Jiumaojiu International Holdings Limited (9922.HK)

Rapid store expansion

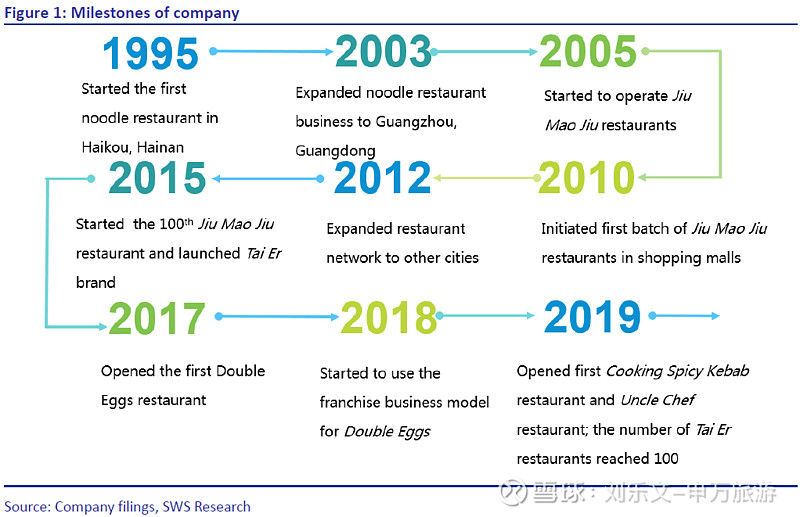

Established in 1995, it started to operate Jiu Mao Jiu restaurant and expand to nation. The firm has tried establishing brand matrix these years and is a leading Chinese restaurant chain operator. The firm has owned a wide collection of brands including Jiu Mao Jiu, Tai Er Chinese Sauerkraut Fish, Double Egg, Cooking Spicy Kebab and Uncle Chef. In 2018, Jiumaojiu has opened 241 restaurants and realized revenue of Rmb1.89bn and net profit of Rmb74m.

Industrialization and standardization of catering industry enables catering companies to develop multi-brand matrix.As the restaurant operating system matures, leading restaurant brands can expand faster thanks to stable supply chain, accurate marketing, standardized procedures and lower operating cost. The Chinese restaurant market size exceeded Rmb4tn at present. The multi-brand strategy enabled Jiumaojiu to reach more potential consumers with less dependence on a single brand.

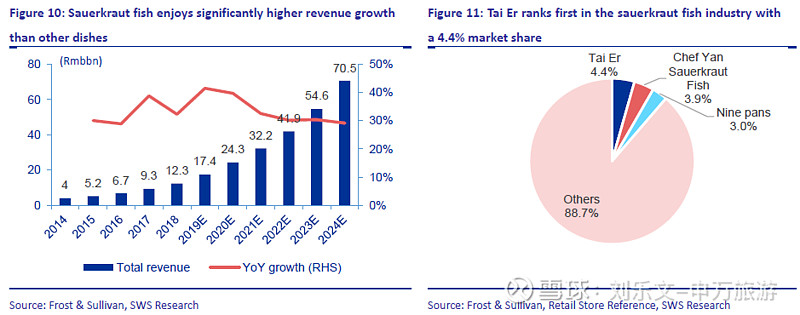

Tai Er Chinese Sauerkraut Fish outperforms in a promising sector. According to Frost & Sullivan, the Chinese Sauerkraut Fish market will grow to Rmb17.4bn in 2019 and will deliver a Cagr of 33.78% from 2018 to 2024E, much higher than the average growth of the catering industry. Similar to hotpot, preparation of sauerkraut fish can be standardized and simplified. Tai Er only provides a single category with limited SKUs to suit the fast-pace lifestyle, especially for the younger generation. This results in an average consumption of Rmb74 per person and turnover rate of 5.2 times/day in tier-one cities. The average payback period of Tai Er restaurant is only seven months, which is much shorter than the industry average of 15-20 months.

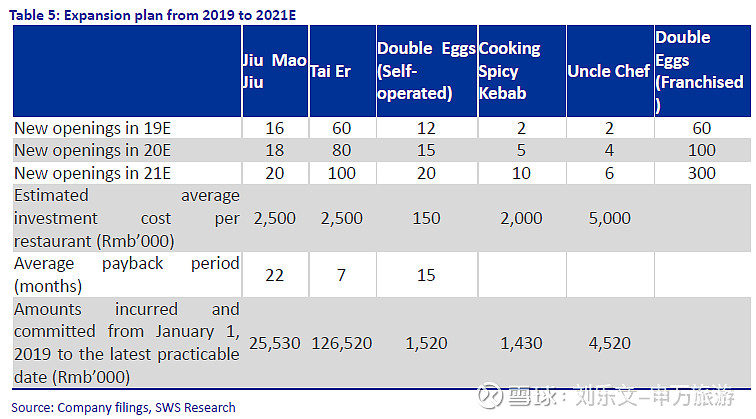

Rapid expansion period with employee stock incentive.Brand managers and employees own 15% of Tai Er’s shares, and 20% of Double Eggs. This mechanism will align the interests of employees with brands, and hence accelerate store expansion. The group plans to open 60 new Tai Er stores in 19E, 80 stores in 20E and 100 store in 21E. It also plans to open 460 franchised Double Eggs stores in three years. Given the strong profitability of Jiu Mao Jiu and Tai Er, and the firm’s proven record of developing new brands, we believe the rapid store expansion will bring out robust earnings growth.

