Insurance保险业务

“Our investment in the insurance companies reflects a first major step in our efforts to achieve a more diversified base of earning power.”

— 1967 Annual Report“在保险行业的投资是我们形成多元化利润来源的重要一步。”

— 1967 年年报

Let’s look first at insurance, Berkshire’s core operation and the engine that has consistentlypropelled our expansion since that 1967 report was published.

我们先来看保险业务,1967 年的年报发布以来不断驱动伯克希尔前进和扩张的核心业务。

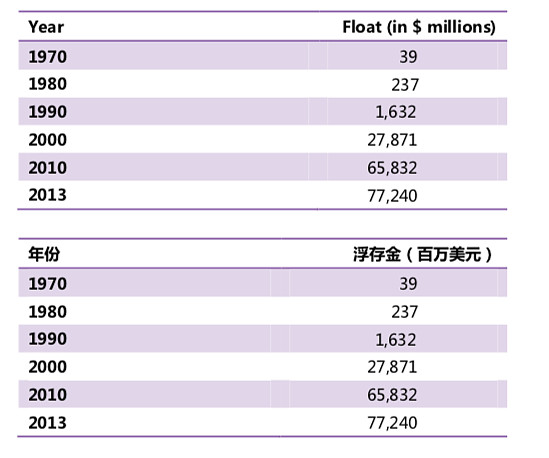

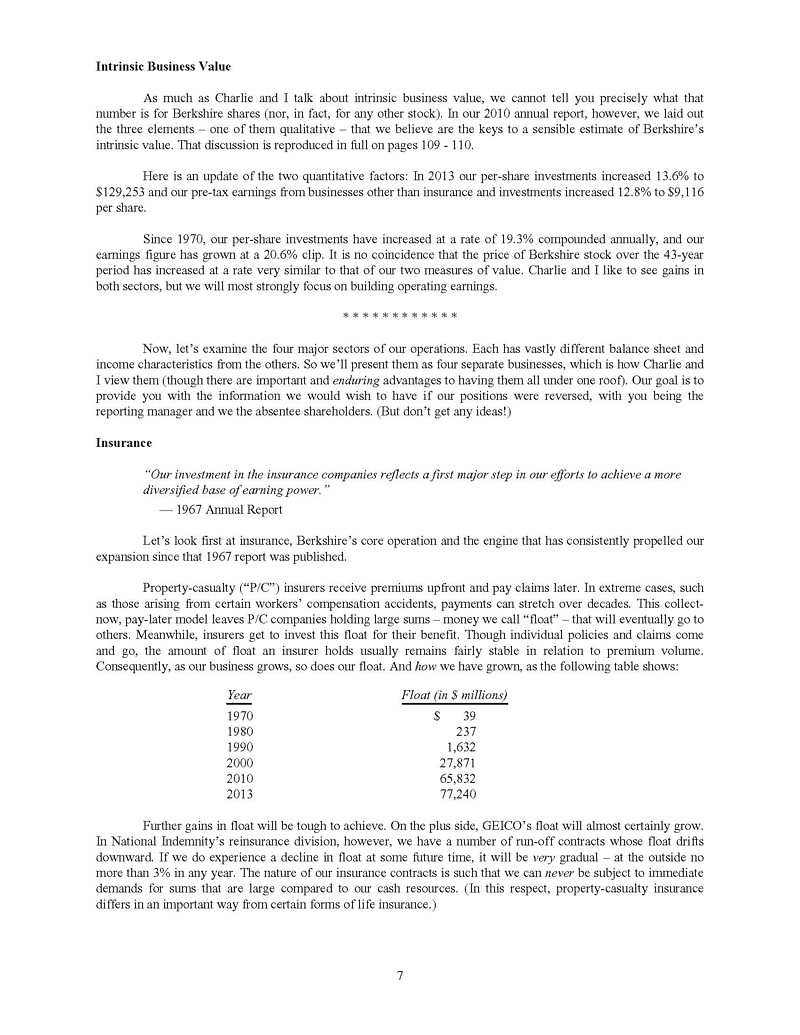

Property-casualty (“P/C”) insurers receive premiums upfront and pay claims later. In extremecases, such as those arising from certain workers’ compensation accidents, payments can stretchover decades. This collect now, pay-later model leaves P/C companies holding large sums – money we call “float” – that will eventually go to others. Meanwhile, insurers get to invest this float for their benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float. And how we have grown, as the following table shows:财产保险公司先收取保费,事后进行理赔支付。在一些极端情况下,比如某些工伤保险,赔 付可能发生在几十年之后。这种现在收钱,将来赔付的模式让我们持有大量的现金——我们把它称作“浮存金”——最终它会支付到别人手中。同时,我们可以使用这些浮存金为伯克 希尔投资。虽然单笔的保单和索赔有进有出,但是我们持有的浮存金总额和保费收入维持一 个稳定关系。所以,当我们的业务扩张时,我们的浮存金规模也扩张。我们增长的速度,参 见下面的表格:

Further gains in float will be tough to achieve. On the plus side, GEICO’s float will almost certainlygrow. In National Indemnity’s reinsurance division, however, we have a number of run-off contracts whose float drifts downward. If we do experience a decline in float at some future time, it will be very gradual – at the outside no more than 3% in any year. The nature of our insurance contracts is such that we can never be subject to immediate demands for sums that are large compared to our cash resources. (In this respect, property-casualty insurance differs in an important way from certain forms of life insurance.)

