products, a maniacal focus on getting laser-sharp on the unit map so that that's actually positive before we scale globally.

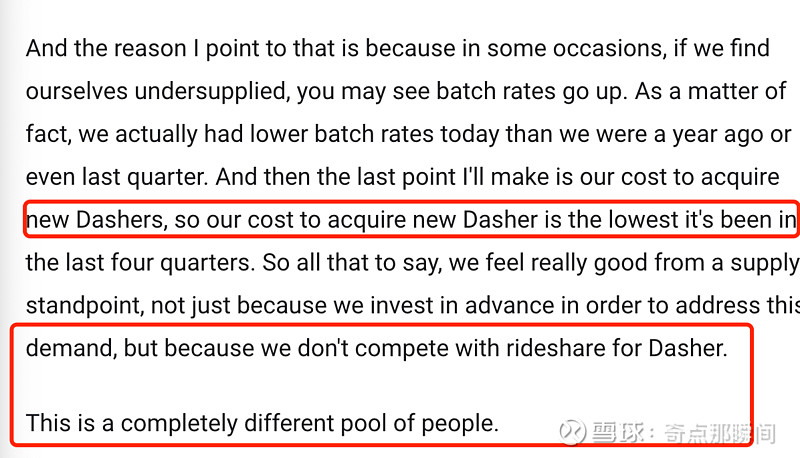

人力成本,下降,骑手供应充足。

是不是,相比“滴滴”,大家更愿意“美团”,前提是都开车。

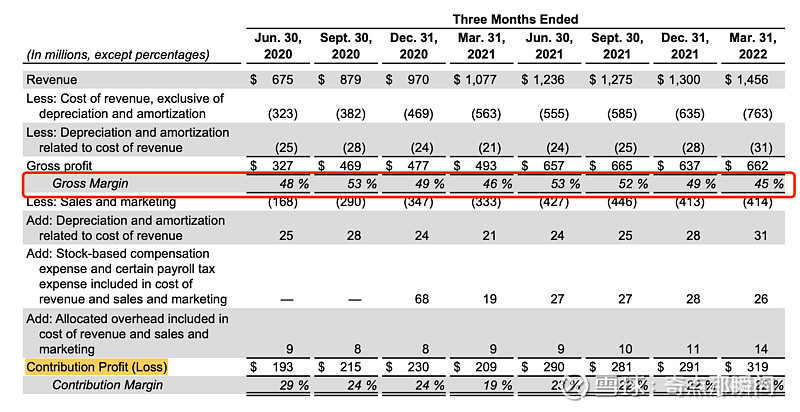

US restaurant margin

margin和market share同时提升

物流网络优化,配送服务提升(refund和投诉),营销费用摊薄,广告业务scale

order frequency 提升,主要是dash pass造成的

on the DashPass, user order frequency has grown and you've also got an increase in mix toward DashPass. So those two things sort of act in concert with each other.

22 ER, 总体感觉,管理层一般,ceo和cfo都是咨询背景出身。CFO存在感特别强,比较少见,相比之下,founder & CEO显得比较弱势。回答方面,并没有特别言之有物,相比airbnb这种,但比pdd那种,还是好很多。对比国内同行mt,对比王兴,那显然不如的。

估值:

21年49亿营收。

22年~60亿营收,6.5~8亿利润,150-220亿市值, 20pe~30pe。

一点想法:

Doordash并没有美团履约端的壁垒。

美国点外卖,真的贵。。。

感性上不喜欢这生意,安全边际要高点,比如60×0.1×17 = 120亿usd