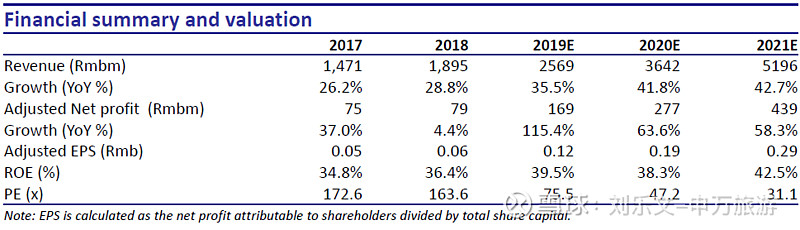

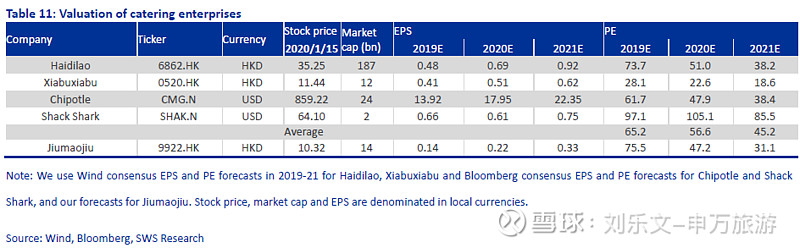

Initiate with Outperform.As a leading restaurant chain operator, Jiumaojiu is implementing the multi-brand and multi-cuisine strategy. As its brand matrix enriching and refreshing, Jiu Mao Jiu can cover more customers and convert its operating ability into scale advantage. We forecast EPS of Rmb0.12 in 19E (+116.6% YoY), Rmb0.19 in 20E (+60.0% YoY), and Rmb0.29 in 21E (+ 51.9% YoY). The stock is trading at75.5x 19E PE, 47.2x 20E PE and 31.1x 21E PE at the exchange Rate (Rmb-HK$) of 1.13. Our target price of HK$12.38 implies 56.6x 20E PE. With 19.96% upside, we initiate coverage of the stock with an Outperform rating.

Risks.Jiumaojiu may fail to innovate new restaurant brands, which will delay the expansion of its brand matrix. Meanwhile, it may lose control over franchised restaurants, undermining the brand value.

投资要点

九毛九创始于1995年并于2005年正式开始经营九毛九餐厅后逐步向全国扩张。公司近年来不断尝试打造品牌矩阵,是目前国内领先的中式餐饮连锁品牌运营商,目前旗下拥有九毛九、太二酸菜鱼、2颗煎蛋等不同餐饮品牌,截止2018年,公司已有开业餐厅241家,实现收入人民币18.93亿元,实现利润0.74亿元。

餐饮行业连锁化和标准化趋势已至,多品牌矩阵有利于长期发展。伴随餐饮运营及相关服务的产业化改造,中国餐饮行业四万亿市场高度分散的局面即将面临变革。优质企业具备连锁化和标准化的产业基础,其品牌运营能力的提升和管理半径的扩张将带来企业的高速成长。类似于九毛九这样打造多品牌矩阵的餐饮企业,有可能率先探索出品牌孵化和复制的路径从而在激烈竞争中,覆盖更多客户群体,降低对单一品牌的依赖,从而实现多元化长期发展。

定位优势赛道,打造爆款太二酸菜鱼。据沙利文报告,2019年酸菜鱼市场规模预计174亿元,2018-2024年年复合增长率为33.78%,远高于餐饮行业平均,是继火锅之后又一适于标准化改造的中式餐饮系列。太二酸菜鱼凭借单品化、轻量化、快餐化的特点快速脱颖而出,在一线城市实现70元以上的客单价和5次以上翻座率,成为目前九毛九最具成长潜力的品牌,也是目前公司门店拓展的重点。从经营角度,精简菜单维持原材料成本稳定,浮动租金模式降低新店培育门槛,翻台率提升将单店模型提升到极优水准,按照公司披露的历史平均现金投资回收期仅7个月。

品牌持股激励员工积极性,门店进入高速扩张阶段。目前旗下太二、2颗鸡蛋煎饼、怂和那未大叔均含有15%/20%/20%/20%的少数股权由品牌经理和员工持有,对于新品牌的打造具有积极的利益绑定。公司计划2019-2021年分别拓展60/80/100家太二酸菜鱼门店,以及2颗鸡蛋煎饼的三年460家的加盟拓展,预计在2019年底328家的基础上至2021年门店数量将突破800家,其规模优势和品牌矩阵的壁垒将进一步加深,进而转化为利润。

首次覆盖给予增持评级。九毛九作为业内领先的中式餐饮连锁运营商,正在实现多品牌多概念战略,在九毛九和太二品牌的积累上,具有打造新品牌并连锁运营的优势。伴随其品牌矩阵的不断丰富和更新,可以有效覆盖更多消费群体并将运营能力转化为规模成长的优势。预计2019-2021年公司经调整后EPS为0.12/0.19/0.29元,按照1人民币=1.13港元的汇率,对应2019-2021年PE分别为75.5/47.2/31.1倍,按照行业同类型公司2020年平均估值56.6倍,给予目标价12.38港元,相比当前仍有19.96%的上涨空间首次覆盖,给予“增持”评级 。

