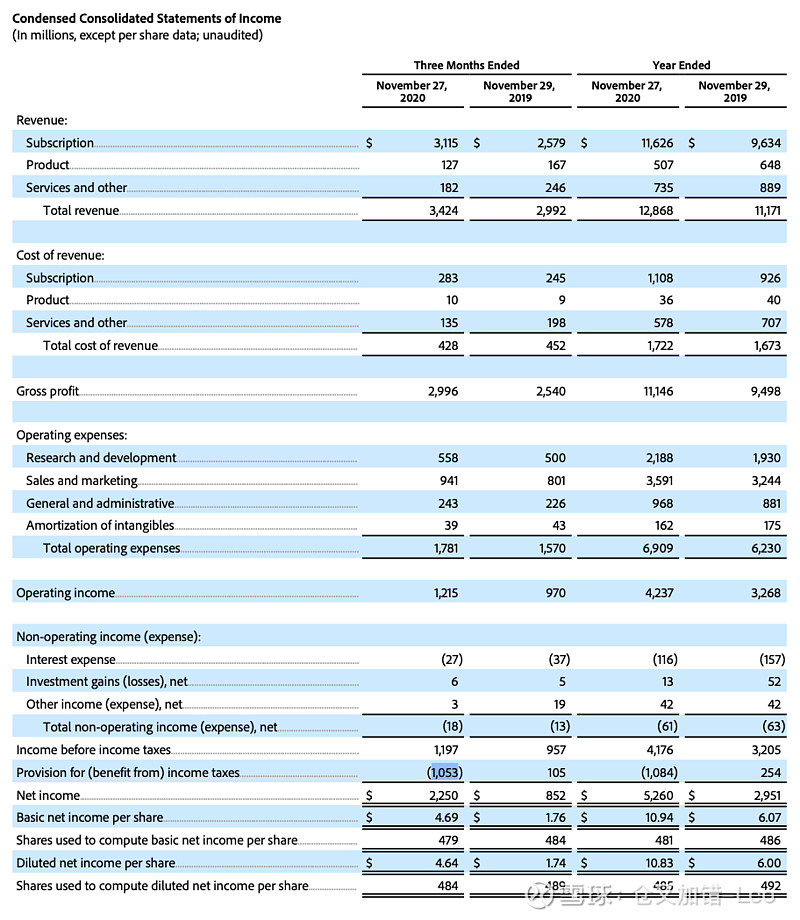

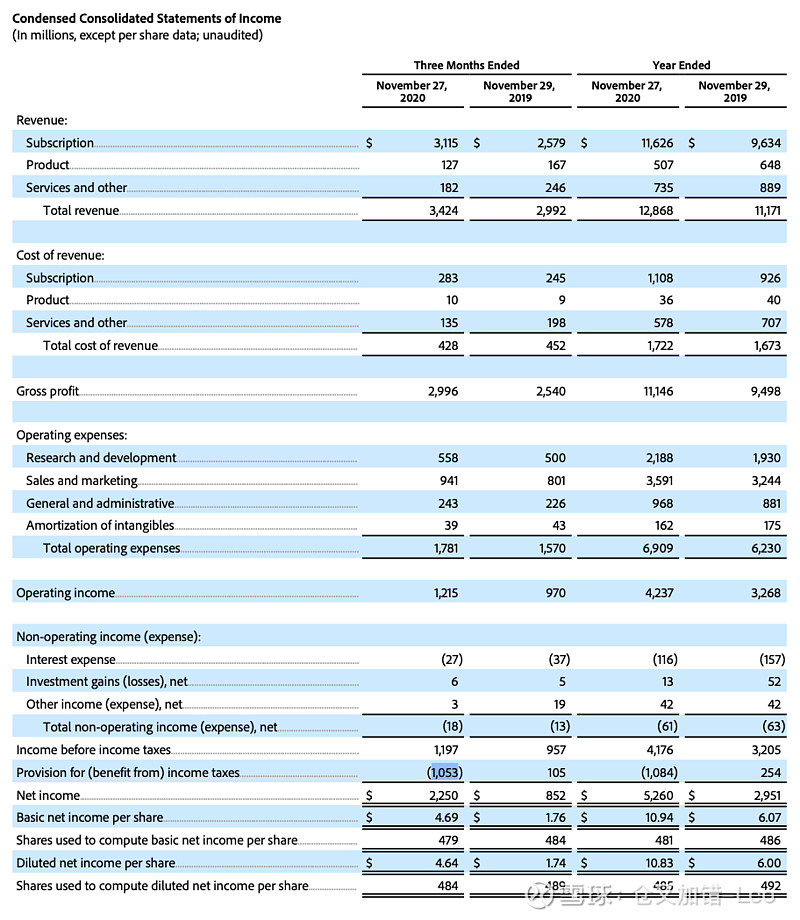

$Adobe(ADBE)$ 4季度巨大一笔“退税”-1053是什么情况?8K里也没个说明。

| 发布于: | 雪球 | 转发:1 | 回复:3 | 喜欢:0 |

$Adobe(ADBE)$ 4季度巨大一笔“退税”-1053是什么情况?8K里也没个说明。

看起来是17年税改之后公司对国际间交易结构(具体操作不明)调整导致的一次性递延所得税资产。具体可以参考Q4的earning call和3月的investor handout.

三月是这么说的:Changes in tax rules and regulations, or interpretations thereof, may adversely affect our effective tax rates. We are a United States-based multinational company subject to tax in multiple U.S. and foreign tax jurisdictions. A significant portion of our foreign earnings for the current fiscal year were earned by our Irish subsidiaries. The U.S. Tax Cuts and Jobs Act (“Tax Act”), enacted into law on December 22, 2017, changed existing U.S. tax law applicable to us and included certain international provisions effective for us starting in fiscal 2019. The applicability and impact of these new tax provisions, and of other international tax law changes, will likely require us to respond by making change(s) to our international trading structure. The net impact of such change(s) is uncertain but is anticipated to adversely affect our effective income tax rate and cash flows in years beyond fiscal 2020.

Q4 earning call:We anticipate an increase in our effective tax rate due to additional taxes on our foreign operations following the changes we made to our international trading structure in FY 2020. Our FY 2020 tax rate included one-time benefits to recognize deferred tax assets resulting from these changes. These deductible assets will be amortized over multi-year period, lowering our cash tax rate over that time.

老师,私信您信息看见麻烦回复下,期待交流