我选择Berkshire股东会发言开始精进学习,是因为相比巴菲特致股东信,股东会发言阅读感更佳,更像老师谆谆教诲、娓娓道来。每篇结构:1. 原文(从CNBC Warren Buffett Archive下载,编号由其提供);2. 翻译和学习;3. 拍照打卡。为鼓励大家共同学习,欢迎大家拍照、跟帖并转发,在我次日发帖时,前日跟帖拍照打卡获点赞最多的小伙伴,将得到10元红包学习奖。

一、原文

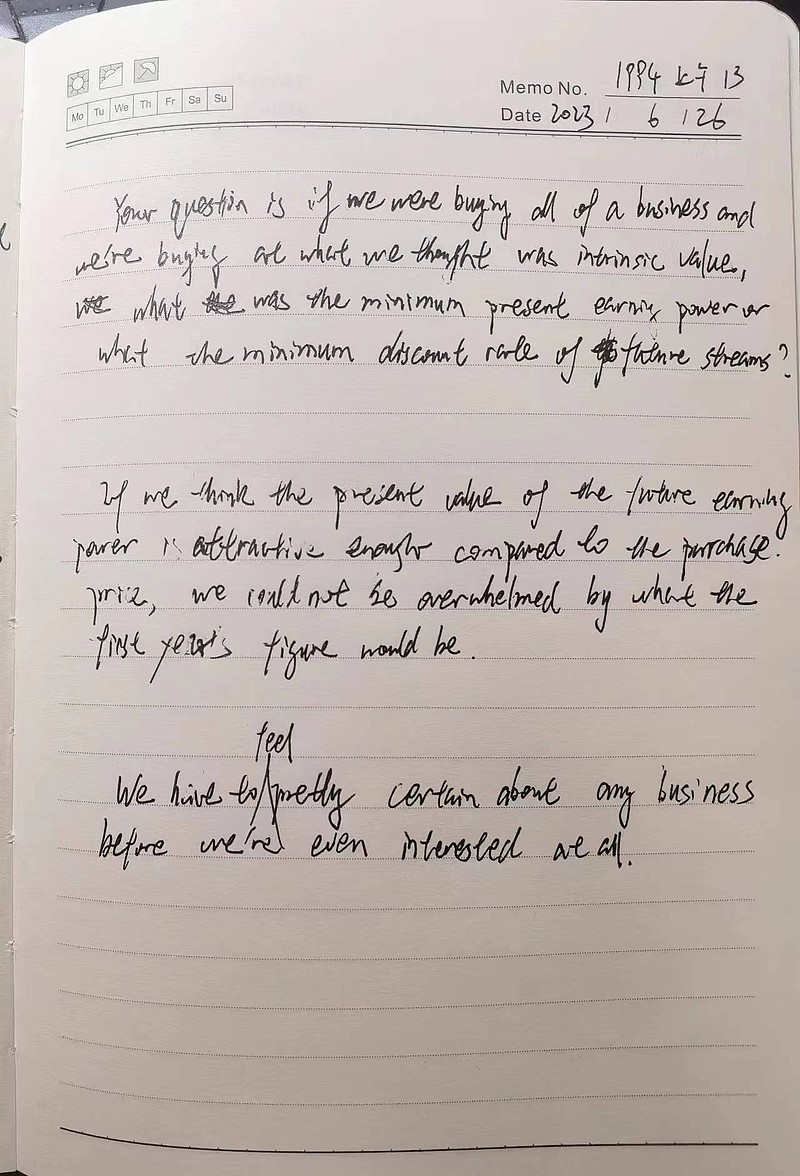

1994 上午场 13. Unlikely we’d buy company with no current cash flow

WARREN BUFFETT: Zone 3.

AUDIENCE MEMBER: Good morning. My name is Howard Bask (PH) and I’m from Kansas City. And I’ve got a theoretical value question for you.

If you were to buy a business and you bought it at its intrinsic value, what’s the minimum after-tax free cash flow yield you’d need to get?

