Summary

2Q18 earnings review. Update fair value.

MRR, Shopify Plus uncovered.

Shopify's ecosystem is growing.

Is there an upper limit of viable “quality” ecommerce stores?

In 10 years, can you imagine any business not being online?

We recommend owning Shopify (NYSE:SHOP) for the long term below our fair value. With MRR coming in lower than expected in 2Q18, the growth trajectory shifts down slightly.

Second-Quarter 2018 Earnings Review

The 2Q18 earnings report was both good and bad. GMV (Gross Merchandise Volume) was good, GPV (Gross Payments Volume) was good, revenue was good, but MRR came up short of our expectations, and full-year guidance was revised up but a little less than we had hoped.

The bottom line is our fair value drops to US$157/share from US$164/share based on our 10-year Discounted Cash Flow model. The main culprit for the decrease was the slower-than-expected MRR growth in 2Q18.

We will present the 2Q18 results compared to our expectations and then dive into a few talking points from the conference call that we think were important.

Summary of 2Q18 Results

*SMRE = Save Money Retire Early’s Forecast

2Q18

(+) Revenue of $245 million vs. SMRE of $239 million

(-) GAAP Operating Loss of -$30.8 million vs. SMRE of -$16 million

(+) Adjusted Net Income of $2.5 million vs. SMRE of $1.8 million

(+) GMV (Gross Merchandise Volume - total sales of all merchants through Shopify) of $9.1 billion vs. SMRE at $8.9 billion

(+) GPV (Gross Payment Volume - sales by merchants using Shopify Payments instead of a third party like PayPal (NASDAQ:PYPL), etc.) $3.6 billion vs. SMRE of $3.4 billion

(-) MRR (Monthly Recurring Revenue) of $35.3 million vs. SMRE of $36.8 million

2018

(-/=) Revenue guidance increased $15 million to $1,015-1,025 million (previously $1,000-1,010 million), $5 million short of where we expected Shopify to revise guidance (SMRE expected guidance to be revised to $1,020-1,030 million)

(=) GAAP Operating Loss unchanged at -$105 million to -$110 million vs. SMRE at -$52 million

3Q18

(-/=) Revenue guidance of $253-257 million vs. SMRE expected guidance between $255 million and $260 million

4Q18

(=) Implied 4Q18 revenue is $299-313 million vs. previous SMRE forecast of $340 million (new SMRE forecast for 4Q18 is $350 million)

Keep in mind that full-year guidance will likely increase by $15-20 million next quarter, and the final reported revenue is expected to beat by another $10-15 million, as historically the company has provided conservative guidance. This puts our expectations right in line with the implied 4Q18 revenue guidance.

MRR (Monthly Recurring Revenue)

Prior to January 1, 2018, Shopify Plus merchants had a capped monthly subscription fee based on their GMV transacted on Shopify. This was 0.15% of GMV, with a minimum of $2,000/month and up to a maximum of $40,000/month.

We learned that the cap was removed for renewals and new contracts as of January 1, 2018. This means Shopify will get a share of the growth of big revenue-generating merchants.

The first place I see a benefit is with the new cannabis merchants in Canada. Ontario and BC governments in the old model would have likely capped out at $40,000/month ($480,000/year) each, but without the cap, the subscription revenue could be substantially larger. As an example, $2 billion in GMV would generate $3 million/year in high-margin subscription revenue. Recall from the article "Shopify: Cannabis Timing - Part 2," we suggested that the cannabis market in Canada could be $8.7 billion, which would translate into $13 million of high-margin subscription revenue.

We also learned that the Shopify Plus MRR contribution only consists of the minimum subscription revenue of $2,000 a month. This implies that there are 4,050 Shopify Plus merchants. This is an increase from the end of 2017, when the company reported 3,600 Shopify Plus merchants.

As Shopify Plus contracts get renewed without the capped subscription, there is going to be a bigger discrepancy between the reported subscription solutions revenue and the quarterly MRR.

For example, in 2Q18, end-of-quarter MRR was $35.3 million. Since this is the monthly number, we multiply by 3 to get the quarterly run rate of $105.9 million. Reported Subscription revenue was $110.7 million. If we consider the $105.9 million as the peak or near the peak of MRR during the quarter, there is at least $4.8 million of recurring revenue that is not classified as MRR. This $4.8 million includes "above cap" Shopify Plus revenue, as well as Apps, Themes and domain registration revenue.

For very large merchants that consistently generate over $1.3 million GMV per month, the added Shopify Plus subscriptions are reasonably considered recurring.

