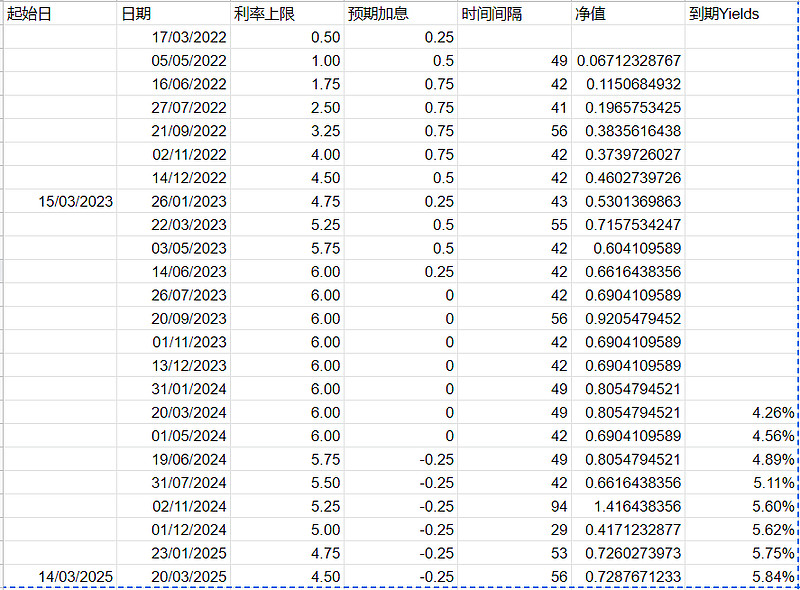

目前是2023年3月加息之前的14日,目前市场预期普遍为三月加息25bp,我们简单来推演一下,发现一些具体情况目前2y的收益率的理论值。

It is now 14 days before the 2023 rate hike in March. Currently, the market is expecting a 25 bp rate rise in March. Let us briefly extrapolate and find out some details about the current theoretical value of the 2Y yield.

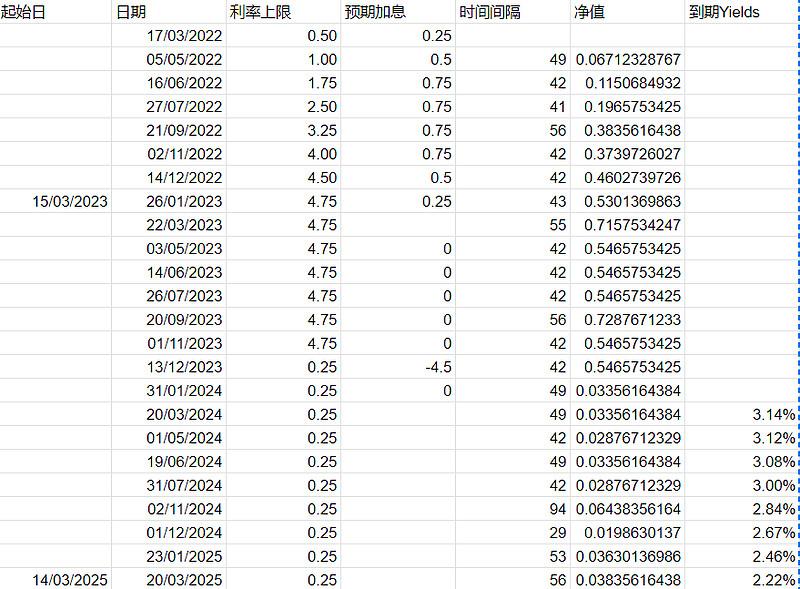

首先看极端乐观情况

Start with extreme optimism

2023年底,突发严重事件,当场降息到0利率并维持。

A 2023, a serious incident, interest rates were cut to zero on the spot and kept there.

则3月的2Y应该是2.22,ZT期货升水当然维持到2023 12月,还有三个季度的换季亏损。

March 2Y should be 2.42, ZT futures premium of course maintained until 202312, there are three quarters of quarterly loss.

这种情况有很多推演,比如说从6月开始到2024年2月,以最大-0.75的速率月降息至0,则推算为1.82。

There is a lot of extrapolation to this scenario, such as from June to 2024 February, when interest rates are cut to zero at a maximum rate of -0.75 per month, which translates to 2.01 per month.

期货贴水仍然会维持到12月,因为2023年 2Y的市场公允利率才会高于现金利率。

The futures discount will remain in place until December, when the market-based 2023 rate for <noun_2y will be higher than the cash rate.

