Investments

投资

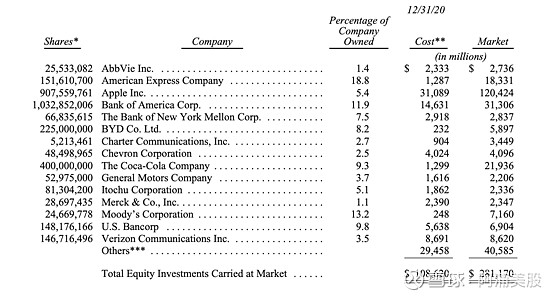

Below we list our fifteen common stock investments that at yearend wereour largest in market value. We exclude our Kraft Heinz holding — 325,442,152shares — because Berkshire is part of a control group and therefore mustaccount for that investment using the “equity” method. On its balance sheet,Berkshire carries the Kraft Heinz holding at a GAAP figure of $13.3 billion, anamount that represents Berkshire’s share of the audited net worth of KraftHeinz on December 31, 2020. Please note, though, that the market value of ourshares on that date was only $11.3 billion.

下面我们列出了我们在截至去年年末市值最大的15项普通股投资。我们排除了公司持有的325442152股 $卡夫亨氏(KHC)$ ,因为伯克希尔是控股集团的一部分,因此必须使用“权益”法对这笔投资进行核算。在他们的资产负债表上, $伯克希尔-哈撒韦A(BRK.A)$ 在GAAP计算下持有卡夫亨氏的股份价值为133亿美元,代表着伯克希尔在卡夫亨氏截至2020年12月31日经审计净资产中所占的份额。不过请注意,当时我们的股票市值只有113亿美元。

* Excludes shares held by pension funds of Berkshire subsidiaries.

** This is our actual purchase price and also our tax basis.

*** Includes a $10 billion investment in Occidental Petroleum, consisting ofpreferred stock and warrants to buy common stock, a combination now beingvalued at $9 billion.

*不包括伯克希尔养老基金子公司持有的股份。

**这是我们的实际购买价格,也是我们的计税依据。

***包括对西方石油公司(OccidentalPetroleum)的100亿美元投资,包括优先股和用于购买普通股的认股权证,目前组合估值为90亿美元。

A Tale of Two Cities

"双城记"

Success stories abound throughout America. Since our country’s birth,individuals with an idea, ambition and often just a pittance of capital havesucceeded beyond their dreams by creating something new or by improving thecustomer’s experience with something old.

在美国,成功的故事比比皆是。自美国诞生以来,那些有理想、有抱负,却往往只有微薄资本的人,通过创造新东西或用旧东西改善顾客体验,取得了超出他们梦想的成功。

Charlie and I journeyed throughout the nation to join with many of theseindividuals or their families. On the West Coast, we began the routine in 1972with our purchase of See’s Candy. A full century ago, Mary See set out todeliver an age-old product that she had reinvented with special recipes. Addedto her business plan were quaint stores staffed by friendly salespeople. Herfirst small outlet in Los Angeles eventually led to several hundred shops,spread throughout the West.

查理和我曾游历全美,与这些人或他们的家人相遇。在西海岸,我们从1972年收购喜诗糖果(See’sCandy)开始了这一惯例。整整一个世纪前,玛丽·时思(Mary See)开始推出一种古老的产品,她用特殊的配方对其进行了改造。除了她的商业计划之外,她还开设了一些古色古香的商店,里面有态度友好的销售人员。她在洛杉矶开的第一家小专卖店最终发展成了几百家商店,遍布整个西部地区。

Today, Mrs. See’s creations continue to delight customers whileproviding life-long employment for thousands of women and men. Berkshire’s jobis simply not to meddle with the company’s success. When a businessmanufactures and distributes a non-essential consumer product, the customer isthe boss. And, after 100 years, the customer’s message to Berkshire remainsclear: “Don’t mess with my candy.” (The website is网页链接)

今天,See女士的产品依旧吸引着客户,同时为成千上万的男女提供终身就业机会。伯克希尔的工作就是不干涉公司的成功。当企业生产和分销一种非必需的消费品时,顾客就是老板。100年后,顾客向伯克希尔传递的信息依然明确:“不要乱动我的糖果。”(喜诗糖果的网址是 https://网页链接,可以试试他们的花生糖。)

Let’s move across the continent to Washington, D.C. In 1936, LeoGoodwin, along with his wife, Lillian, became convinced that auto insurance – astandardized product customarily purchased from agents – could be sold directlyat a much lower price. Armed with $100,000, the pair took on giant insurerspossessing 1,000 times or more their capital. Government Employees InsuranceCompany (later shortened to GEICO) was on its way.