WARREN BUFFETT: Well, your question is if we were buying all of a business and we’re buying at what we thought was intrinsic value, what was the minimum —

AUDIENCE MEMBER: Correct.

WARREN BUFFETT: — present earning power or what the present — the minimum discount rate of future streams?

AUDIENCE MEMBER: No, what’s the minimum current after-tax free cash flow yield you’d…

WARREN BUFFETT: We could conceivably buy a business — I don’t think we would be likely to — but we could we could conceivably buy a business that had no current after-tax cash flow. But, we would have to think it had a tremendous future.

But we would not find — obviously the current figures, particularly in the kind of businesses we buy, tend to be representative, we think, of what’s going to happen in the future.

But that would not necessarily have to be the case. You can argue, for example, in buying stocks, we bought GEICO at a time when it was losing significant money. We didn’t expect it to continue to lose significant money.

But if we think the present value of the future earning power is attractive enough compared to the purchase price, we would not be overwhelmed by what the first year’s figure would be.

Charlie, you want to add to that?

CHARLIE MUNGER: Yeah. We don’t care what we report in the first year or two of — after buying anything.

AUDIENCE MEMBER OFF MIC: (INAUDIBLE) on average over the years (INAUDIBLE).

WARREN BUFFETT: Well, I would say that in a world of 7 percent long-term bond rates that we would certainly want to think we were discounting future after-tax streams of cash at at least a 10 percent rate.

But that will depend on the certainty we feel about the business. The more certain we feel about a business, the closer we are willing to play it.

We have to feel pretty certain about any business before we’re even interested at all. But there are still degrees of certainty, and —

If we thought we were getting a stream of cash over the next 30 years that we felt extremely certain about, we would use a discount rate that would be somewhat less than if it was one where we thought we might get some surprises in five or 10 years — possibility existed. Charlie?

CHARLIE MUNGER: Nothing to add.

二、翻译和学习

这个问题很有趣,既然买股票就是买公司,要求从买资产的角度来看待股票投资,那么你买的资产(并恰好就是以资产内在价值的价格买入的)在当下应当达到什么样的产出回报呢?

但是巴神重复它的问题更有趣:your question is if we were buying all of a business and we’re buying at what we thought was intrinsic value, what was the minimum (尽管此处被打断,但巴神继续说)present earning power or what the minimum discount rate of future streams?

而巴神的回答也让我惊掉下巴:我们可能(虽然不乐于)买进当下没有产出的资产,但它得有光明的未来。这听起来很像是炒概念的人士的话啊。

不过巴神通过一个例子,立刻让我修正了误解。“我们买盖可的时候,盖可可是在亏钱;但我们认为它将来不会亏”。“如果买入价格和未来价值相比有吸引力,那么即使第一年没有什么产出我也会买这个资产。”

这就是说,买股票是买未来的现金流折现;而不是过去或当下,或买入后的第一年乃至第二年的回报。

从巴神的问题重复和回答来看,他把思考方式拉回了他的DCF模式。芒格在很多场合都插科打诨说没见巴神计算过,但在没有芒格插科打诨的演讲里(对巴黎圣母学院学生的座谈),巴神详细说过自己的计算思维。所以,其实我挺讨厌芒格插巴神话的。

巴神举了个量化的例子:如果当下的长期国债利率是7%,我们会考虑用10%的折现率来考虑生意未来产出的折现。小伍哥认为用价格安全边际反过来理解更容易——7%的利率对应15PE,10%折现率对应10PE,所以巴神要求价格方面打七折。七毛买一块,相当符合价投人士的买入标准。

当然,巴神也说到,如果生意的长期确定性很强,那么折扣可以不要求那么高。这里强调的是长期确定性,巴神的例子是 30年vs.5-10年。。。。。。。

我觉得唐朝的三大前提估值法,深得巴神精髓,而且操作起来更直观。

然后巴神还提到一个先后问题:先确认自己懂这生意,才考虑是不是有兴趣往下看。这个先后很牛B啊,能把大量的公司排除掉,比如说高科技、医疗。。。。我们很多人是不管三七二十一就上来看。

三、拍照打卡