本周五Clarios将正式登陆纽交所,赶在上市之前,我来把招股书读完。

在第二部分的结尾处有提到,第三部分主要是读招股书中行业概况的内容,那么接下来就仔细看看Clarios对铅蓄电池行业的看法吧。

According to AVICENNE Energy, our subset of the market was approximately $38 billion in 2019 and is part of the larger $89 billion global rechargeable battery market.

根据AVICENNE Energy的数据,2019年铅蓄电池全球市场规模约为380亿美元,而整个蓄电池的市场规模达到了890亿美元。

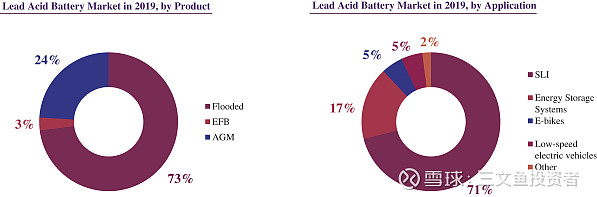

上图左为2019年三种铅蓄电池的市场份额:传统富液电池73%,AGM24%,EFB3%

上图右为2019年铅蓄电池应用领域分布:71%用于启动系统,17%用于储能,电动车和低速电动车各占5%

In the transportation end market, there are three predominant low-voltage battery technologies – SLI, EFB and AGM.Our customers’ choice of technology is informed primarily by four factors: economics, support for increased electrical loads, safety and the ability to monitor and diagnose battery health.

在目前的市场上,存在三种主要的低压电池技术——SLI(传统铅蓄电池)、EFB和AGM。下游客户对技术方案的选择主要取决于四个因素:成本、对增长的电力需求的支持、安全性以及监测和诊断电池运行状况的能力。

While each of SLI, EFB and AGM batteries serve similar functions in the vehicle, their capabilities differ significantly.

虽然 SLI、EFB和AGM电池在车辆中具有相似的功能,但它们的能力却很不一样。

Historically, SLI batteries were selected for their low cost and reliability and used only to power the starting, lighting and ignition systems and a small number of additional features.

SLI电池因其低成本和可靠性而成为大多数情况下的选择,但其仅用于为启动系统以及少量附加功能供电。SLI电池无法满足日益增长的用电需求。

EFBs provide a more reliable alternative to SLI batteries at a modest price premium. An EFB typically has improvements in materials composition, component selection and mechanical construction and, as a result, benefits from higher cycling performance versus SLI batteries.

EFB以适中的价格成为了SLI电池的替代品。EFB在材料成分、组件选择和机械结构方面有所改进,因此与SLI电池相比,它具有更高的循环性能。

AGM batteries are the highest-performing lead-acid battery type across all dimensions.

接下来Clarios要开始吹自家的拳头产品——AGM电池了。

AGM batteries provide superior voltage monitoring and diagnostic capabilities resulting in much more stable voltage over time.

AGM电池提供卓越的电压监测和诊断功能,从而使电压随时间推移更加稳定。

Cycling performance, the battery’s ability to charge and discharge over time and to a greater depth, in AGM batteries is also superior to EFB and SLI batteries.

AGM电池在循环性能方面也优于EFB和SLI电池。

Finally, AGM is the safest lead-acid battery technology. The absorbent mat eliminates the liquid electrolyte found in traditional flooded batteries (SLI and EFB) and the inherent risk of spills.

AGM是最安全的铅酸电池技术。吸收垫有效地消除了传统富液式电池(SLI 和 EFB)中的电解液溢出风险。

AGM batteries also compare favorably to SLI and EFB on a total cost of ownership basis. Although their upfront cost is higher, the stability and vibration resistance of AGM batteries results in significantly lower warranty costs for OEMs.

AGM虽然初始成本比SLI和EFB高,但优越的稳定性和抗震性使得后期的维护成本要低于SLI和EFB电池。

Finally, while there are applications where lithium-ion batteries are being used in low-voltage applications, they are predominantly restricted to use-cases that are highly sensitive to weight reduction or where consumers are not sensitive to price.For example, high-performance and low volume sports cars will sometimes utilize low-voltage lithium-ion batteries.

尽管已经有锂电池用于低压系统中,但仅限于以减轻重量为目的或用在较高档的产品上(消费者对此类产品的价格高低不敏感),比如高性能跑车。

In the broader market however, low-voltage AGM provides multiple clear benefits over lithium-ion.

然而,在更广大的市场中,低压AGM与锂离子电池相比,具有多个明显的优势。

First, AGM batteries are significantly more cost-effective than lithium-ion. We estimate AGM batteries are one-fourth the cost of lithium-ion batteries today. AGM batteries are cheaper to purchase and have lower warranty costs than low-voltage lithium-ion batteries. AGM batteries experience lower warranty costs as compared to lithium-ion.

AGM电池比锂电池购买成本和维护成本都要低,总成本大概是锂电池的四分之一。(这个在前面的部分中已有所提及,此处属于再次强调)

The electronics in low-voltage lithium-ion batteries introduce additional failure modes beyond those present in AGM batteries.

锂电池还存在着AGM所没有的其他可能发生的故障。

和锂电池的比较到此为止,然后就要说到市场竞争情况,首先是发达国家市场的竞争对手。

The top five competitors in this industry globally accounted for 54% market share in 2019 according to AVICENNE Energy and include Clarios, GS Yuasa, Exide Technologies, EastPenn and C&D.

