这是巴菲特在2012年为福布斯杂志写的署名文章,主题是回顾自己的25岁——他将这一年称为自己人生的转折点。

巴菲特在这一年下定决心,放弃接替老师格雷厄姆(他视之为偶像)的宝贵机会,离开纽约、回到家乡奥马哈。他的人生规划是25岁退休,之后在家大量阅读,或去大学讲讲课。

但在偶然情况下,巴菲特在这一年创立了巴菲特合伙基金,之后创下13年无一年亏损、累计年化收益29.5%的惊人业绩,为伯克希尔哈撒韦的传说奠定了基础。

这一年是巴菲特梦开始的一年。

福巴斯杂志把这篇文章起名为《沃伦 · 巴菲特的500亿美元决定》。

注:全文发布在福布斯官网,中文系机器翻译,我只是手工做了一些调整和修改。如有翻译错误,烦请告知,也请读者见谅、以英文为准。

Warren Buffett's $50 Billion Decision

沃伦 · 巴菲特的500亿美元决定

By Warren Buffett

沃伦巴菲特

Benjamin Graham had been my idol ever since I read his book The Intelligent Investor. I had wanted to go to Columbia Business School because he was a professor there, and after I got out of Columbia, returned to Omaha, and started selling securities, I didn’t forget about him. Between 1951 and 1954, I made a pest of myself, sending him frequent securities ideas. Then I got a letter back: “Next time you’re in New York, come and see me.”

自从我读了本杰明•格雷厄姆(Benjamin Graham)的《聪明的投资者》(The Intelligent Investor)一书,他就一直是我的偶像。我想去哥伦比亚大学商学院,因为他是那里的一名教授。从哥伦比亚大学毕业后,我回到奥马哈,开始卖证券,我没有忘记他。1951年至1954年间,我把自己变成了讨厌鬼,频繁地给他发送证券方面的想法。然后我收到了回信: “下次你来纽约的时候,来看看我。”

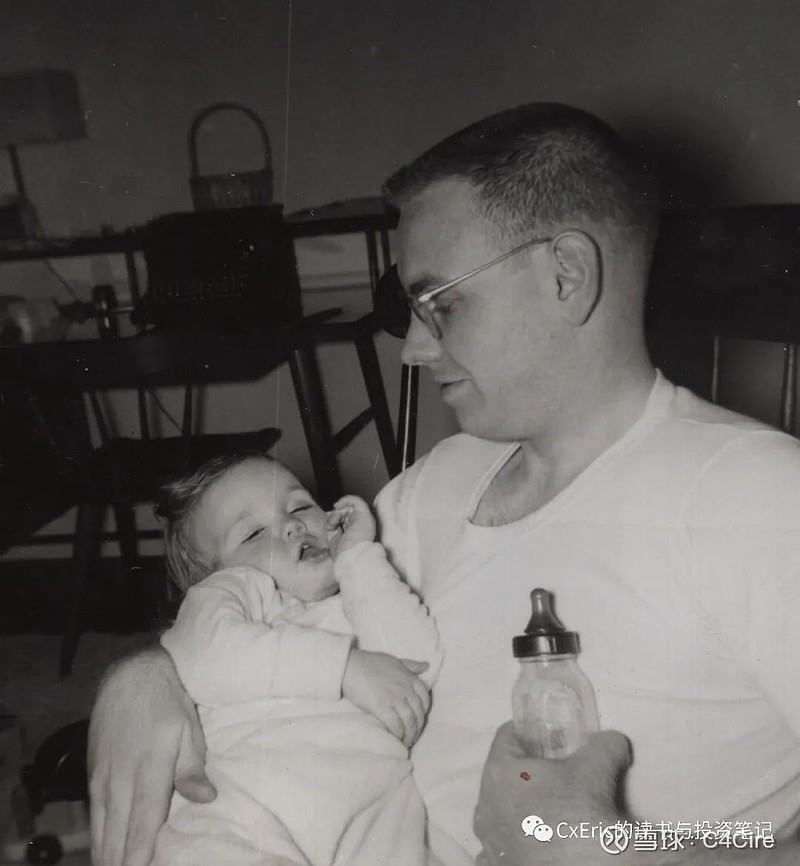

So there I went, and he offered me a job at Graham-Newman Corp., which he ran with Jerry Newman. Everyone says that A.W. Jones started the hedge fund industry, but Graham-Newman’s sister partnership, Newman and Graham, was actually an earlier fund. I moved to White Plains, New York, with my wife, Susie, who was four months pregnant, and my daughter. Every morning, I got on a train to Grand Central and went to work.

