by Thomas Chua

May 26,2022

Reading Time: 7 mins read

The price-earnings (P/E) multiple is one of the most popular tools which analysts use to value stocks. A company trading at 10x P/E implies that for every $1 in net income generated investors are willing to pay $10 or a 10% earnings yield.

市盈率在分析股票价值时被广泛使用,一个公司以十倍PE交易意味着针对每一块钱的净利润投资者愿意付十元,即百分之十的收益率。

Despite its popularity, it remains one of the most misused misunderstood metric. A share valued at 30x P/E might not be expensive relative to another stock trading at 15x PE. Likewise, a share trading at a lower P/E than its 10-year median P/E does not imply that it is a bargain.

虽然它如此常用,但是它却是被错误使用最多的指标之一。一只以三十倍市盈率交易的股票并不一定比其他以十五倍交易的股票贵,同样,一只股票以低于十年平均市盈率交易也并非表示它有折价。

To apply this tool, we must first deconstruct the P/E ratio to better understand what goes in. The P/E ratio is a short-cut to arrive at the Discounted Cash Flow valuation. The most sensible way to determine the worth of a business is to estimate the cash flows a business will generate for its owners over time, and then discount these cash flows back to their present value.

要使用这个工具,我们必须解析PE才能更好理解它的含义。PE市盈率只是现金流折现值的一种直观指标。确定一个生意价值最好的方法是估算它能产生的现金流,然后进行折现。

Hence, to figure out the intrinsic value we need to ask ourselves these questions:

因此,我们要算出内含价值就必须问我们自己如下这些问题:

How much free cash flow (FCF) will the business generate over its lifetime for shareholders?Can the business grow?What is the discount rate (i.e. required rate of return/cost of capital)?

这门生意在整个生命周期里能为股东创造的自由现金流有多少?这个生意能够继续增长吗?选择什么折现率?

In this post, we are going to focus on the relationship between – (1) the amount of cash flow the business generates and (2) its ability to grow this future stream of cash flow.

在这篇文章里,我们重点关注这两者的关系-这个生意创造的现金流量总额,实现这些现金流的能力如何。

This brings us to the next question, Why is the cash flow available to shareholders different across companies? Two companies with the same amount of revenue and net income may well generate different levels of cash flow for shareholders.

这就把我们带到了下一个问题,为什么在不同企业之间能够提供给股东的现金流不一样?两个公司拥有相同的收入和净利润可能他们给股东创造的现金流完全不同。

This is because different companies require different amounts of reinvestment in their business for growth. The more a company needs to reinvest to achieve growth, the less the company retains for its shareholders. And this variation is largely driven by the differences in the return on invested capital (ROIC) achieved.

这是因为不同公司维持增长需要不同的再投资量,一个公司需要更多的再投资来实现增长,那么留给股东的盈余利润就会更少。这种差别主要是由资产回报率来决定的。

ROIC’s Impact on FCF & Growth

Consider two companies, Company A and Company B both generate $1 of earnings per share. Both companies aim to grow their earnings by 10% next year. This would require the companies to reinvest their earnings for expansion.

假设有两个公司A和B,他们的每股收益都是一元,两家公司都想在来年提高10%的收益。这就需要两家公司再投资来扩张。

The key is understanding how much capital is required for each company to achieve a growth of 10% in earnings?

重点考察每个公司为实现这10%的收益增长各需要多少资本再投入?

Suppose Company A is able to generate 60% ROIC (similar to a business like MasterCard ). This means that every $1 invested in the business, results in a 60% growth in earnings. For it to grow its earnings by 10%, Company A would only need to reinvest 16.7% of this year’s profit. Since a 60% return on 16.7% of current earnings will create a 10% increase in profit. This means that Company A is able to distribute 83.3% of current year’s earnings, or 83.3 cents of the $1 in earnings back to shareholders, through dividends, share buybacks, or by reducing its debt.

假设A公司能够产生60%的ROIC(类似于万事达卡这样的企业)。这意味着,每投资1美元的业务,结果在60%的收益增长。A公司只要将今年利润的16.7%用于再投资,就能使利润增长10%。既然当前收益的16.7%以60%的投资回报率即可创造10%的利润增长。这意味着A公司能够通过股息、股票回购或减少债务,将当年盈利的83.3%,即1美元盈利中的83.3美分返还给股东。

On the other hand, Company B is only able to generate 12% ROIC (similar to the S&P 500’s average). To grow its earnings by 10%, it would need to reinvest 83.3% of its earnings. Since a 12% return on 83.3% of current earnings will create 10% more profit. This leaves only 16.7 cents of the $1 in earnings for Company B’s shareholders.

