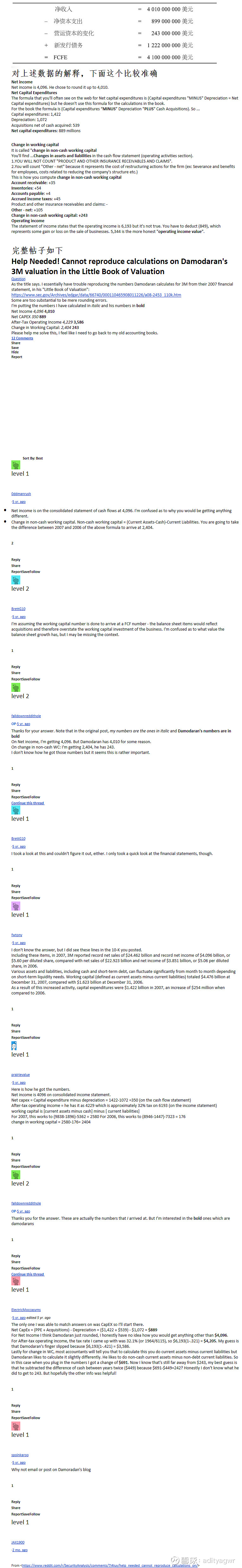

对上述数据的解释,下面这个比较准确

Net income

Net income is 4,096. He chose to round it up to 4,010.

Net Capital Expenditures

The formula that you'll often see on the web for Net capital expenditures is (Capital expenditures "MINUS" Depreciation = Net Capital expenditures) but he doesn't use this formula for the calculations in the book.

For the book the formula is (Capital expenditures “MINUS” Depreciation "PLUS" Cash Acquisitions). So ...

Capital expenditures: 1,422

Depreciation: 1,072

Acquisitions net of cash acquired: 539

Net capital expenditures: 889 millions

Change in working capital

It is called "change in non-cash working capital

You'll find ...Changes in assets and liabilities in the cash flow statement (operating activities section).

1.YOU WILL NOT COUNT "PRODUCT AND OTHER INSURANCE RECEIVABLES AND CLAIMS".

2.You will count "Other - net" because it represents the cost of restructuring actions for the firm (ex: Severance and benefits for employees, costs related to reducing the company's structure etc.)

This is how you compute change in non-cash working capital

Account receivable: +35

Inventories: +54

Accounts payable: +4

Accrued income taxes: +45

Product and other insurance receivables and claims: -

Other - net: +105

Change in non-cash working capital: +243

Operating income

The statement of income states that the operating income is 6,193 but it's not true. You have to deduct (849), which represents some gain or loss on the sale of businesses. 5,344 is the more honest "operating income value".

完整帖子如下

Help Needed! Cannot reproduce calculations on Damodaran's 3M valuation in the Little Book of Valuation

As the title says. I essentially have trouble reproducing the numbers Damodaran calculates for 3M from their 2007 financial statement, in his "Little Book of Valuation":

Some are too substantial to be mere rounding errors.

I'm putting the numbers I have calculated in italic and his numbers in bold

Net Income 4,096 4,010

Net CAPEX 350 889

After-Tax Operating Income 4,229 3,586

Change in Working Capital: 2,404 243

Please help me solve this, I feel like I need to go back to my old accounting books.

Share

Save

Hide

Report

Sort By: Best

level 1

Net income is on the consolidated statement of cash flows at 4,096. I'm confused as to why you would be getting anything different.

Change in non-cash working capital. Non-cash working capital = (Current Assets-Cash)-Current Liabilities. You are going to take the difference between 2007 and 2006 of the above formula to arrive at 2,404.

2

Reply

Share

ReportSaveFollow

level 2

I'm assuming the working capital number is done to arrive at a FCF number - the balance sheet items would reflect acquisitions and therefore overstate the working capital investment of the business. I'm confused as to what value the balance sheet growth has, but I may be missing the context.

1

Reply

Share

ReportSaveFollow

level 2

OP·5 yr. ago

Thanks for your answer. Note that in the original post, my numbers are the ones in italic and Damodaran's numbers are in bold

On Net income, I'm getting 4,096. But Damodaran has 4,010 for some reason.

On change in non-cash WC: I'm getting 2,404, he has 243.

I don't know how he got those numbers but it seems this is rather important.

1

Reply

Share

ReportSaveFollow

level 1

I took a look at this and couldn't figure it out, either. I only took a quick look at the financial statements, though.

1

Reply

Share

ReportSaveFollow

level 1

I don't know the answer, but I did see these lines in the 10-K you posted.

Including these items, in 2007, 3M reported record net sales of $24.462 billion and record net income of $4.096 billion, or $5.60 per diluted share, compared with net sales of $22.923 billion and net income of $3.851 billion, or $5.06 per diluted share, in 2006.

Various assets and liabilities, including cash and short-term debt, can fluctuate significantly from month to month depending on short-term liquidity needs. Working capital (defined as current assets minus current liabilities) totaled $4.476 billion at December 31, 2007, compared with $1.623 billion at December 31, 2006.

As a result of this increased activity, capital expenditures were $1.422 billion in 2007, an increase of $254 million when compared to 2006.

1

Reply

Share

ReportSaveFollow

level 1

Here is how he got the numbers.

Net income is 4096 on consolidated income statement.

Net capex = Capital expenditure minus depreciation = 1422-1072 =350 (on the cash flow statement)

After-tax operating income = he has it as 4229 which is approximately 32% tax on 6193 (on the income statement)

working capital is [current assets minus cash] minus [ current liabilities]

For 2007, this works to (9838-1896)-5362 = 2580 For 2006, this works to (8946-1447)-7323 = 176

change in working capital = 2580-176= 2404

1

Reply

Share

ReportSaveFollow

level 2

OP·5 yr. ago

Thanks you for the answer. These are actually the numbers that I arrived at. But I’m interested in the bold ones which are damodarans

1

Reply

Share

ReportSaveFollow

level 1

·5 yr. ago·edited 5 yr. ago

The only one I was able to match answers on was CapEX so I'll start there.

Net CapEx = (PPE + Acquisitions) - Depreciation = ($1,422 + $539) - $1,072 = $889

For Net Income I think Damodaran just rounded, I honestly have no idea how you would get anything other than $4,096.

For After-tax operating income, the tax rate I came up with was 32.1% (or 1964/6115), so $6,193(1-.321) = $4,205. My guess is that Damodaran's finger slipped because $6,193(1-.421) = $3,586.

Lastly for change in WC, most accountants will tell you that to calculate this you do current assets minus current liabilities but Damodaran likes to calculate it slightly differently. He likes to do non-cash current assets minus non-debt current liabilities. So in this case when you plug in the numbers I got a change of $691. Now I know that's still far away from $243, my best guess is that he subtracted the difference of cash between years twice ($449) because $691-$449=242? Honestly I don't know what he did to get to 243. But hopefully the other info was helpful!

1

Reply

Share

ReportSaveFollow

level 1

Why not email or post on Damoradan's blog

1

Reply

Share

ReportSaveFollow

level 1

From <网页链接