这是一个特殊事件投资(Special Situation),类似于之前介绍的并购套利策略。

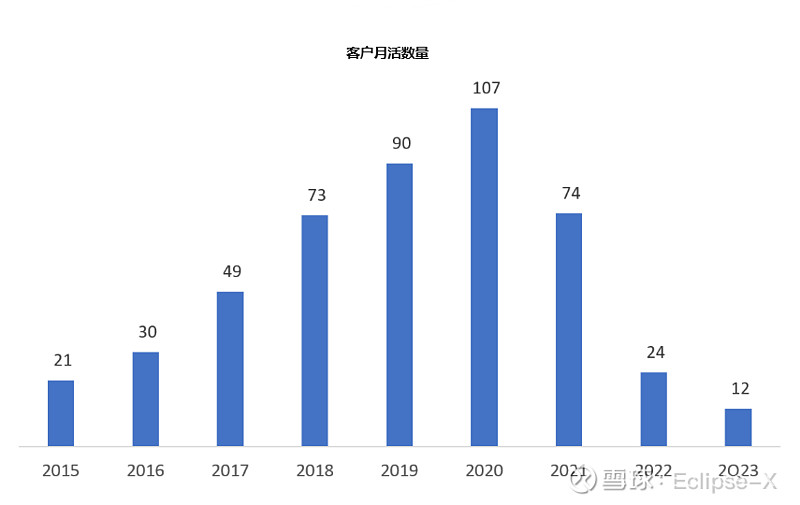

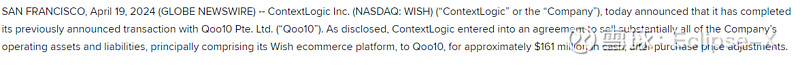

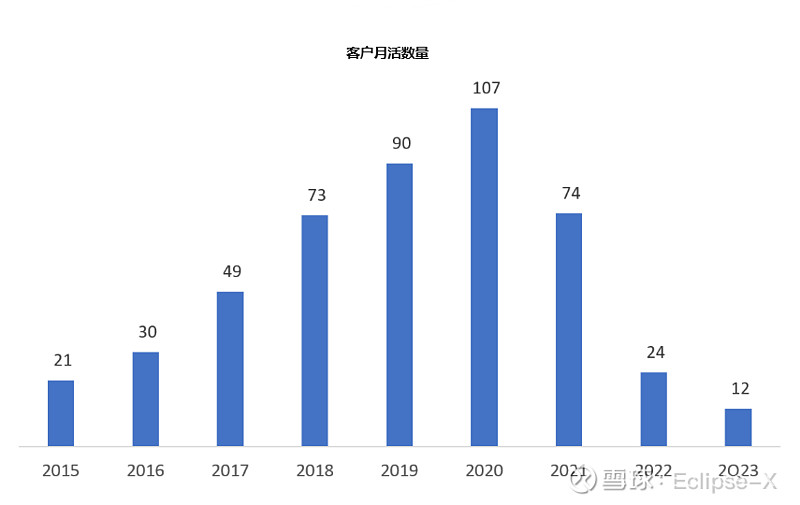

Wish,最初作为美国版拼多多亮相,疫情期间在全民撒钱的狂欢中业绩一飞冲天,市值最高时达到140亿美元,但如今,把过去烧了33亿美元“培养”出来的业务,作价1.6亿出售给新加坡电商Qoo10。

2024年4月19日交易完成后,上市公司ContextLogic目前市值1.4亿,与公司出售后的净现金相差10%出头。当然,这点折价咱熟悉中概的不觉得稀罕,虽然强行清算能获得一些溢价,但公司更大的价值,是作为减税资源。

