US economic data unexpectedly "cold", core inflation exceeds expectations, hitting investor sentiment

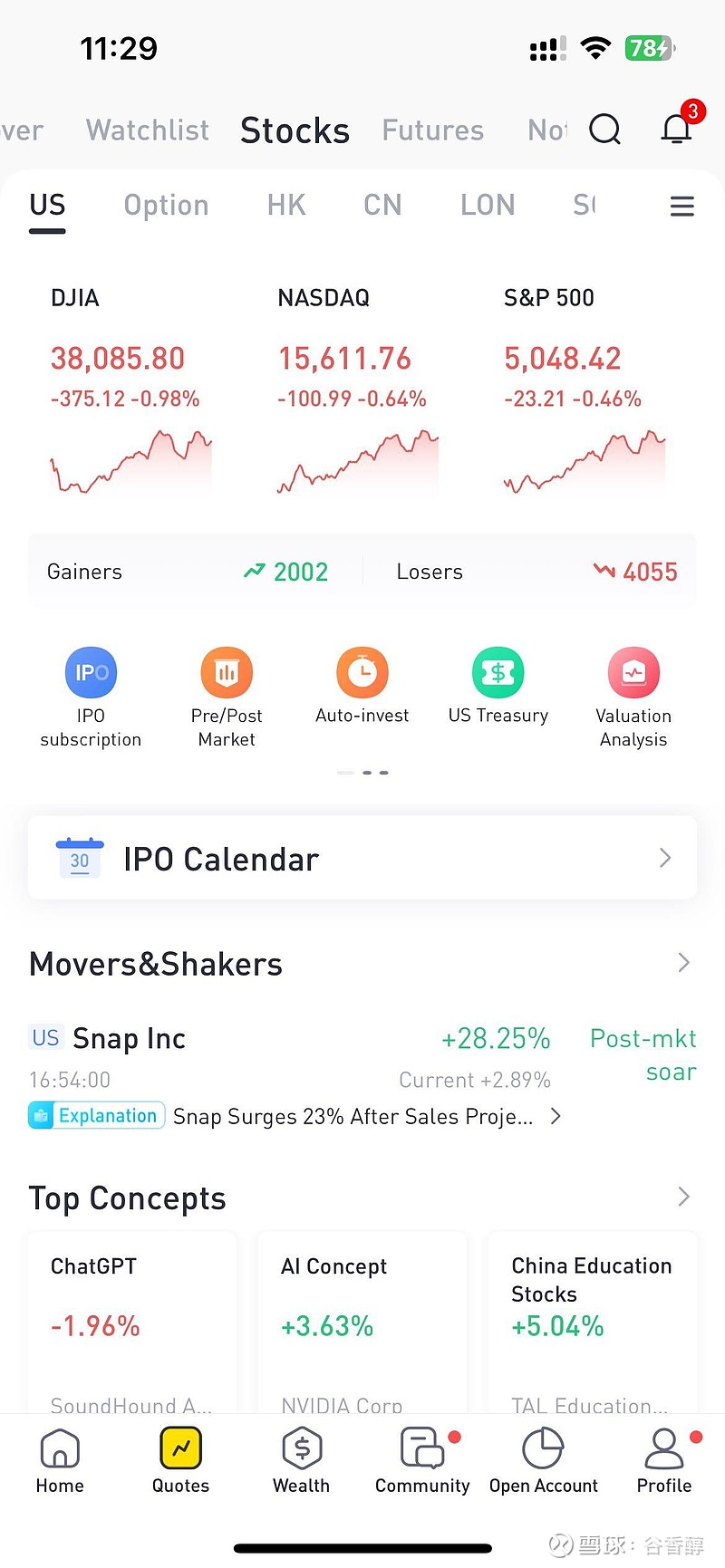

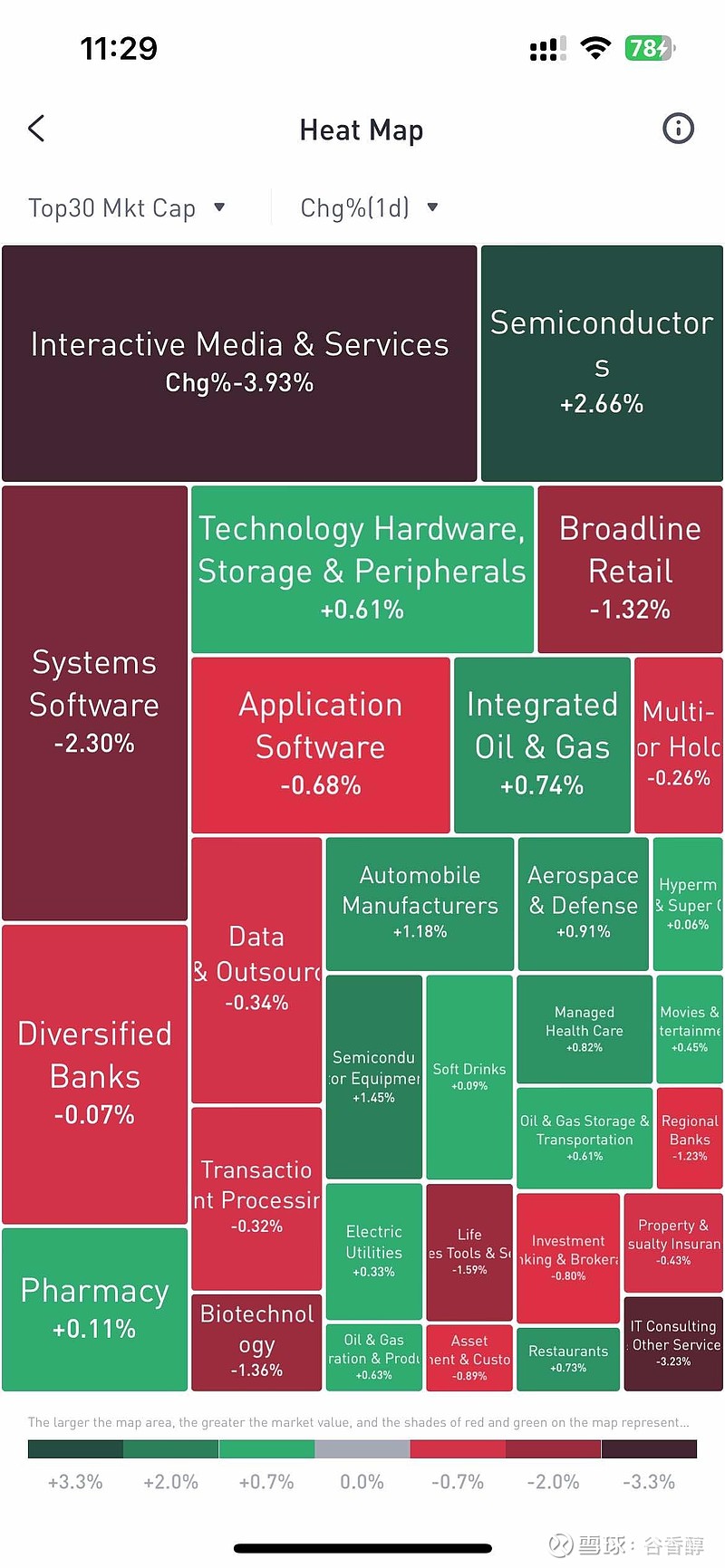

US released two economic data on Thursday that hit the market's nerves. Economic growth unexpectedly "cooled down", and core inflation rose above expectations, hitting investor sentiment. The benchmark 10-year Treasury yield broke through the 4.7% mark during the session, the highest since November last year. The three major US stock indexes fell across the board on the day, with the Dow Jones Industrial Average falling more than 700 points at one point during the session. At the close, the Dow Jones Industrial Average fell 0.98%, the S&P 500 fell 0.46%, and the Nasdaq fell 0.64%.

US first-quarter real GDP preliminary value is the lowest in nearly two years, core PCE index rebounds sharply

Data released by the US Department of Commerce on Thursday showed that the US economy grew at an annual rate of 1.6% in the first quarter of this year, well below market expectations of 2.4% and a significant slowdown from the 3.4% growth rate in the fourth quarter of last year. This is the slowest growth rate in nearly two years.

Also released with the first-quarter inflation data, the core personal consumption expenditure price index (PCE), which excludes food and energy prices, rose at an annual rate of 3.7% on a month-over-month basis, close to double the previous value, indicating that core inflation remains stubborn. After the data was released, the market generally expected the Fed to delay its first rate cut from September to December and estimated that it would only cut rates once this year.

