3年前高盛的人就发出了Copper is the New Oil的声音,最近资源大涨是高盛对了?个人不持有资源股,但关心这个的原因是手上股,原材料成本占比很高,还有就是资源股这么涨肯定会传导到终端消费者,这空调,家电,汽车….不都得跟涨吗?到时是不是听取涨声一片![]() 看来国内新能源车继续卷价格的空间也不大了吧?

看来国内新能源车继续卷价格的空间也不大了吧?

最近羊城雨水充沛,忘了带伞就买了把,发现伞架都是塑料的了,也好避免生锈,那现在资源股这么涨,会不会有新材料,新工艺可以替换呢?

最近凯投宏观目前预计,到2024年底,铜价将达到每吨9250美元。

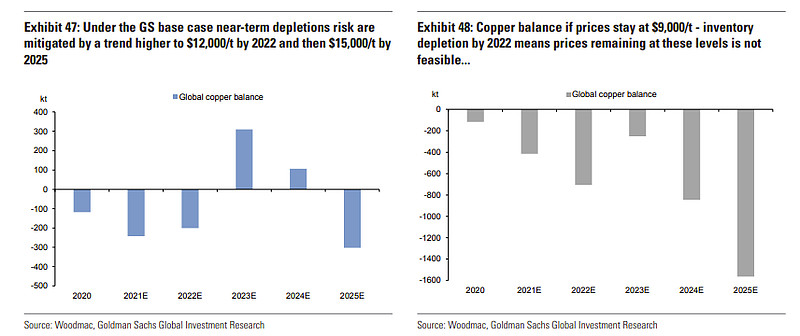

高盛分析师Nicholas Snowdon和Lavinia Forcellese在报告中指出,铜将在二季度出现25万吨供应缺口,2024年下半年铜将出现45万吨供应缺口,到年底铜将涨至每吨10000美元。 高盛分析指出,一方面,中国需求强劲复苏,第一季度铜需求预计同比增长12%,带动铜需求大幅改善。另一方面,铜矿供应持续受到干扰。

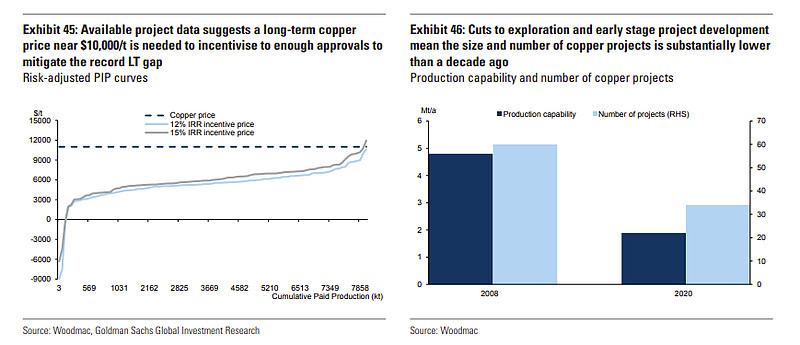

高盛认为,铜市场正处于一个重要的季节性拐点,自去年12月底以来,精炼铜市场出现了明显的季节性过剩阶段,目前这一阶段即将结束,在第二季度,库存水平将逐步走低:

高盛注意到,在过去两周,中国的铜库存达到45万吨后开始回落。机构预计在第二季度将转入去库存周期,本季度全球将出现25万吨的供应缺口,下半年供应缺口将达到约45万吨。

高盛分析指出,在中国需求强劲、供应持续受限的情况下,铜市场将逐步转向供应短缺格局,持续供应短缺将支撑铜价,预计2024年底铜将涨至每吨10000美元:

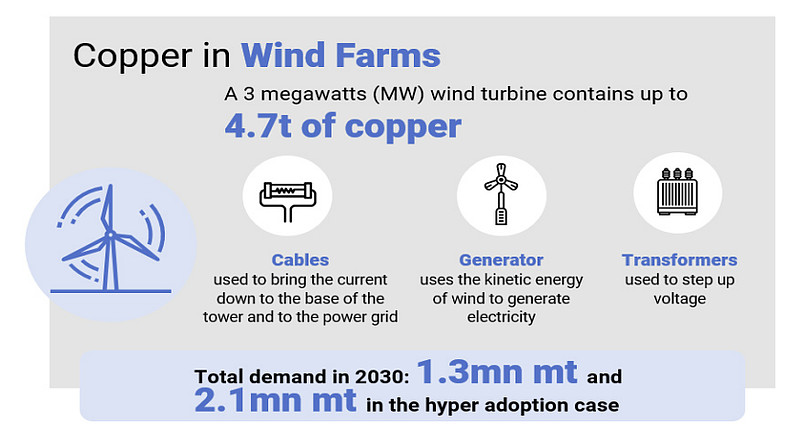

预计2024年第二季度铜市场将出现25万吨供应缺口,下半年缺口将扩大到45万吨。一方面,中国需求强劲复苏,第一季度铜需求预计同比增长12%,其中1-2月终端需求同比增长9%,可再生能源(太阳能需求上涨80%,风电需求上涨69%)和电网投资强劲,带动铜需求大幅改善。