另一方面,B公司只能产生12%的ROIC(类似于标准普尔500指数的平均值)。要使其收益增长10%,就需要将其收益的83.3%用于再投资。既然当前收益的83.3%以12%的投资回报率才能创造10%的利润增长。这样,B公司股东的1美元收益只剩下16.7美分的盈余分配利润。

Here we can see that Company A’s ROIC is five times greater than Company B’s. To achieve the same growth of 10%, Company B needs to reinvest five times its earnings compared to Company A.

这里我们可以看到,A公司的ROIC是B公司的5倍。为了实现同样的10%的增长,B公司需要从其收益里拿出5倍于A公司的投资额用于再投资。

Essentially, this shows us that not every dollar of earnings is worth the same amount. Although both companies have the same earnings per share of $1 and generate 10% growth, they require different reinvestment rates. Thus, it boils down to the ROIC that a company is able to generate.

从本质上讲,这告诉我们,并不是每一美元的收入都有相同的价值。尽管两家公司的每股收益相同,都是1美元,并产生了10%的增长,但它们需要不同的再投资率。这归结为由一个公司能够达到的ROIC决定。

All else constant, a company with a higher ROIC should command a higher P/E multiple and vice versa. A company trading at 30x P/E and another company trading at 12x P/E could both be fair value.

在其他条件不变的情况下,ROIC越高的公司,市盈率就越高,反之亦然。一家公司市盈率为30倍,另一家公司市盈率为12倍可能价值都是合理的。

We need to dig deeper into its ROIC and evaluate its sustainability.

我们需要深入了解它的ROIC并且评估其可持续性。

Why Growth May Destroy Value

为什么增长有可能摧毁价值?

Not all growth is good for shareholders. For growth to generate value for shareholders, its ROIC must be greater than its cost of capital.

并非所有的增长都有利于股东。如果要让增长为股东创造价值,它的ROIC必须大于资本成本。

The S&P 500 index has returned an average of approximately 10% since inception. Hence, we can consider using 10% as the cost of capital. When deciding whether or not to grow, management should evaluate whether the ROIC from reinvesting earnings could exceed 10%.

标准普尔500指数自成立以来的平均回报率约为10%。因此,我们可以考虑用10%作为资金成本。在决定是否需要增长时,管理层应该评估再投资收益的ROIC是否会超过10%。

If ROIC is 8%, reinvesting for growth would reduce value for investors. Companies should then distribute out all earnings to shareholders as the returns from reinvesting those earnings fails to exceed the cost of capital of 10%.

如果ROIC是8%,再投资用于增长的话将降低投资者得到的价值。这种情况下公司应将所有收益分配给股东,因为这些收益的再投资回报率未能超过10%的资本成本。

The best way to think about this is to imagine a company borrowing at 10% interest rate and investing for 8% returns. Every dollar borrowed to invest for growth would result in a -2% returns for shareholders. While the cost of equity capital isn’t an interest expense, it is an opportunity cost for investors.

最好的思考方式是想象一家公司以10%的利率借款后按8%的回报率进行投资。每借入一美元用于投资来维持收益增长,这将为股东带来-2%的回报。虽然股权资本成本不是利息支出,但对投资者来说是机会成本。

It is important to be aware of this. Even if companies have the same earnings per share and the same growth rate, it does not mean that they are worth the same P/E multiple, because ROIC makes a huge difference to whether growth adds value, or destroys value.

意识到这一点很重要。即使公司有相同的每股收益和相同的增长率,这并不意味着它们值得拥有相同的市盈率,因为ROIC的大小对公司的增长来说是增加价值还是摧毁价值有着巨大的影响。

How to Think about the P/E Ratio

该怎么来思考市盈率呢?

In assessing the worth of a company using the P/E ratio, we must first consider whether the company is able to generate ROIC in excess of the cost of capital and growth second. Growth only creates value if the investments generate a return in excess of cost of capital.

在使用市盈率评估一家公司的价值时,我们必须首先考虑该公司是否能够产生超过资本成本的ROIC,其次才是增长,只有当投资产生的回报超过资本成本时,增长才能创造价值。

For example, here is a quick and dirty way to evaluate Apple’s P/E ratio:

举个例子,下面有一个快速而简陋的方法来评估苹果的市盈率:

Apple’s Stock Price Chart

苹果股价图

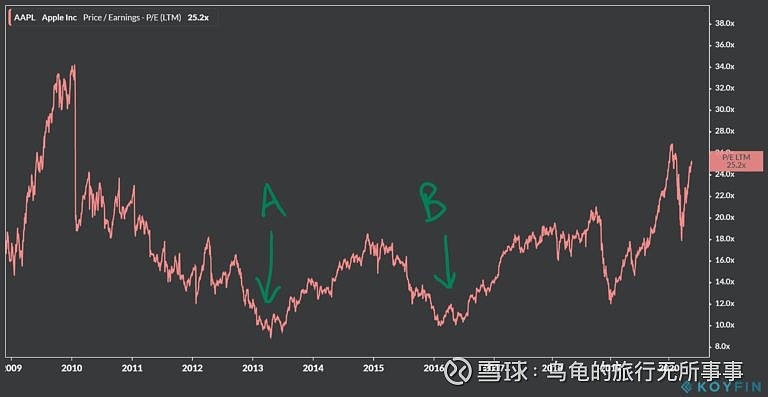

It has traded at P/E of below 10x two times over the past decade (points A and B). This is way below Apple’s average P/E ratio. Mr Market was essentially saying that Apple is unable to maintain its ROIC and was unlikely to grow further.