接下来让我们跨越大陆来到华盛顿特区。1936年,利奥·古德温(Leo Goodwin)和他的妻子莉莲(Lillian)开始相信,汽车保险——一种通常从代理商那里购买的标准化产品——可以直接以低得多的价格出售。两人怀揣10万美元,与拥有1000倍甚至更庞大资本的大型保险公司展开了较量。政府员工保险公司(后来简称为GEICO)由此开始了其漫漫征程。

By luck, I was exposed to the company’s potential a full 70 years ago.It instantly became my first love (of an investment sort). You know the rest ofthe story: Berkshire eventually became the 100% owner of GEICO, which at 84years of age is constantly fine-tuning – but not changing – the vision of Leoand Lillian.

幸运的是,我在整整70年前就意识了这家公司的潜力。它立刻成为了我的初恋(在投资方面)。接下来的故事大家都知道了:伯克希尔最终100%拥有了GEICO,这家84岁年历史公司一直在各种调整,但没有改变利Leo和Lillian当初的愿景。

There has been, however, a change in the company’s size. In 1937, itsfirst full year of operation, GEICO did $238,288 of business. Last year thefigure was $35 billion.

当然,该公司的规模发生了变化。1937年,也就是GEICO运营的第一个整年,它完成了238288美元的业务。去年的数字是350亿美元。

************

Today, with much of finance, media, government and tech located incoastal areas, it’s easy to overlook the many miracles occurring in middleAmerica. Let’s focus on two communities that provide stunning illustrations ofthe talent and ambition existing throughout our country.

如今,许多金融、媒体、政府和科技机构都位于沿海地区,人们很容易忽视美国中部发生的许多奇迹。让我们聚焦两个区域,它们为美国全国各地的人才和雄心提供了令人惊叹的例证。

You will not be surprised that I begin with Omaha.

你将不会惊讶于我从奥马哈开始。

In 1940, Jack Ringwalt, a graduate of Omaha’s Central High School (thealma mater as well of Charlie, my dad, my first wife, our three children andtwo grandchildren), decided to start a property/casualty insurance companyfunded by $125,000 in capital.

1940年,毕业于奥马哈中心高中(也是查理、我父亲、我第一任妻子、我们的三个孩子和两个孙儿的母校)的杰克·林格沃特(Jack Ringwalt)决定用12.5万美元的资本创办一家财产/意外保险公司。

Jack’s dream was preposterous, requiring his pipsqueak operation –somewhat pompously christened as National Indemnity – to compete with giantinsurers, all of which operated with abundant capital. Additionally, thosecompetitors were solidly entrenched with nationwide networks of well-funded andlong-established local agents. Under Jack’s plan, National Indemnity, unlikeGEICO, would itself use whatever agencies deigned to accept it and consequentlyenjoy no cost advantage in its acquisition of business. To overcomethose formidable handicaps, National Indemnity focused on “odd-ball” risks,which were deemed unimportant by the “big boys.” And, improbably, the strategysucceeded.

杰克的梦想似乎是荒谬的,因为这要求他的小公司——有点夸张地被命名为国民保险公司(NationalIndemnity)——要与大型保险公司竞争,而这些公司都拥有充足的资本。此外,这些竞争对手凭借遍布全国、资金雄厚、历史悠久的当地代理商网络而牢固地确立了自己的地位。在杰克的计划中,与GEICO不同的是,国民保险公司本身将会使用任何屈尊接受它的机构,因此在收购业务时没有成本优势。为了克服这些可怕的障碍,国民保险将重点放在了被大公司认为不重要的“古怪”风险上。不可思议的是,这一策略出人意料地成功了。

Jack was honest, shrewd, likeable and a bit quirky. In particular, he dislikedregulators. When he periodically became annoyed with their supervision, hewould feel an urge to sell his company.

杰克诚实、精明、讨人喜欢,还有点古怪。他尤其不喜欢监管机构。每当他对他们的监督感到厌烦时,他就会有卖掉公司的冲动。

Fortunately, I was nearby on one of those occasions. Jack liked the ideaof joining Berkshire, and we made a deal in 1967, taking all of 15 minutes toreach a handshake. I never asked for an audit.

