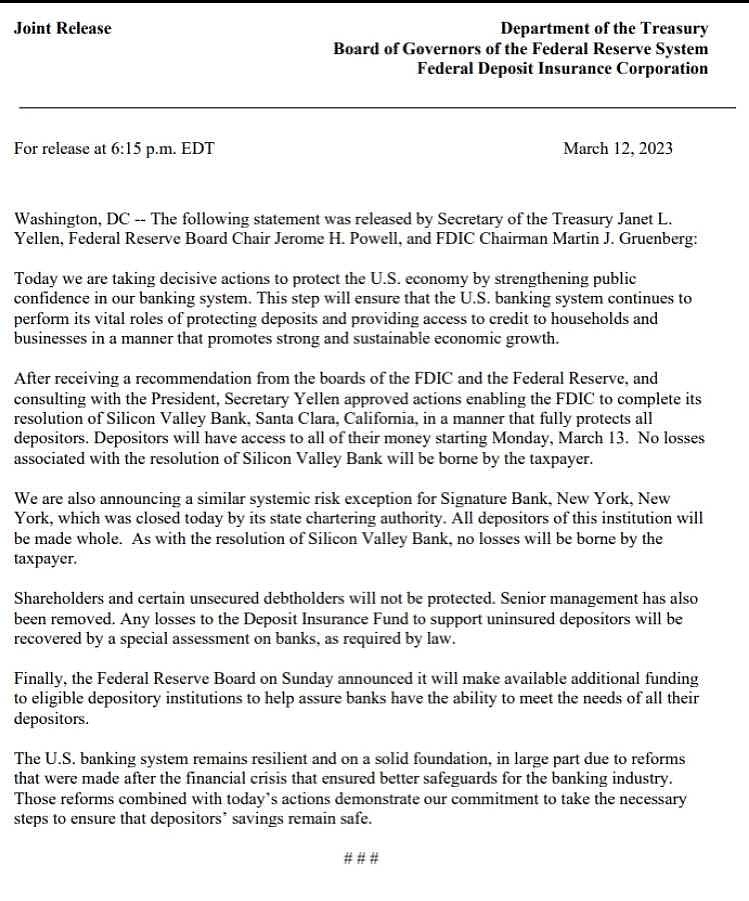

For release at 6:15 p.m. EDT

美国东部时间下午6点15分发布

2

March 12, 2023

2023年3月12日

3

Washington, DC-- The following statement was released by Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg:

华盛顿特区-财政部长珍妮特·l·耶伦、联邦储备委员会主席杰尔姆·h·鲍威尔和FDIC主席马丁·j·格伦伯格发表了以下声明:

4

Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

今天,我们正在采取果断行动,通过增强公众对我们银行体系的信心来保护美国经济。这一步骤将确保美国银行体系继续发挥其重要作用,保护存款,并以促进强劲和可持续的经济增长的方式为家庭和企业提供信贷。

5

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

在收到FDIC和美联储董事会的建议并与总统协商后,耶伦部长批准了使FDIC能够以充分保护所有储户的方式完成对加州圣克拉拉硅谷银行的决议的行动。从3月13日(周一)开始,储户将可以动用自己所有的资金。纳税人不会承担与硅谷银行清算有关的任何损失。

6

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

我们还宣布对New York签名银行(Signature Bank, New York,New York)实施类似的系统性风险例外,该银行今天由其州特许机构关闭。这家机构的所有存款人都将得到全额补偿。与硅谷银行(Silicon Valley Bank)的清算一样,纳税人不会承担任何损失。

7

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

股东和某些无担保债券持有人将得不到保护。高级管理人员也被撤职。存款保险基金为支持无保险储户而遭受的任何损失,都将根据法律要求,通过对银行进行特别评估来弥补。

8

Finally, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.

最后,联邦储备委员会(Federal Reserve Board)周日宣布,将向符合条件的存款机构提供额外资金,以帮助确保银行有能力满足所有储户的需求。

9

The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.

美国银行体系仍然具有弹性和坚实的基础,这在很大程度上归功于金融危机后进行的改革,这些改革确保了对银行业的更好保障。这些改革与今天的行动相结合,表明我们致力于采取必要措施,确保储户的储蓄安全。