PDD这家公司,我最初听到是2017年在tencent工作期间。当时估值100亿美金,增速很快,估值倍数也并不高。因为其主要业务都是在微信生态中完成的,所以希望腾讯能够进行投资。自从那时开始,我持续观察这家公司的战略执行,如果把他称为中国互联网最有持续战斗力的公司一点都不为过。我亲身经历这家公司从主要在微信中获客,到建立独立APP流量入口,到做大DAU,IPO以及IPO之后处理PR危机(来自阿里的恶意攻击),到百亿补贴让用户相信上面是有真品的,到后来做多多买菜,到temu出海并成为出海电商目前最重要的玩家。这家公司的战略执行绝对是传奇。这家2015年成立,2018年公司目前已经超过Alibaba成为中国最值钱的电商公司(1900亿美金市值,一年预计200亿美金利润),但其员工仅有alibaba的1/10。我在做管理过程中,从这家公司学习了很多管理技巧,更加深刻的理解了为什么它能够成功。腾讯目前拥有这家公司17%的股权 = 323亿美金,这笔投资也是腾讯最赚钱的投资。

中国的电商格局:

在中国电商已经有alibaba(市值1800亿美金,公司层面运营利润160亿美金(电商230亿美金运营利润,其他业务亏钱,GMV1.1万亿美金,年增速3%),PDD(市值1900亿美金,运营利润170亿美金,GMV7000亿美金,年增速15%);JD(市值400亿美金,40亿美金运营利润,GMV5000亿美金,年增速0%),抖音电商(GMV5000亿美金,年增速30%,100亿美金运营利润),快手电商(GMV1500亿美金,年增速30%),VIPS (350亿美金GMV,年增速15%,72亿美金市值,16亿美金)。总计,中国电商一年的交易金额是3万亿美金,占中国社会零售总额6.5万亿美金的接近一半,年增速10%。同时产生总计约600亿美金的电商运营利润 =2%的GMV。从以上数字,我们可以看到几个现象:1)电商整体P/E估值不到10x,因为每家电商公司都有很多现金在手上,并且开始了股票回购。这样的估值是非常低了,比起amazon 50x PE,walmart 30x PE,Costco 40x PE。2)看起来市场上有很多电商公司,但每家其实都有各自的特色,和基本的用户盘。例如,阿里是大而全,直播电商、品牌电商、白牌电商都有。抖音快手着重直播电商,拼多多自白牌电商起家,不断进入中小品牌市场。VIPS是尾货电商。虽然看似竞争激烈,2%GMV成为运营利润其实和全世界其他国家的电商水平一致,也侧面证明中国电商的各玩家都有自己的壁垒,竞争格局相对稳定。3)宏观上,长期最好的点上赛道是,消费降级带来的性价比消费和电商出海。而PDD在这两个赛道都有极强的优势,这两边的发展互为补充。

PDD公司的情况:

