Atmus

Let's take a look at Atmus' chart:

It's a spinoff from Cummins so naturally a special situation.

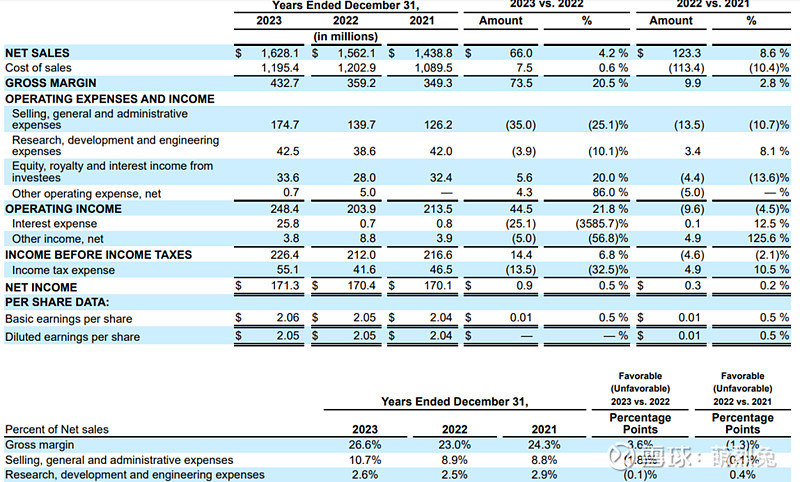

When it was spun off, market worries about corporate cost overhang and it was a "show-me" story so perhaps it makes sense it IPO'ed at 19.5/share, and since its first quarter's sales rose by 10% to 418mm, and net earnings 35mm, so run-rate EPS 1.70/share, 11x earnings, very reasonable. Up to 22/share on first day of trading — you can say 13x PE is a bit rich for a show-me story but actually not that rich honestly. By Sept 2023, full year sales 1.58 bil to 1.63 bil and 56mm ahead of last year in the first half, sales flattish for the second half of the year, EBITDA 285 mm, net debt 510mm, leverage from 2.35x to below 2x. Full year adj EPS 2.05-2.25, get rid of the one-time separation it's still 1.95 at the midpoint, so when it sells down to 18.76/share in Oct, Nov, that's dirt cheap…

Game changer came in Nov — 3Q sales 396mm, slight decline from 401mm a year ago. Net earnings fell to 38mm due to interest expense, and corporate cost overhang came in to knock EPS to 0.45 per share (adj would be 52 cents per share). But full-year sales guidance hiked to 1.6-1.625 bil, while adj earnings hiked to 2.20-2.30/share (because previously second half of the year only 0.84 per share!). Adj EBITDA 295mm, net debt down to 461mm, so net debt/adj EBITDA only 1.5x. Balance sheet healthy, and yet Feb 2024 it traded down to 10x YET AGAIN!… Just compare its multiple with Donaldson's and you'd realize how crazy cheap it was…

Lesson is I should pay a lot more attention to the spin-off space. Solvay and Atmus are both vivid lessons…

