$比亚迪(SZ002594)$ 比亚迪降价打击的主要是合资品牌的燃油车,$长城汽车(SH601633)$ $吉利汽车(00175)$ 只不过是被波及,比亚迪下一波打击才可能轮到你们。

比亚迪今年年初推出了中国近两年价格战中最激进的折扣,因为该汽车制造商希望将更多消费者从内燃机汽车转向电动汽车。

比亚迪的对手以大幅内燃机车折扣来应对降价,大众汽车和丰田汽车等制造商对因电动汽车和插电式混合动力汽车而失去市场份额的车型提供大幅折扣。

BYD started the year with some of the most 网页链接{aggressive discounts} in China’s almost two-year-long price war, as the automaker looked to convert more consumers from combustion engines to electric cars.

Now, legacy manufacturers like Volkswagen and Toyota are striking back in an effort to hold on to their share of the world’s biggest car market.

SAIC-Volkswagen, one of the German manufacturer’s local ventures, slashed the price of one version of its top-selling sedan, the Lavida XR, to 69,800 yuan ($9,630), bringing it in line with BYD’s popular Seagull hatchback. Toyota, whose sales have fallen almost 15% year-on-year since BYD’s most-recent round of price cuts in March, slashed the price of its latest China-edition Camry sedan to 130,000 yuan, from 170,000 yuan.

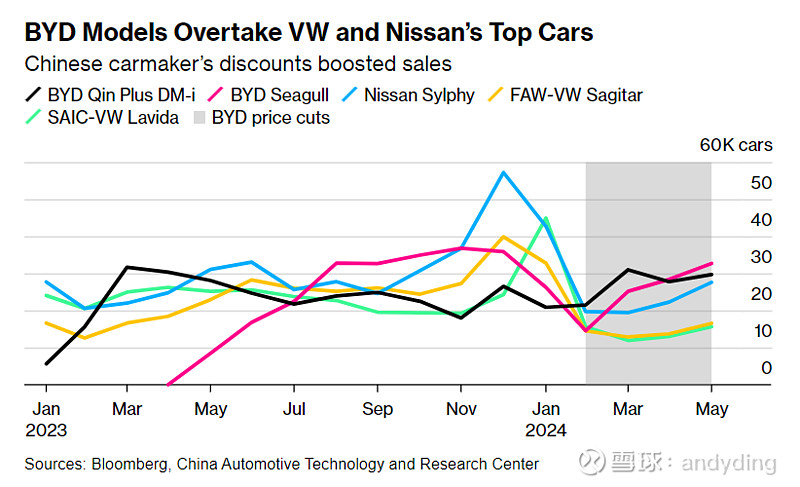

The stakes are high for the legacy automakers, which are struggling to keep up with their electric rivals’ broad range of affordable and technologically advanced cars that increasingly appeal to Chinese drivers. Nissan’s once top-selling Sylphy sedan, produced through a venture with Dongfeng Motor, and SAIC-VW’s Sagitar and Lavida models, have fallen behind BYD vehicles in monthly sales.

“Nissan’s Sylphy and VW’s Lavida and Sagitar have been hit hard after BYD’s deep price cuts,” said Joanna Chen, a Hong Kong-based auto analyst for Bloomberg Intelligence. She noted sales of plug-in hybrids — where BYD also dominates — have been particularly strong and accelerated market-share losses for internal combustion engine cars.

So far this year, Nissan’s Sylphy is barely hanging on to its ranking as China’s second-most popular car, with BYD’s top-selling hybrid, the Qin Plus DM-i, fewer than 1,000 units behind.

HSBC Qianhai Securities points to record levels of discounting on internal combustion engine cars, which hit 19.7% in May, citing data from China’s Passenger Car Association. Electric vehicle discounts slipped to 9.7% from the previous month’s peak of 12.8%.

The discounting may not be over yet, with HSBC Qianhai’s head of China autos research Yuqian Ding warning that a summer lull in sales would prompt a fresh wave of price cuts.

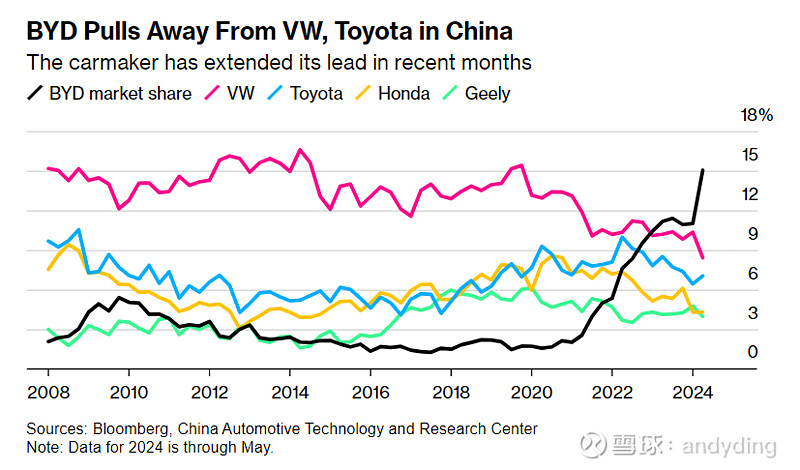

Overall, BYD has increased its share of China’s auto market to 15% as of the end of May, four percentage points higher than at the end of the first quarter. VW’s share is down to 8.4%, according to Bloomberg calculations, its lowest since China Automotive Technology and Research Center started compiling the data.

The gap may have widened even further after BYD posted 网页链接{record sales} for June, fueled by additional price cuts and new technology — namely, its latest-generation plug-in hybrid boasting 网页链接{2,000 kilometers} (1,240 miles) of range.

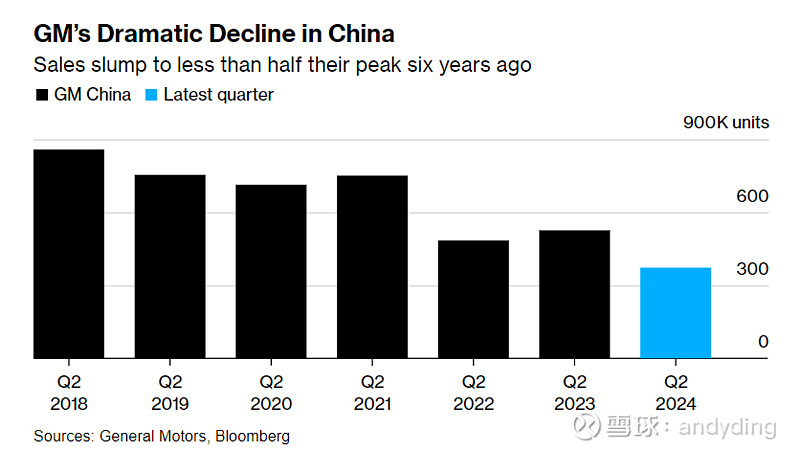

Across the board, foreign automakers are feeling the pain of falling sales in China. General Motors stumbled further, with second-quarter sales slumping 29% from a year ago, to less than half the company’s peak in 2018.

At the same time, new-energy vehicles sales — which include both EVs and plug-in hybrids — have jumped since the traditional Lunar New Year slowdown. Recent data shows the penetration rate of NEV sales nearing the 50% mark, leaving less rom for brands highly reliant on combustion-engine cars to mount a comeback.