另一方面,铜矿供应持续受到干扰,中国铜原料联合谈判小组倡议联合减产,建议减产幅度5-10%,这意味着减产规模可能达到10万吨,将对铜供应形成直接冲击。

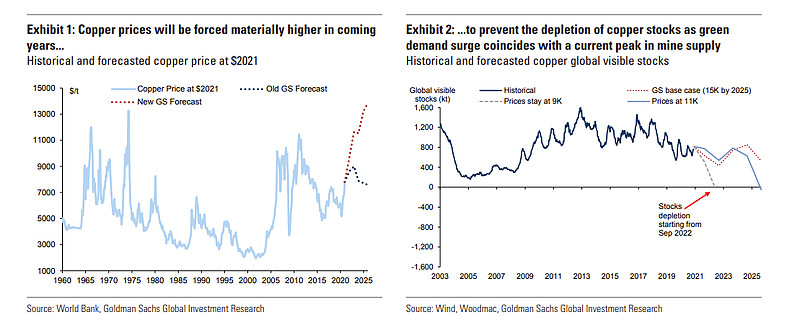

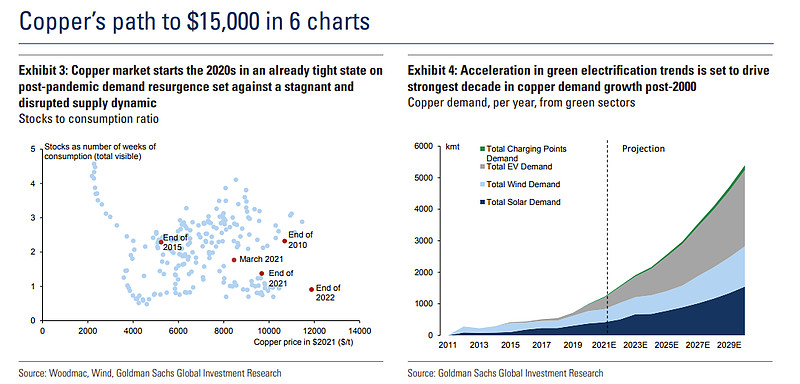

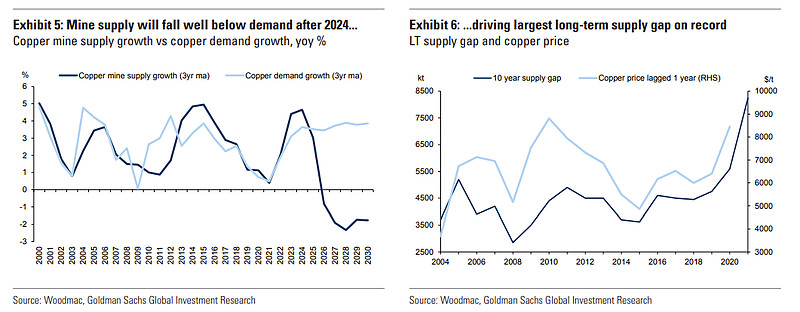

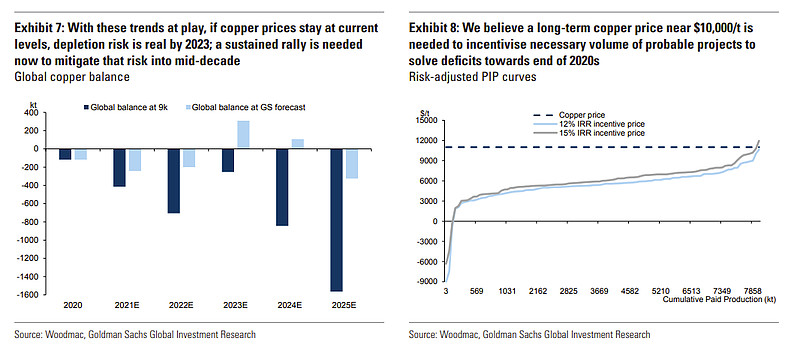

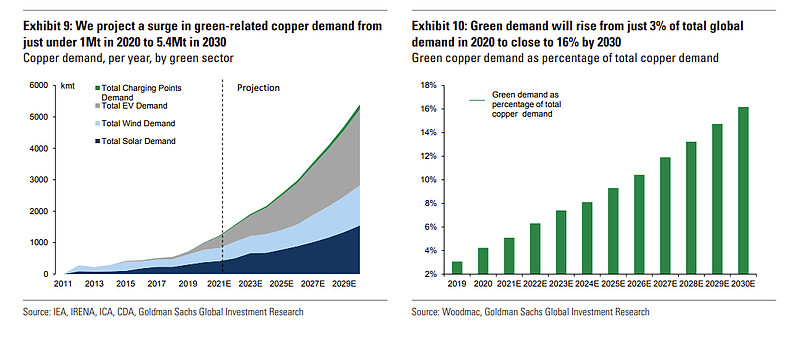

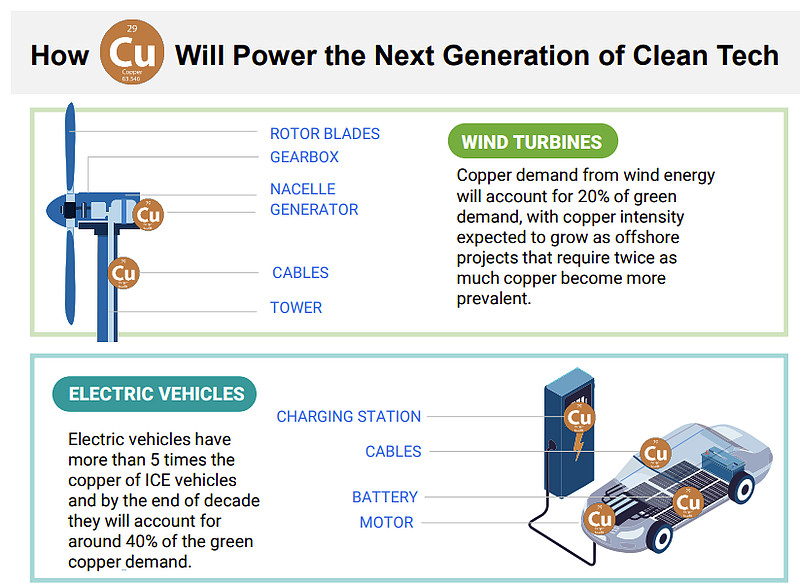

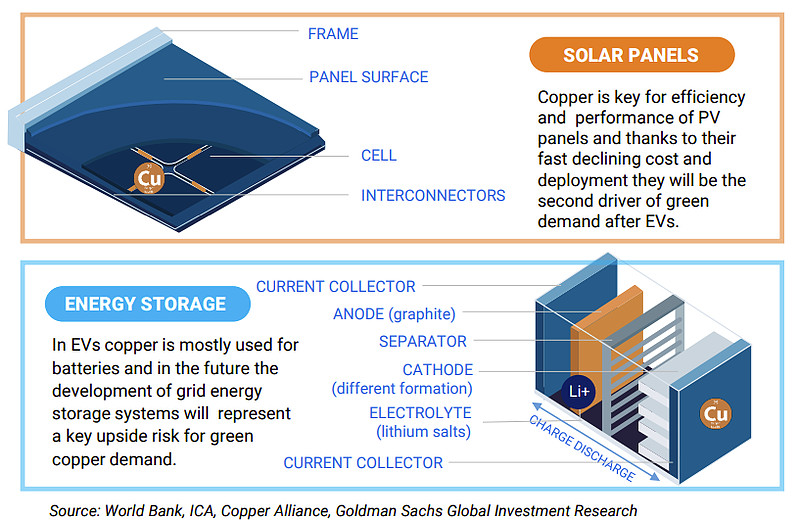

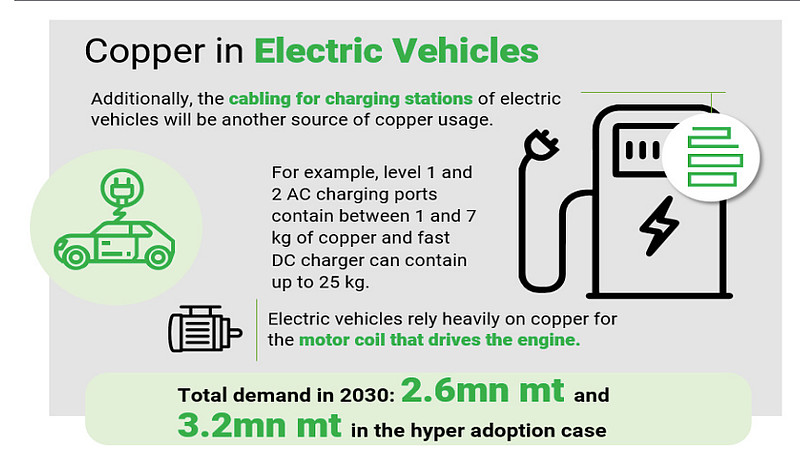

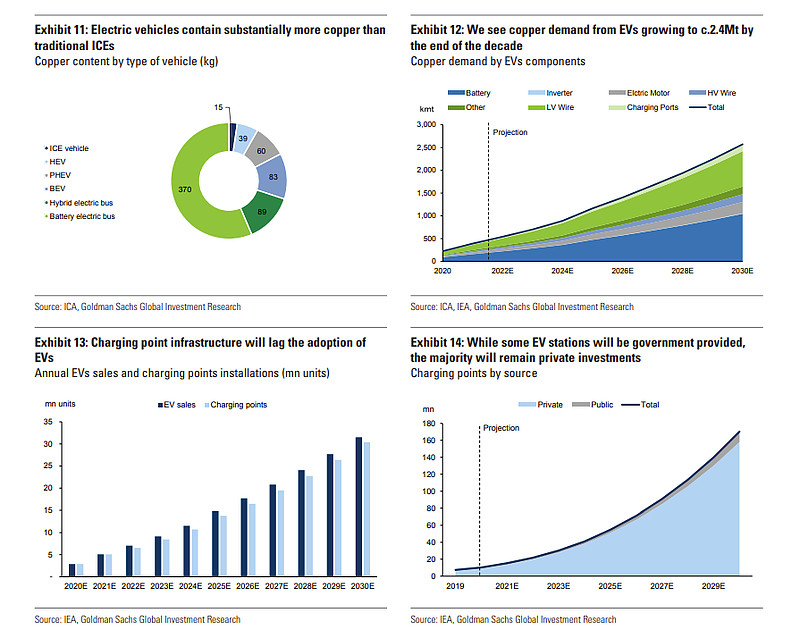

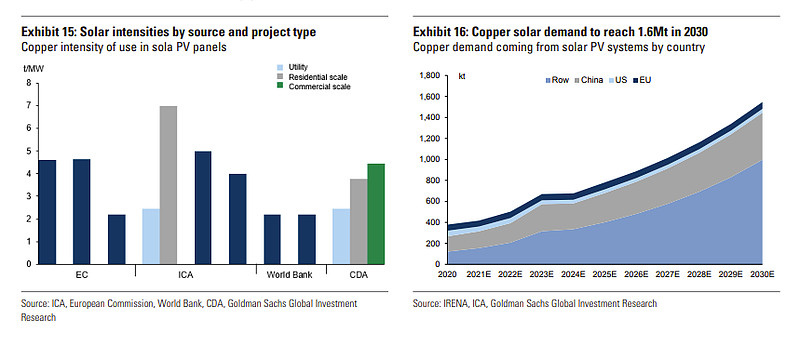

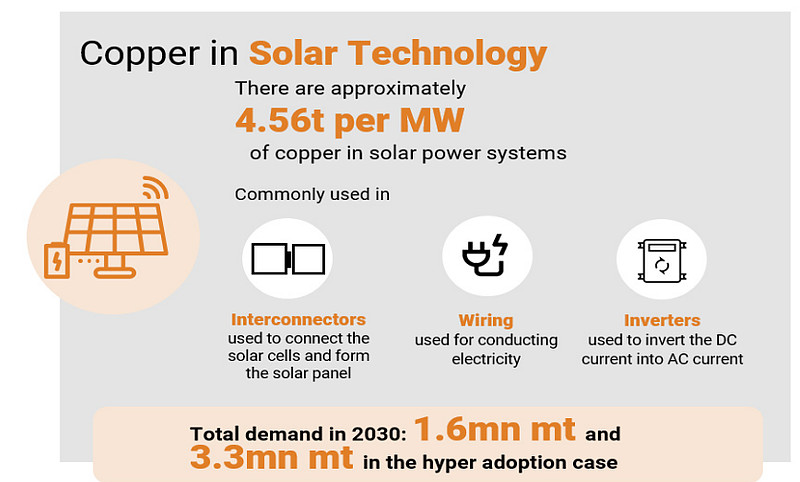