幸运的是,有一次我就在附近。杰克想加入伯克希尔,于是我们在1967年达成了交易,只用了15分钟就达成了协议。我都从没要求过账目审计。

Today National Indemnity is the only company in the world preparedto insure certain giant risks. And, yes, it remains based in Omaha, a few milesfrom Berkshire’s home office.

今天,国民保险公司是世界上唯一一家愿意为某些巨大风险承保的公司。是的,它的总部仍然在奥马哈,距离伯克希尔的总部只有几英里。

Over the years, we have purchased four additional businesses from Omahafamilies, the best known among them being Nebraska Furniture Mart (“NFM”). Thecompany’s founder, Rose Blumkin (“Mrs. B”), arrived in Seattle in 1915 as aRussian emigrant, unable to read or speak English. She settled in Omaha severalyears later and by 1936 had saved $2,500 with which to start a furniture store.

多年来,我们又从奥马哈地区收购了四家企业,其中最著名的是内布拉斯加州家具城(NFM)。该公司的创始人罗斯·布卢姆金(Rose Blumkin,B夫人)是俄罗斯移民,在1915年来到西雅图,她既不会读也不会说英语。几年后,她定居在奥马哈。在1936年,她攒下了2500美元,用这笔钱开了一家家具店。

Competitors and suppliers ignored her, and for a time their judgmentseemed correct: World War II stalled her business, and at yearend 1946, thecompany’s net worth had grown to only $72,264. Cash, both in the till and ondeposit, totaled $50 (that’s not a typo).

竞争对手和供应商忽视了她,而他们的判断在当时无疑是正确的:第二次世界大战让她的生意停滞了。1946年底,公司的净资产仅增长到72264美元。现金只有50美元(没有打错字)。

One invaluable asset, however, went unrecorded in the 1946 figures:Louie Blumkin, Mrs. B’s only son, had rejoined the store after four years inthe U.S. Army. Louie fought at Normandy’s Omaha Beach following the D-Dayinvasion, earned a Purple Heart for injuries sustained in the Battle of theBulge, and finally sailed home in November 1945.

然而,有一笔无价的财富没有在1946年的数字中记录下来:B夫人唯一的儿子路易·布卢姆金(Louie Blumkin)在美国军队服役四年后重新加入了这家店。在诺曼底登陆后,路易参加了诺曼底奥马哈海滩的战斗,并因在Bulge战役中受伤而获得了紫心勋章,最终在1945年11月乘船回国。

Once Mrs. B and Louie were reunited, there was no stopping NFM. Drivenby their dream, mother and son worked days, nights and weekends. The result wasa retailing miracle.

一旦B夫人和路易重聚,就没有什么能阻止这家家具店的发展了。在梦想的驱使下,母亲和儿子不分昼夜地工作。结果是他们创造了一个零售业奇迹。

By 1983, the pair had created a business worth $60 million. That year,on my birthday, Berkshire purchased 80% of NFM, again without an audit. Icounted on Blumkin family members to run the business; the third and fourthgeneration do so today. Mrs. B, it should be noted, worked daily until she was103 – a ridiculously premature retirement age as judged by Charlie and me.

到1983年,两人已经让家具店的业务规模达到了6000万美元。那一年,在我生日那天,伯克希尔收购了NFM 80%的股份。同样,我们没有对这家家具店进行审计。我指望布卢姆金的家族成员来经营企业。今天,NFM正由第三代和第四代布卢姆金的家族成员管理着。需要指出的是,B夫人每天都在工作,直到103岁——在我和查理看来,要说在这个年纪退休,那可早的太荒谬了。

NFM now owns the three largest home-furnishings stores in the U.S. Eachset a sales record in 2020, a feat achieved despite the closing of NFM’s storesfor more than six weeks because of COVID-19.

NFM目前拥有美国最大的三家家居用品商店,尽管NFM的门店因为新冠疫情关闭了六周多,但这三家商店在2020年都创下了销售记录。

A post-script to this story says it all: When Mrs. B’s large familygathered for holiday meals, she always asked that they sing a song beforeeating. Her selection never varied: Irving Berlin’s “God Bless America.”

这个故事的后记说明了一切:每当B夫人的一大家子人聚在一起过节吃饭时,她总是要求他们在吃饭前唱首歌。她的选择从未改变过:欧文·柏林(Irving Berlin)的《上帝保佑美国》(God Bless America)。

************

Let’s move somewhat east to Knoxville, the third largest city in Tennessee.There, Berkshire has ownership in two remarkable companies – ClaytonHomes (100% owned) and Pilot Travel Centers (38% owned now, but headed for 80%in 2023).