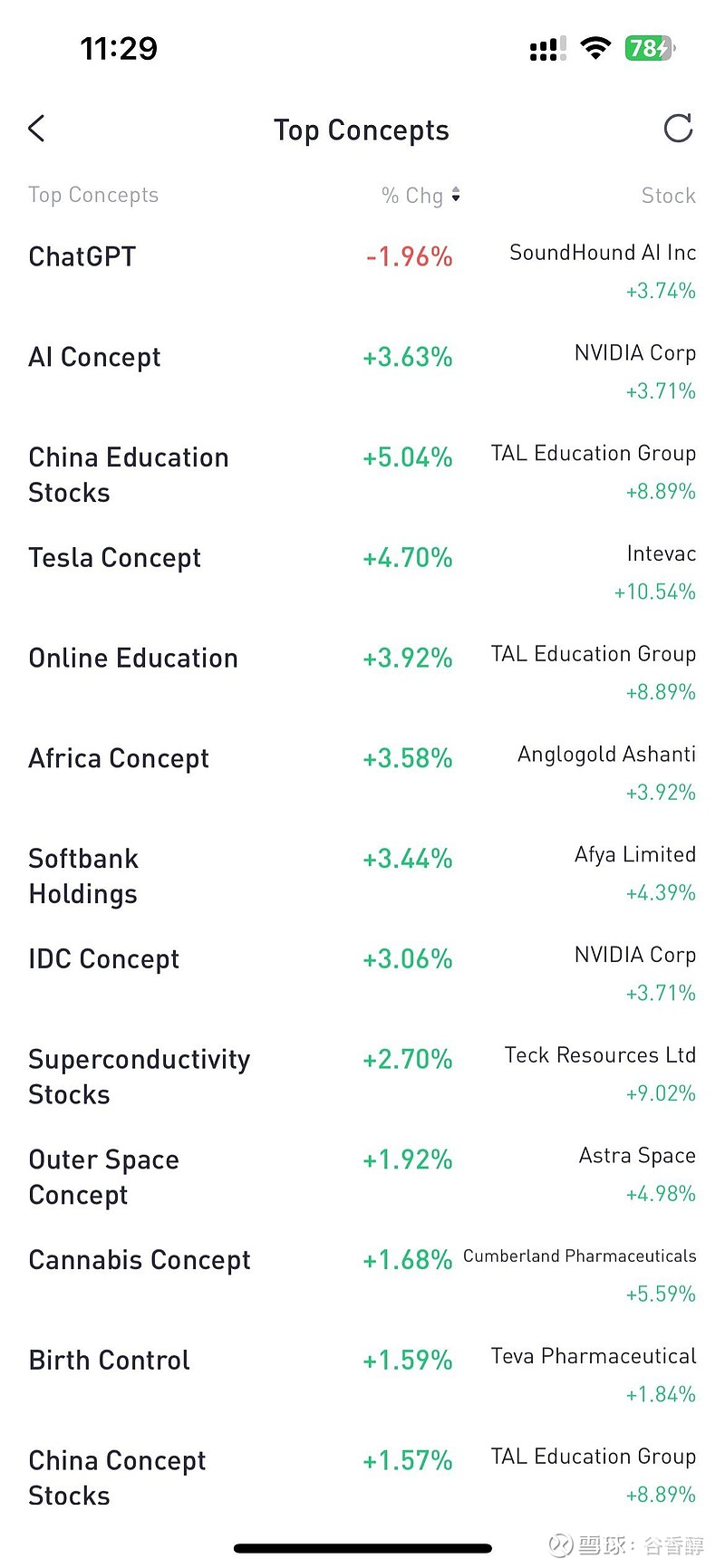

Meta, the parent company of Facebook, led the decline in S&P and Nasdaq components on the 25th

Another factor that affected overnight market sentiment was the earnings reports of US tech giants. Meta, the parent company of Facebook, which released its earnings report after the US stock market closed on Wednesday, gave an unoptimistic outlook for the second quarter of this year, and its stock price plummeted by nearly 11% on Thursday, leading the decline in S&P and Nasdaq components.

Revenue growth accelerates, dividends paid for the first time in history, Google's parent company's stock price surges over 12% after hours on the 25th

However, the latest earnings reports released by Microsoft and Google's parent company Alphabet after the US stock market closed on Thursday brought good news to the market. In addition to accelerating revenue growth, Google also paid its first dividend and announced an additional buyback of more than $700 billion in stock, sending its stock price up more than 12% after hours. Microsoft's positive earnings report also pushed its stock price up 4.5%.

European stock markets mixed on the 25th

In Europe, the three major European stock indexes were mixed on Thursday, with the UK's FTSE 100 index up 0.48%, the French CAC40 index down 0.93% and the German DAX index down 0.95%. On the one hand, investors are digesting the latest earnings reports released by a number of large companies, and on the other hand, they are cautiously assessing potential acquisitions in the mining industry.

BHP Billiton proposes all-cash takeover of Anglo American, Anglo American's share price surges over 16% on the 25th

BHP Billiton, the world's largest mining company, confirmed on Thursday that it has made an all-cash takeover bid for Anglo American, a 107-year-old mining company. BHP Billiton valued Anglo American at 311 billion pounds, a premium of 15% to its market capitalization of 270 billion pounds. If successful, it could be the largest acquisition deal in the world this year. Anglo American's shares traded on the London Stock Exchange rose more than 16% on the day.

International oil prices rise on the 25th

In commodities, renewed geopolitical tensions in the Middle East added to market concerns, pushing up international oil prices on Thursday. At the close, the light crude oil futures contract for June delivery on the New York Mercantile Exchange settled at $83.57 a barrel, up 0.92%, and the June Brent crude oil futures contract in London settled at $89.01 a barrel, up 1.12%.

International gold prices rise on the 25th

In addition, a weaker dollar made gold more attractive, and international gold prices rose on Thursday. At the close,New York Mercantile Exchange June gold futures settle at $2,342.50 per ounce, up 0.18%