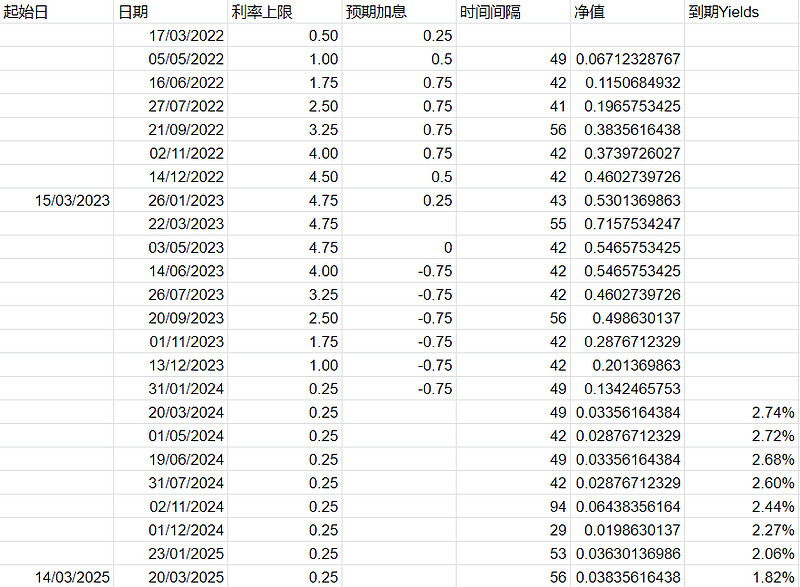

中等乐观情况

Moderate optimism

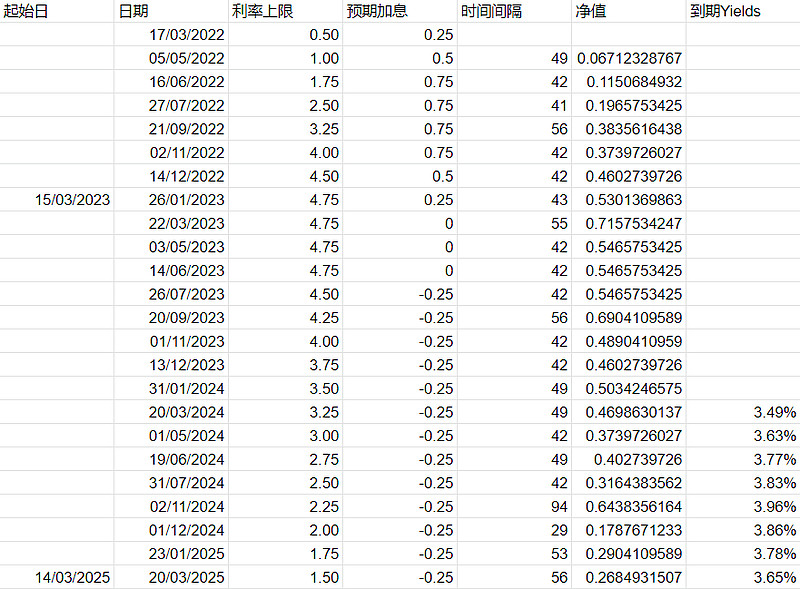

加息周期于2023 3月结束,终点5.0.

The rate-raising cycle ended in March 2023, with the end point at 5.0.

自2023年7月开始降息,方案以加息周期同态对称。至2024年7月降到0-0.25

Since the 2023 rate cut began in July, the package has been homomorphic to the cycle of interest rate rises. The 2024 fell to 0-0.25 in July

3月份如果CPI合适,这个预期符合市场实际的话,利率有望跌至2.70

In March, if the CPI is right and this expectation is in line with market reality, interest rates could fall to 2.70

以同样的降息路径推导,如果

To derive the same path of interest rate cuts, if

2023年09月开始降息,则3.01%

The 2023 rate cut in September was 3.01%

2023年11月开始降息,则3.32%

The 2023 rate cut, which began in November, was 3.32 per cent

2023年12月开始降息,则3.65%

The 2023 rate cut in December was 3.65 per cent

根据市场已经于03.14成交的最低水平3.83,可以算出这个降息路径还是有人认可的。

Based on the market has been trading at 03.14 at the lowest level of 3.83, you can calculate the path of this rate cut is the worst.