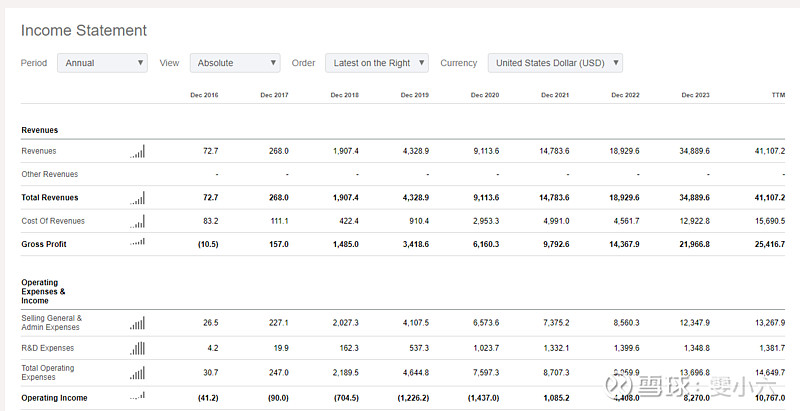

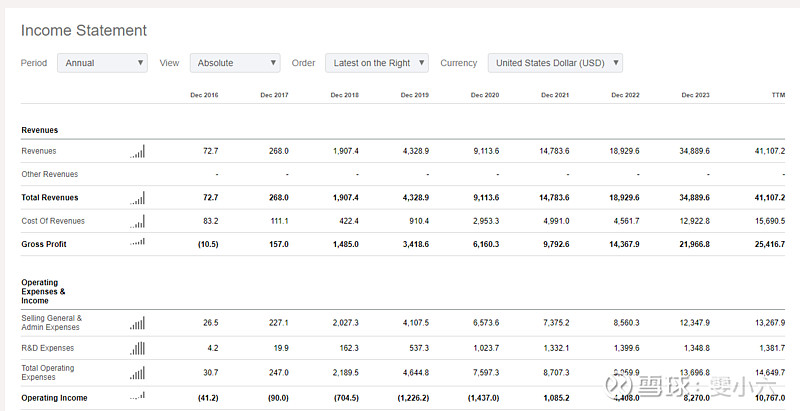

拼多多上市时股价20USD,2年左右市值涨到200USD,后续跌到50USD(我在这个位置买入了~30%的仓位),目前股价135USD(占我接近70%的仓位)。而过去3年PDD的财务表现极为亮眼:收入从2020年的90亿美金增长至Trailing 12 month的400亿美金。运营利润从2020年亏损14亿美金,至trailing 12 month的110亿美金,今年预计达到170亿美金(Q1 是电商淡季,24年Q1有36亿美金运营利润)

我2022年的投资逻辑是:

1)在当时PDD的GMV只有alibaba的40%,但其APP DAU和阿里巴巴一致,总下单次数甚至超过阿里巴巴,成为了中国的人下单最多的电商平台(因为其平均下单价值不到阿里巴巴的40%)。所以我得出一个结论拼多多已经是中国用户mind share最大的电商平台。

2)在21年时,PDD的take rate只有1.5%,而目前超过5%。也就是每卖一单时,PDD平台的抽佣上涨至3x。这有个trigger point是PDD在2021年做了全站推广,即当商户输入有的货物数量和可以接受的售卖价格后,平台可以自动算出平台可以卖出多少货,以及平台需要的抽佣率。这完全不同于之前的电商广告模式,这是算法技术的巨大进步,不仅仅能在全站的所有广告位自动寻找所有SKU产品的投放最优解,还能极度简化商户的投放复杂度,让工厂制造商直接上平台来售卖货物,减少了中间商赚差价的空间,将货物成本打至最低。

3)相比其他电商平台,PDD的商户多以没有品牌的商务为主,这意味着平台享有极大的溢价权力。那时,天猫平台上很多大牌是不给佣金的,所以阿里5%的佣金是靠60%的商户给8%的佣金,而另外40%的商户不给佣金完成的。但是因为PDD的商户以白牌为主,几乎100%的商户都可以抽佣,这意味着更大的税基。当平台提高抽佣率时,对收入的增长极为明显。

4)在2022年时PDD仅有7000员工,而阿里有十几万员工。PDD的运营效率是全行业最高,甚至让人觉得他做的不是传统的电商生意,而是一个更加高科技的生意。所以当收入增长后,其利润弹性会非常大。

5)2023年开始PDD开始推出海外版temu并开始大规模获客,因为1)PDD已经掌握了国内最有性价比的商户的货源,2)PDD历史上的管理水平是中国最好的公司之一,3)海外通货膨胀率很高,底层人民生活水平在过去几十年并未有明显提高。使得全世界需要中国的便宜货。同时,像出海电商Shein、Aliexpress、shopee 都取得了较大规模和较快增速。这为PDD的增长提供了第二曲线,这些在2022年时尚未被计算在股价之中。

我为什么现在还持有PDD的股票,并且保持很高的仓位?

1)10x PE, 1900亿美金市值,300亿美金净现金,运营利润预计超过170亿美金。

2)来自通缩的帮助,国内预期有15%-20%的年增长。并且我自己深入研究过PDD平台的运营逻辑,这是一种极致的性价比逻辑,在所有层面都不断的选出最具性价比的产品推给消费者,最大化下单数量。这能不断增加pdd的用户心智份额。

3)海外属于很早阶段,整个赛道很大。Amazon 有8000亿美金,其中3P GMV 中的70% 的部分产地时中国。Amazon是个全世界的京东,强调快速送货,优质服务。但问题是1)品类不齐全。2)价格不是最具性价比的。而全世界范围内,temu、shopee、shein、aliexpress多家跨境电商的GMV 分为别为500亿美元、800亿美金、300亿美金、700伊亿美金,并且享有平均30%的行业增速。

4)PDD的海外业务和国内业务,逻辑相同。就是极致的选货送货,极致价格力。当PDD海外业务快速增长时,他将享有对国内供货商更强的议价权,让他做这个生意时更容易赚钱。

5)PDD的管理战斗力真的很强,在过去几乎没有犯过错误。我对其团队有很强的信心,认为他们能成为出海电商的第一名,并且占有较大市场份额和更大的利润份额。

关于temu,我还不是很熟悉,头脑中的问题包括,1)未来temu如何扩展业务模式 --> 半托管 2)物流怎么办?毕竟国外没有很强的物流系统。--> Amazon强在前置仓。3)shopee是怎么崛起的,shopee只在东南亚&巴西,因为控货能力不强,无法进入其他国家。4)在东南亚、南美洲、欧洲的竞争格局又会是如何?但有几个thesis是valid的:1)amazon 3p 70%是中国货,pdd控中国货最有优势。2)全世界哪个国家都有穷人,有穷人就有temu存在的价值。3)中国的social推广和其他模式还是在全球电商领域比较先进的。以上1、2、3是全球所有国家都适用的原因。

