主要内容:

1. 2019.12.2---2019.12.6 回顾

2. 重要财报日历,来源:Earnings Whispers

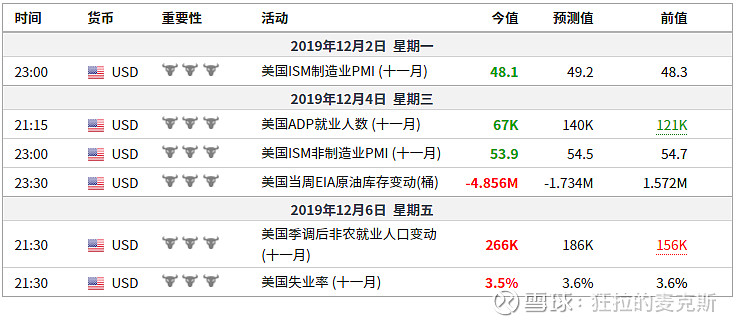

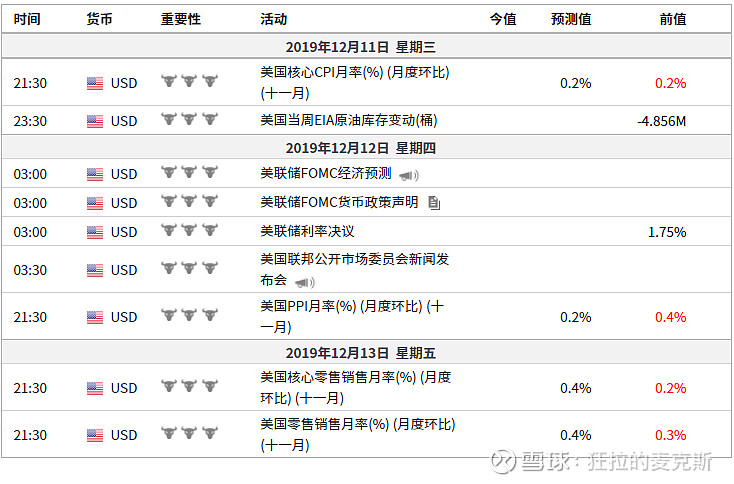

3. 重要经济数据日历,来源:英为财情

4. 医药热点

5. 重要看点,来源:SA Stocks to Watch

1. 2019.12.2---2019.12.6 回顾

经济数据

美国劳工部:11月专业技术和医疗保健就业人数录得显著增加。制造业就业人数增长,反映了罢工工人回归岗位的情况。

路透评美国11月非农就业数据:美国11月非农就业增长也受到了医疗行业增加的推动,这使得就业增长远高于今年18万人的月平均水平。11月份美国制造业活动出现连续第四个月的收缩,因贸易紧张态势,商业信心受损,进而削弱了资本支出。美国11月非农就业人口增幅为10个月以来最大,因此前罢工的通用汽车工人重返就业市场。且医疗行业增加招聘,这证明尽管制造业持续低迷,但经济依旧温和扩张。尽管在企业投资下滑的情况下,就业市场依旧维持着韧性。但由于需求下降,加之劳动力短缺,相较于去年平均每月增加22.3万新增就业人口的程度相比,今年劳动力市场的增幅有所放缓。此前美国政府表示,在明年2月发布的年度就业修订报告中,可能会将截至2019年3月之前12个月的就业增长削减至少50万人。

市场评论:美国11月季调后非农就业人口表现远好于预期,尽管平均每小时工资月率仅增长0.2%不及预期,但整体来看,这是一份强劲的报告,暗示美国经济明年有望继续走强。受此影响,美元兑非美货币普遍走高。

分析师:美国11月季调后非农就业人口大幅回暖,失业率也维持在长期低位,薪资增速小幅低于预期,这份报告将给美联储更多理由维持利率不变,支撑美联储认为劳动力市场维持强劲可支持消费者和经济增长的观点。受此影响股指期货及美元跳升,美债下行。美国11月非农就业报告与近期数据相一致,表明美国经济持续企稳,申请失业金人数维持在半个月低位,服务业活动扩张,消费者信心处于扩张期最佳水平。美国制造业就业人数大增5.4万,上月为减少4.3万,很大程度上反映了通用汽车罢工工人回归工作的情况。尽管有这一因素的刺激,由于全球贸易需求疲软,工厂招聘依然举步维艰,限制了商业扩张计划。

道明银行旗下的TD Ameritrade首席市场策略师KINAHAN:美国11月非农就业报告出现井喷式增长,将过去三个月平均新增非农就业人数推升至20万以上,这是相当了不起的表现。我不感兴趣的部分在于汽车领域,这只是通用汽车员工恢复工作。但有趣的是制造业就业人数增加5.4万,虽然其中有通用汽车的因素,但整体是积极的。医疗保健行业继续增长,而运输与仓储行业也出现好趋势,这些领域与消费者健康状况相关。很高兴看到消费者健康状况得到持续确认。

