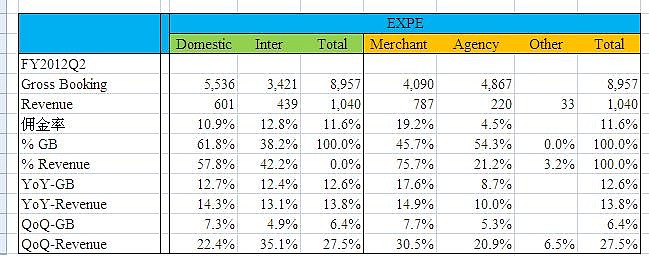

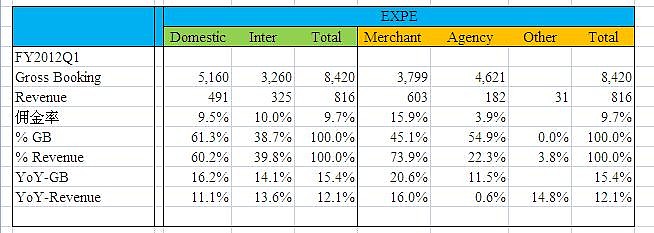

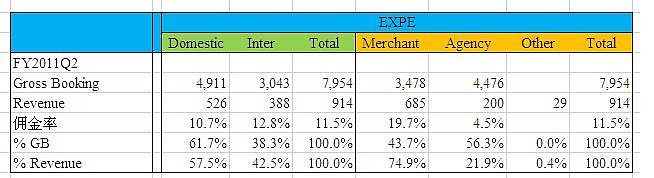

FY2012Q2,FY2012Q1,FY2011Q2比较

FY2012 Q2

FY2012Q1

FY2011Q2

(1) 业务地区分布变化不大

(2) Merchant和Agency两种模式,Q2和上年同期相比,Merchant的模式无论是gross booking和revenue增速还是快于Agency的模式。

不过管理层在电话会上特别提到了,他们的一个关于这两种模式,未来他们的计划:

“Specifically, for participating hotels, we'll be able to offer customers the choice of whether to pay Expedia in advance or pay at the hotel at the time of the stay. So far the reaction from our suppliers has been positive, and our initial testing indicate that customers really like this flexibility. We believe that these innovations, if and when rolled out on a broad basis, would be likely to drive back the growth in our agency hotel business, which could result in a blended hotel margin as well as our merchant hotel flow trending down over time.

With that said, we remind you that, in general, our suppliers pay us based on the considerable scale and breadth of our distribution platform and not based on a specific model under which we do business. As we introduce further innovation into the global hotel business, you would expect the current bright line between agency model and the merchant model to blur over time.”

总披露内容看,管理层觉得效果还好,不过目前对财报看起来影响不大。

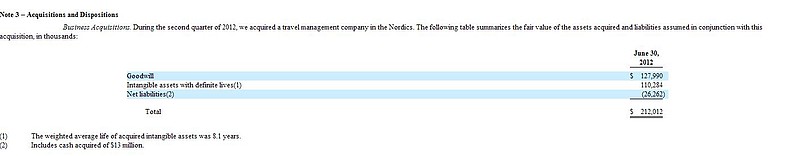

2. 收购VIA

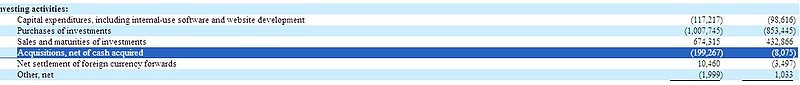

完成了对VIA的收购,已经在财报反映,从报表简单的信息看,收购价在200M左右,具体细节未说明:

总对价是212M,其中包括收购VIA获得的现金13M,所以净现金用于收购的是199M。

“During the quarter, Expedia® expanded the global corporate travel footprint of Egencia® by completing the acquisition of VIA Travel®, the largest travel management company in the Nordics.

It's worth noting that second quarter results were helped by that acquisition of VIA Travel, which we completed in late April and contributed roughly 2 percentage points of growth in gross bookings and revenue, and 3 points of adjusted EBITDA growth for the quarter. VIA Travel is the leading travel management company in the Nordics, and we're happy to have them as part of the Egencia team.”

3.回购

在Q2回购了3M的普通股,均价33.24。看股价,应该是4月份回购的。

Year-to-date, we repurchased 8.8 million common shares, including 3.0 million common shares during the second quarter of 2012, for an aggregate purchase price of $291 million excluding transaction costs (an average of $33.24 per share). Twenty million shares of common stock are available for repurchase under the April 25, 2012 authorization.

4.股利分配

Q2,支付了12M的股利;管理层还准备在Q2支付USD0.13 per share的股利,估计的总的支付金额为18M。股利比例到是不算太高。

On June 19, 2012, we paid a quarterly dividend of $12 million ($0.09 per common share). In addition, the Executive Committee of Expedia’s Board of Directors declared a cash dividend of $0.13 per share of outstanding common stock to be paid to stockholders of record as of the close of business on August 28, 2012, with a payment date of September 18, 2012. Based on our current shares outstanding, we estimate the total payment for this quarterly dividend will be approximately $18 million. Future declaration of dividends and the establishment of future record and payment dates are subject to the final determination of Expedia’s Board of Directors.

5.移动端

总体看,移动端增长速度比较快,和之前tripadvisor披露的速度差不多,另外管理层对待移动端态度也是先积攒用户。此外,同样也提到了平板的重要性在上升,这和我在TA的披露的信息是一致的。对以移动端,

从我个人目前的感受是,iphone更多的是作为一个即时信息交流和搜索的平台,平板离交易更近。

“On mobile, we continue to grow very quickly, triple-digit growth rates for essentially all of our brands. “

”Tablet is starting to become a big player in mobile transactions and in traffic as well.“

”But I think we're going to be in that stage for a couple of years. I think we're going to a net investor in mobile over a period of time. We want to establish a user base in mobile, in loyalty, so that we get users coming direct to us as well as through indirect channels like Google, TripAdvisor, metasearch as well.”

6.汇率的影响

欧洲和汇率的影响不小,而且管理层也说是比预计的更差。由于对于Priceline,欧洲市场的比重更大,我想这个影响可能会在500-600个基点的水平。

“As expected, foreign exchange was a headwind this quarter and hit us harder than anticipated, given the strength of the dollar relative to the euro. In total, we estimate that foreign currency costs to us 300 to 400 basis points of growth in gross bookings, revenue and adjusted EBITDA. This was 100 to 200 basis points worse than we expected when we talked to you last quarter.”

总体看,表现还算中性,盘后大涨主要是由于分析师预期不高。

@从易

欢迎大家讨论。

相关8-K和电话会的链接

网页链接

网页链接