风险有两个

1)美国大选的不确定性,如果特朗普上台可能会对中国产的货物增加更多关税。但是我不太担忧这个事,因为a)美国目前占temu的总盘子的35%,b)征收关税到中国这些便宜白牌商户对美国来说投入产出比很低,美国底层人民不会高兴,对组织中国的制造业升级有没有任何帮助。

2)阿里巴巴在过去一年多有明显的运营管理提升,如果阿里的竞争加剧可能会伤及pdd在国内的基本盘。目前我也不太担忧这个问题。我观察阿里的APP,其内部斗争明显减少,但是其运营逻辑缺没有变化,仍然是最大化GMV和收入的运营策略。如果阿里巴巴要学习PDD,他必须改变这个逻辑,以产品的价格力作为核心指标,这可能意味着短期降低公司的收入和利润。同时,阿里巴巴也受到抖音、快手、京东等多方的竞争压力。让其很难全心和拼多多竞争。目前观察其不太会对pdd国内产生影响。

Company Overview: Pinduoduo

I first heard about Pinduoduo (PDD) in 2017 while working at Tencent. At that time, the company was valued at $10 billion and was experiencing rapid growth, yet its valuation multiples were not high. Its main business was conducted within the WeChat ecosystem, prompting interest in investment from Tencent. Since then, I have been closely monitoring PDD's strategic execution. Describing it as one of the most enduringly competitive companies in China's internet sector is no exaggeration. I have witnessed firsthand its growth from initially acquiring customers primarily through WeChat to establishing an independent APP as a traffic portal, expanding its daily active users, navigating its IPO, handling PR crises (including hostile actions from Alibaba), convincing customers of the authenticity of its products through billion-yuan subsidies, and expanding into grocery with Duoduo Grocery. Furthermore, its international expansion through Temu has positioned it as a key player in the global e-commerce market. Indeed, Pinduoduo's strategic execution is legendary. Founded in 2015, by 2023, it surpassed Alibaba to become China's most valuable e-commerce company, with a market value of $190 billion and an anticipated annual profit of $17-20 billion, yet its workforce is only a tenth of Alibaba's size. During my tenure in management, I learned numerous management techniques from Pinduoduo, gaining a deeper understanding of its success factors. Tencent currently holds a 17% stake in the company, valued at $32.3 billion, making it one of Tencent's most profitable investments.

Chinese E-commerce Landscape:

In China, the e-commerce sector includes Alibaba (market value of $180 billion, corporate-level operating profit of $16 billion derived from $23 billion in e-commerce and losses in other areas, with a GMV of $1.1 trillion and an annual growth rate of 3%), PDD (market value of $190 billion, operating profit of $17 billion, GMV of $700 billion, and an annual growth rate of 15%), JD.com (market value of $40 billion, operating profit of $4 billion, GMV of $500 billion, and a growth rate of 0%), Douyin e-commerce (GMV of $500 billion, annual growth rate of 30%, operating profit of $10 billion), Kuaishou e-commerce (GMV of $150 billion, annual growth rate of 30%), and VIPS (GMV of $35 billion, annual growth rate of 15%, market value of $7.2 billion, operating profit of $1.6 billion). Collectively, China's e-commerce transactions amount to approximately $3 trillion annually, nearly half of the country's total retail sales of $6.5 trillion, with an overall growth rate of 8-10%. This generates about $60 billion in e-commerce operating profits, accounting for 2% of GMV. From these figures, several phenomena are evident:

1)The P/E valuation of the sector is under 10x with substantial cash reserves, significantly lower compared to Amazon's 50x, Walmart's 30x, and Costco's 40x.

2)Although the market features several e-commerce players, each has its unique characteristics and core customer base. For instance, Alibaba offers a comprehensive range of services, Douyin and Kuaishou focus on livestream e-commerce, PDD started with non-branded products and has since expanded into the mid-market brand segment, and VIPS specializes in off-season goods. Despite intense competition, the profit margin from GMV aligning with global e-commerce standards indicates well-established market positions for these players, suggesting a relatively stable competitive landscape.

3)Strategically, the best long-term opportunities lie in cost-effective consumption driven by economic downgrading and international e-commerce expansion, areas where PDD holds significant advantages, with developments in one complementing the other.