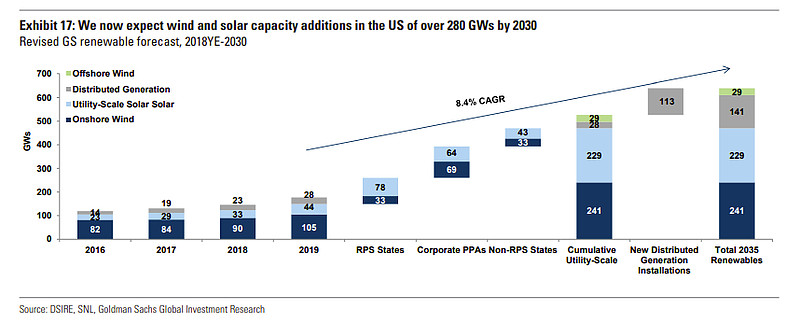

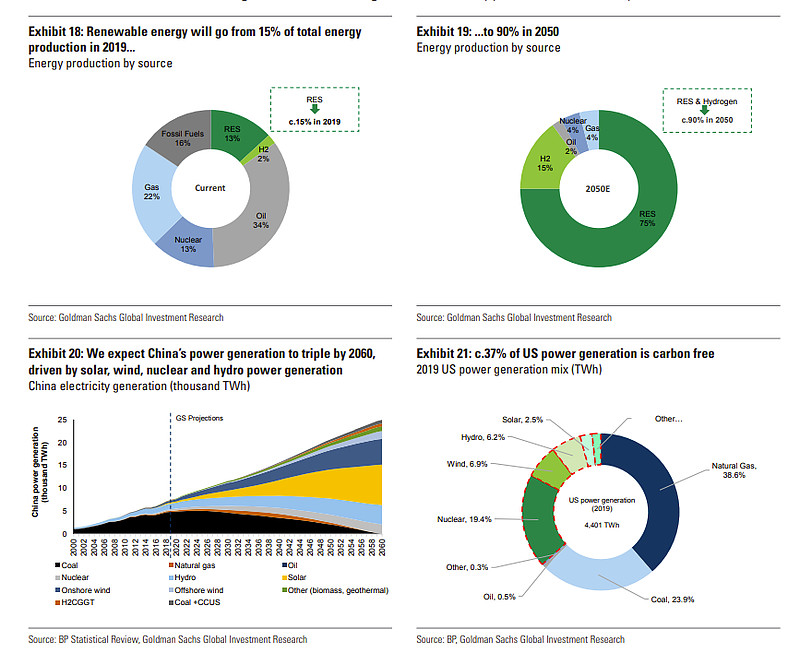

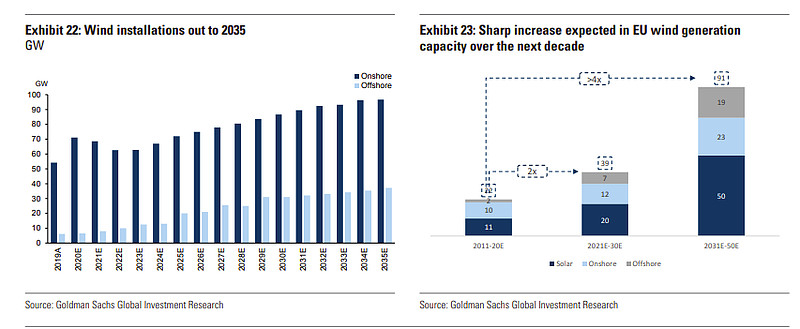

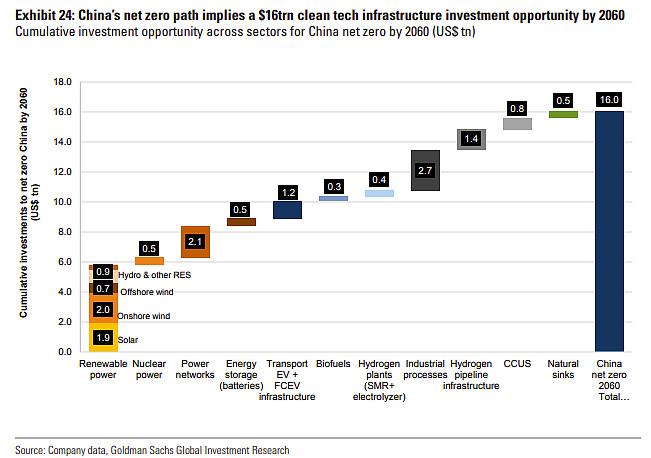

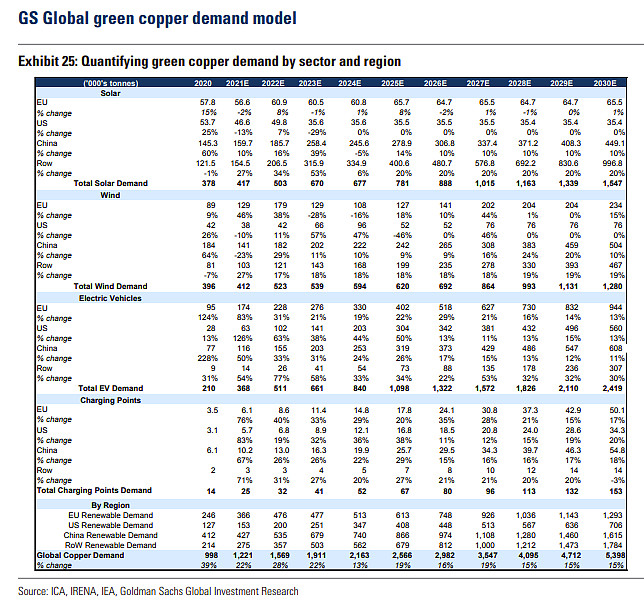

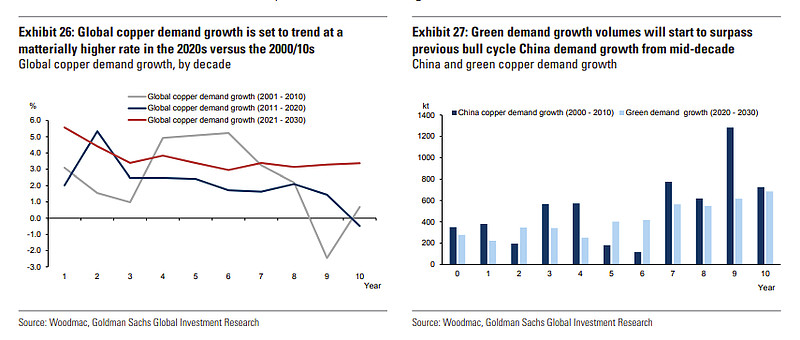

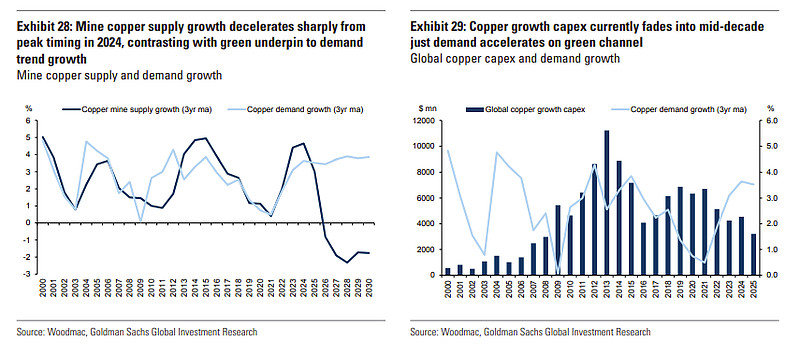

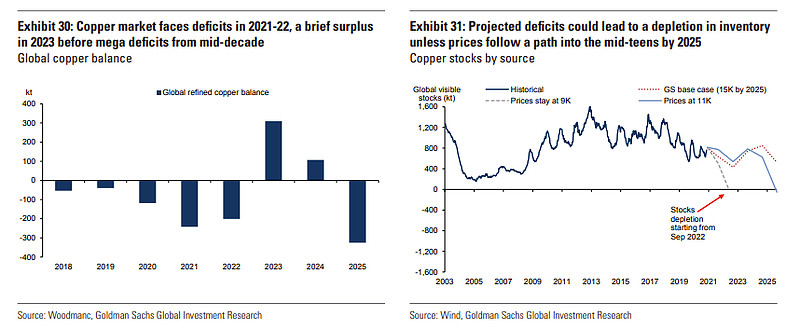

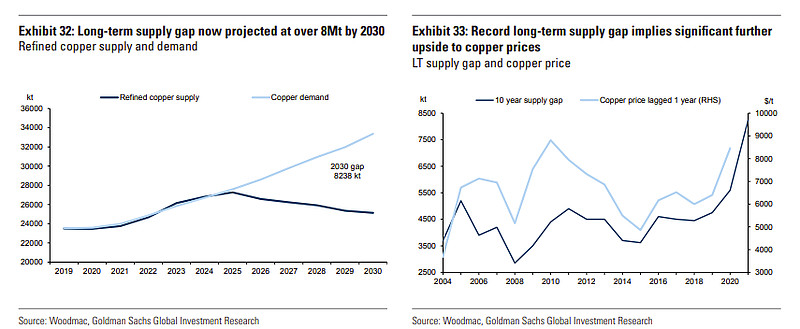

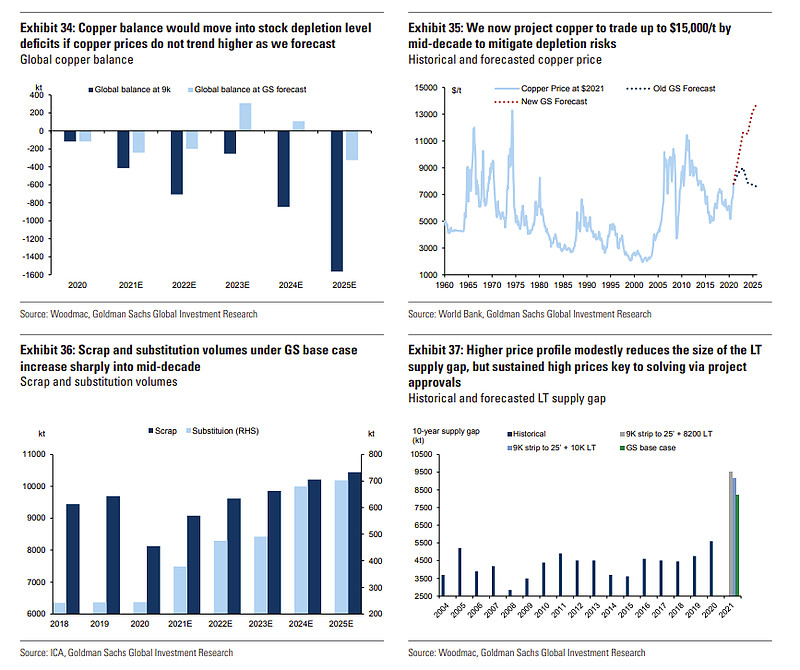

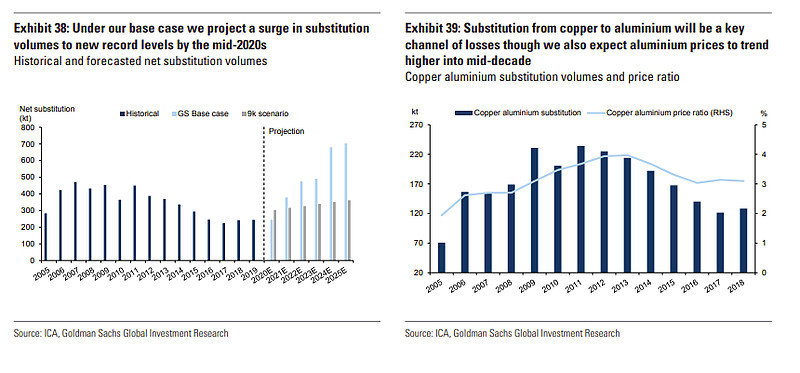

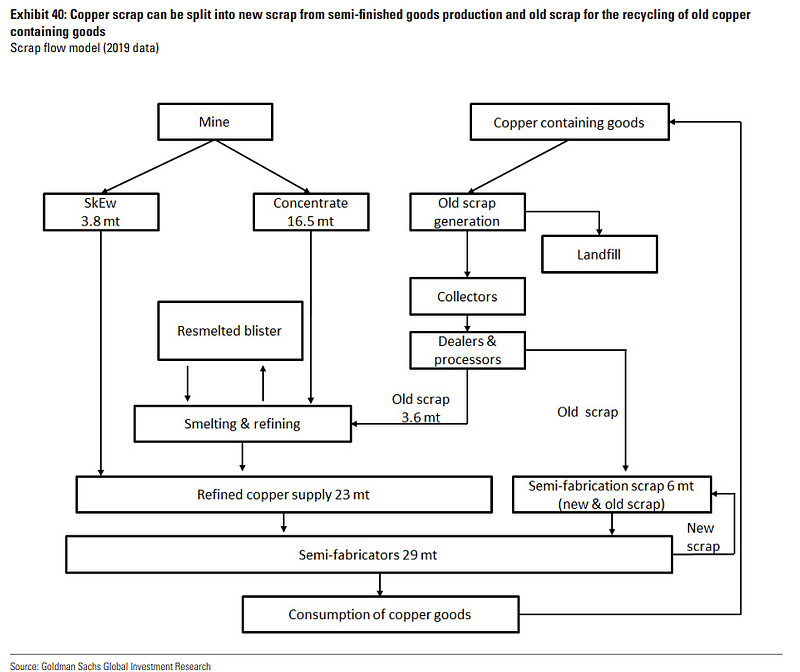

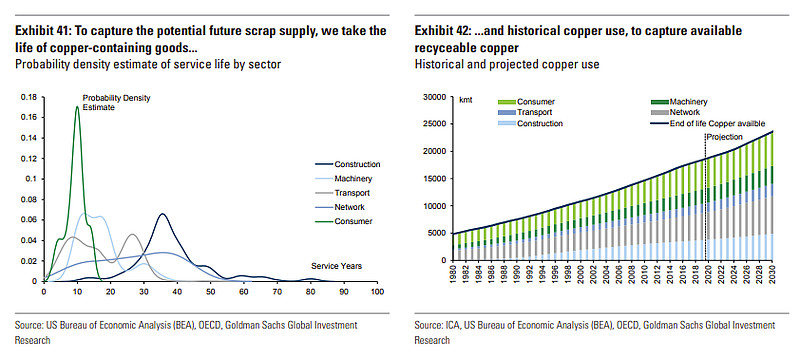