Now some Q&A's…

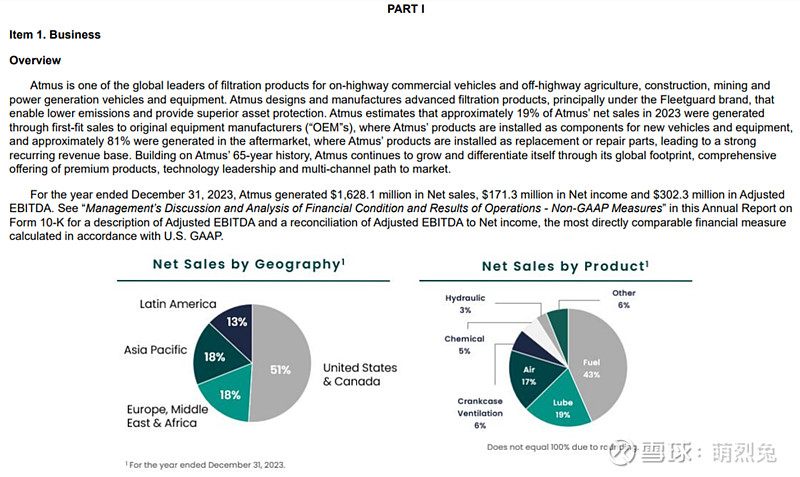

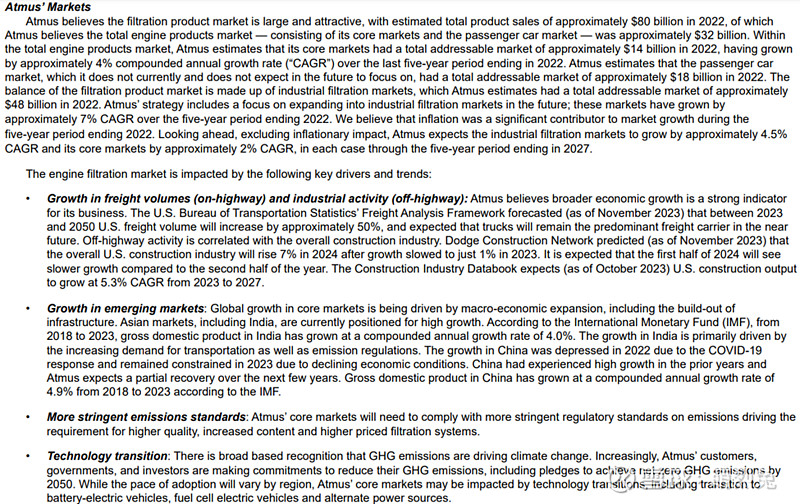

Overview: no exposure to light vehicles, only heavy (2/3) and medium (1/3) duty vehicles, 50% in US and Canada, and 18% in Europe, 18% in APAC, 13-15% in Latam. First-fit business very important because that’s the start of the flywheel, although 20% of sales only. 60% on highway, 40% off highway. Fuel filtration and crane ventilation are the most value-added parts for the business. Crankcase ventilation captures all hazardous gases when starting the vehicle so they don’t go into the environment, typically it’s new vehicles that need it. Lubrication filtration (oil filtration, taking engine oil in the diesel engine, filtering through, removing contaminants, but not critical technology) hasn’t changed in 15 years, more commoditized, OEM hasn’t changed requirements. Fuel filtration (critical, because it’s going through fuel injector, very small openings to inject things into the engine, continuously increased filtration requirements) is controlling what goes into the combustion engine; Dominant player in air filtration (on chest, not engine, so Donaldson built a deep relationship with the OEMs, very specific player in the chassis space) is Donaldson. Aftermarket is more profitable than OEM, but OEM biz is not loss maker.

1. In simple terms, can you please explain this business to me? More specifically, I wonder the functional differences between Fuel/Lube/Air Filtration/Crankcase Ventilation/Hydraulic Filter/Coolants & Coolant Filter, and what are the unit prices, profit margin, engineering sophistication, and customer stickiness/embeddedness associated with each of these products?

Overview: no exposure to light vehicles, only heavy (2/3) and medium (1/3) duty vehicles, 50% in US and Canada, and 18% in Europe, 18% in APAC, 13-15% in Latam. First-fit business very important because that’s the start of the flywheel, although 20% of sales only. 60% on highway, 40% off highway. Fuel filtration and crane ventilation are the most value-added parts for the business. Crankcase ventilation captures all hazardous gases when starting the vehicle so they don’t go into the environment, typically it’s new vehicles that need it. Lubrication filtration (oil filtration, taking engine oil in the diesel engine, filtering through, removing contaminants, but not critical technology) hasn’t changed in 15 years, more commoditized, OEM hasn’t changed requirements. Fuel filtration (critical, because it’s going through fuel injector, very small openings to inject things into the engine, continuously increased filtration requirements) is controlling what goes into the combustion engine; Dominant player in air filtration (on chest, not engine, so Donaldson built a deep relationship with the OEMs, very specific player in the chassis space) is Donaldson. Aftermarket is more profitable than OEM, but OEM biz is not loss maker.

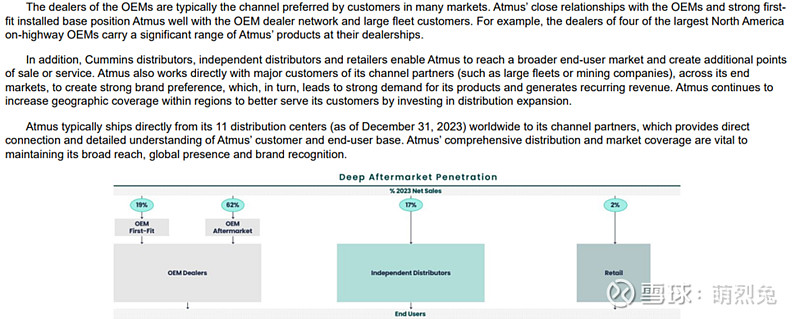

2. Want to dig a bit deeper into your relationship with the OEMs since it seems OEM dealers are responsible for 81% of your sales.