第二类情况,加息周期于2023 1月结束,终点4.75.【目前芝加哥所掉期的最大概率】

In the second scenario, the cycle ended in November 2023 with a final point of 4.75. The maximum probability of a swap in Chicago today

自2023年7月开始降息,方案为0.25等量降息。

The 2023 rate cut, which began in July, is set at 0.25 per cent.

3.65,微微高于当前市场给出水平。等同于镜面降息方案的12月情况。

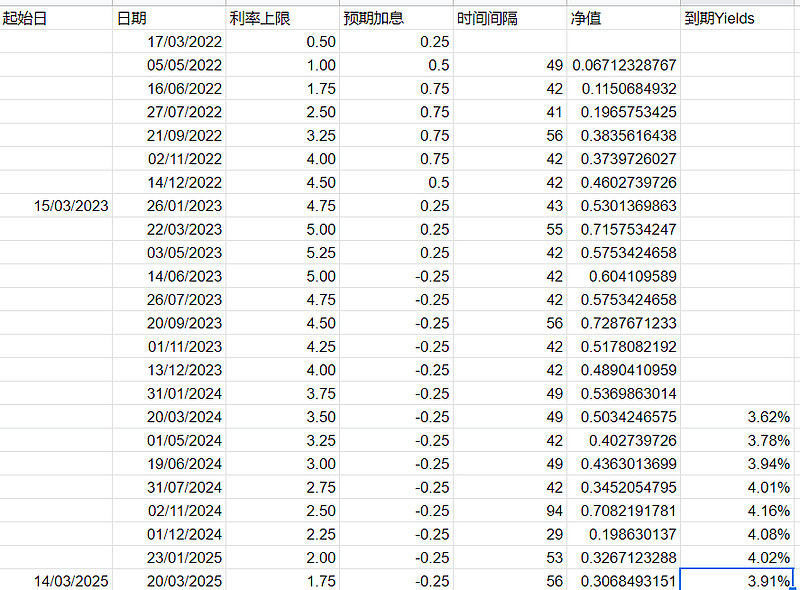

第三类情况,加息周期于2023 5月结束,终点5.25。6月开始降息,-0.25为梯度。

3.91,比较接近目前的市场最乐观认知。

3.91, which is close to the most optimistic view of the current market.