于是我去了那里,他给了我一份在 Graham-Newman 公司的工作,他和 Jerry Newman 一起经营这家公司。每个人都说A.W.Jones开创了对冲基金业,但Graham-Newman公司的姐妹合伙企业Newman and Graham实际上是一家更早的基金。我带着怀孕四个月的妻子苏茜和女儿搬到了纽约的怀特普莱恩斯。每天早上,我坐火车去中央车站上班。

It was a short-lived position: The next year, when I was 25, Mr. Graham—that’s what I called him then—gave me a heads-up that he was going to retire. Actually, he did more than that: He offered me the chance to replace him, with Jerry’s son Mickey as the new senior partner and me as the new junior partner. It was a very tiny fund—$6 million or $7 million—but it was a famous fund.

这是一个短暂的职位: 第二年,我25岁的时候,格雷厄姆先生——我当时就是这么叫他的——提前告诉我,他将要退休。事实上,他做的不止这些: 他给了我一个机会来取代他,杰瑞的儿子米奇成为新的高级合伙人,而我成为新的初级合伙人。这只基金规模很小,只有600万美元或700万美元,但它是一只著名的基金。

This was a traumatic decision. Here was my chance to step into the shoes of my hero—I even named my first son Howard Graham Buffett. (Howard was for my father.) But I also wanted to come back to Omaha. I probably went to work for a month thinking every morning that I would tell Mr. Graham I was going to leave. But it was hard to do.

这是一个痛苦的的决定。我终于有机会接替我心目中的英雄——我甚至给我的第一个儿子取名为霍华德•格雷厄姆•巴菲特(Howard Graham Buffett)。(霍华德是我父亲的名字。)但我也想回到奥马哈。大概有一个月的时间,我上班的时候每天早上都想着要告诉格雷厄姆先生我要走了。但这很难做到。

The thing is, when I got out of college, I had $9,800, but by the end of 1955, I was up to $127,000. I thought, I’ll go back to Omaha, take some college classes, and read a lot—I was going to retire! I figured we could live on $12,000 a year, and off my $127,000 asset base, I could easily make that. I told my wife, “Compound interest guarantees I’m going to get rich.”

问题是,当我从大学毕业的时候,我有9800美元,但是到了1955年底,我已经有127000美元了。我想,我会回到奥马哈,参加一些大学课程,读很多书ーー我准备退休了!我想我们可以靠每年1.2万美元的收入生活,用我12.7万美元的资产基础,我可以轻松做到这一点。我告诉我妻子,“复利保证我会变得富有。”

My wife and kids went back to Omaha just ahead of me. I got in the car, and on my way west checked out companies I was interested in investing in. It was due diligence. I stopped in Hazleton, Pennsylvania, to visit the Jeddo-Highland Coal Company. I visited the Kalamazoo Stove & Furnace Company in Michigan, which was being liquidated. I went to see what the building looked like, what they had for sale. I went to Delaware, Ohio, to check out Greif Bros. Cooperage. (Who knows anything about cooperage anymore?) Its chairman met with me. I didn’t have appointments; I would just drop in. I found that people always talked to me. All these people helped me.

我的妻子和孩子比我先回了奥马哈。我上了车,在去西部的路上查看了一些我感兴趣的投资公司。这是尽职调查。我在宾夕法尼亚州的黑泽尔顿停留,参观了 Jeddo-Highland 煤炭公司。我访问了密歇根州的卡拉马祖炉具与炉子公司,该公司正在清算。我去看看建筑物是什么样子的,他们有什么可卖的。我去了俄亥俄州的特拉华州,去看格雷夫兄弟合作社。(现在还有谁知道什么是合作社?)它的主席会见了我。我没有预约,我只是顺便来看看。我发现人们总是和我说话。所有这些人都帮助了我。

In Omaha, I rented a house at 5202 Underwood for $175 a month. I told my wife, “I’d be glad to buy a house, but that’s like a carpenter selling his toolkit.” I didn’t want to use up my capital.

