财报回顾

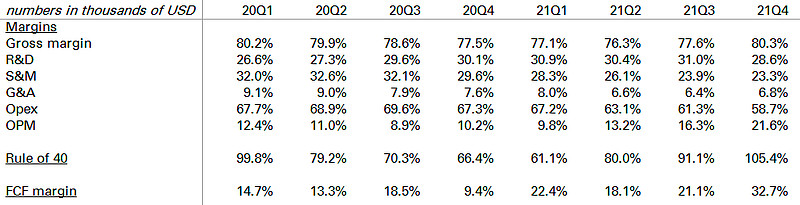

收入增速加速到了83.7% yoy。虽然这部分是由于20Q4增速‘放缓’导致的,但20.6% qoq的增长还是表明了Datadog的出色表现。

Outlook方面,Datadog预计Q1收入336m,+3.2% qoq, +69.5% yoy。全年收入1520m,+47.7%。大幅超过sell side consensus的30%+增长。

除了top-line,财务杠杆和现金流情况也是令人满意——我前不久还向喜欢Adobe, Salesforce等‘传统SaaS’投资人吐槽,Rule of 40已经过时了,现在是Rule of 100的时代。

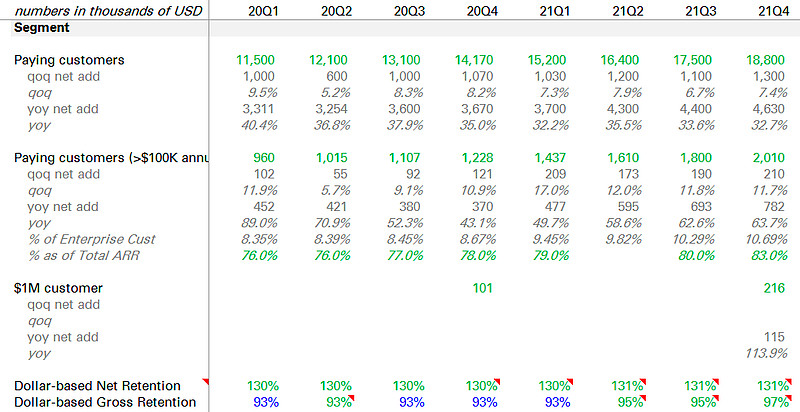

其他运营指标方面:

客户环比新增1300,近期新高;大客户环比增长210;

DBNER继续维持130%+

公司似乎暗示churn rate改善到低单位数

产品mix继续改善,使用2/4/6件产品的客户从一年前的72%/22%/3%提升到78%/43%/10%

电话会议里部分有意思的点

本季公司提到 record new logo ARR,再结合客户环比增长数量略高于过去,我觉得应该是反映了公司landing bigger,在企业市场的销售比较顺利。

公司给了很多关于product mix的data point,有心人可以结合analyst day数据拼凑一下Datadog 产品线的情况:目前最早的业务infrastructure yoy处于重新加速状态,Observability‘三大支柱’的APM和Log仍然是高速增长阶段。除此之外的新产品线本年新增了超过1亿的ARR。

本季代表性的新客户:

1)与美国某航空公司的6年合约,该公司使用6件产品,将DDOG作为de facto monitoring solution for all new IT projects and applications。(land bigger + 开始吃其他厂商份额)

2)某欧洲汽车厂商增加采购至百万级,该公司开始整合目前使用的5种monitoring方案。 (Observability市场开始进入整合阶段。)

3)千万级ARR的up-sell,某financial infrastructure公司也是‘consolidating multiple monitoring tools on DDOG’,使用10种产品,并且Cloud security,Cloud Workload Security,CSPM。(Datadog在DevSecOps领域开始发力)

4)一笔数百万级别的land,客户是全球媒体公司,替换客户此前使用的开源方案。

从这些新客户案例,以及Q&A里可以看出,Datadog目前是在与其他厂商以及开源方案的竞争中有不错的态势。

思考

在Datadog发布财报前,竞争对手$Dynatrace(DT)$ $New Relic(NEWR)$ 都发布了不那么令人印象深刻的财报,而Datadog的财报则进一步证明了该公司是Observability市场的something different。

当然,作为投资人肯定忍不住思考,‘Datadog还能走多远?’,对于市场空间的担忧我想可以被Q&A中管理层这段话很好的安抚下。

We mostly compete against customers building it themselves or being on the tool and starting in the cloud without idea what's going on. We do see a few big replacements in every quarter.

这也是我所认知的Datadog,monitoring并不是什么新鲜的发明,但是对于新的应用——serverless,container却有大量的空白等着比较有创新精神的选手们去填充。

其实DDOG这么优秀的财报确实没啥好分析的。我觉得最有意思的还是Q&A里的这段对话。

Kash Rangan from Goldman Sachs

Got it. And second and final one, thank you so much for that. As you look at the consumption model, when trends are improving, obviously, those revenue outcomes can be as impressive as the ones that you have. As you've become a larger company, are you contemplating things to minimize the volatility of these results and have a little bit more predictability on the other positive side? And that would mean like a snowflake gives concessions to its customers as they keep making technology improvements, they pass back some of these savings to alleviate any potential pushback as you become a more strategic vendor? Oh my god, I'm spending those so much. It is of great value, but at the same time, can you elaborate a little bit on how you can think ahead and anticipate some of the things that can get underway? That's it for me, thank you so much and congrats.

Olivier Pomel

Yes. So, the way we deal with that is – and again, the backdrop there is the explosion of data volumes. So, if data volume at our customers grow a lot faster than the top line, at some point, you can't grow what you charge for that linearly with the data volume. The way we deal with that is, we give them more and more options. And those options are differentiated technologically at least so that we can keep developing new ways of storing the data, different types of data in different ways for different periods of time and let customers choose what they want to use out of that.

So that's what we're doing with Online Archives, for example, which is – which we announced last year and which is going great this year. That's also why we invested in – we're investing in the ability pipeline. So, there's a number of things we're doing to help put customers in control and make sure that what we deliver always, always aligns with the – what we charge always aligns with the value customers get.

众所周知DDOG是一个consumption-based pricing model,因此在特定阶段可以认为DDOG的增速应该 = 云增长 + Observability工具渗透率提升 。而基本的云市场增长某种程度上又是不断爆发的数据量相关,因此看上去DDOG已经找到了躺赢的模式。(SNOW同理)

当然,没有什么商业模式能/应该一成不变躺着收钱。至少DDOG给出的结局方案是不断给予客户更多选择,并顺应其需求提供更新的产品——我自己非常认可这一项。这也是我觉得现阶段研究SaaS,跟踪公司的product blog比做financial model有alpha得多的原因。