$中远海能(SH600026)$ $招商南油(SH601975)$

一月十九日

2024

POTEN&合作伙伴 休斯顿/纽约/伦敦/雅典/新加坡/广州/珀斯

油轮意见 在

展望未来 VLCC船龄概况及订单

>=15岁 11至15岁 6至10岁 0至5岁

2024年主要油轮市场发展

今年是我们预测系列的第二年。上周我们讨论了2023年的预测 。在这一期中,我们将再次伸出我们的脖子,并讨论几个趋势/ 4 4

发展,我们预计2024年。

31

1.VLCC新造船订单将于2024年启动。

几年来,VLCC的订单量一直是所有主要油轮市场中最低

的,占现有船队的百分比也接近历史最低水平。截至2024年1月1日,VLCC订单数量为23艘,占贸易船队的2}燕豌,交易奥尔德岛宛菏爽财

7%。这其中有很多原因:VLCC的盈利在2020年的首次6%。相比之下,苏伊士型为9.9%,非洲型/LR2型为12.#船只油轮船队回收历史

大流行/浮式存储高峰之后暴跌,2021年期间表现惨淡。

与苏伊士运河和阿芙拉型油轮不同,2022年俄罗斯入

乌克兰后,VLCC并没有从贸易流动错位中获得重大提振

。目前的红海危机对VLCC的影响也比对小型油轮的影响

.

小。不过,我们认为今年情况会有所改变。VLCC仍然是长距离运输原油最经济的油轮,运价在2023年强劲复苏。更少的集装箱船和液化天然气船订单打开了堆场位置(

尽管大部分在2027年及以后)。然而,最重要的是,主

要的VLCC船东正看着极低的订单量,并决定石油市场每

年需要更多的VLCC交付。而一旦有几个知名的业主冒险

我们预计会有更多的人跟进。我们预测,2024年VLCC =VLCC=Suezmax=Aframax=Panamax MR#手机

的订单量将增加一倍以上。 2021.这是至少20年来的最低水平。油轮船队并不年轻,事实上,它

已经变老了。自2019年以来,油轮船队的平均船龄增加了4年(从2019年1月的9.1年增至目前的13.1年)。随着未来2年有限的交付计划,该舰队可能会变得更老。回收不足的主要原因是旧船的溢价。对船

2.地缘政治风险将主导2024年的油轮市场。

主来说,出售船只作进一步的交易(主要是进入黑暗舰队)比回收船

只更有利可图。我们预计这种情况将在2024年发生变化。作为对俄罗

石油和油轮市场与地缘政治风险似乎总是齐头并进。自俄斯新一轮制裁的一部分,欧盟对二手船销售的审查可能会使船东更不

罗斯入侵乌克兰以来,它们一直是推动油轮市场波动的主 愿意将船舶出售给未知的买家。然而,更重要的是,我们认为黑暗舰

要因素。以色列和哈马斯之间的冲突重新点燃了中东的紧 队已经达到了一个足够大的水平,可以服务于制裁贸易。此外,对委

张局势,胡塞叛军的参与和他们破坏商业航运的行动进一 内瑞拉制裁的解除减少了对这些船只的需求,监管机构加强审查将限

步提高了该地区局势升级的风险。我们预计紧张局势将继 制这些船只的贸易选择。我们预计到2024年,油轮回收将达到至少50

续保持。除了这些持续不断的冲突之外,台湾的选举也加艘。剧了南中国海的紧张局势。几个主要的民主国家正在进行投票。美国、印度、墨西哥和委内瑞拉的大选都有可能改

变地缘政治格局。 4.OPEC+将取消部分自愿减产计划

以沙特阿拉伯和俄罗斯为首的欧佩克+国家在2022年下半年和2023年再次削减原油产量,以支持非欧佩克产量增加和全球需求增长乏力的情况下的油价。

3.拆船大幅增加

由于“黑暗舰队”的一些船只将开始被淘汰,油轮回收将在2024年加 为了避免失去更多的市场份额,我们预计欧佩克将扭转一些

速。 这些削减,并开始增加产量和出口在下半年再次

2023年,油轮回收率处于非常低的水平。劳氏船级社的数据显 2024年的时候。

示,去年只有14艘油轮(》10,000载重吨)被回收,低于2022 年的57艘和21年的95艘。今年应该会有50艘以上的拆船

总的来说,2024年应该是油宇宙中又一个强劲的一年。

《油轮意见》由Poten&Partners的油轮研究与咨询部门发布。对于这个意见的反馈,每周通过电子邮件接收,或对我们的服务和研究产品的信息,请发送电子邮件到Research@ poten com。请访问我们的网站网页链接与我们的油轮经纪人联系。

