人间四月芳菲尽

山寺桃花始盛开

长恨春归无觅处

不知转入此中来

HKTV (1137.HK)

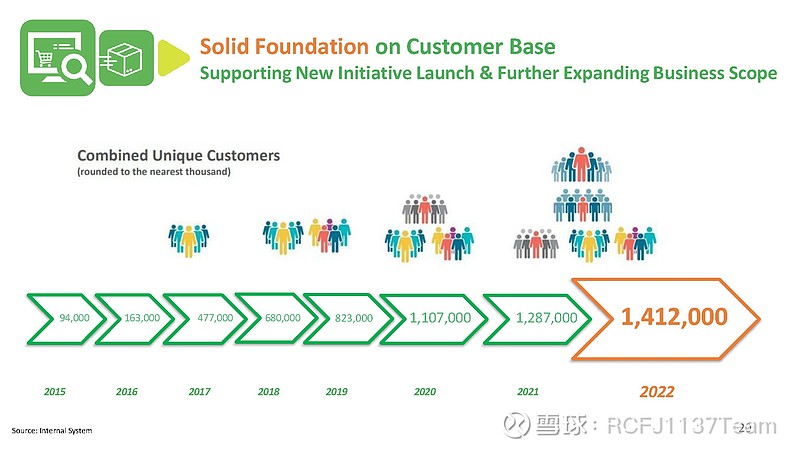

Despite a barrage of challenging local macro-economic and operational issues, HKTV is quietly revolutionizing the Hong Kong retail sector. Last year, the company had more than 1.4 Mn combined unique users, which means that it has reached all demographics of the Hong Kong market. This year, the company has launched delivery services to Macau and England, which has further widened the addressable market and with the launch of Everuts and, later in the year. the automated stores, completely new geographical markets and segments are opening up.

Inexplicably this development has largely gone unnoticed by the financial community, as the share price has been on a downward trend since December 2021, despite the company having;

==> Delivered strong organic growth with a steady increase in monthly orders, increase in SKUs and a continuous widening of the company’s business scope

==> Improved key metrics, as shown in the excellent results presentation, in the areas of;

—(a) Yearly combined unique customers (see Figure 1);

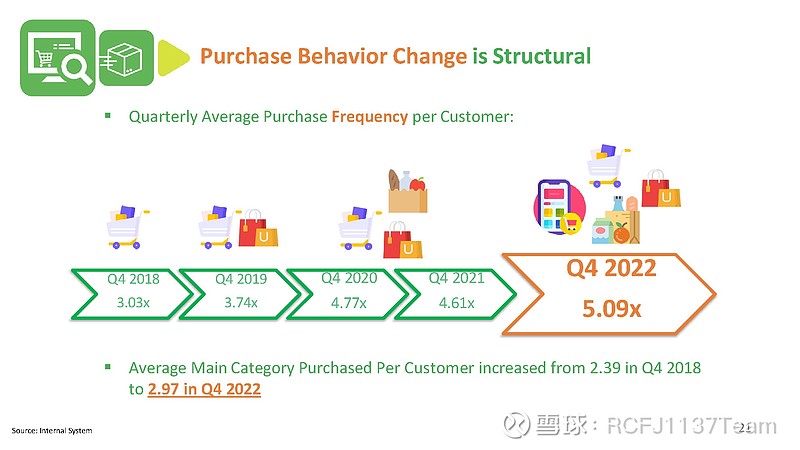

—(b) Quarterly average purchase frequency per customer (see Figure 2); and

— (c) Average main category purchased per customer (see Figure 2)

==> Decreased operating expenses as a percentage of GMV

==> Sharply increased advertising income, which is all profit

Overall, the situation for HKTV has never been better as:

==> The company is well funded and generate substantial cash flows which are enough to self-finance all infrastructure investments in the core e-commerce business as well as funding new ventures and paying dividends to shareholders

==> The competitive landscape has improved and now, following TVB’s withdrawal, there’s nearly no local competition at all

==> The company’s continuous investments in infrastructure secures the longer term survival of the business, creates barriers of entry and balance sheet value

==> Many of the recent projects are more or less certain to succeed and create growth such as;

—(a) Shipping to Macau and England;

—(b) Wet market deliveries;

—(c) Express deliveries and shortened delivery times;

—(d) 24-hour live streaming; as well as

—(e) Third party logistics services

==> The quality of merchants has gradually improved with most of the world’s top consumer brands present such as Adidas, Asics, Calvin Klein, Dyson, Fila, Häagen-Dazs, Lego, Levis, L’Oreal, Nespresso, Philips, Puma, Reebok, Samsung, Samsonite, Starbucks, Timberland, Under Armour and many more

HKTV is the only growth story in the Hong Kong consumer space and the only winner during the last five years. This is unlikely to change as its business model is impossible to replicate and the cost advantages are structurally secured.

While the pandemic has been accelerating the off-line to on-line conversion, it has also created many problems and an overall weak economic environment in Hong Kong. We can now see that the local situation is improving, driven by a sharp increase in tourism, which is likely to generate an overall growth in consumption. It is particularly encouraging to note that the Hong Kong unemployment rate is back at pre-pandemic levels.

We are grateful to the short sellers which have created an opportunity to increase our holdings at very attractive prices, but we don’t expect this share price situation to last much longer. With more than 44 Mn shares borrowed (see Figure 3), the repurchase of these shares will lead to a rapid rebound in the share price, particularly as the shareholder base remains solid and concentrated in “strong hands”. Most importantly, HKTV is currently severely undervalued as the stock:

==> Trades at around 0.5x GMV;

==> Has had three consecutive years of net profits;

==> Had paid dividends for two consecutive years;

==> Generated an adjusted Ecommerce EBITDA of around HKD 400 Mn last year;

==> Holds more than HKD 1 Bn in cash and liquid assets by the end of last year; and

==> Has a net asset value of HKD 2.39 per share at the end of 2022

HKTV is uniquely positioned and will benefit from economies of scale, growth in overseas projects and an overall improvement in the Hong Kong economy and overall consumption levels.

May the spirit of Lion Rock (狮子山精神) be with us!

Figure 1:

Source: Company PPT

Figure 2:

Source: Company PPT

Figure 3:

Source: sfc.hk, webb-site, RCFJ1137Team

【免责声明】我们持有香港科技探索 HKTV(01137.HK)股份,上述意见及推测仅反映我们于分享本报告当前的判断,作为我们的价值投资笔记,仅为记录我们的学习,分享我们的心得,可能充满个人的偏见和错误,在任何时候均不构成对任何私人投资邀请和建议。对依据或者使用本文章所造成的一切后果,作者均不承担任何法律责任。