PDD's Financial Performance:

Pinduoduo's stock debuted at $20 USD and reached a high of $200 USD within about two years. Subsequent fluctuations saw it drop to $50 USD, where I purchased approximately 30% of my holdings. Currently, the stock price stands at $135 USD, accounting for nearly 65% of my portfolio. Over the past three years, PDD's financial performance has been particularly strong: revenue grew from $9 billion in 2020 to a trailing 12-month figure of $40 billion. Operating profit turned from a loss of $1.4 billion in 2020 to $11 billion in the trailing 12 months, with an expected profit of $17-20 billion this year (Q1, typically a slow season for e-commerce, saw $3.6 billion in operating profits).

My 2022 Investment Rationale was as follows:

At the time, PDD's GMV was only 40% of Alibaba's, but its app's Daily Active Users (DAU) matched Alibaba's, and its total number of orders even surpassed Alibaba, making it the most frequently used e-commerce platform in China (given its average order value was less than 40% of Alibaba's). Thus, I concluded that Pinduoduo had become the e-commerce platform with the largest mind share among Chinese users.

In 2021, PDD's take rate was only 1.5%, which has now increased to over 5%. This means that for every sale, PDD's commission has tripled. A trigger point was in 2021 when PDD implemented a site-wide promotion algorithm, allowing the platform to automatically calculate how much inventory merchants could sell and the necessary commission rates based on their input of available stock and acceptable selling prices. This approach, distinct from traditional e-commerce advertising models, represents a significant advancement in algorithmic technology. It not only automates optimal ad placements across all SKU products but also simplifies merchants selling experience, enabling manufacturers to sell directly on the platform, reducing the middlemen's markup, and minimizing the cost of goods.

Compared to other e-commerce platforms, most of PDD's merchants are non-branded, which means the platform enjoys significant pricing power. At that time, many big brands on the Tmall platform did not pay commissions, resulting in Alibaba's 5% commission being primarily derived from 60% of merchants paying an 8% rate, while the remaining 40% did not contribute. However, since PDD's merchants primarily offer generic products, nearly 100% are subject to commissions, meaning a larger taxable base. When the platform increases its commission rates, the impact on revenue growth is significant.

In 2022, PDD had only 7,000 employees compared to Alibaba's workforce of over a hundred thousand. PDD's operational efficiency is the highest in the industry, suggesting that its business is more high-tech than traditional e-commerce. Therefore, with revenue growth, its profit elasticity is expected to be substantial.

From 2023, PDD began aggressively expanding its international version, Temu, due to (1) having access to the most cost-effective domestic suppliers, (2) historically being among the best-managed companies in China, and (3) high inflation rates overseas where the standard of living for the lower economic classes has not significantly improved over decades. This necessitates a demand for affordable goods from China worldwide. Similar international e-commerce platforms like Shein, Aliexpress, and Shopee have achieved significant scale and growth rates. This provides a second growth curve for PDD, which was not yet reflected in the stock price in 2022.

Why I Still Hold PDD Stock and Maintain a High Position:

With a PE ratio of 10x, a market value of $190 billion, and net cash of $30+ billion, operating profits are expected to exceed $17 billion.

Supported by deflation, domestic growth is expected at 15%-20% annually. I have thoroughly researched PDD's operational logic, which is based on continuously selecting the most cost-effective products for consumers, maximizing order numbers, and thereby increasing PDD's share of consumer mindshare.

Internationally, it is still early days, but the market is vast. Amazon has a $800 billion GMV, 70% of which originates from China. Unlike Amazon, which emphasizes quick delivery and quality service, PDD and other international platforms like Temu, Shopee, Shein, and Aliexpress, which have GMVs of $50 billion, $80 billion, $30 billion, and $70 billion respectively, offer more competitive prices and enjoy an average industry growth rate of 30%.

PDD's overseas business operates under the same logic as its domestic operations—extreme product selection and pricing efficiency. As PDD's international business grows rapidly, it will gain stronger bargaining power with domestic suppliers, making the business more profitable.

PDD's management capabilities are exceptionally strong, having made virtually no missteps in the past. I have great confidence in its team and believe they can become a leading player in international e-commerce, capturing significant market share and profit margins.

Risks Include:

Uncertainty due to the U.S. elections; a potential Trump presidency could lead to increased tariffs on Chinese goods. However, I am not overly concerned because (a) the U.S. currently accounts for 35% of Temu's total business, and (b) imposing tariffs on these inexpensive generic Chinese goods would yield a low return on investment for the U.S., not pleasing the American working class and not aiding in upgrading China's manufacturing sector.

Alibaba has shown significant operational improvements over the past year. If Alibaba intensifies competition, it could potentially impact PDD's domestic base. Currently, I am not overly concerned. Observations suggest that while internal strife within Alibaba has decreased, its operational logic remains unchanged, still focused on maximizing GMV and revenue. For Alibaba to compete effectively with PDD, it would need to shift this focus, potentially leading to short-term reductions in revenue and profit. Moreover, Alibaba faces competitive pressures from Douyin, Kuaishou, and JD.com, making it challenging for them to fully concentrate on competing with PDD.