If Kylie Cosmetics generated an estimated $386 million in revenue (GMV) in 2017, that would be $32 million per month, well over the $1.3 million required to reach the minimum Shopify Plus cost included in MRR. That’s an extra $0.5 million/year of subscription revenue for Shopify from just one merchant that isn’t counted in the MRR. With over 3,600 reported Shopify Plus merchants, if we assume the average Shopify Plus merchant pays $250/month in additional subscriptions (i.e., $2,250/month total), then $0.9 million/month is excluded from the MRR.

Shopify’s ecosystem is growing

What’s more, App revenue more than doubled year over year and contributed more to revenue growth than the incremental revenue Shopify Plus generates above the minimum $2,000/month. This fact should seem obvious, since the apps are sold across the entire merchant base of over 600,000, while Shopify Plus only takes from a small subset of 3,600+ merchants. For example, $2/month from 600,000 is greater than $250/month from 3,600.

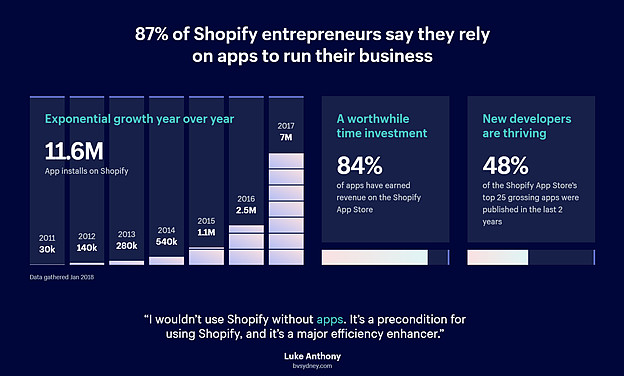

Shopify’s app installs (a proxy for app sales) are growing at a blistering pace. In 2017, it had 7 million app installs, an increase over 2016 by 180%, an increased pace over 2016 which grew by 127%. And these are not all free apps. The company paid out $47.2 million to app developers in 2017, an increase of 136% from 2016. Shopify pays out 80% of app revenue to developers, but the company also brings app development in-house when it sees the benefit of those apps for a wide base of merchants. This is evident from its acquisition of Kit CRM in 2016.

With App revenue more than doubling y/y in 2Q18, if this rate of growth continues through the end of 2018, App revenue could contribute double the revenue of 2017 - in other words, $25 million of high-margin revenue in 2018.

(Source: Shopify)

(Source: Shopify)

(Source: Shopify)

(Source: Shopify)

Facebook - Sales Channels

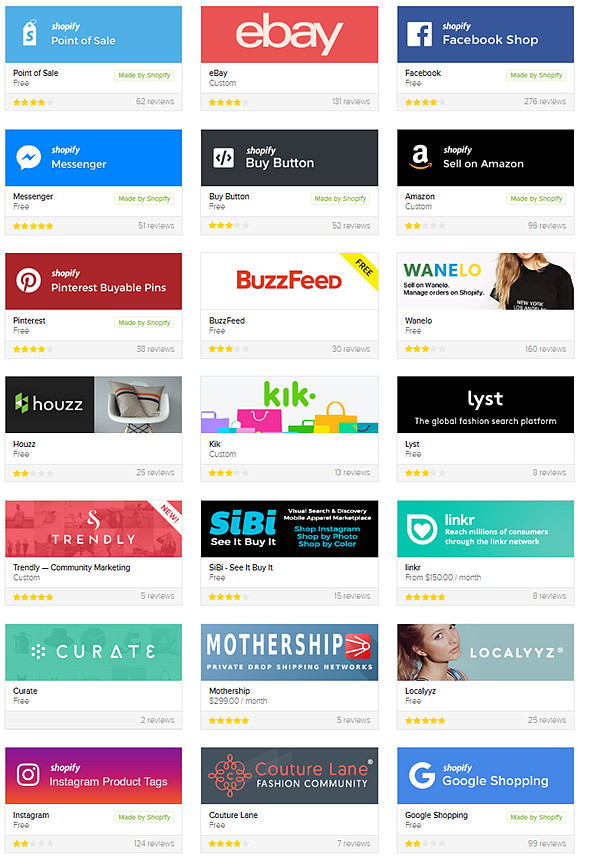

With Facebook (NASDAQ:FB) seeing slowing revenue growth, we thought there could be an impact on Shopify, however, GMV grew faster than we had expected. Shopify merchants use Facebook but apparently don’t rely on it as much as “advertised”. Shopify provides many sales channels for merchants to find consumers.

In the Fall of 2017, Shopify added eBay (NASDAQ:EBAY) as a sales channel for US merchants. The eBay channel was touted as having a massive audience of 169 million active buyers. Shopify has many integrations powered by the Shopify Sales Channel Platform, “a collection of APIs that can be used to add commerce to any site, app, or platform. Sales channels are an important part of a Shopify merchant’s business strategy, and more than 60% of merchants sell in two or more channels.”