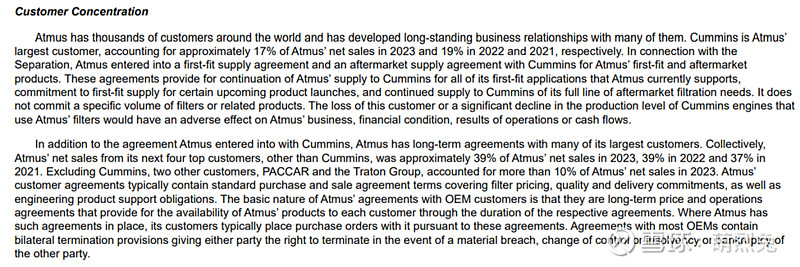

More specifically, the largest clients (three of them, including Cummins) each represent more than 10% of revenue. What’s it like to be on the negotiation table of these downstream juggernauts? How long are the agreements? Do they have price escalation clauses? Do they adjust for inflationary pressures? Are there floors for profitability for these contracts? Do they specify how much they have to purchase (in terms of volume?)? Now there is a “change of control” event due to the spinoff, are any of these contracts renegotiated or changed? Are the Cummins contracts more profitable than the PACCAR and Traton contracts?

First-fit, governed by multi-year agreements, very specific on pricing, whether can pass along commodity prices, efficiency clauses (especially if a new product), tend to be more aggressive pricing. The other part, aftermarket, although it goes through the OEM’s aftermarket, Atmus sets pricing on a notification basis, no long-term agreement, no history of giving back pricing, more flexibility, they have flexibility to pass along prices to the end customers and a little extra for themselves. Why more flexibility? Very early in the cycle customers go to the dealers, stick through maintenance cycles, want original parts and products to make sure functions correctly, not sensitive to a bit price changes in a critical part. Atmus’s entire filtration for class-A vehicle, 300-400 dollars of content, price of vehicle is typically 200,000. Can scale, mining vehicle $1mm, then 2,000 dollars of content. First five years of ownership, retention is ~95%, goes through strong relationship with the OEMs. Not a huge difference in profitability across channels, because costs the same, sells at the same prices across channels (flexibility embedded in all three).

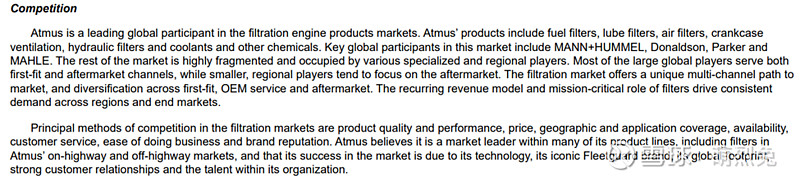

3. What is the competitive landscape – compete on price, design, reliability, or what? Atmus has adj EBITDA margin of 18.6%, but Donalson which is a competitor has much higher FCF margin (450mm FCF on 3.5 billion revenue) and therefore a much higher valuation multiple, why is that the case?

Concentration of customer is indeed an issue for Atmus, partly is just natural consolidation in the heavy vehicle space. Daimler exclusively outsources engines to Cummins, next several years Cummins will have 95% of medium duty engine market globally, “winning with the winners”, partner with the truck manufacturers that keep taking market share and expand through them.

Five-year exclusivity agreement with Cummins both on first-fit and aftermarket – pretty long-term agreement in this industry. “No one knows the Cummins engine like we do”. Today pretty nice market price with Cummins, pretty competitive in pricing already.

Five main global players, big five controls 80-85%, Atmus, Donaldson, Parker Hannifin bought Clarifor (2018, hydraulics and more of an aftermarket), MAHLE, MANN+HUMEL. Best pure play apples to apples would be Donaldson, a little further down the line on their diversification strategy, a “mobile solutions business” and also diversified into industrial filtration, and a kick into life sciences. Short-run do have a drag in cashflow due to separation, like setting up own information technology system, and capex in setting up distribution centers (previously shared those with Cummins), 80% through in terms of volume, Europe and Africa to go, should get these done by the end of this year. 60-day payment day on payroll -- a delay in payment of cash as well, now moving toward own payment system and pay employees on a real time basis. FCF conversion in general 85-90%, Donaldson 100-100%, conversion a little lower 1). Step up capex, was a cashcow in Cummins and wasn’t investing in the thing, “depreciation shield” needs to catch up as capex is higher than depreciation now; 2). India JV is non-consolidated, providing technology, local folks manufacturing and distribution, Atmus gets dividend and royalty, 90% cash, so a little leakage, remaining 10% going back into the JV.