让我们向东转移到田纳西州的第三大城市诺克斯维尔。在那里,伯克希尔拥有两家引人注目的公司——克莱顿住宅(ClaytonHomes)(100%持股)和Pilot Travel Centers(目前持股38%,但到2023年将达到80%)。

Each company was started by a young man who had graduated from theUniversity of Tennessee and stayed put in Knoxville. Neither had a meaningfulamount of capital nor wealthy parents.

每一家公司都是由一位毕业于田纳西大学并留在诺克斯维尔的年轻人创立的。这两个年轻人都没有足够的资金,父母也不富裕。

But, so what? Today, Clayton and Pilot each have annual pre-taxearnings of more than $1 billion. Together they employ about 47,000 menand women.

但是,那又怎样?如今,克莱顿和Pilot的年税前利润都超过了10亿美元。这两家公司共雇用了大约4.7万名员工。

Jim Clayton, after several other business ventures, founded ClaytonHomes on a shoestring in 1956, and “Big Jim” Haslam started what became PilotTravel Centers in 1958 by purchasing a service station for $6,000. Each of themen later brought into the business a son with the same passion, values andbrains as his father. Sometimes there is a magic to genes.

吉姆-克莱顿(Jim Clayton)在经历了几次商业冒险之后,于1956年以小本经营的方式创建了克莱顿住宅(ClaytonHomes)。1958年,“大个子吉姆”(Big Jim Haslam)以6000美元的价格购买了一个服务站,创建了后来的Pilot Travel Centers。后来,他俩的儿子也都加入了他们的父亲的公司,他们的儿子有着和他们父亲一样的激情、价值观和头脑。有时候基因太有魔力了。

“Big Jim” Haslam, now 90, has recently authored an inspirational book inwhich he relates how Jim Clayton’s son, Kevin, encouraged the Haslams tosell a large portion of Pilot to Berkshire. Every retailer knows that satisfiedcustomers are a store’s best salespeople. That’s true when businesses arechanging hands as well.

现年90岁的“大吉姆”Haslam最近写了一本励志书,他在书中讲述了JimClayton的儿子Kevin是如何鼓励Haslam家族将大部分的PilotTravel Centers卖给伯克希尔的。每个零售商都知道满意的顾客是商店的最佳销售人员。当企业易手时也是如此。

************

When you next fly over Knoxville or Omaha, tip your hat to the Claytons,Haslams and Blumkins as well as to the army of successful entrepreneurs whopopulate every part of our country. These builders needed America’s frameworkfor prosperity – a unique experiment when it was crafted in 1789 – to achievetheir potential. In turn, America needed citizens like Jim C., Jim H., Mrs. Band Louie to accomplish the miracles our founding fathers sought.

当您下次飞越诺克斯维尔或奥马哈时,请向Clayton家族、Haslam家族和Blumkin家族,以及遍布全国各地的成功企业家们脱帽致敬吧。这些创造者需要美国的繁荣框架(它始于1789年进行的一次独特实验)来实现他们的潜力。反过来,美国需要像吉姆·C、吉姆·H、布卢姆金夫人和路易这样的公民来实现开国元勋所追求的奇迹。

Today, many people forge similar miracles throughout the world,creating a spread of prosperity that benefits all of humanity. In itsbrief 232 years of existence, however, there has been no incubator forunleashing human potential like America. Despite some severe interruptions, ourcountry’s economic progress has been breathtaking.

如今,许多人在世界各地创造了类似的奇迹,创造了使全人类受益的繁荣。然而,在短暂的232年历史中,还没有一个像美国这样释放人类潜能的孵化器。尽管出现了严重的中断,但我们国家的经济发展一直是惊人的。

Beyond that, we retain our constitutional aspiration of becoming “a moreperfect union.” Progress on that front has been slow, uneven and oftendiscouraging. We have, however, moved forward and will continue to do so.

除此之外,我们仍保留宪法所赋予我们成为“一个更完美的联邦”的愿望。在这方面的进展是缓慢的、不平衡且经常令人沮丧。但是,我们已经向前迈进,并将继续前进。

Our unwavering conclusion: Never bet against America.

我们坚定不移的结论:永远不要和美国对赌。