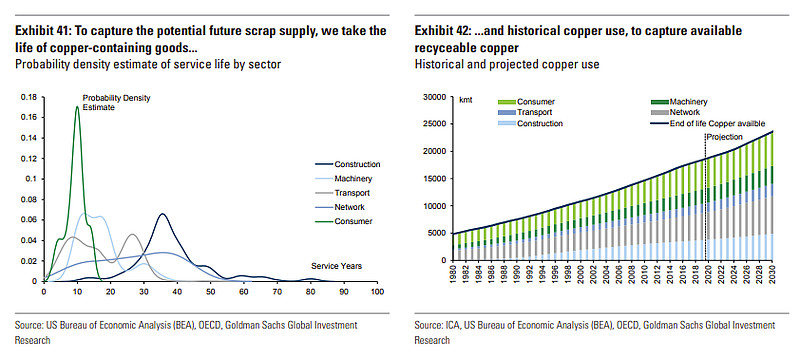

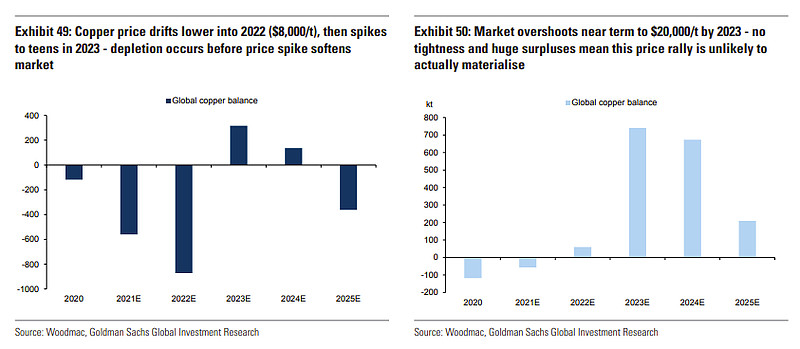

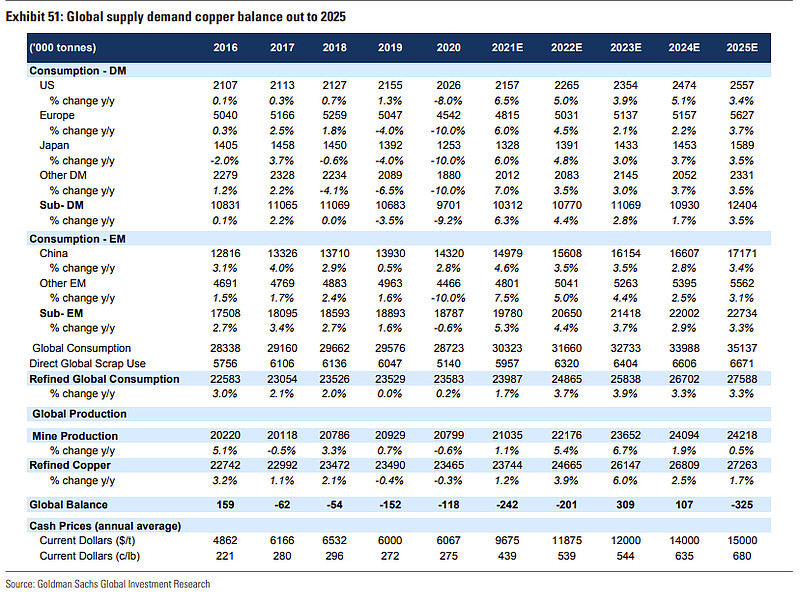

以下是高盛2021年报告中的截图:

Kaitou Macro currently predicts that by the end of 2024, the price of copper will reach 9,250 US dollars per ton.

Goldman Sachs analysts Nicholas Snowdon and Lavinia Forcellese pointed out in the report that copper will have a supply gap of 250,000 tons in the second quarter, a supply gap of 450,000 tons in the second half of 2024, and copper will rise to 10,000 US dollars per