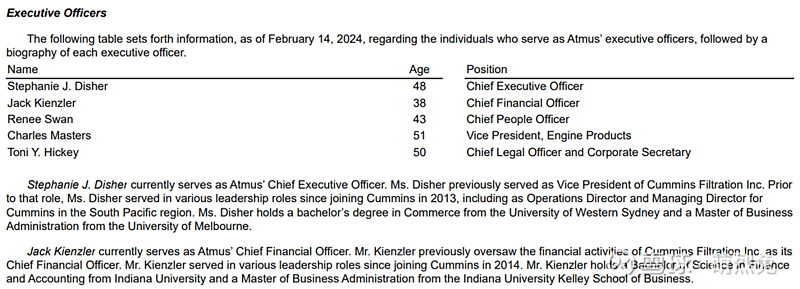

4. The management team, especially the CEO and CFO, are very young (and on the picture in the PPT they do look very young). How was the leadership selection process conducted and why were they picked to head Atmus?

Stephanie started off as a trainee, was handpicked by CEO of Cummins to run filtration business and prepare for the spinoff. Operations + Finance experiences. Opened up the wall between Cummins and Atmus, if you like start-up venture, come to Atmus; if you want stability in an established business, then go to Cummins. Jack started with KPMG, deal-advisor group, then Cummins, spent a lot of time at merger-acquisition and investor relations roles, great insight on growth of the business.

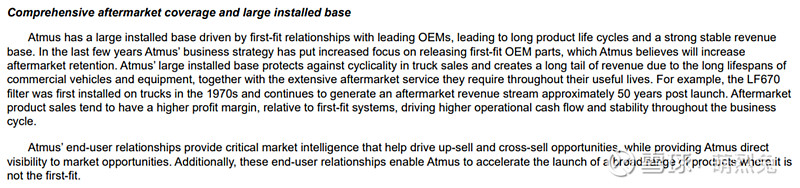

5. Product longevity seems very, very long – do trucks actually run 50 years? (owners typically expect 15 years of life, so the 50 years is a little bit way too long for me. Did I miss something?)

Exception not the norm with this example, typically it’s 13-15 years for on-highway, and 15-20 years for off-highway. But products are very durable indeed, and aftermarket relationship can last for a long while.

6. On financial statements, why revenue was increasing but net income was not over the last 3 years. In addition, how was the debt load of ~$600mm decided upon spinoff and what’s the strategic rationale there? What’s the average cost of debt and maturity schedule?

Input costs run-up during the inflationary time, playing a little of catch-up until 2023 caught up, EBITDA margin from 2022 to 2023, catch-up pricing. Did start to have an interest expense servicing the debt. 650mm dividend paid to Cummins, 600mm loan and 50mm revolver, and revolver already repaid. SOFR+135 bps, floating rate debt, will start paying that this year, maturity evenly distributed in the next three years, intend to pay the terms as they mature. No pension liabilities, environmental liabilities, and asbestos liabilities coming onto Atmus’ balance sheet. Intention is to keep debt level under 2.0x net debt/EBITDA.

7. In terms of markets, in the emerging markets such as China, surmise there must be low cost domestic producers trying to eat your lunch? Are there any publicly traded peers in China and India that encroach on your market share?

Lastly, how is the company adapting to increasing electrification which seems like an inevitable future for us?

In India, JV, exclusive path into India, local family, fantastic operator for manufacturer and distributor, decentralized market, don’t consolidate (not controller), 300mm revenue second largest market, not much competition.

In China, go to market through JV (Dongfeng) AND entirely owned entity (because some don’t want to touch Dongfeng). Smaller market, 100mm market if consolidated into balance sheet. More knock-offs and smaller competitors in China, important to protect through patents. More concerned about brand and reputation, inexpensive product in the first place. Donaldson is a big competitor in China.

Hydrogen, fuel cell and such are very similar to the technology Atmus has right now, very similar content. If moves to electrification, less content for Atmus, but for heavy, not seeing the move in that direction; electrification may make more sense for a medium duty vehicle, could move first, but also seeing alternative fuel in the space. 2032 would be ~5% of alternative energy vehicles. Volvo is one of the leaders in alternative (in the hundreds of vehicles they produce), PACCAR also reports but it’s less than 100, good source is to go to the OEM to see the numbers.