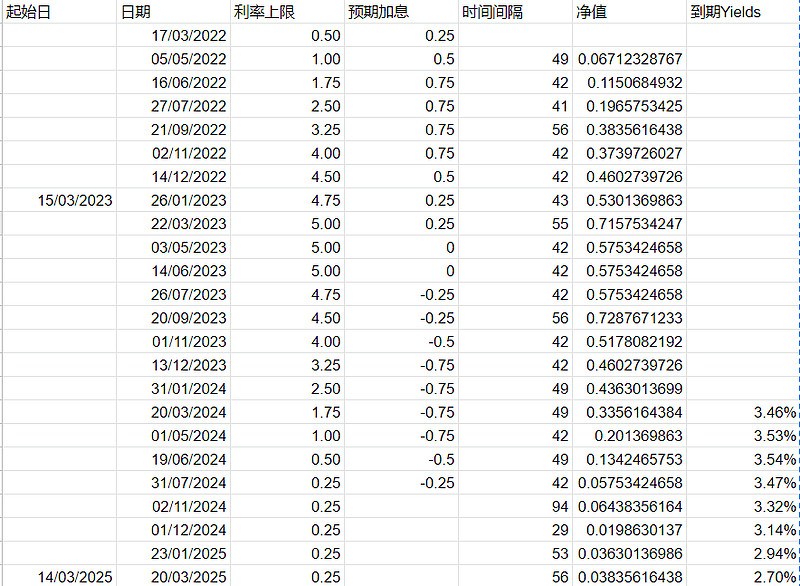

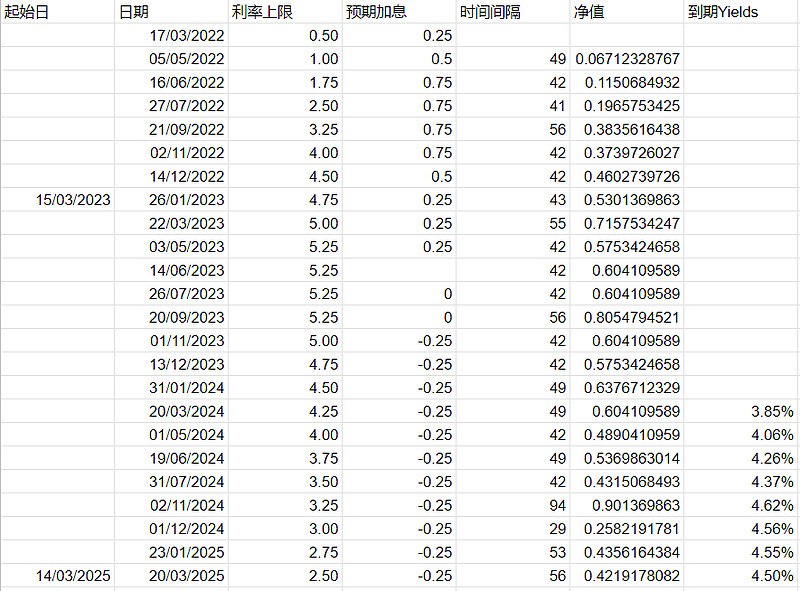

中等悲观情况

Medium pessimism

情形1,加息周期于2023 5月结束,终点5.25。11月开始降息,-0.25为梯度。

Scenario 1, the rate-raising cycle ends at 5.25 in May 20235. Interest rates were cut in November, with a gradient of -0.25.

当然我们其实可以假定,市场是几种认知的人在博弈,只是每个人都在一定区间选择加仓、减仓的决策而已。

Of course, we can actually assume that the market is several cognitive people in the game, but everyone in a certain range of options to increase or reduce the position of decision-making only.

情形2,加息周期于2023 5月结束,终点5.5。12月开始降息,-0.25为梯度。

Scenario 2, the rate-raising cycle ends in May 20235 with an end point of 5.5. Interest rates were cut in December, with a gradient of -0.25.

4.90,符合3月8日左右的市场认知。注意这里的起始日期之类的数据有一些偏差,但是量级不会有很大冲突。

4.90, in line with market perception around March 8. Note that there are some deviations in data such as the start date, but the orders of magnitude do not conflict much.

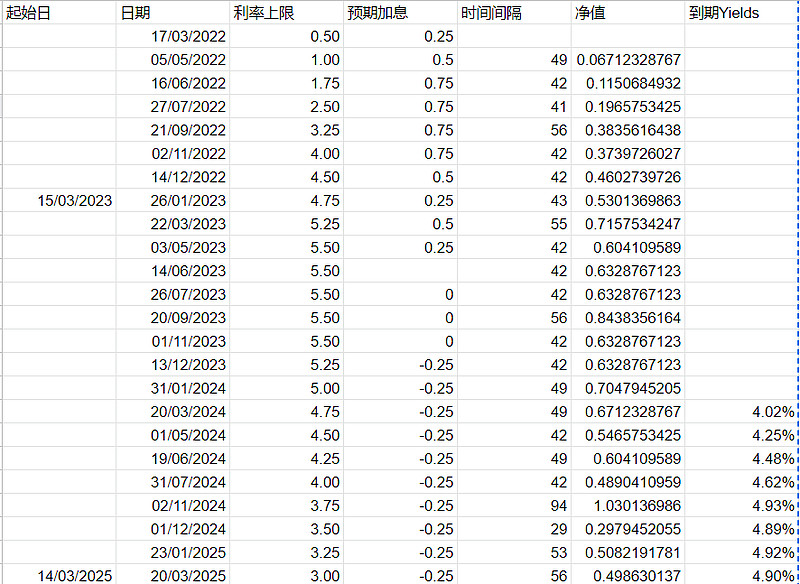

非常悲观情况

Very pessimistic

由于特殊的情况,核心cpi持续反弹,最终利率终点在6.0,并且2024年6月才开始降息。

Due to exceptional circumstances, the core CPI continued to rebound, with the final rate end point at 6.0, and the 2024 rate cut only began in June.

这个值毫无疑问属于加仓点,美国要是能在这个利率水平上用就业率顶住利率如此之久。

That would be a safe place to add to the position if the U. S. could hold its job rate at that level for so long.

虽然对我账户造成的损失也不会小,但是到时候房子得多便宜很难想象。

Although the loss to my account will not be small, but then the house is much cheaper it is hard to imagine.

左思右想,除非发生工业革命。

那么,尽可能中性的一篇文章写完,本人目前持中性乐观看法。写于2023.03.14cpi前。

Well, as neutral as possible to write an article, I am currently neutral optimism. Written before