富兰克林曾经说过:“这世界上,只有死亡和税是逃不掉的“,而Wish就能让你许下心愿,用它过去的血泪免去未来税务局的纠缠。

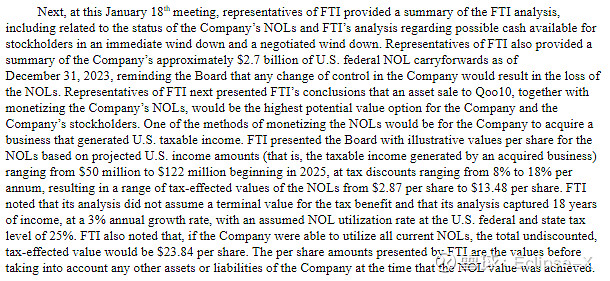

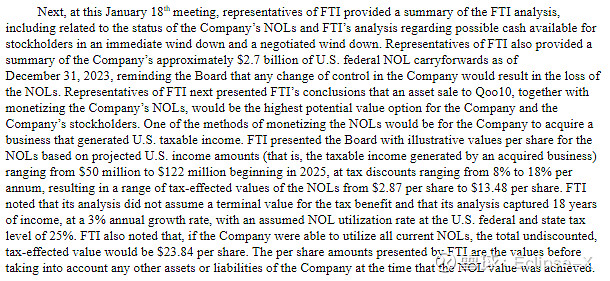

公司已经在声明中表示,打算寻找能实现其税收资产价值的交易,并聘请摩根大通和FTI咨询作为外部顾问。公司壳上拥有约27亿美元的联邦层面的经营损失,和90亿美元各州的经营损失。基于FTI给出的现金流折现计算,其每股价值大概是23.84美元。换算过来,大概等于资产负债表上5.8亿美元的递延税务资产。

总结来看,如果没有交易,立即清算,有10%溢价,考虑中间各种摩擦费用,会再减去几个点。如果能够找到交易,假设市场确实有效,考虑到要利用这笔经营损失,交易对手公司一定是有收入和可观盈利的,那最起码是可靠的公司,让我们稍微安心一些。这样如果实现的话,回报可能是300%以上。

这笔投资有几乎唯一的重要因素,那就是管理层可靠,在认真推动交易。如果管理层不干实事,准备在这养老,把公司账上的现金当作私家财产,那对股东可是灾难。至于是否能找到交易,应该不是难事,美国有很多盈利而且愿意上市的公司,Wish作为免税的壳资源,反而是稀缺品。

公司现在的大股东除了美国的指数基金,前几位里有知名的风投机构纪源资本(GGV Capital), General Atlantic,和刚刚离职的CEO Jun Yan,同时也是纪源资本的合伙人(看背景在国内还有北大和中欧)。他们与管理层应该有多年的投资和工作经验,如果哪位朋友有更多相关信息,欢迎来讨论。

$ContextLogic(WISH)$ $ContextLogic(LOGC)$ $拼多多(PDD)$

全部讨论

Ceo拿1刀薪水,董事减少,压缩开支,办公室也缩小改成远程办公。我觉得还是比较有意思的。

感谢分享。我也分享一个账面上递延所得税资产超过市值的公司,$The RealReal(REAL)$ ,当然,并购当中是都可以免税,需要满足一定的条件,比如据我了解大公司收购基本是不行的,一般要是 merge 才可以。

Federal NOL 算的没错。90亿美金state NOL价值没有计算,按照加州8.84%企业税率,90亿美金state NOL价值为8亿美金左右。加上federal NOL价值为5.8亿美金,实际账面金额是13.8亿美金的免税额度。NOL合计价值每股$58美金。加上6.5美金的现金估值,企业估值是$65美金/股。

讨论赞编辑删除

用gemini查了一下,这个Carryforward losses的使用应该还是有一些限制的。不知道ContextLogic能绕过去吗?

不过AI的答案经常有问题。

Mergers and acquisitions (M&A) can be a way to utilize tax loss carryforwards (NOLs) to offset income tax in the US, but there are limitations and anti-abuse rules to consider. Here's a breakdown:

How it can work:

A profitable company can acquire a company with a history of losses, inheriting its NOLs.The profitable company can then use these NOLs to offset its own future taxable income, reducing its tax liability.

Limitations and hurdles:

Section 382: This IRS regulation limits the amount of NOLs a company can use after an ownership change like a merger. The purpose is to prevent companies from simply buying NOLs to avoid taxes.Change of Business: The IRS may restrict NOL use if the acquiring company significantly changes the acquired company's business after the merger.Principal Purpose Test: If the primary reason for the M&A is to acquire NOLs and not for legitimate business reasons, the IRS can disallow the NOL benefit.

Overall, using M&A for NOL benefits is complex and requires careful tax planning. Consulting with a tax advisor is crucial to ensure the M&A structure complies with regulations and effectively utilizes the NOLs.

Here are some additional points to consider:

There are two main types of tax loss carryforwards: NOLs (applicable to businesses) and capital loss carryforwards (applicable to businesses and individuals, with different rules). M&A typically deals with NOLs.NOLs can be carried forward for a certain number of years, but they eventually expire if not used.

现在一把手原来是基金经理,别学巴菲特把现金拿去炒股票就好……

请问有没有Special Situation 群?我也有案例想请教