总结:

1.相比较收入增长,管理层更关注毛利润的增长。且通过减少一定的营销开支和低效率且不盈利业务;将平台资源更有效的分配保持专注和成本控制,并举例微信在小游戏、微信搜索等业务的创新和良好的经营结果。

2.视频号广告收入大幅增加源自用户规模和广告加载策略,广告加载率远低于同行,仍保证了很好的用户体验。

3.微信小游戏流水增长 50% 是因为 DAU 和单用户收入的增加,该表现是源于其背后的微信生态。而且小游戏和端游月活用户重合地低于 50%,且付费用户重合度仅百分之十几。

4.微信搜索 DAU 超 1 亿,且在加强变现的情况下收入增长了数倍。

5.王者荣耀和和平精英的收入停滞了,管理层更换了游戏变现团队,并预期今年二季度游戏收入将有所改善。

6.视频号将继续发力直播电商业务,但不会像抖音快手一样发力本地生活业务,反而会帮助美团推广本地生活服务。

以下为电话会议原文:

Pony Ma:Thank you, Wendy. Good evening. Thank you, everyone, for joining us. In 2023, we sharpened our strategic focus and achieved substantial progress in our major products following our high-quality revenue growth model.

Notably, video accounts total user time spent more than doubled as we enriched our short video content ecosystem. Our mini games platform increased gross receipts by over 50% year on year. Our number of major hit games in China, achieving both high DAU and substantial monetization, increased from six in 2022 to eight in 2023. And international games achieved double-digit revenue growth and rose to 30% of games revenue.

Tencent Video and Tencent Music extend their industry leadership with 117 million and 107 million paid subscribers, respectively. WeCom and Tencent Meeting strengthened their enterprise software leadership and increased monetization. And we also achieved significant technology breakthroughs. Our Tencent Hunyuan foundation model is now among the top tier of large language model in China, with notable strengths in advanced logical reasoning.

Our upgraded advertising AI model enabled us to deliver better ad targeting and higher revenue. We invested further in sustainable social value initiatives. Our digital philanthropy platform helped raise 3.8 billion RMB in public donations during 99 Giving Day campaign in 2023. Our New Cornerstone Investigator Program supported 104 scientists, contributing to fundamental science research.

Looking at our financial numbers for the quarter. Total revenue was 155 billion RMB, up 7% year on year and stable quarter on quarter. Gross profit was 78 billion RMB, up 25% year on year and 1% quarter on quarter. Non-IFRS operating profit was 49 billion RMB, up 35% year on year or down 5% quarter on quarter.

Non-IFRS net profit attributable to equity holders was 43 billion RMB, up 44% year on year or down 5% quarter on quarter. Now, I will hand it over to Martin for the strategy review.

Martin:Thank you, Pony. Good evening and good morning to everybody. During the course of 2023, we have established a high-quality revenue growth model, which will support our continued economic value creation. This, together with our increased focus on capital allocation discipline, will further enhance shareholder value.

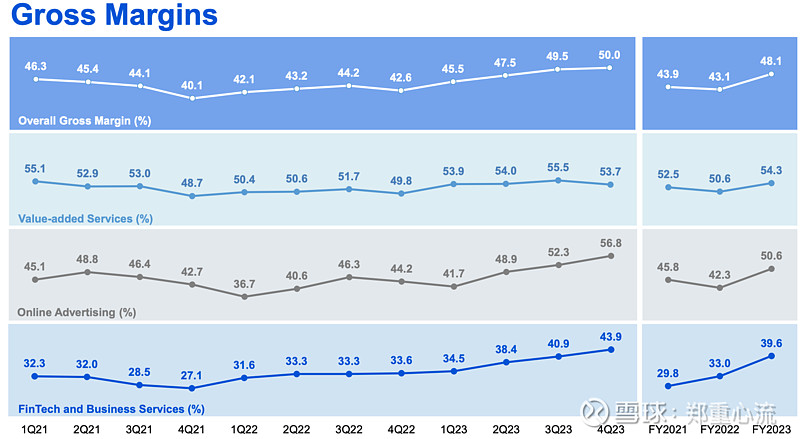

Starting with our financial performance. We have seen a healthy increase in revenue since the first quarter of 2023 by increasing high-quality revenue streams and reducing low-quality ones. Importantly, our gross profit growth has consistently surpassed revenue growth due to the margins of our incremental revenue being significantly higher than the 50% overall gross margins for the entire company. This incremental revenue is generated predominantly from our leading social and payment platforms, which have already been built and have their costs covered.