在奥马哈,我以每月175美元的价格在安德伍德街5202号租了一套房子。我告诉我的妻子,“我很乐意买一所房子,但那就像木匠卖工具箱一样。”我不想耗尽我的资本。

I had no plans to start a partnership, or even have a job. I had no worries as long as I could operate on my own. I certainly did not want to sell securities to other people again. But by pure accident, seven people, including a few of my relatives, said to me, “You used to sell stocks, and we want you to tell us what to do with our money.” I replied, “I’m not going to do that again, but I’ll form a partnership like Ben and Jerry had, and if you want to join me, you can.” My father-in-law, my college roommate, his mother, my aunt Alice, my sister, my brother-in-law, and my lawyer all signed on. I also had my hundred dollars. That was the beginning—totally accidental.

我没有计划开始一段合伙关系,甚至没有想过找一份工作。只要我能自己独立运作,我就没有烦恼。我当然不想再把证券卖给其他人。但纯属偶然的是,包括我几个亲戚在内的七个人对我说: “你以前是做证券推销工作的,,我们希望你告诉我们如何处理我们的钱。”我回答说: “我不会再推销股票了,不过我会像格雷厄姆纽曼公司的2名创始人那样创立一家合伙事业,如果你们愿意,可以当我的合伙人。”结果,我的岳父,我的大学室友和他妈妈,我的姑姑爱丽丝,我的姐姐、姐夫,以及我的律师全都成为我的合伙人。我也投入一百美元。那只是个开始ーー完全是个意外。

When I formed that partnership, we had dinner, the seven of them plus me—I’m 99 percent sure it was at the Omaha Club. I bought a ledger for 49 cents, and they brought their checks. Before I took their money, I gave them a half sheet of paper that I had made carbons of—something I called the ground rules. I said, “There are two or four pages of partnership legal documents. Don’t worry about that. I’ll tell you what’s in it, and you won’t get any surprises.

当我成立这家合伙企业时,我们共进了晚餐,他们七个人加上我ーー我99% 确定是在奥马哈俱乐部。我花49美分买了一本分类账,他们带来了支票。在我拿走他们的钱之前,我给了他们半张纸,是我用复写纸复写的---- 我称之为基本规则。我说,“有两到四页的合伙法律文件。别担心。我会告诉你里面有什么,你不会得到任何惊喜。

“But these ground rules are the philosophy. If you are in tune with me, then let’s go. If you aren’t, I understand. I’m not going to tell you what we own or anything like that. I want to get bouquets when I deserve bouquets, and I want to get soft fruit thrown at me when I deserve it. But I don’t want fruit thrown at me if I’m down 5 percent, and the market’s down 15 percent—I’m going to think I deserve a bouquet for that.” We made everything clear, and they gave me their checks.

“但这些基本规则就是我们的投资理念。如果你和我意见一致,那么我们就开始吧。如果你不同意,我也可以理解。我不会告诉你我们拥有什么或类似的东西。我希望在该收到鲜花时收到鲜花,在该被扔水果的时候被扔水果。但是,如果我的表现是下跌5%,而同期大盘下跌15%时,我不希望有人会对我扔水果——此时,我想我理应得到一束鲜花。我们把一切都说清楚了,他们给了我支票。

I did no solicitation, but more checks began coming from people I didn’t know. Back in New York, Graham-Newman was being liquidated. There was a college president up in Vermont, Homer Dodge, who had been invested with Graham, and he asked, “Ben, what should I do with my money?” Ben said, “Well, there’s this kid who used to work for me.…” So Dodge drove out to Omaha, to this rented house I lived in. I was 25, looked about 17, and acted like 12. He said, “What are you doing?” I said, “Here’s what I’m doing with my family, and I’ll do it with you.”