风险提示:新的餐饮品牌培育持续不顺利,导致品牌矩阵开拓受阻;加盟模式存在管理失控并导致品牌受损的风险。

报告正文

1

Successfully incubated Tai Er to build a multi-brand restaurant chain

1.1 Fast-growing Chinese restaurant chain

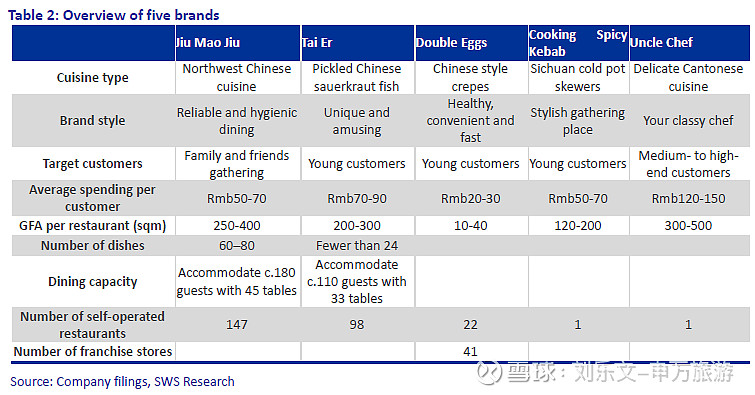

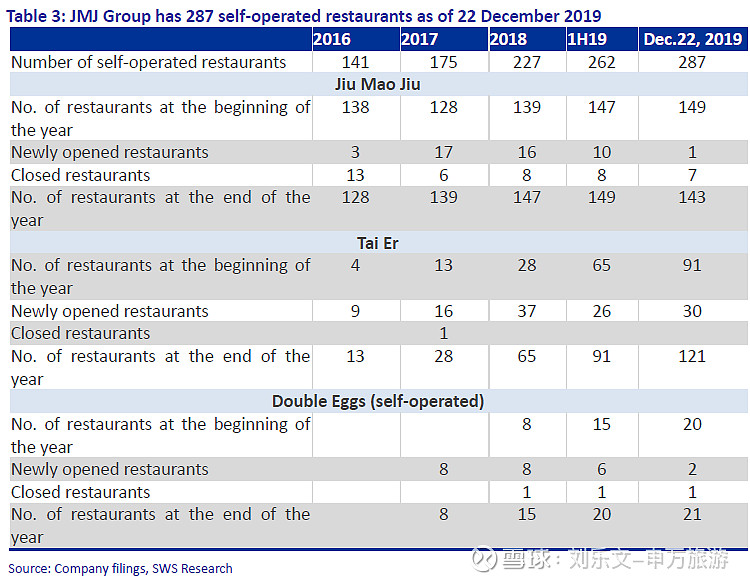

Jiumaojiu is a leading Chinese restaurant chain operator. Its predecessor was Traditional Shanxi Noodles founded in October 1995. The company launched the "Jiu Mao Jiu" brand in 2005, and gradually expanded its restaurant network and brand matrix after 2010. At present, it operates five major brands including Jiu Mao Jiu, Tai Er, Double Eggs, Cooking Spicy Kebab and Uncle Chef. As of December 22, 2019, it operated a total of 287 self-operated restaurants and managed 41 franchised restaurants.

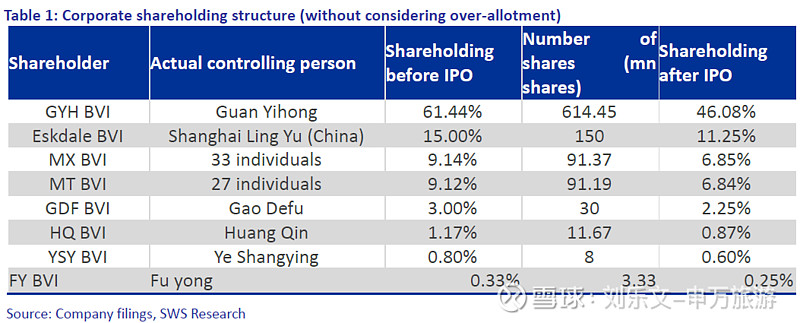

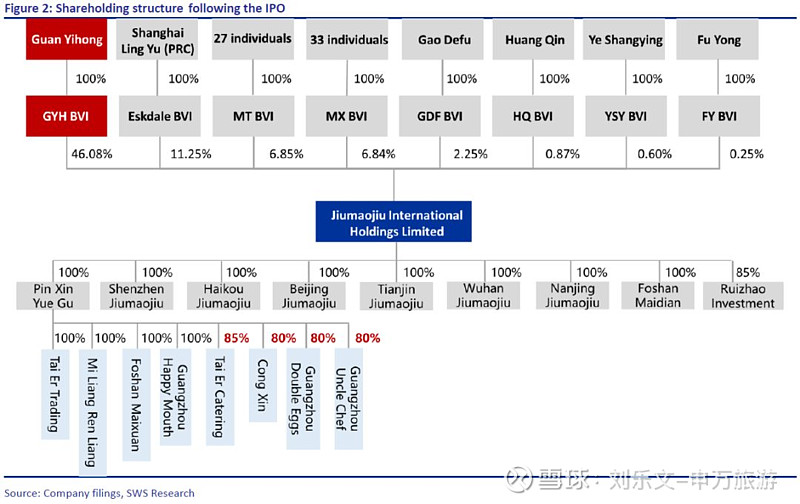

Employee shareholding scheme provides incentive for brand cultivation.The company's founder Guan Yihong holds a 61.44% of shares, and his stake will decrease to 46.08% after the IPO, without considering the over-allotment. The company's second largest shareholder is Shanghai Lingyu (a sister fund of Beijing He Xie Cheng Zhang, IDG), with an original shareholding of 15%. The third and fourth largest shareholders (MT BVI and MX BVI) are the company's employee shareholding schemes, of which MT BVI contains 22 current employees and five former employees, and MX BVI consists of 23 current employees, nine former employees and one external investors. The company encourages employees to contribute capital during new brand development. Currently, Tai Er, Double Eggs, Cooking Spicy Kebab and Uncle Chef each contain 15%, 20%, 20% and 20% minority equity, respectively, held by the brand managers and employees. We believe the market-oriented incentives, which align the interests of employees with the company, are facilitate in motivating employees in new brand development and cultivation.

1.2 Entering a rapid-expansion stage

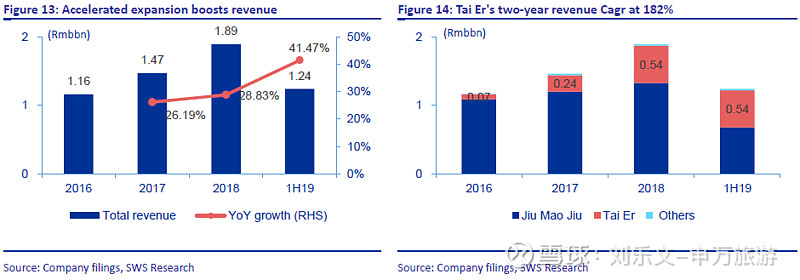

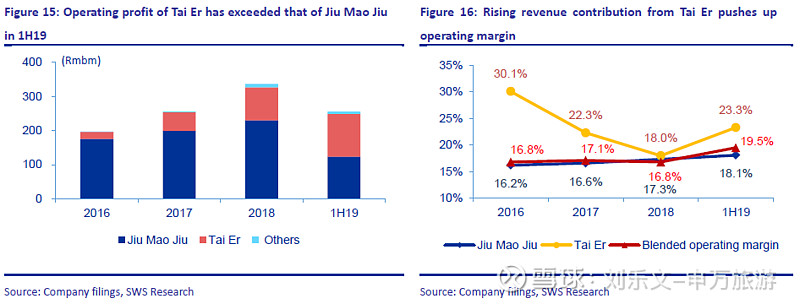

Jiu Mao Jiu and Tai Er are the two main brands of the company. Tai Er's enjoys industry-leading profitability.At present, the company operates five brands including Jiu Mao Jiu, Tai Er, Double Eggs, Cooking Spicy Kebab and Uncle Chef. Among them, Jiu Mao Jiu and Tai Er contributed more than 98% of the company's revenue. In 1H19, Jiu Mao Jiu realized revenue of Rmb683m (+5.82% YoY), accounting for 55.2% of total sales, and delivered operating profit of Rmb124m (+ 6.18% YoY). Tai Er achieved sales of Rmb538m (+ 146.8% YoY), accounting for 43.5% of total revenue, and generated operating profit of Rmb125m (+ 155.7% YoY), with an operating margin of 23.3%.