We now consider gross profit growth as a key proxy and, frankly, a better proxy than revenue growth for our organic growth given this shift in terms of the revenue mix. We further enhanced our operating profit growth from gross profit growth through operating leverage. First, we streamlined operations and prudently reduced aggressive marketing expenditures. We perceive these measures as a less recurring strategy.

Second, and more importantly, we're committed to operational efficiency and disciplined resource allocation, which includes thoughtful staff distribution and effective marketing expense management. This approach ensures a focused organization and a lean cost structure moving forward. In the next few slides, I will provide more details on the drivers for our earnings growth going forward. Weixin provides the first set of examples of how we nurtured high-quality revenue streams.

The Weixin platform is delivering consistent growth in both DAU and daily time spent per user. New services within Weixin such as video accounts, mini games, and Weixin Search contributes to greater engagement and overall platform health while, at the same time, generating additional revenue at very high margins given they are offered on top of a relatively stable platform cost base. Going into each one of them. Firstly, for video accounts, total user time spent more than doubled in 2023, driven by strong growth in DAU and time spent per user.

Video accounts advertising revenue has substantially increased, thanks to the increased traffic and improved ad targeting, despite ad load was kept to much lower levels than industry peers, which then offers a better user experience overall.Secondly, mini games experienced a 50% increase in gross receipts in 2023, benefiting from more DAU and higher revenue per user. The growth in gross receipts drove an increase in high-margin platform fees for us. Weixin mini games are the clear industry leader with mini games user retention rate and time spent per user notably higher than in peer services as a result of Weixin's platform stickiness, well-developed ecosystems such as social sharing and notification, and our game technology know-how.

Thirdly, Weixin Search now achieves over 100 million DAU, up over 20% year on year. And Weixin Search content QV grew over 30% year on year. Our search revenue grew multiple times year on year in 2023 as we ramped up monetization on these under-monetized assets. In addition, our fintech service provides a second set of examples of high-quality revenue streams.

We've spent many years building a solid base for fintech services in the form of our widely used payment services with our strict adherence to regulatory requirements and with careful risk management. In recent months, we completed a comprehensive self-inspection and corresponding ratification process, upgrading our operational compliance capability. We also strengthened our payment ecosystem by improving user security, refining mini program-based transaction tools, and enhancing cross-border payment experience. On top of this solid base, we're providing additional products and services in collaboration with licensed financial institutions, which generate high incremental margins as these revenues are recorded on a net fee basis.

In wealth management, we generate low take rate but high margin fee income from a large and growing pool of aggregated customer assets by offering customers high-quality products and superb convenience. The products are primarily low risk money market funds and, to a lesser extent, fixed-income mutual funds. In consumer loans, our partnership with WeBank and other licensed banks facilitate us distributing small-sized cash loans and installment payment services, and we kept the default rate low by applying stringent tech-enabled risk management procedures. For both wealth management and consumer loans, we offer substantially better economics for consumers, partners, and ourselves versus stand-alone fintech businesses as we reduce customer acquisition costs and credit charges.

Now, moving on to games. Our domestic game business revenue has been soft during 2023, but we expect it to improve from the second quarter of 2024. The reason for slow growth in 2023 was that our two biggest games, Honor of Kings and Peacekeeper Elite, have maintained their leading positions in terms of DAU, but monetization has temporarily stagnated, which caused us to take remedial actions. For Peacekeeper Elite, we identified the need for more creative monetization strategies and have revamped the leadership of its monetization team.