根据AVICENNE Energy的数据,2019年该行业的全球前五大公司占据了54%的市场份额,包括Clarios、GS Yuasa(汤浅)、Exide Technologies(埃克赛德)、EastPenn(东宾)和C&D(西恩迪)。

Additionally, competition in our industry is highly regional due to the costs required to ship heavy batteries long distances.

由于长途运输重型电池所需的成本较高,铅蓄电池行业的竞争具有高度的区域性。(想在中国挑战骆驼股份的霸主地位没那么容易,必须得在国内建厂)

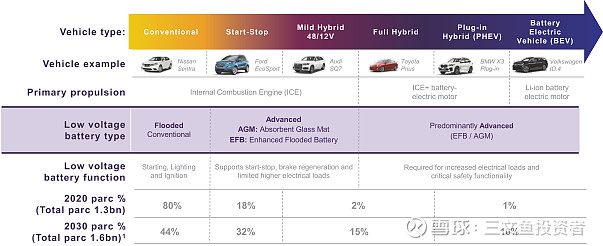

上图是Clarios结合IHS Markit的数据对各类汽车的占比做出的预测:

传统燃油车(无启停系统)的比例从2020年的80%下降到2030年的44%;

传统燃油车(有启停系统)的比例从2020年的18%上升到2030年的32%;

油电混动和48V/12V轻混的比例从2020年的2%上升到2030年的15%;

插电混动和纯电动的比例从2020年的1%上升到2030年的10%;

We operate our business through three segments: (i) Americas, (ii) EMEA and (iii) Asia, which correspond to the global markets we participate in.

Clarios将全球划分成三块区域运营,分别是美洲、EMEA(欧洲、中东和非洲)以及亚洲(除中东)。

Our Americas segment consists of manufacturing operations located in the United States, Mexico, Brazil and Colombia, with distribution operations that expand across the continents of North America and South America, and investments in non-consolidated partially owned affiliates which primarily operate within the United States.

Clarios在美洲的美国、墨西哥、巴西和哥伦比亚四个国家均设有电池厂,分销渠道遍布全美洲。

Our EMEA segment consists of manufacturing operations located in Germany, the Czech Republic and Spain, with distribution operations that expand across the continents of Europe, Africa and the transcontinental region of the Middle East, and investments in consolidated and non-consolidated partially owned affiliates which primarily operate in the Middle East.

Clarios在欧洲的德国、捷克和西班牙三个国家设有电池厂,分销渠道遍布全EMEA地区,并通过子公司在中东地区开展业务。

Our Asia segment consists of manufacturing operations located in China and Korea, with distribution operations that expand across the countries making up the Asia Pacific region, and investments in non-consolidated partially owned affiliates which primarily operate in India and China.

Clarios在亚洲的中国和韩国分别设有电池厂,分销渠道遍布全亚洲,并在中国和印度设有子公司。

The most significant raw materials we use to manufacture our products include lead, polypropylene, separators and sulfuric acid.

AGM电池最重要的原材料包括铅、聚丙烯、隔膜和硫酸。

We primarily compete in the battery market with Exide Technologies, Stryten Manufacturing (formerly the U.S. operations of Exide Technologies), GS Yuasa Corporation, Camel Group Company Limited, East Penn Manufacturing Company and Banner Batteries GB Limited. The North American, European and Asian lead-acid battery markets are highly competitive. The manufacturers in these markets compete on price, quality, volume, technical innovation, service and warranty.

Clarios在各区域电池市场上的主要竞争对手包括Exide Technologies(埃克赛德)、Stryten Manufacturing(前身为埃克赛德在美国的业务)、GS Yuasa Corporation(日本汤浅)、Camel Group Company Limited(骆驼股份)、East Penn Manufacturing Company(美国东宾)和Banner Batteries GB Limited(奥地利班纳)竞争。其中北美、欧洲和亚洲的市场竞争尤其激烈。这些市场中的制造商在价格、质量、数量、技术创新、服务和保修方面展开竞争。

显而易见,在国产品牌中,Clarios只把骆驼当作直接竞争对手。![]()

最后再看一看Clarios对业务季节性的说明。

Our business is impacted by seasonal factors, as aftermarket replacements are highest in the winter months. Our net sales reflect our channel partners’ stocking patterns to meet this increased demand, and have historically been greatest between our fourth and first fiscal quarters (late summer through early winter). Global climate change may impact the seasonality of our business as the demand for our products, such as automotive replacement batteries, may be affected by unseasonable weather conditions.

铅蓄电池业务受到季节性因素的影响,其中冬季的售后市场更换率最高。净销售额可以很好地反映出这一点,在第四和第一财季(夏末至初冬,也就是7月至12月)会达到全年最高峰。全球气候变化也可能会影响铅蓄电池业务的季节性,因为对铅蓄电池(例如汽车更换电池)的需求可能会受到变化莫测的天气条件的影响。

到这里,Clarios招股说明书就已经全部阅读完毕,从已读的内容中可以得出结论,考虑到成本和安全性因素,从传统铅蓄电池切换到锂电池,中间必然还需要AGM和EFB电池做过渡,而这个过渡期不会只是一两年这么短暂,而且存量的燃油车不可能说扔就扔,铅蓄电池的替换市场仍存在着很大的空间。同时,骆驼股份前期在铅回收上面的投入正在逐渐迎来可观的回报,更重要的是,这项业务非常契合国家政策鼓励的方向。

由于不是专业出身,我就不解读财务报告的部分了,免得误人子弟,有想要继续深研的可以通过下方传送门寻找答案![]()

传送门:Clarios招股说明书