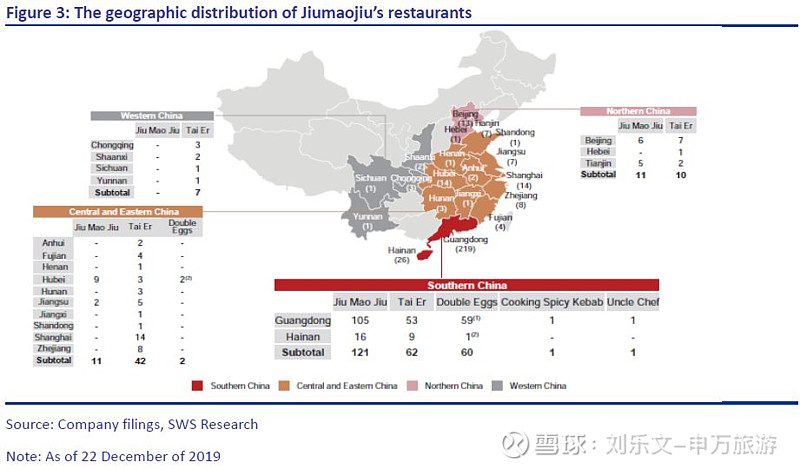

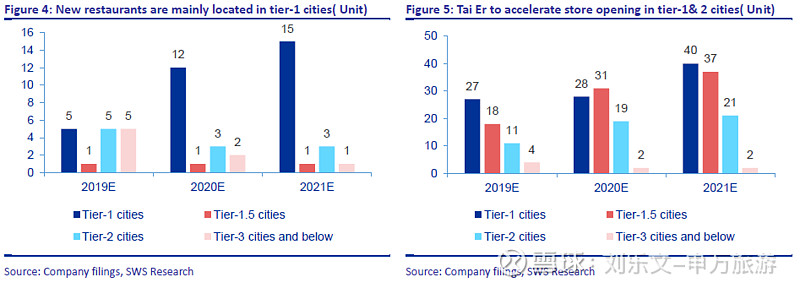

Headquartered in southern China, the firm grew rapidly in central and eastern China with Tai Er brand.At present, 245 of the company's 328 restaurants are located in southern China, including 219 in Guangdong. Jiu Mao Jiu operates 105 restaurants in Guangdong, accounting for 73.4% of its national restaurant network. Tai Er has 53 restaurants in Guangdong (43.8%), followed by 14 restaurants in Shanghai (11.6%). Over the past two years, the company was aggressively expanding the store network of Tai Er, opening 37 new Tai Er restaurants in 2018 and 56 stores in 2019 (as of December 22), accounting for 60.7% and 73% of total new restaurants, respectively.

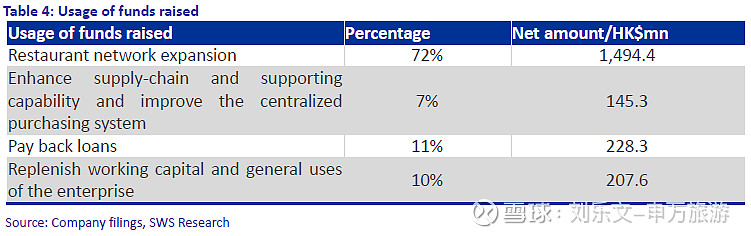

Supported by the funds raised through IPO, the firm targeted to open 370 new self-operated restaurants and 460 franchised restaurants within three years (2019-21).Using the median (HK$6.05) of the IPO price HK$6.60, we expect the firm to raise a net of HK$2.08bn, of which c.72% or HK$14.94bn will be directed to restaurant network expansion. Specifically, the company plans to open 18 self-operated Jiu Mao Jiu restaurants, 80 Tai Er restaurants and 24 other brand restaurants in 20E, and 20 self-operated Jiu Mao Jiu restaurants, 100 Tai Er restaurants and 36 other brand restaurants in 21E.

2

Industry perspective: Chain and standardizedoperations

2.1 Chain and standardized operations represent thegeneral trend

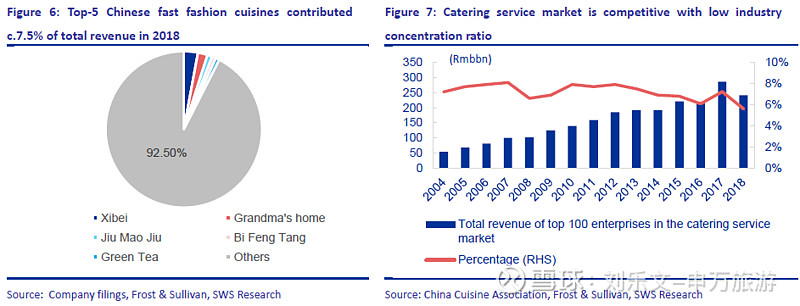

The low selection cost of consumers resulted in a naturally dispersed catering market. Catering consumption is based on the economy and culture, featuring high consumption frequency and typical “long-tail” characteristics. China's numerous cuisines and distinctive regional differences contribute to high abundance and low concentration in the catering service industry. The Chinese cuisine market was relatively fragmented in 2018 with over 4m restaurants, and the top three players aggregately accounted for only 0.8% of the market share. Xibei, the leader in the Chinese fast fashion catering industry which Jiumaojiu competes with, has a mere market share of 2.9%, while Jiumaojiu ranked th third with a 1% market share. The combined market share of the top five players was only 7.5%. Compared to the highly concentrated Internet industry which enjoys exclusive application scenarios and a significant Matthew effect backed by a large user base, catering service consumers have many choices and low thresholds. Anyone can eat at any restaurant as long as they can use chopsticks, and consumers won’t choose a specific food category for all three meals in a day. As such, no restaurant can capture the entire time of consumers, so catering service providers focusing on long-tail consumers can occupy a considerable proportion.