We look forward to the game delivering more innovative and engaging experiences that would also help monetization. We're optimistic that our new monetization team can deliver on this front given its sister product PUBG Mobile's team has already delivered a notable rebound in its monetization internationally. For Honor of Kings, our monetization activities have been overly concentrated within this Chinese New Year period in 2023. We're rolling out a more evenly distributed monetization strategy in the year of 2024, which we'd expect to benefit year-round revenue generation.

Looking beyond these two games, several of our recent releases have performed well in terms of DAU and are now converting that DAU success into monetization. Our number of major hit games in China increased from six in '22 to eight in '23. We define major hit games as games exceeding average quarterly DAU of 5 million for mobile and 2 million for PC and, at the same time, generating over 4 billion RMB annual gross receipts. We view these thresholds as indicative of a major and enduring hit.

And games surpassing such DAU and revenue thresholds will contribute to long-term stability and growth of our game portfolio. Having a large and expanding portfolio of major hits illustrates our ability in continually developing new major hits and in operating multiple, highly popular games at the same time. During the year, our new major titles are, one, Fight of the Golden Spatula. It has transitioned from a niche auto chess game to one of the most popular mobile games in the domestic market, ranking top 5 by DAU and total time spent.

Second, LoL Wild Rift, now also ranks among the top 5 mobile games by total time spent and gross receipts in China. We expect to keep adding major hits to our portfolio in the course of this year. We're looking forward to releasing several major new games, which should also contribute to improving revenue trends through 2024. DnF Mobile is a key title for us given the success and longevity of DnF PC and given a general scarcity of successful action games on mobile.

DnF Mobile has just completed a major closed beta test successfully. And given the positive results, we intend to launch the game in the second quarter of this year. Other high potential games in our portfolio for 2024 include Honor of Fight, Need for Speed Mobile, and One Piece Mobile. In 2023, we also made notable progress in core technologies, especially those involving AI, that will serve as our growth multiplier going forward.

After deploying leading-edge technologies such as the Mixture of Experts, MoE, architecture, our foundation model, Tencent Hunyuan, is now achieving top-tier Chinese language performance among large language models in China and the worldwide. The enhanced Hunyuan excels particularly in multi-turn conversations, logical inference, and numerical reasoning, areas which has been challenging for large language models. We've scaled the model up to the trillion-parameter mark, leveraging the MoE architecture to enhance performance and reduce inference costs, and we are rapidly improving the model's text-to-picture and text-to-video capabilities. We're increasingly integrating Hunyuan to provide copilot services for our enterprise SaaS products, including Tencent Meeting and Tencent Docs, and we are also developing new gen AI tools for effective content production internally.

More generally, deploying AI technology in our existing businesses have begun to deliver significant revenue benefits. This is most obvious in our advertising business, where our AI-powered ad tech platform is contributing to more accurate ad targeting, higher ad click-through rates, and thus faster advertising revenue growth rates. We're also seeing early stage business opportunities from providing AI services to Tencent Cloud customers. Finally, with this high-quality revenue growth model, we have the resources to keep investing in our businesses while, at the same time, returning more capital to our shareholders.

Historically, we have continually paid cash dividends to our shareholders and periodically repurchased shares at times when we believed our share price was undervalued, which is particularly true today. With our record-high and growing profit and cash flow, we propose to increase our upcoming cash dividend by 42% year on year to 3.4 Hong Kong dollars per share, and we intend to at least double our buyback activity year on year from 49 billion Hong Kong dollars in 2023 to at least 100 billion Hong Kong dollars in '24. We believe this commitment to return at least 132 billion Hong Kong dollars, or $16.9 billion, to shareholders during the year is well supported by our free cash flow, which was $24 billion for the full year of '23, along with our gross cash position of $57 billion and our investment portfolio of $126 billion. Now, with that, I will pass it to James to talk about business review.