加拿大皇家银行资本市场首席美国经济学家PORCELLI:我认为美联储将对于他们之前一直坚持的表述感到满意,美国经济看起来不错。我认为这很贴切,美联储认为现在是时候停下来(停止降息)。

MarketWatch评美国11月非农数据:美国11月非农新增就业人口录得26.6万人,失业率则降至50年来低位,反映出美国劳动力市场坚若磐石的韧性。几乎所有行业的招聘活动均表现强劲,其中医疗、酒店及专业职位的招聘人数最多。制造业就业人数增加了5.4万人,几乎全部来自于复工的通用汽车工人。因全球贸易态势紧张,美国制造业今年几乎没有增加新的就业岗位。不过,绝大多数经济学家认为,如此强劲的增长幅度是不可持续的。经济放缓已经导致部分公司缩减了招聘规模,而当前紧缩的劳动力市场上,熟练的劳动力已为不可多得的人才。

FHN金融公司利率策略师VOGEL:无疑,美国11月非农就业报告超出了所有人的预期。尽管我们知道将有很多汽车工人,但健康和教育行业就业人数也增加了许多。

11月美国非农报告快评:薪资数据限制非农影响力,下周美联储鹰鸽角力,美元承压

优秀的非农就业人数给美联储鹰派提供了更多支持,但是薪资数据限制了非农的影响力。平均每小时工资月率仅0.2%,弱于预期,但平均每小时工资年率录得3.1%,高于预期。因此鸽派不太可能放任鹰派行动,他们会以薪资未有起色通胀可能仍低迷为理由,继续推进降低借贷利率。鲍威尔此前在回答中表明只有在通胀持续高于目标时才会加息。美联储可能会在物价确实上涨时才行动。11月的非农,由于薪资增长好坏参半,仍不足以表现物价是升还是降。因此,有大可能性是美联储会保留任何加息的选项,同时又对降息持开放态度。这一预期可能进一步给美元施压,甚至可能回吐非农带来的涨幅。

富国银行全球市场高级策略师Sameer Samana评美国11月非农报告:从本次非农报告中可以看到一个有趣的现象,即劳动参与率越来越高,不仅劳动力市场有所改善,越来越多人不再离场观望,而是选择进入劳动力市场。市场对于2020年的诸多预测均建立也在美国消费者依旧维持消费力的基础上,本次的非农报告强化了这一前景。同时非农报告也向投资者表明,应当确保自己的股票配置,克制过早采取防御措施的冲动。

个股

Wayfair(W)

2019.12.5

Wayfair Reports 36% Increase in Direct Retail Sales for Peak Five-Day Holiday Shopping Weekend

Wayfair Inc. (NYSE: W), one of the world’s largest online destinations for the home, today reported a 36 percent increase year over year in direct retail gross sales, defined as dollars of order intake, for the five-day peak shopping period of Thanksgiving Day through Cyber Monday. Customers took advantage of the ease and convenience of Wayfair’s online shopping experience throughout the entire weekend to discover exceptional value across a wide range of product categories making Black Friday and Cyber Monday Wayfair’s highest revenue days ever. A record-breaking number of Wayfair customers shopped for every room of the house snapping up great deals across all categories including live Christmas trees and seasonal decor, furniture, rugs, bedding, housewares, large appliances and home improvement items. More customers than ever before took advantage of Wayfair’s award-winning mobile app for a seamless shopping experience from their phone or tablet with approximately one in four holiday weekend orders placed through the app.

Oppenheimer weighs in on Outperform-rated Wayfair's (W ) Thanksgiving weekend performance.

"Overall, we look upon a Thanksgiving holiday sales gain of +36% as about consistent with recent top-line trends at Wayfair," notes analyst Brian Nagel.

"While it can be difficult to tie together top-line expansion over the Thanksgiving holiday and sales growth for the entire fourth quarter, we generally believe that the +36% figure reported by Wayfair suggests that the company is positioned well to post Q4 revenue increases at least in line with a current Street forecast of +28%," he adds.

Nagel and team are optimistic that Wayfair's vendor partners will work to adjust merchandising and pricing disciplines to account better for recent tariff costs. They also see a re-strengthening top line as expense growth pressures ease somewhat.

2018的黑五数据:

Wayfair (NYSE:W) reports a 58% pop in direct retail gross sales during the five-day shopping period covering Black Friday to Cyber Monday.

"While Cyber Monday was the peak sales day of the holiday weekend, Black Friday marked the highest growth day as consumers continued to shift their spending from brick and mortar to online," notes the retailer.

Wayfair says its customers shopped for every room of the house during the shopping bonzanza - purchasing everyday essentials such as bedding and kitchenware as well as major furnishings including sofas, recliners and dining sets.