The advantage of a fragmented industry:The fragmentation of the industry also means high abundance. China has a far richer diversity in diets than any other region in the world, with a wide range of consumer groups. At the current stage, clothing, retailing, and food industries have formed strong brand barriers and relatively fixed consumer groups. Unless the business model evolves, it is difficult for newcomers to get ahead. But the brand awareness of the catering service industry is still in the incubation period, with no restrictions from monopolies along the industry value chain. With ongoing diet innovations, there will be no best product but better product, which will increase competition and provide more opportunities for new entrants.

The disadvantage of a fragmented industry: Low entry barriers, diversified consumer tastes and low customer stickiness determine that China's catering market is fully competitive. Most Chinese cuisine restaurants are in a dilemma of expansion. Firstly, the high degree of dependence on chefs makes it difficult to replicate their business model (though catering service providers of certain categories can solve the problem by standardization). Secondly, there exist natural difficulties in expanding to different regions given diversified food taste among Chinese regions. Finally, the growing number of stores could bring about difficulties in management after reaching a certain scale.

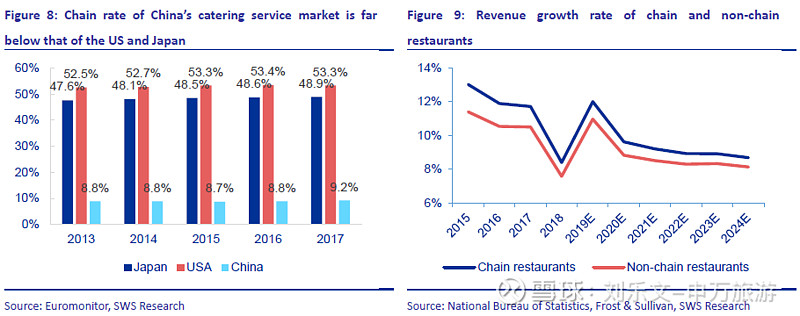

Referring to international counterparts, there is room for improvement in the chain rate and standardization of China's catering service industry.Since 2013, the revenue growth rate of chain catering companies has surpassed the overall revenue growth of catering companies, with the overall chain rate beginning to rise. In 2017, the number of catering stores exceeded 5m (10 times more than that of the lodging industry), but the chain rate (the proportion of chain stores to total number) was only 9.2%, far lower than that of the US and Japan. Most Chinese cuisine restaurants face a dilemma of expansion due to the three major reasons mentioned above. In 2017, American CR5 catering companies were all fast food chains, taking up a combined market share of 10.55%, of which McDonald's (MCD:US) ranked first with annual revenue of Rmb36.4bn, occupying a 4.56% market share. Considering the basic needs of consumers, standardization avoids disappointing customers, and quality assurance reduces consumers’ trial and error costs. Meanwhile, chain operations can help expand brand influence and scale advantages, improve accessibility, and cut down transaction costs.

2.2 Sauerkraut fish features single product, fewer SKUs andfast food

The sauerkraut fish sub-industry recorded significantly faster revenue growth than other food and beverage categories, with Tai Er ranking first among all sauerkraut fish restaurants in China.According to Sullivan's forecast, the Chinese sauerkraut fish market will be worth Rmb17.4bn in 2019 (+41.5% YoY), which is significantly higher than the overall growth rate of the Chinese cuisine industry (10.4%). The Chinese sauerkraut fish restaurant market is forecasted to grow at a Cagr of 33.78% from 2018 to 2024, reaching Rmb70.5bn in sales in 2024. In 2018, Tai Er delivered a revenue of Rmb540m and ranked first in the industry with a 4.4% market share.

The success of sauerkraut fish mainly lies in its excellent operation model with high turnover brought by single product, fewer menus and fast food style. Single product:The popularity of sauerkraut fish is a prerequisite for it to become a core product. In terms of demand, searches for sauerkraut fish on mobile terminals has surpassed the yellow pheasant chicken in 2018, and also beat the boiled fish which is also a Sichuan-flavor cuisine, according to Meituan.com. In terms of cost, sauerkraut fish, as a single product, enjoys strong economy of scale, which enables the company to significantly increase production efficiency and reduce costs. Fewer SKUs:By comparing the menus, we found that Tai Er only offers no more than 23 menu items in addition to the Pickled Chinese sauerkraut fish, while Jiumaojiurestaurants offer 60 to 80 menu items. Fewer SKUs cut down the time customers spend on menus and simultaneously reduce restaurants' preparing time. More concentrated procurement saves costs as well. Fast food: Tai Er only provides tables for four people, and does not cater to the dining demand for more than four people, in which situation the demand tends to be more fast food alike. Such operation model greatly enhanced dining efficiency, which in turn sharply increases the turnover rate and the table turnover rate.

2.3 Highly reproducible model and better brandincubation capability

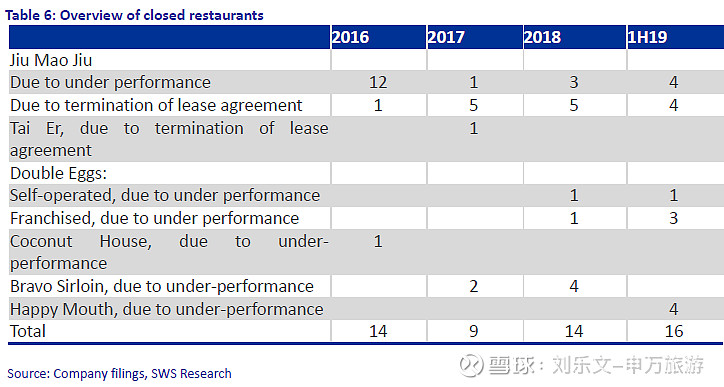

The company intends to gradually grow into a multi-brand operator at low trialand error costs.In additionto the five brands currently in operation, the company previously fostered BravoSirloin (six successively closed in 2017-18), Coconut House (onestore closed after trial operation in 2016), and Happy Mouth (four storesclosed or transferred in 2019H1). Through the current operation of the fivebrands, the company has established a sound product mix covering differentlevels of consumers with a diversified per customer spending range, whileaiming to build its own brand portfolio through the launch of new products.

