俺的有些观点大家可能不易接受,我们求同存异,很享受跟大家交流的过程。把俺聚会上提到的一些想法跟大家分享下,欢迎拍砖:

=============================================================

零和博弈

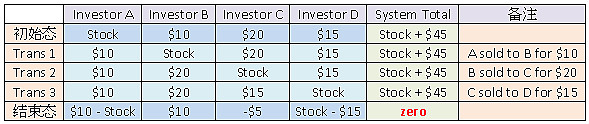

这个问题可以用一个简化的模型研究下:

假设股票不分红并忽略交易费用

假设有A / B / C / D四位二级市场参与者分别持有:股票 / $10 / $20 / $15

然后发生以下3次交易:

A 以 $10 价格将股票卖给 B

B 以 $20 价格将股票卖给 C

C 以 $15 价格将股票卖给 D

最后每个参与者的持仓分别为:

A: +$10 - Stock

B: +$10

C: -$5

D: -$15 + Stock

可以看出整个过程是一个零和博弈过程 ,跟德州扑克的本质是一样的:

交易过程实现资金再分配,并没有产生新价值

有人赚钱必然有人赔钱且数量上相等 (+10+10-5-15=0)

如果股票仍不分红,D 同学会将同样的零和游戏进行下去

如果股票开始分红,D 同学所持股票的价值就是其未来所有分红的折现

“That is really what Wall Street did, they don’t really create anything they just move money around.” - 李录

顺便提下,价值投资唯一的原则就是不要赔钱。观察上面的交易过程不难看出其实要做到这点非常简单:只要不(被迫)止损而造成永久资金损失,就没有人能从你手中赚到钱 ,永远立于不败之地。 [哈哈] 这就是为什么巴菲特老人家一再告诫我们不要使用杠杆的根本原因。

"Rule No.1: Never lose money. Rule No.2: Never forget rule No.1." - Warren Buffett

=============================================================

投资还是投机

俺比较倾向这样的定义:通过交易某种金融产品产生收益

如果收益来至金融产品本身产生的价值,如:存款利息,债券利息,房产租金,这样的市场行为叫投资

如果收益来至其他市场参与者的损失,如:期权,期货,黄金,汇率,这样的市场行为叫投机,跟德州扑克的本质是一样的

股票交易收益来自两个方面:

股息 - 投资过程,这部分收益来至公司创造的价值

增值 - 投机过程,这部分收益来至其他市场参与者的损失,是零和博弈

=============================================================

有效市场理解

暂不考虑市场参与者是否完全理性的因素,二级市场的有效性的取决于上市公司可获取信息的完整性,掌握的信息越完整则做出的判断越有效。

二级市场上市公司信息可分为以下4类:

历史价格及成交量信息

针对这类信息的研究统称技术分析,这部分信息明显不全面,单纯的依靠技术分析不能洞悉上市公司全貌,效果属弱有效。有人说技术分析像占星术一样完全不靠谱,俺觉得更像中医,精华与糟粕并存,应属金融行为学范畴,有机会跟大家交流。

基本面信息,如:财务报告,公司运营和管理,行业现状与发展等

这对这类信息的研究统称基本面分析,研究对象是所有公开信息,比较全面,效果属半强有效。这部分比较主流,高手如云,俺通常采用拿来主义。

内部信息,即非公开信息,如:公司开发中新产品信息,商谈中的并购信息等

内部交易数据会有披露。内部交易界定法律上属灰色地带。内部交易总体上长期击败市场回报,属强有效。

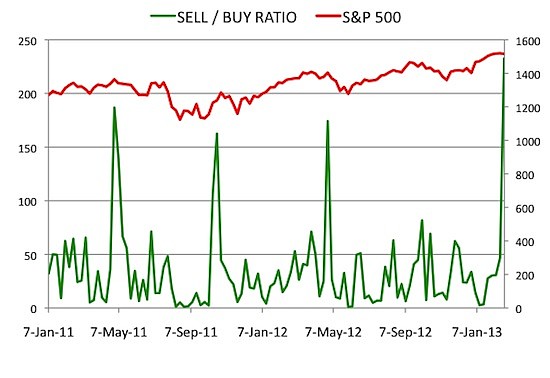

另,市场总体内部交易的sell / buy ratio是内部人士用个人资金投票的结果,要比 AAII Investor Sentiment Survey 业余投资者用情绪投票的结果更有参考价值:

市场参与者信息,如:主流资金的投资理念,操作手法,建仓时间及成本等

俺对这部分信息研究很感兴趣,研究目的不是为了跟风,而是尽量知己知彼,跟德州扑克根据其他参与者流露的信息调整自己的加注策略的道理是一样的。

这部分信息披露存在滞后性和不完整性,这是规则设置而非技术困难造成的,因为这类游戏从来就是这么玩的,跟德州扑克如果大家都明着底牌就没法玩了是一个道理。但模糊正确的信息要好于信息的完全缺失。

主流资金总体的流向决定股价的走向,有机会跟大家交流。

=============================================================

投资大师眼中的零和博弈

David Einhorn 在他的”Fooling Some of the People All of the Time”书中提到 counterparty 问题:“In order to invest, we need to understand why the opportunity exists and believe we have a sizable analytical edge over the person on the other side of the trade. When we buy something, we generally do not know who is selling. It would be foolish to assume that our counterparty is uninformed or unsophisticated. In most circumstances, today’s seller has followed the situation longer and more closely than we have, has previously been a buyer, and has now changed his mind to become a seller. Even worse, the counterparty could be a company insider or an informed industry player working at a key supplier, customer or competitor. We need to have a better grasp on the situation than he does. Given who that may be, our burden is high.”

Ray Dalio 前阵子接受采访时则说的非常直白:“The bets are zero sum. In order for you to beat me in the game, it’s like poker, it’s a zero sum game. We have 1,500 people that work at Bridgewater, we spend hundreds of millions of dollars on research, and so on. We’ve been doing this for 37 years and we don’t know that we’re going to win. We have to have diversified bets. So it’s very important for most people to know when not to make a bet. Because if you’re going to come to the poker table, you’re going to have to beat me, and you’re going to have to beat those who take money. So the nature of investing is that a very small percentage of the people take money essentially in that poker game away from other people who don’t know when prices go up whether that means it’s a good investment or if it’s a more expensive investment.”

结论:二级市场就是一特大号赌场,每只股票都是一特大号德州扑克台!上桌出手前至少观察下哪些大户 / 大师 / 高手已经在场,琢磨下对他们了解多少,计划下怎么从他们手中赢到钱...

=============================================================

投资和扑克有着必然的内在联系 - 擅长扑克的人投资方面表现也会出色。 [哈哈]

In 2006, David Einhorn finished 18th in the World Series of Poker main event and almost made it to the final table...

Warren Buffett is a famously world-class bridge player, putting in 12 hours a week at the table, often with Bill Gates...

“If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.” - Warren Buffett

结论:德州扑克是价值投资者的一项必修技,有助于提高功力! [哈哈]

如果对此仍半信半疑,Google 下 ‘poker and investin’:

不要错过下面几篇:

The 22 Biggest Poker Players On Wall Street

The 13 Poker Concepts That Every Investor Needs To Know

… ...