在过去十年里,它的市盈率有两次低于10倍(A点和B点)。这远远低于苹果的平均市盈率。市场先生本质上认为,苹果公司无法维持其ROIC,也不太可能进一步增长。

When compared with the broad market’s valuation (S&P 500). Apple was also below the market’s valuation P/E ratio of 17x during point A and 21x during point B. Mr Market was telling us that Apple’s ROIC and growth will be lower compared to the average American company.

当与整个市场的估值(标准普尔500指数)相比时,苹果的市盈率在A点也低于市场17倍的平均值,B点市场则是21倍。市场先生告诉我们,苹果的ROIC和增长率将低于美国公司的平均水平。

Investors should then evaluate if the current P/E underestimates Apple’s ROIC and growth going forward.

然后,投资者应该评估目前的市盈率是否低估了苹果的ROIC和未来的增长潜力。

In hindsight, Apple continued to generate a high ROIC of approximately 30% and grew its EPS at a CAGR of 11.13%—a rate far above the S&P 500’s ROIC of 12% but lower than Apple’s historical average ROIC of 40%. Apple should rightfully have suffered a P/E contraction. But Mr. Market over discounted Apple with its P/E collapsing below the average S&P 500 companies’ P/E multiple.

事后看来,苹果继续产生高达约30%资本回报率,每股收益以11.13%的复合年增长率增长——远高于标准普尔500指数的12%的资本回报率,但低于苹果40%的历史平均资本回报率。苹果理应杀估值,但市场先生过度反应造成苹果的市盈率低于标准普尔500指数成分股的平均市盈率。

Mr. Market eventually corrected Apple’s P/E multiple. Investors who had been right on evaluating its ROIC and growth, and bought Apple when it was trading at P/E multiple of ~10x would have generated handsome returns of approximately 600% in seven years and more than 300% in four years if they had bought in at points A and B respectively.

市场先生最终修正了苹果的市盈率。如果投资者对苹果的ROIC和增长做出了正确的评估,并在苹果的市盈率达到10倍左右时买入,即分别在A点和B点买入,那么他们将在7年内获得约600%的可观回报,在4年内获得超过300%的回报。

Apple’s Stock Price Chart

Q:what are some downsides of using ROIC as an indicator?

使用ROIC作为指标有什么缺点?

A:

Thomas

Great question! For ROIC the challenge lies in evaluating whether it is a flash in a pan or is it sustainable. Cases whereby it is a flash in a pan:

1. Cyclical industries such as oil and gas. During periods of high oil prices (e.g. 2008-09), companies in O&G were highly profitable. However, most of them are unable to generate ROIC above Cost of capital after that period.

2. A fad – Such as Gopro, sales skyrocketed when it first came out and it was everywhere. But it soon proved to be a fad and demand died down, bringing the ROIC down with it.

As investors we need to identify the sustainability of the company’s competitive advantages (i.e. moat) to ensure that the high ROIC can stay high.

Also equally important, it is important to know when it is in the “too hard” pile. Personally, I can never figure out if Lululemon is a fad or is atheletic wear as a fashion a permanent trend. Would it end up like GAP hoody trend? That is too difficult for me so I just move on to the next company that is within my circle of competence.

很好的问题!对于ROIC来说,难点在于评估它是昙花一现还是可持续的。这些是昙花一现的情况:

1.石油和天然气等周期性工业。在高油价时期(如2008-2009年),O&G公司利润很高。然而,在这一时期之后,他们中的大多数人都无法产生高于资本成本的ROIC。

2.像GoPro这样的时尚品牌,当它第一次出现的时候,它的销量猛增,而且到处都是。但很快就被证明只是一种风潮,随后需求减少了,ROIC也随之下降。

作为投资者,我们需要确定公司竞争优势(即护城河)的可持续性,以确保高ROIC能够保持在高水平。

同样重要的是,知道它属于“太难”是很重要的。就我个人而言,我永远也搞不清Lululemon是一种时髦还是一种永久的时尚趋势。它最终会变成下一个曾经风靡一时的GAP卫衣外套吗?这对我来说太难了,所以我就转到下一家属于我能力范围内的公司。