With well-established brands driving newly-established ones, the potential for replication is greatly improved. The success of the brand Tai Er plays a significant role for the company to incubate other brands.From the perspective of incentives, the company has adopted an employee stock ownership scheme for the operation of new brands following Tai Er, ensuring the operating efficiency. From the perspective of locations,the company is vigorously increasing its presence in shopping malls. As of 22 December 2019, it had cooperated with 102 shopping malls for over three years, among which 49 partners partnered with at least two brands of the company. The well-established brands can generate significant synergies with new brands in terms of rents and customer flow. Therefore, the company boasts significantly higher success rate in new brand incubation than other startups.

3

Operation perspective: optimal single store model

3.1 Expansion boosts revenue growth and increases theproportion of high-margin brands

Tai Er has become the company's most important profit contributor, while revenue rapidly picks up thanks to accelerating store openings.The company achieved revenue of Rmb1.9bn in 2018 (+28.8% YoY) and Rmb1.2bn in 1H19 (+ 41.5% YoY). Among the brands the company owns, Tai Er posted a revenue Cagr of 182% from 2016 to 2018. The brand achieved revenue of Rmb538m in 1H19 (+146.8% YoY) and contributed Rmb125m to operating profit, higher than Jiu Mao Jiu’s Rmb124m. We expect the gap between the two brands to further expand after the opening of new restaurants. The company's adjusted net profit was Rmb786m in 2018 (+4.4% YoY), due to the impact of store shutdowns and cultivation of new restaurants. In 1H19, the adjusted net profit was Rmb1.2bn, up 106.5% YoY driven by the opening of new Tai Er restaurants.

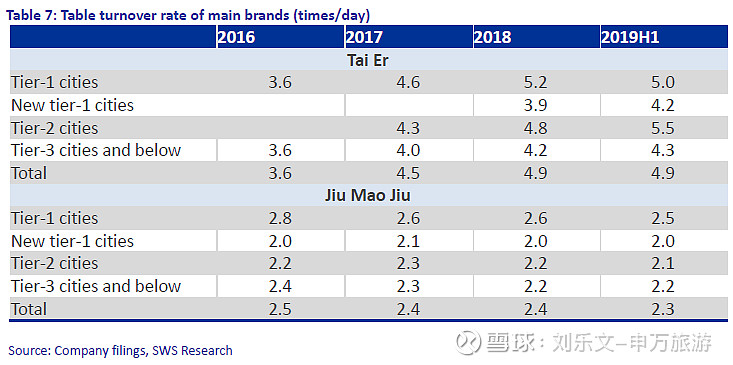

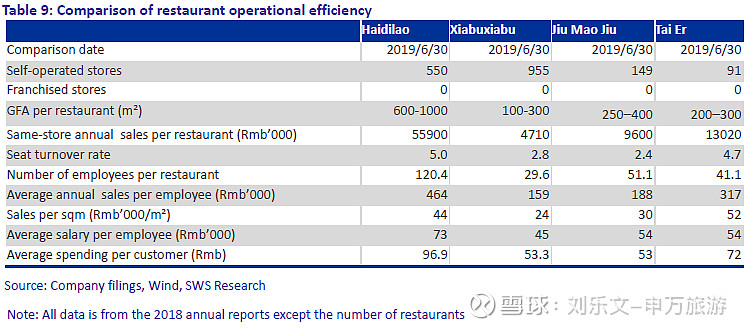

Rising proportion of high-margin brand helps improve the operating margin.With sales per square meter as the most direct factor to measure the operating efficiency of a store, more seats multiplied by the turnover rate means higher unit sales, under the condition that the average spending per customer remains stable. Growing sales per sqm can dilute rents and labor costs, resulting in higher profit margin of a single restaurant. With the operating efficiency of a single store unchanged, the restaurant itself does not enjoy a scale effect, and its profit margin will not increase with the rise in the number of restaurants. Among the multiple brands the company runs, Jiu Mao Jiu’s table turnover rate was 2.3 times per day in 1H19, vs 4.9 times/day for Tai Er. As such, the gross margin of Tai Er's single restaurant has doubled that of Jiu Mao Jiu’s. Following increasing sales of Tai Er, we believe the company's gross margin will continue to improve.

3.2 High turnover rate ensures optimal operationalefficiency

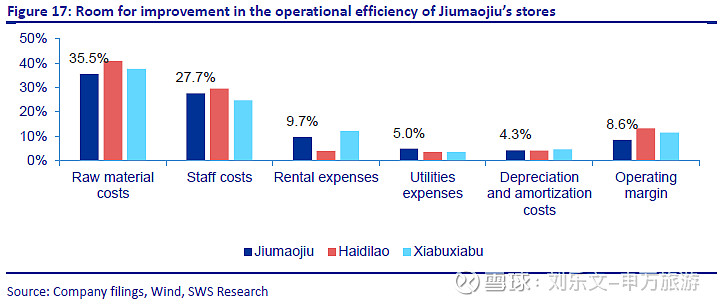

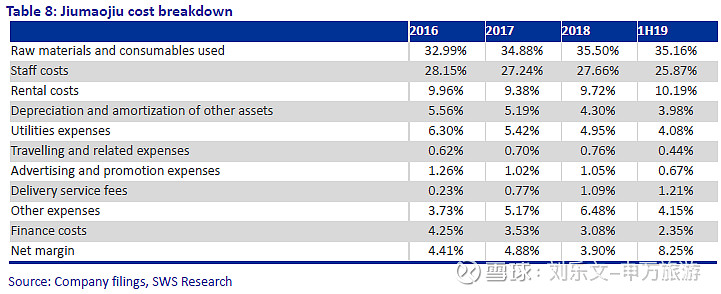

A simpler menu reduces the difficulty in purchasing and logistics, and the firm’s supply chain system and central kitchen guarantee stable raw material supplies. For Jiumaojiu, raw material costs and staff costs accounted for more than 60%, and other costs mainly included rent, utilities and depreciation costs. With over 23 years of experience in the catering industry, Jiumaojiu has gradually established a highly standardized and easily replicable business model which is employed in the development of all its brands.