获取更多的浮存金越来越困难了。不过 GEICO 的浮存金继续增长基本确定无疑。在 National Indemnity 的再保险业务部门,我们流失了一些保单,浮存金也相应下降。即便未来我们出 现浮存金的下降,那也会是非常轻微的——每年最多不会超过 3%。相较于我们的流动性规 模,我们的保单特性保证我们不会受制于任何短期的流动性压力。(在这方面,财险业务和 某些形式的寿险业务有非常的区别。)

If our premiums exceed the total of our expenses and eventual losses, we register an underwriting profit that adds to the investment income our float produces. When such a profit is earned, we enjoy the use of free money – and, better yet, get paid for holding it.如果我们的保费收入超过了总成本和最终的赔付支出,我们会在利用浮存金投资获得的投资 收益之外,录得一个承保利润。赚到这种利润的时候,我们是在享受持有这些免费资金的好 处——更好的是,我们还因为持有资金而赚到钱。这就好像你去银行贷款,银行还倒贴给你 利息。

Unfortunately, the wish of all insurers to achieve this happy result creates intense competition, so vigorous in most years that it causes the P/C industry as a whole to operate at a significant underwriting loss. This loss, in effect, is what the industry pays to hold its float. For example,State Farm, by far the country’s largest insurer and a well-managed company besides, incurred an underwriting loss in nine of the twelve years ending in 2012 (the latest year for which their financials are available, as I write this). Competitive dynamics almost guarantee that the insurance industry – despite the float income all companies enjoy – will continue its dismal record of earning subnormal returns as compared to other businesses.不幸的是,保险公司实现这个美好结果的强烈愿望导致了激烈的竞争,竞争如此惨烈以至于 大多数年份,财产保险行业整体处在严重的承保亏损中运行。这笔承保亏损,实质上就是整 个行业为了获得浮存金而支付的成本。举个例子,State Farm,当前美国最大且管理良好的 保险公司,截止到 2012 年前的 12 年里有 9 年都录得承保亏损(依据我写作本报告时所能获 得的最新一年的财务数据)。保险行业有很多种亏钱的方式,而且这个行业从来不曾停止寻 找新的亏钱方式。

As noted in the first section of this report, we have now operated at an underwriting profit for eleven consecutive years, our pre-tax gain for the period having totaled $22 billion. Looking ahead, I believe we will continue to underwrite profitably in most years. Doing so is the daily focus of all of our insurance managers who know that while float is valuable, it can be drowned by poor underwriting results.

正如前一部分提到的,我们已经连续 11 年录得承保利润,我们这一时期内的税前承保利润 累计达 220 亿美元。预计未来大部分年份中,我们依然会保持录得承保利润。实现承保利润 是我们保险公司管理层的每日工作,他们明白浮存金的价值,糟糕的承保亏损将会吞噬它的 价值。

So how does our float affect intrinsic value? When Berkshire’s book value is calculated, the full amount of our float is deducted as a liability, just as if we had to pay it out tomorrow and could not replenish it. But to think of float as strictly a liability is incorrect; it should instead be viewed as a revolving fund. Daily, we pay old claims – some $17 billion to more than five million claimants in 2013 – and that reduces float. Just as surely, we each day write new business and thereby generate new claims that add to float. If our revolving float is both costless and long-enduring, which I believe it will be, the true value of this liability is dramatically less than the accounting liability.那我们诱人的浮存金将会如何影响内在价值?当伯克希尔计算账面价值的时候,所有的浮存 金都作为负债被扣除了,就好像我们明天就要兑现债务,并且再也无法补充回来。但把浮存 金当做一种严格意义上的负债是错误的,它实际上应该被看做一笔循环基金。2013 年,我 们平均每天赔付超过 500 多万笔保单总计 170 亿美元——这减少了浮存金。同时,我们每天 都承接新保单从而增加浮存金。如果浮存金是无成本并且是长期存在的,我相信对伯克希尔 来说确实如此,那这项负债的真实价值就远比账面负债小得多。

A counterpart to this overstated liability is $15.5 billion of “goodwill” that is attributable to ourinsurance companies and included in book value as an asset. In very large part, this goodwill represents the price we paid for the float-generating capabilities of our insurance operations. The cost of the goodwill, however, has no bearing on its true value. For example, if an insurance business sustains large and prolonged underwriting losses, any goodwill asset carried on the books should be deemed valueless, whatever its original cost.我们资产账面上记录的,对应保险公司的 155 亿“商誉”部分地抵消了负债账面价值的高估。实际上,这些商誉代表着我们为保险公司产生浮存金的能力所支付的价格。然而商誉的账面 成本,和它的真实价值毫无对应关系。比如说一家持续产生大额承保亏损的保险公司,其商 誉应该为零,无论其历史成本是多少。

Fortunately, that does not describe Berkshire. Charlie and I believe the true economic value of

our insurance goodwill – what we would happily pay to purchase an insurance operation possessing float of similar quality to that we have – to be far in excess of its historic carrying value. The value of our float is one reason – a huge reason – why we believe Berkshire’s intrinsic business value substantially exceeds its book value.幸运的是,伯克希尔的情况不是那样。查理和我相信,我们保险公司的真实商誉——我们愿 意为购买一家能产生类似质量的浮存金的保险公司所支付的价格——远超过账面上记录的 历史成本。浮存金的价值是我们认为伯克希尔的内在价值明显超过账面价值的一个原因—— 一个重要原因。

************

Berkshire’s attractive insurance economics exist only because we have some terrific managersrunning disciplined operations that possess strong, hard-to-replicate business models. Let me tell you about the major units.伯克希尔优越的经济特性之所以存在,是因为我们有一群卓越的经理人经营我们拿手的业务,并且这些业务模式基础强健并且难以复制。让我将给大家介绍一些主要的公司。

First by float size is the Berkshire Hathaway Reinsurance Group, managed by Ajit Jain. Ajit insures risks that no one else has the desire or the capital to take on. His operation combines capacity, speed, decisiveness and, most important, brains in a manner unique in the insurance business.