Since the Cambridge Analytica scandal with Facebook, there were concerns that Shopify merchants rely too heavily on Facebook advertising as a sales channel. The reality is that merchants and consumers will find each other, whether Facebook exists or not. E-commerce isn’t stopping for a sales tax or any individual sales channel. The most we would expect to see is a transition period in the short term as merchants discover where consumers are “hanging out”. Long term, e-commerce is the trend that is causing a disruption in retail. If one sales channel becomes obsolete, another will become relevant.

(Source: Shopify)

(Source: Shopify)

Is there an upper limit of viable “quality” e-commerce stores?

This seems to be a concern that continues to be brought up in almost every short report on Shopify these days. I’m paraphrasing: “The churn of Shopify merchants is high”, “the number of e-commerce businesses is already too many to serve the population”, “the quality of every new merchant is getting worse.”

A Word on Churn

We know that not everyone is cut out to be an entrepreneur. Many will try, many will fail. The easier Shopify makes it to “try” to start a business, the easier it will be for entrepreneurs to “try and fail,” or in other words, the churn rate will accelerate as it becomes easier and cheaper to start a business. It’s what we should expect.

There is nothing wrong with churn. It’s a natural course of business because of the lower barriers to entry. Unsuccessful entrepreneurs today might be successful in the future. No one is successful on day one. Shopify has created a platform where entrepreneurs can try a hundred times for the cost of trying one brick-and-mortar store. Think about it. You can have a Shopify store for a year and it will only cost you about $400. You can dropship, which would minimize inventory.

Your first-month rent for a brick-and-mortar store would cost you more than $400 in most cities. That’s without any renovations or inventory. This is pretty simplified, but I think the point is clear. Entrepreneurs can try and try and try and never really break the bank on Shopify. But ultimately, those that have the persistence to keep trying and failing could be the Shopify Plus merchants of the future, or at least a regular Shopify merchant.

We previously referred to the churn as a big sifter where the company attracts many merchants, ultimately to capture the good ones that will be Shopify Advanced and Plus merchants. But that analogy needs to be updated.

Shopify is more like a school. Stage 1 is learning how to dropship, where you learn the mechanics of selling other people's products online. Some people spend more time than others at this stage and some quit before they make it out of this stage. If you graduate to stage 2, you can become a “maker” and design your own products to sell online. Stage 3 is learning to scale up your production and become a Shopify Advanced or Plus merchant.

Not everyone graduates high school, not everyone gets a post-secondary degree, and not everyone gets a Master's degree or a PhD. It’s the same expectation we should consider when looking at Shopify’s merchants.

What we should consider is this...

Total Addressable Market

Shopify has said the total addressable market of merchants is 47 million in the SMB (small-medium sized businesses) space. Total global retail sales in 2018 are estimated to be $25 trillion.

In 2012, the US had 27.9 million small businesses and 18,500 businesses with 500 employees or more. This is one business for every 11 people. But 73%, or 20 million, of those businesses are sole proprietorships, perfect for Shopify. With 7.6 billion people in the world, this would mean 500 million sole proprietors might need an online platform for their business. The company is conservatively only identifying less than 10% of this estimate as its total addressable market.

Whether it is providing a product or service, online or offline, Shopify’s platform has something. The Point of Sale (POS) system can replace the need to get clunky hardware commonly used in restaurants and brick-and-mortar retailers. Shopify can be the access point for credit transactions for these sole proprietors and also for restaurants that haven’t yet moved online. Every business will need an online presence, and Shopify is becoming the first name on the list of whom to turn to.

In 10 years, can you imagine any business not being online?

With only ~600,000 merchants, Shopify has only captured a fraction of its stated total addressable market - just over 1% of 47 million SMBs. And when we look more globally, its 600,000 merchants are really an insignificant fraction of the total market of potentially 500 million businesses that will eventually need an online presence.

The reality is that the world is moving online. It’s the same trend we saw in smartphones. 10 years ago, the world was buying 122 million smartphones a year. That’s no small number, but only 10 years later, now we are buying 1,536 million smartphones a year. And Apple (NASDAQ:AAPL) only sold 15% of those. So, while Shopify's 600,000 merchants might seem like a lot, 6 million merchants might be just as likely in 10 years, and that would be about 15% of its total addressable market of 47 million SMBs.

In 10 years, if you search for a restaurant or retail store, you won’t be met with a blank page like you can sometimes still see today. Everyone will be online, whether Shopify is providing that service to them or someone else.

Conclusion

We are investing for the next 10 years. E-commerce already seems like it is everywhere, but it’s just getting started. In 10 years, can you imagine any business not being online? Our 10-year revenue model gives us a fair value of US$157/share (down from US$164/share). We are buyers of the dip.