Poten & Partners的油轮研究与咨询部门发布了油轮意见。有关此意见的反馈,每周通过电子邮件接收此信息,或有关我们服务的信息 和研究产品,请发电子邮件给Research@poten.com。请访问我们的网站网页链接联系我们的油轮经纪人。

反馈

重点词汇

tanker

油轮;罐车;空中加油飞机;罐运

consulting

提供咨询的;担任顾问的;提供咨询业务的;咨询业;请教;求教;向…咨询;(consult的现在分词)

brokers

(作为中间人)商订,安排;(broker的第三人称单数);经纪人;掮客;(broker的复数)

lowest level

最低水平;最低级别;最低层次

fleet

舰队;船队;小河;小湾;水道;沟;海军;车队;快速的;敏捷的;浅的;浅;不深地;疾驰;飞逝;掠过;消失;转瞬即逝;使(时间)飞快地过去

查看更多

Tanker Opinions are published by the Tanker Research & Consulting department at Poten & Partners. For feedback on this opinion, to receive this via email every week, or for information on our services

and research products, please send an email to Research@poten.com. Please visit our website at 网页链接 to contact our tanker brokers.

2021.

This was the lowest level in at least 20 years. The tanker fleet is not

young, as a matter of fact, it has been getting older. Since 2019, the average

age of the tanker fleet has increased by four years (from 9.1 in Jan 2019 to 13.1

currently). With the limited deliveries scheduled over the next 2 years, the fleet

will likely get even older. The main reason for the dearth in recycling is the

premium valuations of older vessels. It was much more profitable for owners

to sell vessels for further trading (mostly into the dark fleet) than to recycle

them. We expect this to change in 2024. EU scrutiny on secondhand sales as

part of a new set of sanctions on Russia could make owners more reluctant to

sell ships to unknown buyers. However, more importantly, we think the dark

fleet has reached a level where it is big enough to service the sanctioned trades.

Furthermore, sanctions relief for Venezuela has reduced demand for these

vessels and increased scrutiny of regulators will limit the trading options of

these vessels. We expect tanker recycling in 2024 to reach at least 50 vessels.

4. OPEC+ will reverse some of their voluntary production cuts

OPEC+ countries, led by Saudi Arabia and Russia have cut crude oil production

in the second half of 2022 and again in 2023 in an effort to support prices in the

face of increasing non-OPEC production and lackluster global demand growth.

To avoid losing more market share, we expect that OPEC will reverse some of

these cuts and start to increase production and exports again in the second half

of 2024.

Overall, the year 2024 should be another strong year across the tanker

universe.

Key tanker market developments for 2024

This is the second year of our forecasting series. Last week we

discussed how we did with respect to our 2023 predictions . In

this issue we will stick our neck out again and discuss several

trends/developments that we expect for 2024.