Yet he never exposes Berkshire to risks that are inappropriate in relation to our resources. Indeed, we are far more conservative in avoiding risk than most large insurers. For example, if the insurance industry should experience a $250 billion loss from some mega catastrophe – a loss about triple anything it has ever experienced – Berkshire as a whole would likely record a significant profit for the year because of its many streams of earnings. And we would remain awash in cash, looking for large opportunities if the catastrophe caused markets to go into shock. All other major insurers and reinsurers would meanwhile be far in the red, with some facing insolvency.

首先,浮存金规模排在第一的是伯克希尔哈撒韦再保险集团,由 Ajit Jain 领导。Ajit 对其他 人都不愿意承保,或者没有足够资本进行承保的风险进行承保。他的公司集能力、速度、果 断,以及最重要的,保险专业智慧于一身。他从未让伯克希尔暴露于与我们的资源不相称的 风险之下。实际上,我们比多数大保险公司在规避风险方面都更加谨慎。举例来说,如果保 险行业因某项巨灾遭遇了 2500 亿美元的亏损——这是历史上所发生过最大规模亏损的 3 倍 ——伯克希尔当年整体上依然能够实现盈利,因为它有如此多的利润来源。我们一直会攥满 现金,等待巨灾冲击市场这样的好机会。而其他的大保险公司和再保险公司则可能会出现大 额的亏损,有些甚至将面临破产。

From a standing start in 1985, Ajit has created an insurance business with float of $37 billion and a large cumulative underwriting profit, a feat no other insurance CEO has come close to matching.Ajit’s mind is an idea factory that is always looking for more lines of business he can add to his current assortment.

从 1985 年开始,Ajit 已经创立了一个浮存金 370 亿美元,实现巨额累计承保利润的再保险 公司,这是一项任何其他保险公司的 CEO 都难以望其项背成就。Ajit 的大脑就想一个创意工 厂,无时不刻搜寻着任何可以扩展他现有业务的机会。

One venture materialized last June when he formed Berkshire Hathaway Specialty Insurance(“BHSI”). This initiative took us into commercial insurance, where we were instantly accepted by both major insurance brokers and corporate risk managers throughout America. These professionals recognize that no other insurer can match the financial strength of Berkshire, which guarantees that legitimate claims arising many years in the future will be paid promptly and fully.去年 6 月一项新业务成行,Ajit 组建了伯克希尔哈撒韦专业保险公司(“BHSI”)。这是我们首 次进入商业保险领域,全国主要的保险经纪人和企业风险管理人都非常认可我们。这些专业 人士明白,在财务稳健方面没有任何其他保险公司可与伯克希尔相比,这保证了它们未来多 年的任何合法索赔都会得到及时的全额赔付。

BHSI is led by Peter Eastwood, an experienced underwriter who is widely respected in the insurance world. Peter has assembled a spectacular team that is already writing a substantial amount of business with many Fortune 500 companies and with smaller operations as well. BHSI will be a major asset for Berkshire, one that will generate volume in the billions within a few years. Give Peter a Berkshire greeting when you see him at the annual meeting.

BHSI 由 Peter Eastwood 领导,他是一名经验丰富、受人尊敬的保险人。Peter 组建的豪华团 队已经为许多世界 500 强企业提供了大量承保,当然也包括小一些的公司。BHSI 将会成为 伯克希尔的重要资产之一,一块在未来几年内贡献数十亿美元的财富。如果大家在年会上碰 到 Peter 的话,向他致以伯克希尔式的问候。

************

We have another reinsurance powerhouse in General Re, managed by Tad Montross.

我们还有另外一驾再保险马车,它属于通用再保险,由 Tad Montross 掌管。

At bottom, a sound insurance operation needs to adhere to four disciplines. It must (1) understandall exposures that might cause a policy to incur losses; (2) conservatively assess the likelihood of any exposure actually causing a loss and the probable cost if it does; (3) set a premium that, on average, will deliver a profit after both prospective loss costs and operating expenses are covered; and (4) be willing to walk away if the appropriate premium can’t beobtained.最起码地,一家优秀的保险公司必须遵守四项原则。它必须(1)理解所有可能导致保单形 成损失的风险敞口;(2)保守地衡量风险敞口实际形成损失的概率以及可能的损失规模;(3) 设定合理的保费,平均来看,要能在覆盖潜在的损失成本和运营成本后实现承保利润;(4) 愿意在收取不了合意的保费时放弃保单。

Many insurers pass the first three tests and flunk the fourth. They simply can’t turn their back onbusiness that is being eagerly written by their competitors. That old line, “The other guy is doing it, so we must as well,” spells trouble in any business, but in none more so than insurance.很多保险公司顺利通过前三条,但在第四条上不及格。它们无法在它们的竞争对手也争抢的 业务上回头。古话说,“别人这么干,我也得这么干”,这在很多行业都造成了麻烦,但这在 保险行业造成的麻烦尤其多。

Tad has observed all four of the insurance commandments, and it shows in his results. GeneralRe’s huge float has been better than cost-free under his leadership, and we expect that, on average, to continue. We are particularly enthusiastic about General Re’s international lifereinsurance business, which has grown consistently and profitably since we acquired the company in 1998.

Tad 非常明了保险行业的四条军规,他的业绩证明了这一点。在他的领导下,通用再保险的 巨额浮存金比免费的资金还要诱人,并且我们预计这种情况依然会继续。我们尤其对通用再 保险的国际人寿再保险业务充满热情,从 1998 年我们收购公司以来,这项业务持续增长并 不断盈利。

It can be remembered that soon after we purchased General Re, the company was beset by problems that caused commentators – and me as well, briefly – to believe I had made a huge mistake. That day is long gone. General Re is now a gem.当初我们买下通用再保险时,公司问题缠身,许多评论员——甚至在短时间内包括我,都认 为我自己犯下了巨大错误。不过事情过去很久了。现在,通用再保险是一块珍宝。

************

Finally, there is GEICO, the insurer on which I cut my teeth 63 years ago. GEICO is managed by

Tony Nicely, who joined the company at 18 and completed 52 years of service in 2013. Tony became CEO in 1993, and since then the company has been flying.