2. 重要财报日历

3. 重要经济数据日历

4. 医药热点

a.第61届美国血液学会(ASH)年会将于2019年12月7-10日在美国奥兰多隆重举行。该会议是血液病领域首屈一指的学术会议,汇集了全球血液病临床和实验科学家,共同探讨血液病领域的新技术、新进展。很多医药公司会分享最新的临床实验结果,比如$强生(JNJ)$ ,百时美施贵宝(BMY), bluebird bio(BLUE) 等

b. A drug prices bill sponsored by Democrats is expected to be passed in the House next week, although it's very unlikely to pass the Senate. While a bipartisan bill from the Senate Finance Committee would impact prices on 2% of all drug sales and the Trump Administration's plan would hit about 3% of sales, the House bill being floated would apply to the entire U.S. market. Biopharma majors to watch next week as the Congressional wrangling continues include Pfizer (PFE), Merck (NYSE:MRK), Bristol-Myers Squibb (NYSE:BMY), Novartis (NYSE:NVS), Roche (OTCQX:RHHBY), Johnson & Johnson (NYSE:JNJ), Eli Lilly (NYSE:LLY), GlaxoSmithKline (NYSE:GSK), AstraZeneca (NYSE:AZN), Amgen (NASDAQ:AMGN) Biogen (NASDAQ:BIIB), Gilead Sciences (NASDAQ:GILD), Teva Pharmaceutical Industries (NYSE:TEVA), Takeda (NYSE:TAK), AbbVie (NYSE:ABBV) and Bausch Health Companies (NYSE:BHC)

5. 重要看点

a. U.S. Congress reportedly near deal on annual defense policy bill

Lawmakers are said to be near a compromise on a $700B U.S. military policy bill, easing worries that Congress could fail to pass the legislation before year-end for the first time in 58 years.

Aides from the Senate and House Armed Services Committees, which write the annual National Defense Authorization Act, tell Reuters that a compromise bill could be announced as soon as early next week after months of negotiations.

Potentially relevant tickers include LMT, NOC, GD, BA, UTX, RTN, HII, TXT, LHX, KTOS, MRCY, AJRD

b. Spotlight on space: Will declining launch costs, advances in technology and rising public-sector interest position space exploration as the next trillion-dollar industry? That's a question that is likely to be bandied around at the Morgan Stanley 2nd Annual Space Summit on December 10. The summit will bring together experts from Morgan Stanley Research, private and public firms, space investors and other space experts. Registered participants include HawkEye 360, Intelsat (NYSE:I), Maxar (NYSE:MAXR), Parsons, Planet, Rocket Lab, ViaSat (NASDAQ:VSAT) and others - while bigger players like SpaceX (SPACE), Virgin Galactic (NYSE:SPCE), Boeing (NYSE:BA), Northrup Grumman (NYSE:NOC) and Lockheed Martin (NYSE:LMT) will also be in focus. Looking ahead on the space calendar, SpaceX is scheduled to fly another Falcon 9 in the second half of December. Boeing is scheduled to launch its Starliner capsule atop United Launch Alliance's Atlas V rocket from Launch Complex 41 to the International Space Station on December 19.

The head of the Federal Aviation Administration will testify December 11 in front of a U.S. House panel regarding the status of the agency review of the grounded Boeing 737 MAX. FAA Administrator Stephen Dickson stated a few weeks ago that the FAA will handle the review of the ~300 Max jets built since the grounding. Boeing still needs to complete a software audit and schedule a key certification test flight before the plane can be ungrounded by the FAA.

a. UBS Global TMT Conference: Plenty of heavy-hitting tech, media and telcomm players will be in New York City on December 9-10 for the UBS conference. The list of speakers includes ViacomCBS (NASDAQ:VIAC) CEO Bob Bakish, AT&T (NYSE:T) CEO Randall Stephenson and Charter (NASDAQ:CHTR) CEO Tom Rutledge. Netflix (NASDAQ:NFLX) Chief Content Officer Ted Sarandos could break some news and Peloton Interactive CEO John Foley (NASDAQ:PTON) will look to spin the advertising story on the company in a positive way. Other TMT players due to present include DocuSign (NASDAQ:DOCU), MDC Partners (NASDAQ:MDCA), World Wrestling Entertainment (NYSE:WWE), Zscaler (NASDAQ:ZS), Sierra Wireless (NASDAQ:SWIR), Match.com (NASDAQ:MTCH), Zix (NASDAQ:ZIXI), RealReal (NASDAQ:REAL), Western Digital (NASDAQ:WDC), K12 (NYSE:LRN), AMC Networks (NASDAQ:AMCX), TiVo (NASDAQ:TIVO), Verizon (NYSE:VZ), T-Mobile (NASDAQ:TMUS), Microsoft (NASDAQ:MSFT), News Corp (NASDAQ:NWS), and Fiverr (FVRR).

b. The Hollywood Foreign Press Association will announce this year's Globe award nominations on December 9. Netflix (NFLX) could have a good day, with three films (The Irishman, Marriage Story and The Two Popes) in the mix for best motion picture. Sony (NYSE:SNE) is also expected to do well with Quentin Tarantino's Once Upon a Time, while Warner Bros. (T) could see either Joker and Just Mercy make the cut.

Cisco (NASDAQ:CSCO) says it will unveil innovations for the "Future of the Internet" at an event on December 11. Cisco Chairman/CEO Chuck Robbins and members of Cisco's leadership team will share their vision for the future Internet and what it can help organizations around the world achieve.