James:

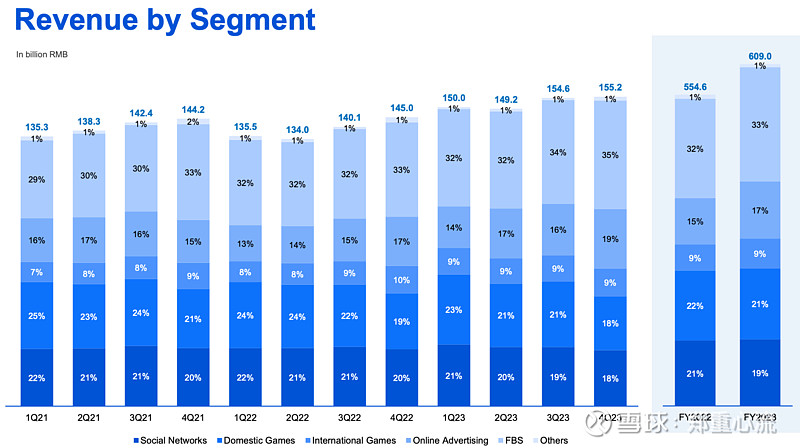

Thank you, Martin. For the fourth quarter of 2023, our total revenue was up 7% year on year. VAS represented 45% of our revenue, within which the social network segment was 18%, domestic games was 18%, and international games 9%. Online advertising was 19% of our revenue, and fintech and business services represented 35%.

The value-added services segment revenue was 69 billion renminbi in the fourth quarter, down 2% year on year. Social network revenue of 28 billion renminbi was also down 2% year on year. Revenue from music-related and game-related livestreaming services decreased, but revenue from the video account streaming service, music subscriptions, and mini games increased. Long-form subscription -- long-form video subscription revenue increased 1% year on year, driven by higher ARPU, while the video subscriptions declined slightly to 117 million.

Our self-commissioned drama series Blossoms Shanghai ranked first by video views across all online platforms in China year to date, extending Tencent Video's audience lead within the online video industry. Music subscription revenue increased 45% year on year on 21% growth in subscription count and 20% growth in ARPU. Domestic games revenue was down 3% year on year to 27 billion renminbi. Recently released PC games VALORANT and Lost Ark contributed to PC game revenue increasing, but were offset by decreased revenue from Honor of Kings and Peacekeeper Elite.

International games revenue increased 1% year on year in renminbi terms, or decreased in constant currency terms to 14 billion renminbi, as Supercell was repositioning some of its games. PUBG Mobile extended its revenue recovery, and VALORANT maintained solid growth. In aggregate, our domestic plus international game subsegments reported revenue was down 2% year on year, although game gross receipts were slightly up year on year. We expect our domestic and international game reported revenue to improve from the second quarter of 2024 onwards as revamps for big existing games such as Brawl Stars and Peacekeeper Elite have started to yield results and as we will be launching new games, including Dungeon and Fighter Mobile.

Moving to communications and social networks. For Weixin video accounts, on the content consumption side, time spent increased over 80% year on year in the fourth quarter, driven partly by DAU and mostly by time spent per user, benefiting from our enhanced content recommendation engine. On the content creation side, daily video uploads grew rapidly year by year. We provided targeted traffic support for creators in key categories such as knowledge-based content, lifestyle, and music, which contributed to a sharp increase in the number of creators with over 10,000 followers.

And with more followers and better livestreaming tools, the number of creators that directly generate revenue from their video accounts more than tripled year on year. For QQ, the number of active QQ channels grew at a double-digit rate quarter on quarter, and we launched a new version of QQ that features a refreshed user interface and enriched functionalities. Moving on to some domestic games highlights. The release of Set 10 drove Fight of the Golden Spatula to double its average DAU year on year in the fourth quarter to a new high.

Arena Breakout increased its gross receipts and average DAU, each by over 30% year on year, driven by a new competitive PvE mode, an upgraded Battle Pass, and more appealing virtual items. And Arena Breakout is now the seventh biggest mobile game in China by total time spent. Naruto Mobile, an eight-year-old game developed by our MoreFun Studio, achieved record-high gross receipts and average DAU in January, benefiting from extensive content updates. We view the success of Naruto as a positive leading indicator for our upcoming One Piece game, also from MoreFun.