最后,是 GEICO,63 年前让我开始入行时投资的保险公司。GEICO 由 Tony Nicely 掌管,他18 岁就加入了公司,到 2013 年,已经服役 52 年。1993 年 Tony 当上了 CEO,公司从那一刻 开始起飞。

When I was first introduced to GEICO in January 1951, I was blown away by the huge cost advantage the company enjoyed compared to the expenses borne by the giants of the industry. That operational efficiency continues today and is an all-important asset. No one likes to buy auto insurance. But almost everyone likes to drive. The insurance needed is a major expenditure for most families. Savings matter to them – and only a low-cost operation can deliver these.

1951 年 1 月我第一次接触到 GEICO 的时候就被公司无与伦比的成本优势所震撼。这项优势 至今依旧保持并且是公司最最重要的资产。没人喜欢买车险。但是几乎每个人都喜欢开车。必不可少的车险成了大多数家庭的主要开支。便宜对他们来说非常重要——而只有低成本的 保险公司能为他们提供这样的车险。

GEICO’s cost advantage is the factor that has enabled the company to gobble up market shareyear after year. Its low costs create a moat – an enduring one – that competitors are unable to cross. Meanwhile, our little gecko continues to tell Americans how GEICO can save them important money. With our latest reduction in operating costs, his story has become even more compelling.

GEICO 的成本优势是其市场份额年年上升的原因。它的低成本优势是其它竞争对手难以逾越 的、持久的护城河。我们的小蜥蜴9一直在宣传 GEICO 如何为大家省钱。最近公司进行了新 一轮的运营成本削减,它的传说还将继续。

In 1995, we purchased the half of GEICO that we didn’t already own, paying $1.4 billion morethan the net tangible assets we acquired. That’s “goodwill,” and it will forever remain unchanged on our books. As GEICO’s business grows, however, so does its true economic goodwill. I believe that figure to be approaching $20 billion.

1995 年,我们买下 GEICO 剩余的一半股份时,比可辨净认资产多花了 14 亿。这被记作“商 誉”,并且在财报上的数值一直不变。但是随着 GEICO 的业务增长,它的真实商誉也不断增 长。我认为这个数值现在接近 200 亿。

