标普没跌透

历史数据:To date, we're down 25% from the top on February 19th

The typical bear market is down 40%A 40% market drawdown would take the S&P 500 to 2,032

The typical bear market takes 2.9 years to recoverThat 2.9-year average excludes 1929, which lasted 25 years

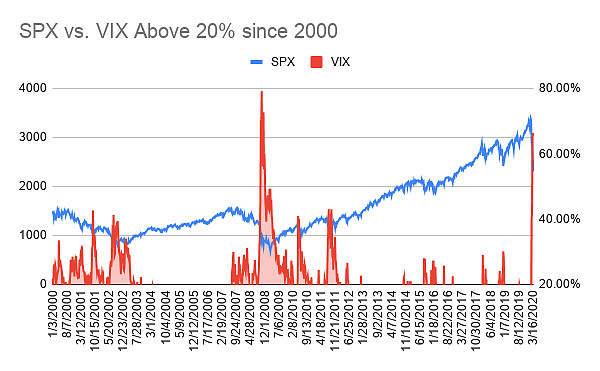

VIX恐慌指标对比:

An important observation during the 2008 debacle is that relief rallies were constantly faded in the SPX until the VIX index eventually dropped back under 30%. Meanwhile, though not to the same extent, during the 2000-2003 bear market, VIX had persistently stayed above 20%, with multiple spikes above 40% before making the final bottom in 2003.

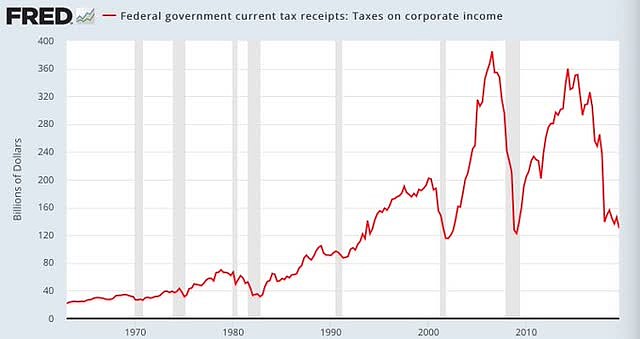

大公司该出点血了,经济繁荣时期交的税和2001年科技股泡沫、2008年金融危机差不多