Jiumaojiu believes the simplest is the most elegant.The firm offers no more than 23 dishes in Tai Er, and takes advantage of buying food ingredients in bulk. Jiumaojiu produces most semi-processed products at its central kitchens in Guangdong, Hainan and Hubei. This ensures consistency of food quality and taste among different restaurants and economies of scale.

The contingent rent payment method helps to keep the company's rental cost ratio stable, and enables it to obtain better located properties.Unlike the fixed rent of ordinary restaurants, a substantial portion of the company's restaurant lease agreements are variable rent arrangements, under which its rent payable typically ranges from 8% to 11% of the revenue of the particular restaurant. Some of these leases also include a minimum rent payment clause pursuant to which the firm is required to pay the higher of the minimum rent or the contingent rent calculated with reference to the revenue of the restaurant. Although the contingent rent model reduces the profit elasticity of its restaurants, it guarantees the lessor’s revenue, which helps the firm to obtain better located properties in negotiations.

The rent-free period and high turnover rate make the company's rental costs lower than competitors.Compared with Haidilao, Jiumaojiu’s restaurants have a smaller area and a smaller variety of dishes. The firm focuses on simple meals with a high turnover rate, and has lower standards on cooking and services, making its ratio of raw material costs and staff costs lower than those of competitors. The firm’s restaurant leases typically include a rent-free period of two to three months for interior design and renovation of the premises. Due to high turnover, the firm’s rental costs are diluted. The average rental costs of its restaurants stood at 11-15% in 2018, and its rental costs accounted for 9.7%, slightly lower than the average.

Costs of each brand remained stable, and changes to its brands’ revenue contributions caused structural adjustments of costs.The raw material costs of Tai Er exceeded that of Jiu Mao Jiu. With increasing revenue from Tai Er restaurants, the proportion of raw material costs has increased structurally. However, Tai Er's staff costs were lower than that of other brands, lowering the firm’s overall staff cost ratio.

Main brands – Jiu Mao Jiu and Tai Er, have set up large-scale chain stores. The company adopts a centralized purchase order model, which has stabilized raw material costs. At present, the operational efficiency of the firm’s restaurants continues to improve due to a higher turnover rate. Therefore, changes in staff costs are not obvious. However, when its restaurant operations become stable, we expect the company to record rising staff costs in a labor-intensive industry.

Turnover rate determines revenue growth.According to the formula, restaurant revenue = the number of customers x average spending per customer = the number of seats x seat turnover rate x average spending per customer, turnover rate and average spending per customer are the most important factors which affect revenue, as the number of seats is fixed.

Jiu Mao Jiu and Tai Er are positioned as mass-market brands. In 2018, the average spending per customer of Jiu Mao Jiu and Tai Er reached Rmb53 and Rmb72, respectively, with two-year Cagrs of 5% for both brands. The mass-market catering sector is highly price-sensitive, featuring low margins, high turnover rates, low value-added products and limited room for price hikes. As a result, the same-store sales growth mainly depends on the improvement in table turnover rate.

Each store reaches optimal operational efficiency; a duplicable business model helps to shatter the growth ceiling of a single brand.In 2018, the same-store table turnover rates of Jiu Mao Jiu and Tai Er stood at 2.4 times/day and 4.7 times/day, respectively. We calculate the maximum table turnover rate of stores that operate 24 hours a day is c.7 times/day, but Tai Er operates only c.12 hours per day. We believe Tai Er’s turnover rate of 4.7 times/day is close to the upper ceiling. Hence, Tai Er restaurants have reached optimal operational efficiency. In the short term, as it is impossible to increase the turnover rate by extending the firm’s business hours, its revenue will be stable.

Chinese food is rich in variety, and consumer tastes change rapidly. With the emergence of new products, consumers' attention is rapidly shifting, and it is difficult for a single product to continue to grow for a long time. Moreover, the catering industry is a fully competitive market, and the number of restaurants under a single brand that can be accommodated in this market is limited. A catering company may easily encounter a growth bottleneck if relying heavily on a single brand, and therefore it needs to build new brands continuously to break through the growth ceiling of a single brand. As such, we consider brand operation capability and supply chain construction as the core competitiveness of the company.

4

Earnings forecasts and valuation

4.1 Airport is a crucial channel for global duty-free retailing

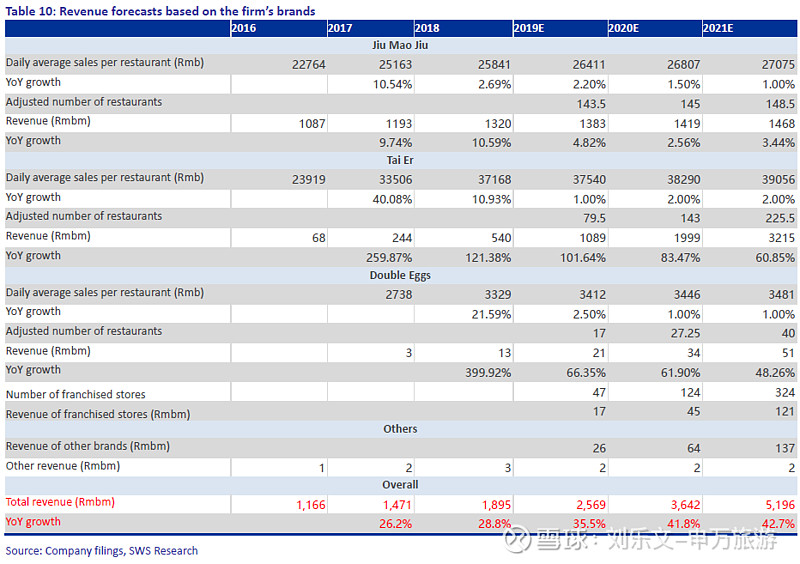

Revenue breakdown by brand:In Section 3.2, we stated that the firm has nearly reached optimal operational efficiency for each store, and therefore each brand’s sales mainly depend on the increase in the average spending per customer and the number of stores. We use the firm’s guidance on store expansion in 2019-21E. Regarding the average spending per customer, we find it is difficult for a restaurant to significantly increase its prices. Therefore, we expect the firm’s average spending per customer to increase, when raw material costs climb, and forecast a daily same store sales growth of 1-3%.