************

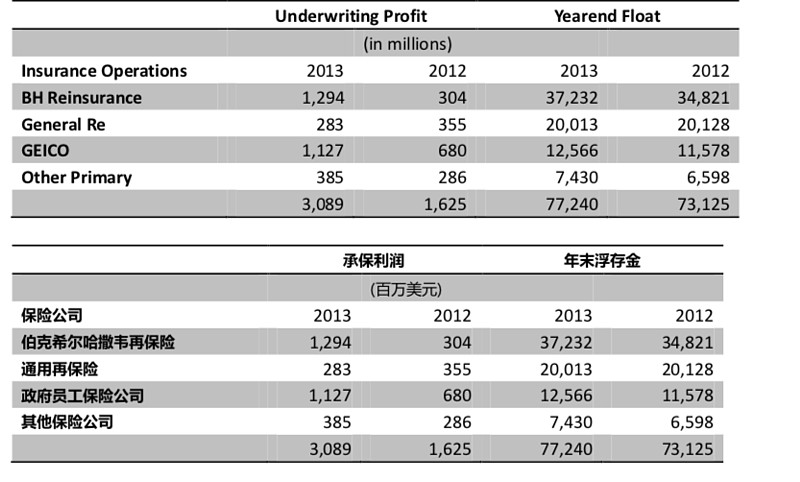

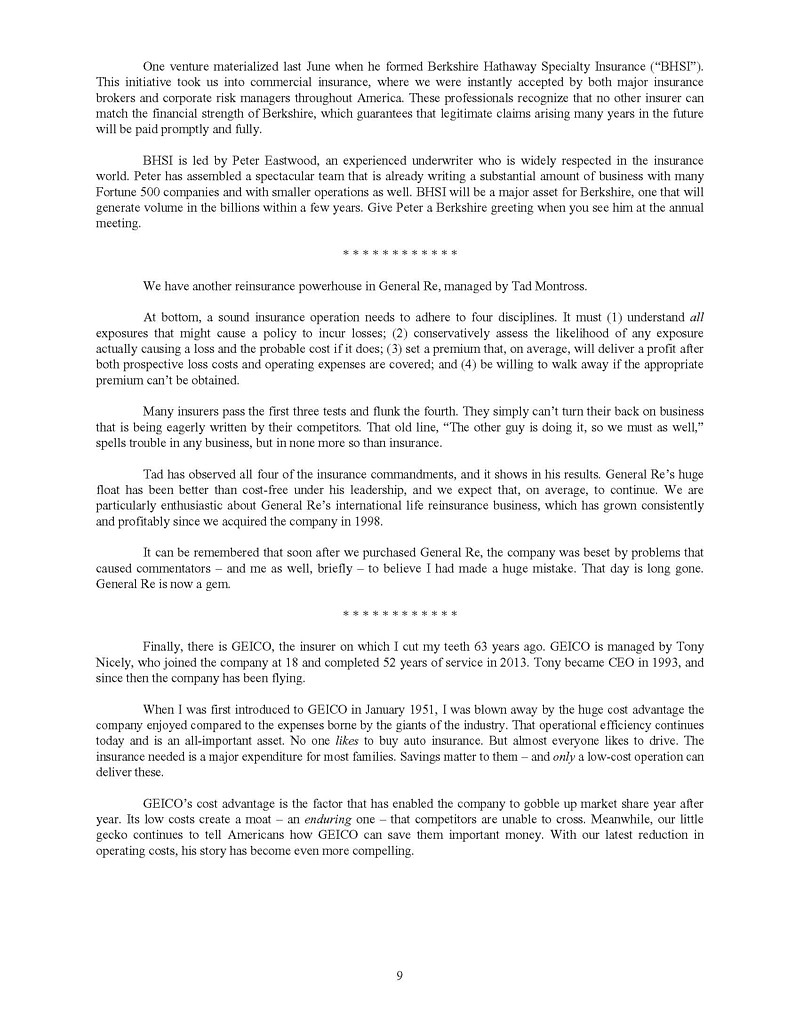

In addition to our three major insurance operations, we own a group of smaller companies, most

of them plying their trade in odd corners of the insurance world. In aggregate, these companies are a growing operation that consistently delivers an underwriting profit. Moreover, as the table below shows, they also provide us with substantial float. Charlie and I treasure these companies and their managers.除了我们的三家主要保险公司外,我们还有一些小保险公司,它们的大部分专注于保险行业 的一些细分领域。整体上,这些公司一直为我们贡献承保利润。另外,正如表格数据显示的 那样,它们也提供了大量浮存金。查理和我感谢这些公司和它们的经理人们。

Simply put, insurance is the sale of promises. The “customer” pays money now; the insurer

promises to pay money in the future if certain events occur.

简单的说,保险卖的是对未来的承诺。“顾客”现在付钱,保险公司承诺未来某些事件发生 的情况下付钱。

Sometimes, the promise will not be tested for decades. (Think of life insurance bought by those in their 20s.) Therefore, both the ability and willingness of the insurer to pay – even if economic chaos prevails when payment time arrives – is all-important.有时候,承诺在未来几十年都有效。(比如大家 20 来岁时买的寿险。)因此,保险公司的赔 付能力和赔付意愿非常的重要,哪怕赔款的需要刚好赶上经济危机。

Berkshire’s promises have no equal, a fact affirmed in recent years by the actions of the world’slargest and most sophisticated insurers, some of which have wanted to shed themselves of huge and exceptionally long lived liabilities, particularly those involving asbestos claims. That is, theseinsurers wished to “cede” their liabilities to a reinsurer. Choosing the wrong reinsurer, however –one that down the road proved to be financially strapped or a bad actor – would put the original insurer in danger of getting the liabilities right back in its lap.伯克希尔的信誉是无人能比的,最近几年的事实更加证明了一点,一些全球最大、最富经验 的保险公司正在试图摆脱它们巨额的长寿风险,尤其涉及到石棉的保单。它们希望将这些负 债转移给再保险公司。但是如果选择了错误的再保险公司——那些将会陷入财务困境或者运 营不良的再保险公司,对原保险公司来说意味着将赔付责任转回自己脚下的风险。

Almost without exception, the largest insurers seeking aid came to Berkshire. Indeed, in the largest such transaction ever recorded, Lloyd’s in 2007 turned over to us both many thousands ofknown claims arising from policies written before 1993 and an unknown but huge number of claims from that same period sure to materialize in the future. (Yes, we will be receiving claims decades from now that apply to events taking place prior to 1993.)毫无例外,所有寻求帮助的大保险公司都会联系伯克希尔。实际上,2007 年 Lloyd’s 将上千 笔 1993 年前的确定将会索赔的保单出售给了我们,同期的保单里还有不确定数量但是绝对 是大额的索赔未来基本一定会赔付,这是创纪录的一笔交易。(对,我们会接收几十年前的 保单并对 1993 前发生的事件承保。)

Berkshire’s ultimate payments arising from the Lloyd’s transaction are today unknowable. What iscertain, however, is that Berkshire will pay all valid claims up to the $15 billion limit of our policy.No other insurer’s promise would have given Lloyd’s the comfort provided by its agreement withBerkshire. The CEO of the entity then handling Lloyd’s claims said it best: “Names [the original insurers at Lloyd’s] wanted to sleep easy at night, and we think we’ve just bought them the world’s best mattress.”

伯克希尔因为 Lloyd’s 的交易最终的赔付额今天还不得而知。但是可以确定的是,伯克希尔 一定会赔付上限为 150 亿内的一切有效索赔。没有任何其他保险公司的承诺能给予 Lloyd’s伯克希尔所提供的安心。公司的 CEO 拿着 Lloyd’s 的保单说:“某某(Lloyd’s 的原承保人)希 望晚上能安心睡觉,我们想我们已经给他送去了世界上最好的床垫。”、

Berkshire’s great managers, premier financial strength and a variety of business models possessing wide moats form something unique in the insurance world. The combination is a huge asset for Berkshire shareholders that will only get more valuable with time.伯克希尔优秀的经理人团队,良好的财务稳健性,还有多元化的业务,构成了它在保险行业 独一无二的护城河。这样的构成是伯克希尔股东们的巨大财富,并且随着时间推移,它会变得越发值钱。

Regulated, Capital-Intensive Businesses受管制的、资本密集型业务

“Though there are many regulatory restraints in the utility industry, it’s possible that we will makeadditional commitments in the field. If we do, the amounts involved could be large.”