我没有做任何揽客,但是更多的支票开始从我不认识的人那里寄来。在纽约,格雷厄姆-纽曼公司正在被清算。佛蒙特州有一位大学校长,名叫霍默 · 道奇,他投资了格雷厄姆,他问道: “本,我的钱该怎么处理?”本说,“嗯,有个孩子曾经为我工作... ...”于是道奇开车去了奥马哈,来到我住的租来的房子。我当时25岁,看上去大约17岁,行为举止像12岁。他说: “你在干什么?”我说,“这就是我和家人做的事,我也会和你一起做。”

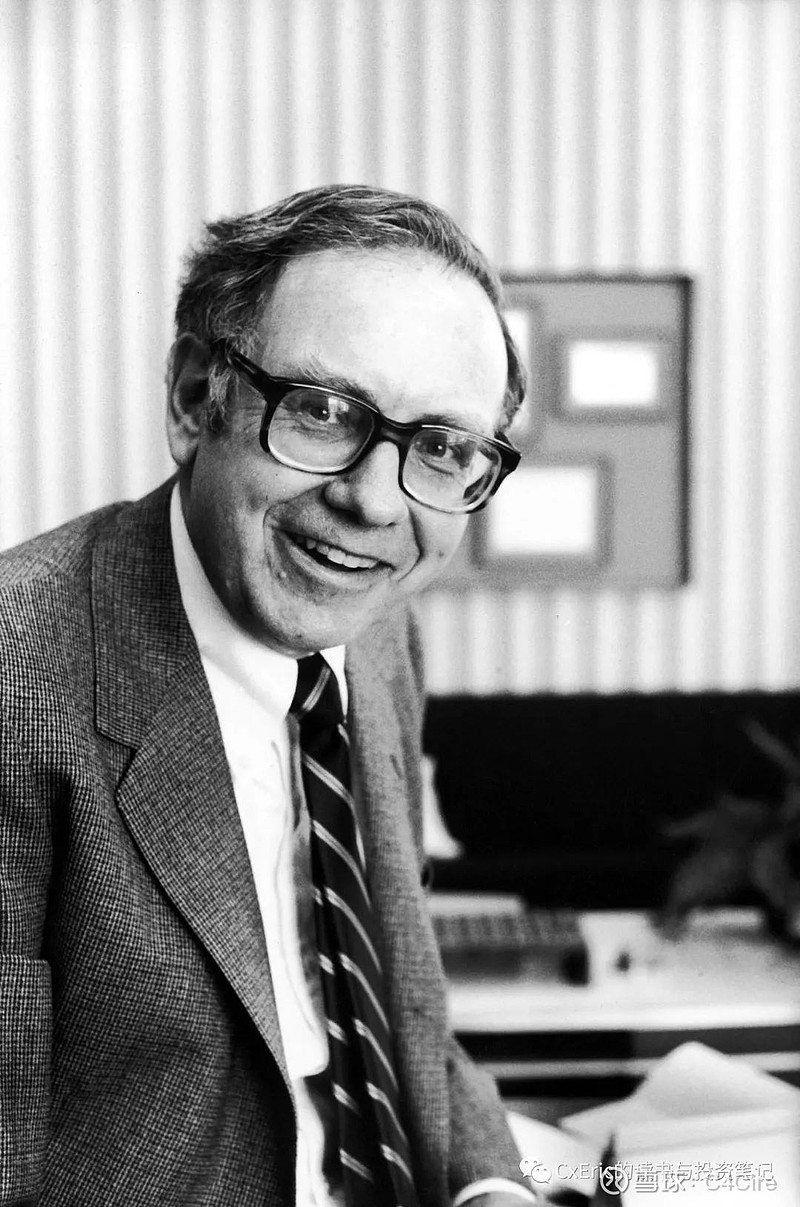

Although I had no idea, age 25 was a turning point. I was changing my life, setting up something that would turn into a fairly good-size partnership called Berkshire Hathaway. I wasn’t scared. I was doing something I liked, and I’m still doing it.

虽然我不知道,但25岁是一个转折点。我改变了我的生活,建立了一个相当大规模的合伙企业,名为伯克希尔·哈撒韦。我并不害怕。我一直在做我喜欢的事情,现在还在做。

$格力电器(SZ000651)$ $伯克希尔-哈撒韦A(BRK.A)$ $上证指数(SH000001)$

感谢阅读。