We launched our party game Dream Stars in December. Party games aggregate a range of game modes, and we're still building out the number and variety of Dream Stars game modes to compete with the game modes featured in incumbent party games, as well as releasing tools for players to create their own game modes. We view party games as a genre that will require sustained effort over a long period, but we're encouraged that Dream Stars ranked among the top 10 mobile games in China by DAU during the Chinese New Year, and we believe that Dream Stars is already the industry leader in party games measured by DAU within certain game modes such as social deduction and tower defense. Among our international games, PUBG Mobile increased its DAU and gross receipts year on year in the fourth quarter, benefiting from the introduction of the Frozen Kingdom theme mode and an innovative top-tier outfit with upgradeable weapons.

NIKKE released a new storyline and new characters. And encouragingly, NIKKE's average DAU reached a 2023 year-high level in the fourth quarter. Supercell's five-year-old game Brawl Stars achieved record-high gross receipts and DAU in February 2024 due to enhancements to its friend invitation system, the introduction of a new 5v5 game mode, and a complete redesign of its Battle Pass. Brawl Stars' resurgence demonstrates the latent franchise value of our evergreen titles and their potential to unleash new growth.

Moving to online advertising. Our ad revenue was 30 billion renminbi in the fourth quarter, up 21% year on year, benefiting from upgrades to our ad tech platform and more advertising revenue in video accounts. We generated increased ad revenue from all major categories except automotive, with notable step-ups in revenue from internet services, healthcare, and consumer goods categories. We refined our ad targeting by utilizing more real-time data in the AI powering our ad tech, enabling us to match target users with more relevant ads in a more timely manner across both our own and our ad network properties.

Our video accounts ad revenue more than doubled year on year despite maintaining a very low ad load due to increased video views and upgraded ad targeting. Weixin Search increased its revenues severalfold year on year in the quarter on growth in commercial queries and RPM. Summarizing fintech and business services. Segment revenue is 54 billion renminbi in the fourth quarter, up 15% year on year.

Fintech services revenues sustained a teens year-on-year growth rate on increased commercial payment volume, wealth management fees, and consumer loan fees. Gross profit grew faster than revenue due to a shift from social to commercial payments. Within commercial payments, daily active users and transactions per user both increased. We enhanced mini program-based, QR code, and palm payment solutions, helping offline merchants boost repeat sales.

For business services, revenue grew around 20% year on year in the fourth quarter, benefiting from higher cloud spending by industries such as retail and finance and increased technology service fees on video accounts e-commerce transactions. Business services gross profit more than quadrupled year on year due to those technology service fees, as well as supply chain optimization initiatives. Among our enterprise software as a service products, we deployed AI for real-time content comprehension in Tencent Meeting, deployed AI prompt-based document generation in Tencent Docs, and rolled out a paid customer acquisition tool for WeCom. We deepened our enterprise SaaS penetration among domestic companies such as Vivo, as well as multinationals such as Novo Nordisk.

As a result, our enterprise software revenue from WeCom, Tencent Meetings, and Tencent Docs together more than doubled year on year. And I'll now pass it to John.

John:Thank you, James. Hello, everyone. For Quarter 4 2023 and full year 2023, we have reclassified interest income from above to below the operating profit line. Additionally, investment-related gains and losses and donations both previously included in other gains or losses net above the operating line are now combined as net gains or losses from investment and others and presented below the operating profit line.

The reclassification aims to better reflect the results of day-to-day operations. Comparative figures have also been restated. For fourth quarter 2023, total revenue was 155.2 billion renminbi, up 7% year on year. Gross profit was 77.6 billion renminbi, up 25% year on year.

Operating profit was 41.4 billion renminbi, up 42% year on year. Net losses from investments and others were 6.7 billion renminbi, primarily reflecting impairment provisions against certain investees. Interest income was 3.9 billion renminbi, up 52% year on year, driven by growth in cash reserves and improved use on term deposits. Finance costs were 3.5 billion renminbi, down 3% year on year, due to reduced forex losses, partially offset by higher interest expenses.