— 1999 Annual Report“虽然公用事业充满管制,我们还是有机会进行一些投资。一旦我们决定投资,一定是大手 笔。”

——1999 年年报

We have two major operations, BNSF and MidAmerican Energy, that share important characteristics distinguishing them from our other businesses. Consequently, we assign them their own section in this letter and split out their combined financial statistics in our GAAP balance sheet and income statement.这个版块主要有两家公司,BNSF(伯灵顿北方圣特菲铁路公司)和 MidAmercian Energy(中 美洲能源),它们有一些重要共同特点区别于我们其他的公司。所以,我们在这里把它们单 独归为一类进行讨论,并在 GAAP 会计报表中单独列示它们的合并资产负债表和营收表。

A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact not needed because each company has earning power that even under terrible economic conditions will far exceed its interest requirements. Last year, forexample, BNSF’s interest coverage was 9:1. (Our definition of coverage is pre-tax

earnings/interest, not EBITDA/interest, a commonly-used measure we view as seriously flawed.)它们的一个重要特征是,两家公司都有巨额的长期受管制的资产投资,这些资产部分由大额 长期账务支持,伯克希尔并不承担相关的债务责任。它们实际上并不需要我们的信用支持,因为它们具备良好的盈利能力,即使在恶劣的环境下也能覆盖它们的债务利息。比如在去年 疲软的经济中,BNSF 的利息覆盖倍数是 9:1(。我们对覆盖倍数的定义应该是税前利润/利息,而不是 EBITDA(息税折旧摊销前利润)/利息,一项我们认为被普遍使用的错误指标。)

At MidAmerican, meanwhile, two factors ensure the company’s ability to service its debt underall circumstances. The first is common to all utilities: recession-resistant earnings, which result from these companies exclusively offering an essential service. The second is enjoyed by few other utilities: a great diversity of earnings streams, which shield us from being seriously harmed by any single regulatory body. Now, with the acquisition of NV Energy, MidAmerican’s earnings base has further broadened. This particular strength, supplemented by Berkshire’s ownership,has enabled MidAmerican and its utility subsidiaries to significantly lower their cost of debt. This advantage benefits both us and our customers.在中美洲能源,有两个因素确保它在各种情形下都具有还本付息的能力。第一个因素与其他 公用事业企业相同:抗周期的盈利能力,这源于公司垄断地提供社会必需的服务。第二个因 素则只有少数公用事业公司才具备:多元化的利润来源,这保护我们不会因为监管部门的某 一项措施而遭受重创。收购了 NV Energy 以后,中美洲能源的利润来源进一步扩大了。同时,由于伯克希尔的股东背景,中美洲能源和它的分支机构可以以显著低于同行的利率借债。这 种优势即有利于我们也有利于我们的顾客。

Every day, our two subsidiaries power the American economy in major ways:

每天,我们的两家公司都在驱动着美国经济:

BNSF carries about 15% (measured by ton-miles) of all inter-city freight, whether it is transported by truck, rail, water, air, or pipeline. Indeed, we move more ton-miles of

goods than anyone else, a fact establishing BNSF as the most important artery in oureconomy’s circulatory system. Its hold on the number-one position strengthened in 2013. BNSF 承担了全国 15%(以吨-英里衡量)的城际间货运量,包括公路、铁路、水路、航空以及管道运输。BNSF 的吨-英里运量超过其他任何公司,这个事实意味着 BNSF是全国经济循环系统最重要的大动脉。2013 年它依然保持着其龙头地位。

BNSF, like all railroads, also moves its cargo in an extraordinarily fuel-efficient and environmentally friendly way, carrying a ton of freight about 500 miles on a single gallon of diesel fuel. Trucks taking on the same job guzzle about four times as much fuel.和其他铁路公司一样,BNSF 还以一种非常节约能源和环境友好的方式在运输着货物,它运输一顿货物 500 英里只需一加仑柴油。卡车实现同样的运力大约要使用 4 倍的能 源。

MidAmerican’s utilities serve regulated retail customers in eleven states. No utilitycompany stretches further. In addition, we are the leader in renewables: From a standing start nine years ago, MidAmerican now accounts for 7% of the country’s wind generationcapacity, with more on the way. Our share in solar – most of which is still in construction –is even larger.

中美洲能源的电力设施为 11 个州的零售客户服务。没有任何公用事业公司服务范围 比我们更广。另外,我们是再生能源方面的领导者: 9 年前开始涉足,到目前我们 已经占全国风力发电量的 7%,未来还会更多。我们在太阳能上的份额——虽然大部 分还在建设当中,甚至更高。

MidAmerican can make these investments because it retains all of its earnings. Here’s alittle known fact: Last year MidAmerican retained more dollars of earnings – by far – than any other American electric utility. We and our regulators see this as an important advantage – one almost certain to exist five, ten and twenty years from now.中美洲能源之所以能进行上述投资是因为它留存了所有利润。事实上:去年中美洲能 源迄今为止累计留存的利润超过美国任何其他电力公司。我们和监管部门都把这看作一项重要的优势——一项还会持续 5 年、10 年、20 年的优势。

When our current projects are completed, MidAmerican’s renewables portfolio will have cost $15billion. We relish making such commitments as long as they promise reasonable returns. And, on that front, we put a large amount of trust in future regulation.等我们的在建项目完工后,中美洲能源的可再生能源投资将达到 150 亿。只要这些投资的预 期回报合理,我们都喜欢这样的投资。在这方面,我们给予了未来的监管极大的信任。

Our confidence is justified both by our past experience and by the knowledge that society will forever need massive investments in both transportation and energy. It is in the self-interest of governments to treat capital providers in a manner that will ensure the continued flow of funds

to essential projects. It is meanwhile in our self interest to conduct our operations in a way that earns the approval of our regulators and the people they represent.我们的信心来源于过往的经验,也来源于社会在交通和能源方面会一直需要大量投资的认识。政府为了自己的利益将会合理对待资本提供者,以保证有持续的资金来满足必须的公共项目。从我们自身的利益出发,我们愿意去争取监管者和它们所代表的人民的认可和批准。

Tangible proof of our dedication to that duty was delivered last year in a poll of customer satisfaction covering 52 holding companies and their 101 operating electric utilities. Our MidAmerican group ranked number one, with 95.3% of respondents giving us a “very satisfied” vote and not a single customer rating us “dissatisfied.” The bottom score in the survey, incidentally, was a dismal 34.5%.