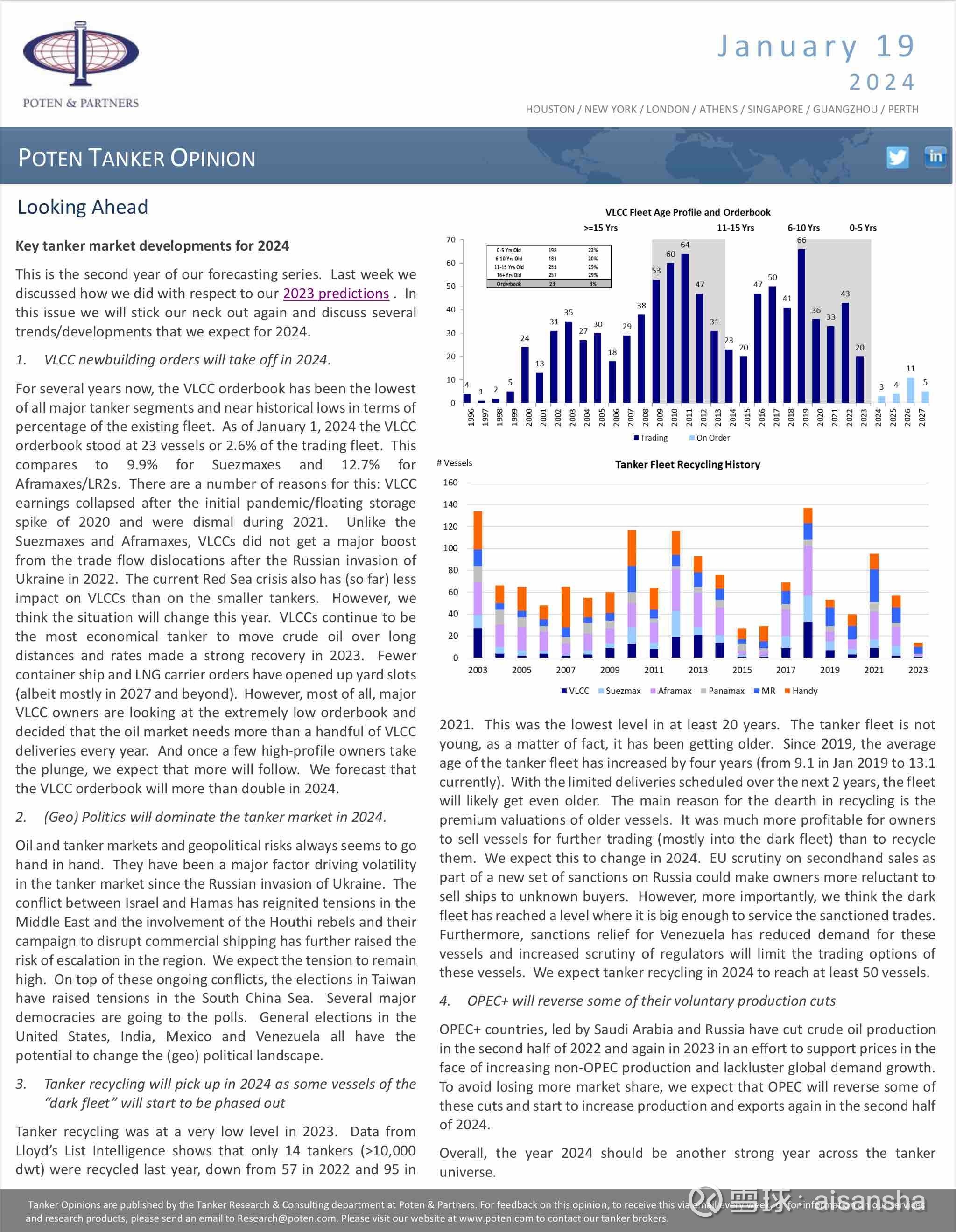

1. VLCC newbuilding orders will take off in 2024.

For several years now, the VLCC orderbook has been the lowest

of all major tanker segments and near historical lows in terms of

percentage of the existing fleet. As of January 1, 2024 the VLCC

orderbook stood at 23 vessels or 2.6% of the trading fleet. This

compares to 9.9% for Suezmaxes and 12.7% for

Aframaxes/LR2s. There are a number of reasons for this: VLCC

earnings collapsed after the initial pandemic/floating storage

spike of 2020 and were dismal during 2021. Unlike the

Suezmaxes and Aframaxes, VLCCs did not get a major boost

from the trade flow dislocations after the Russian invasion of

Ukraine in 2022. The current Red Sea crisis also has (so far) less

impact on VLCCs than on the smaller tankers. However, we

think the situation will change this year. VLCCs continue to be

the most economical tanker to move crude oil over long

distances and rates made a strong recovery in 2023. Fewer

container ship and LNG carrier orders have opened up yard slots

(albeit mostly in 2027 and beyond). However, most of all, major

VLCC owners are looking at the extremely low orderbook and

decided that the oil market needs more than a handful of VLCC

deliveries every year. And once a few high-profile owners take

the plunge, we expect that more will follow. We forecast that

the VLCC orderbook will more than double in 2024.

2. (Geo) Politics will dominate the tanker market in 2024.

Oil and tanker markets and geopolitical risks always seems to go

hand in hand. They have been a major factor driving volatility

in the tanker market since the Russian invasion of Ukraine. The

conflict between Israel and Hamas has reignited tensions in the

Middle East and the involvement of the Houthi rebels and their

campaign to disrupt commercial shipping has further raised the

risk of escalation in the region. We expect the tension to remain

high. On top of these ongoing conflicts, the elections in Taiwan

have raised tensions in the South China Sea. Several major

democracies are going to the polls. General elections in the

United States, India, Mexico and Venezuela all have the

potential to change the (geo) political landscape.

3. Tanker recycling will pick up in 2024 as some vessels of the

“dark fleet” will start to be phased out

Tanker recycling was at a very low level in 2023. Data from

Lloyd’s List Intelligence shows that only 14 tankers (>10,000

dwt) were recycled last year, down from 57 in 2022 and 95 in

Looking Ahead

HOUSTON / NEW YORK / LONDON / ATHENS / SINGAPORE / GUANGZHOU / PERTH

J a n u a r y 1 9

2 0 2 4

2015

POTEN TANKER OPINION