Share of profit of associates and JVs was 2.4 billion renminbi, versus loss of 1.6 billion renminbi in the same period last year. On a non-IFRS basis, share of profit increased to 4.5 billion renminbi, up from a profit of 3.1 billion renminbi last year, driven by better profitability of certain domestic associates and the successful game released by an overseas studio investee. Income tax expense rose by 111% year on year to 9.7 billion renminbi, driven by operating profit growth and increased withholding tax provision. IFRS net profit attributable to equity holders was 27 billion renminbi, down 75% year on year, primarily due to the 106.6 billion renminbi gained from the disposal of Meituan recognized in the same quarter last year.

Diluted EPS was 2.807 renminbi, down 74% year on year. Now, I'll share our non-IFRS financial figures. For Quarter 4, operating profit was 49.1 billion renminbi, up 35% year on year. Net profit attributable to equity holders was 42.7 billion renminbi, up 44% year on year.

Diluted EPS was 4.443 renminbi, up 46% year on year. Moving on to gross margins. For Quater 4, overall gross margin was 50%, up 7.4 percentage points year on year. And by segment, gross margin for value-added services was 53.7%, up 3.9 percentage points year on year.

This was due to higher mix of high-margin mini games platform service fee and reduced contribution from low-margin music- and games-related livestreaming revenue, along with our cost control measures. Gross margin for online advertising increased to 56.8%, up 12.6 percentage points year on year. As Martin highlighted, our high-quality revenue streams, particularly video accounts ad revenue generated from our own traffic with platform costs already paid for, contributed to our incremental margins. Our efficiency efforts also led to margin improvement.

Gross margin for fintech and business services was 43.9%, up 10.3 percentage points year on year. This was driven by margin enhancement following cloud business restructuring, emerging high-quality revenues, including video accounts e-commerce technology service fee, structural shift toward high-margin products within fintech services, and our efficiency initiatives. For Quarter 4 operating expenses, selling and marketing expenses were 11 billion renminbi, up 79% year on year against the low base last year, driven by more spending on promotion advertising to support new content release. It represented 7.1% of revenues.

R&D expenses were 16.4 billion renminbi, up 3% year on year. G&A expenses, excluding R&D, were 10.8 billion renminbi, down 6% year on year due to lower staff force and optimized operating lease expenses. At quarter-end, we had approximately 105,000 employees, down 3% year on year or partly stable quarter on quarter. Let's look at our operating and net margin ratios.

For fourth quarter 2023, non-IFRS operating margin was 31.7%, up 6.6 percentage points year on year. Non-IFRS net margin was 28.2%, up 7.1 percentage points year on year. Next, I will highlight some key cash flow and balance sheet metrics. For Quarter 4, total capex was 7.5 billion renminbi, up 33% year on year.

Within total capex, operating capex was 6.7 billion renminbi, more than tripled year on year, driven by increased investment in GPUs and servers. Nonoperating capex decreased by 78% year on year to 0.8 billion renminbi. Free cash flow was 34.2 billion renminbi for Quarter 4, up 48% year on year. For full year 2023, as highlighted by Martin, our free cash flow was $24 billion, or 167 billion renminbi, up 89% year on year.

Net cash position was 54.7 billion renminbi, up 50% quarter on quarter, reflecting strong free cash flow generation, partly offset by cash outflows for share repurchases and strategic investments. To conclude, I'll discuss our share repurchase and annual dividend. For the full year of 2023, we repurchased 152 million shares with a total consideration of 49 billion Hong Kong dollars. As a result, our total issued shares after accounting for employee share options and award issuance decreased by 0.9% year on year as of the end of 2023.

The weighted average number of shares for calculating our 2023 diluted EPS also decreased by 0.9% year on year. Subject to the shareholders' approval at the upcoming 2024 AGM, we are proposing an annual dividend of 3.4 Hong Kong dollars per share, reflecting a 42% increase from the previous year. This dividend will be payable to shareholders on the 31st of May 2024. Thank you.$腾讯控股(00700)$