去年一份消费者对 52 家控股公司和它们的 101 家电力公司满意度调查的结果,是我们投资 于未来这一决心的有力证明。我们的中美洲能源排名第一,95.3%的被调查者表示“非常满 意”,并且没有一个被调查者表示“不满意”。调查中垫底的公司,仅有 34.5%的满意度。

All three of our companies were ranked far lower by this measure before they were acquired by MidAmerican. The extraordinary customer satisfaction we have achieved is of great importance

as we expand: Regulators in states we hope to enter are glad to see us, knowing we will be responsible operators.我们现有的三家公司在被中美洲能源收购以前的调查中排名远低于现在。优异的消费者满意 度在我们扩张的时候发挥着重要作用:我们希望进入地区的监管部门愿意看到我们的到来,因为他们知道我们是负责任的公司。

Our railroad has been diligent as well in anticipating the needs of its customers. Whatever you may have heard about our country’s crumbling infrastructure in no way applies to BNSF or railroads generally. America’s rail system has never been in better shape, a consequence of huge investments by the industry. We are not, however, resting: BNSF spent $4 billion on the railroad in 2013, double its depreciation charge and a single-year record for any railroad. And, we will spend considerably more in 2014. Like Noah, who foresaw early on the need for dependabletransportation, we know it’s our job to plan ahead.预见到消费者的需求增长,我们的铁路板块也在兢兢业业的工作。你听说的任何关于我们国 家基础设施建设的怨言,都不适用于 BNSF 和铁路行业。美国的铁路系统从未有过今天这样 良好的状态,这是行业巨额投资的成果。当然我们也没闲着:2013 年 BHSF 在铁路上投资了40 亿,是折旧额的两倍,也是有史以来最高的单年投资额。我们可能在 2014 年投资更多。就好像预见到未来交通需求的诺亚一样,我们明白必须未雨绸缪。

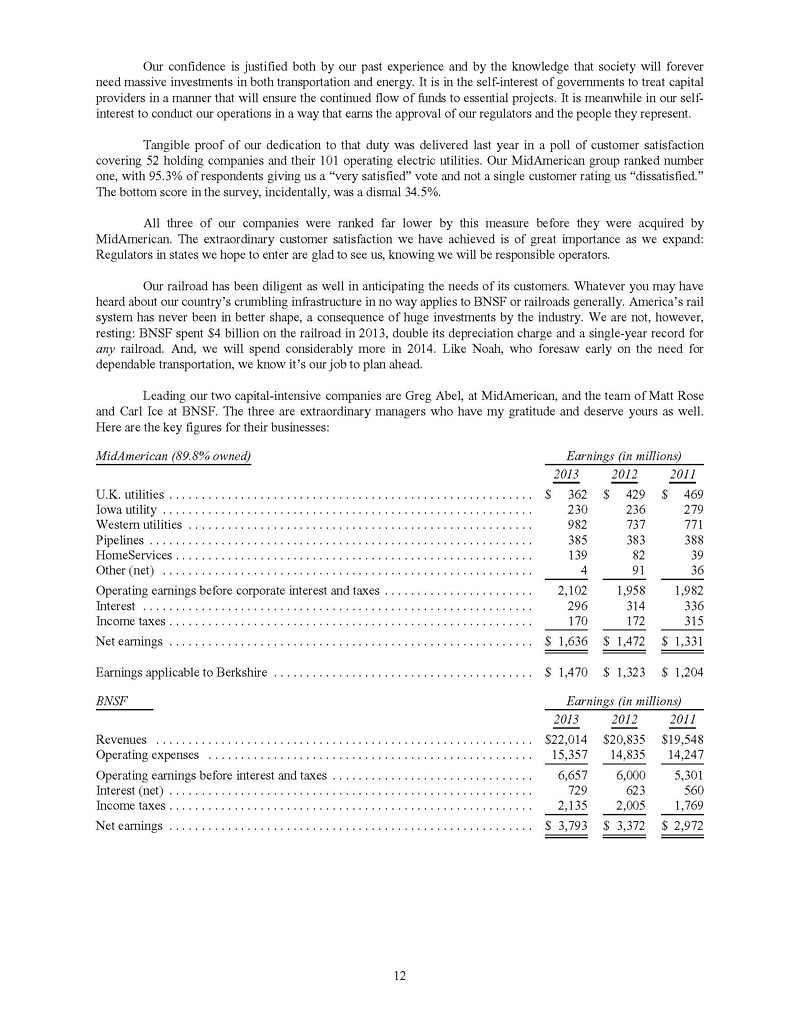

Leading our two capital-intensive companies are Greg Abel, at MidAmerican, and the team of Matt Rose and Carl Ice at BNSF. The three are extraordinary managers who have my gratitude and deserve yours as well.