ton by the end of the year. Goldman Sachs analysis points out that, on the one hand, China's demand is recovering strongly. Copper demand is expected to increase 12% year on year in the first quarter, driving a sharp improvement in copper demand. On the other hand, copper supplies continue to be disrupted.

Goldman Sachs believes that the copper market is at an important seasonal inflection point. Since the end of December last year, the refined copper market has shown an obvious seasonal surplus phase. Currently, this stage is coming to an end. In the second quarter, inventory levels will gradually decline:

Goldman Sachs noticed that in the past two weeks, China's copper stocks began to decline after reaching 450,000 tons. The agency expects to switch to an inventory removal cycle in the second quarter. There will be a global supply gap of 250,000 tons this quarter, and the supply gap will reach about 450,000 tons in the second half of the year.

Goldman Sachs analysis points out that with strong demand in China and continued supply restrictions, the copper market will gradually shift to a pattern of supply shortages. Continued supply shortages will support copper prices. Copper is expected to rise to 10,000 US dollars per ton by the end of 2024:

The copper market is expected to have a supply gap of 250,000 tons in the second quarter of 2024, and the gap will widen to 450,000 tons in the second half of the year. On the one hand, China's demand is recovering strongly. Copper demand is expected to increase 12% year on year in the first quarter. Among them, terminal demand increased 9% year on year in January-February, and strong investment in renewable energy (demand for solar energy rose 80%, demand for wind power rose 69%) and power grids, driving a significant improvement in copper demand.

On the other hand, the supply of copper ore continues to be disrupted. The China Copper Raw Materials Joint Negotiation Group proposed a joint production reduction and recommended a 5-10% reduction. This means that the scale of production reduction may reach 100,000 tons, which will have a direct impact on copper supply.