In summary, we expect Jiu Mao Jiu restaurants to achieve revenue of Rmb1.38bn in 19E, Rmb1.42bn in 20E and Rmb1.47bn in 21E, and Tai Er restaurants to achieve revenue of Rmb1.09bn in 19E, Rmb2.00bn in 20E and Rmb3.22bn in 21E. Considering the other brands and businesses, we expect overall revenue to be Rmb2.57bn in 19E (+35.5% YoY), Rmb3.64bn in 20E (+41.8% YoY), and Rmb5.20bn in 21E (+42.7% YoY).

Although the proportion of start-up costs will increase given the firm’s rapid development, we believe the significant increase in the Tai Er brand will be expected to reduce operational expense ratio and structural chance will stimulate profit growth rate to exceed revenue growth rate. We choose chain hotpot restaurant Hai Di Lao and Xiabu Xiabu that will be likely to expand to a large scale, Chipotle Mexican Grill and Shake Shack with low SKU as comparable companies. Hamburgers are Shake Shack's key SKU. Shake Shack's fast-food development is more like Tai Er's than traditional Chinese restaurants with more SKUs. Also, Shake Shack's operating model is more close to Tai Er's popularity. Both of them operate most restaurants in shopping malls in tier one cities and have similar positions. We forecast adjusted EPS of Rmb0.12 in 19E, Rmb0.19 in 20E and Rmb0.29 in 21E. The stock is trading at 75.5x 19E PE, 47.2x 20E PE and 31.1x 21E PE at the exchange Rate (Rmb-HK$) of 1.13. Compared with other similar catering enterprises, our target price of HK$12.38 implies 56.6x 20E PE. With 19.96% upside, we initiate coverage of the stock with an Outperform rating.

5

Risks

(1)Jiumaojiu may fail to launch new restaurant brands and enter new markets;

(2)Jiumaojiu may be unable to continue to successfully develop new brands;

(3)Restaurants are vulnerable to risks related to rental increases andfluctuations, unexpected land acquisitions, building closures or demolition.

Introduction of Share Investment Rating

Security Investment Rating:

When measuring the difference between the markup of the security and that of the market’s benchmark within six months after the release of this report, we define the terms as follows:

BUY: Share price performance is expected to generate more than 20% upside.

Outperform: Share price performance is expected to generate between 10-20% upside.

Hold: Share price performance is expected to generate between 10% downside to 10% upside.

Underperform: Share price performance is expected to generate between 10-20% downside.

SELL: Share price performance is expected to generate more than 20% downside.

Industry Investment Rating:

When measuring the difference between the markup of the industry index and that of the market’s benchmark within six months after the release of the report, we define the terms as follows:

Overweight: Industry performs better than that of the whole market;

Neutral: Industry performs about the same as that of the whole market;

Underweight: Industry performs worse than that of the whole market.

We would like to remind you that different security research institutions adopt different rating terminologies and rating standards. We adopt the relative rating method to recommend the relative weightings of investment. The clients’ decisions to buy or sell securities shall be based on their actual situation, such as their portfolio structures and other necessary factors. The clients shall read through the whole report so as to obtain the complete opinions and information and shall not rely solely on the investment ratings to reach a conclusion. The Company employs its own industry classification system. The industry classification is available at our sales personnel if you are interested.

HSCEI is the benchmark employed in this report.

Disclaimer:

This report is published by SWS Research Co., Ltd. (subsidiary of Shenwan Hongyuan Securities, hereinafter referred to as the “Company”) in mainland China (excluding Hong Kong, Macao and Taiwan), and to be used solely by the clients of the Company (including Qualified Foreign Institutional Investors and other qualified clients in accordance with the law). The Company will not deem any other person as its client notwithstanding his receipt of this report. The clients understand that the text message reminder and telephone recommendation are no more than a brief communication of the research opinions, which are subject to the complete report released on the Company’s website (网页链接). The clients may ask for follow-up explanations if they so wish. Save and except as otherwise stipulated in this report, the contactor upon the first page of the report only acts as the liaison who shall not provide any consulting services.

This report is based on public information, however, the authenticity, accuracy or completeness of such information is not warranted by the Company. The materials, tools, opinions and speculations contained herein are for the clients’ reference only, and are not to be regarded or deemed as an invitation for the sale or purchase of any security or other investment instruments. The materials, opinions and estimates contained herein only reflect the judgment of the Company on the day this report is released. The prices, values and investment returns of the securities or investment instruments referred to herein may fluctuate. At different periods, the Company may release reports which are inconsistent with the materials, opinions and estimates contained herein.

The clients shall consider the Company’s possible conflict of interests which may affect the objectivity of this report, and shall not base their investment decisions solely on this report. The clients should make investment decisions independently and solely at your own risk. Please be reminded that in any event, the company will not share gains or losses of any securities investment with the clients. Whether written or oral, any commitment to share gains or losses of securities investment is invalid. The investment and services referred to herein may not be suitable for certain clients and shall not constitute personal advice for individual clients. The Company does not ensure that this report fully takes into consideration of the particular investment objectives, financial situations or needs of individual clients. The Company strongly suggests the clients to consider themselves whether the opinions or suggestions herein are suitable for the clients’ particular situations; and to consult an independent investment consultant if necessary. Under no circumstances shall the information contained herein or the opinions expressed herein forms an investment recommendation to anyone. Under no circumstances shall the Company be held responsible for any loss caused by the use of any contents herein by anyone. Please be particularly cautious to the risks and exposures of the market via investment. Independent investment consultant should be consulted before any investment decision is rendered based on this report or at any request of explanation for this report where the receiver of this report is not a client of the Company.

The Company possesses all copyrights of this report which shall be treated as non-public information. The Company reserves all rights related to this report. Unless otherwise indicated in writing, all the copyrights of all the materials herein belong to the Company. In the absence of any prior authorization by the Company in writing, no part of this report shall be copied, photocopied, replicated or redistributed to any other person in any form by any means, or be used in any other ways which will infringe upon the copyrights of the Company. All the trademarks, service marks and marks used herein are trademarks, service marks or marks of the Company, and no one shall have the right to use them at any circumstances without the prior consent of the Company.