领导我们两家重资本公司的是中美洲能源的 Greg Abel,还有 BNSF 的 Matt Rose 和 Carl Ice团队。他们三人都是卓越的经理人,应该受到我和大家的感谢。

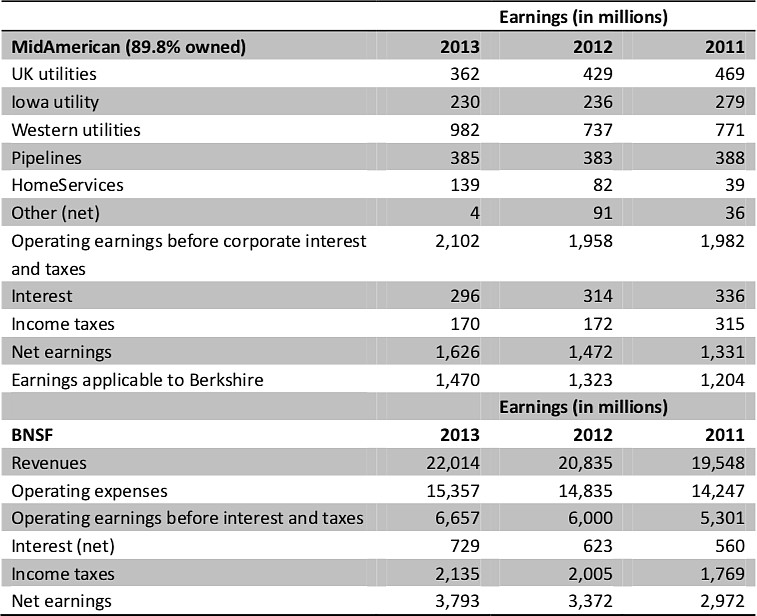

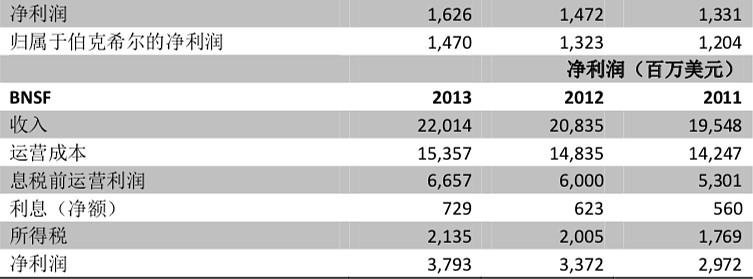

Here are the key figures for their businesses:

以下是他们公司的业务数据:

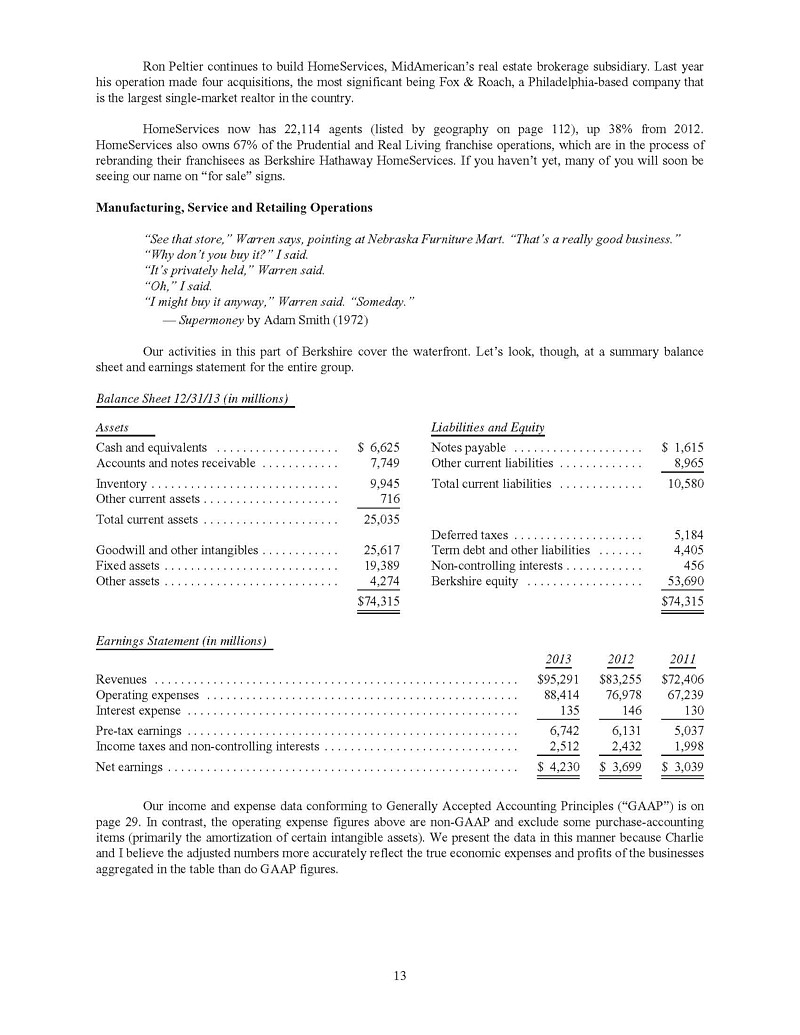

Ron Peltier continues to build HomeServices, MidAmerican’s real estate brokerage subsidiary.Last year his operation made four acquisitions, the most significant being Fox & Roach, a Philadelphia-based company that is the largest single-market realtor in the country.

Ron Peltire 在继续打造 HomeServices,中美洲能源的房地产经济业务。去年他进行了四次收 购,最主要的是对 Fox & Roach 的收购,一家总部位于费城、全国最大的地区性经纪公司。

HomeServices now has 22,114 agents (listed by geography on page 112), up 38% from 2012. HomeServices also owns 67% of the Prudential and Real Living franchise operations, which are in the process of rebranding their franchisees as Berkshire Hathaway HomeServices. If you haven’tyet, many of you will soon be seeing our name on “for sale” signs.

HomeServices 现在有 22,114 名经纪人(各地区的名单见 112 页),比 2012 年增加 38%。HomeServices 还拥有 Prudential and Real Living 67%的特许经营权业务,它正在更名为Berkshire Hathaway HomeServices。大家很快就会在“待售”的房屋广告上看到我们的名字

未完待续……

英文原版如下:

声明:本文意在传播价值,不涉及商业用途。版权归原作者所有

图文来源:网络