$香港电视(01137)$ 【胸中自有青山在,何必随人看桃花】

同样一家企业,摆在球友面前,有人唱衰,有人唱多,有人因爱生恨(恨铁不成钢),有人坚守价值投资,有人偏好趋势投机,大家不必去“嘲笑”甚至“斥责”市场中的任何力量,因为都是交易者,短期难言对错。然而,从“判断价值”做出选择的那个时点,就是对球友个人“深研能力”的变现。

1137股价从港视在6月30日发布盈利消息以来,展开一轮波澜壮阔的上涨行情,表现惊人,由6月30日(星期二)收市价每股HK$4.45,一路走高,攀升至9月3日(星期四)盘中最高价位HK$13.48,驱动力主要来自于扭亏为盈的价值重估。再仔细琢磨,本轮行情每股股价升幅大约9元港币,由6月30日至9月3日,大概有9个自然周,那么1137股价升幅平均是每个星期涨1元港币的节奏,这样野蛮生长的速度,肯定不可持续。一年52个周,难道1137可以涨52元吗?显然不现实。人人都爱狂欢,但股价一跌就对公司狂喷乱踩,给创始人“贴标签”,这是不理智的。球友们千万不要对“短期股价运动方向”有错误期待和美丽误会。我们建议更多关注HKTVmall企业中长期价值成长的逻辑。

上周,1137股价遭遇惊魂一周,出现深度调整,【内因】是8月份的核心运营数据表现没有达到趋势投机者的心理预期,似乎8月份HKTVmall四个展会并没有谷起“旺丁又旺财”的效果,环比7月份的业务表现,电商核心指标未能超越高峰值,成长持续性受到质疑。【外因】是进入9月份后美股持续暴跌,那些之前万众追捧的科技股FAANGMT是重灾区,对港股相关股票形成传导效应,港股新经济科网股都随美股出现显著回调,龙头筹码松动之后,部分市场资金热情退烧,避险情绪浓厚,导致估值大幅萎缩。(★注: 影响股价波动的因素其实还有很多,例如:流动性、杠杆、股东结构、行业表现、以及政策面等等,这里就不展开深入讨论了★)

其实,不仅我们团队,而且包括与我们有深度交流的1137球友他们,均表达对HKTVmall的八月份核心运营数据还是理性乐观的,YoY同比增长录得巨大进步,客观分析,本港在八月份疫情反复,HKTVmall公司自身主动执行更为严苛的疫情防控措施,因此制约了三分之一的物流配送资源不能有效发挥,导致HKTVmall用户体验转差,FB出现大量用户针对配送和客服的投诉,造成部分用户更是交货期延迟而取消订单、甚至放弃落新单,这些突发状况必定拖累了八月份的经营表现,但是公司9月4日(星期五)晚间公告最终呈现的结果只是比七月份最高峰值略有下降,再对照2020年已连续披露的8个月的经营数据历史表现,八月份MAU、每日订单量、GMV值、ARPU值,均排第二位,仅次于七月份的高峰值,特别指出,作为流量蓄水池的“在线访问人数”又创新高,公司公告已写明: 每月活跃访客,透过手机应用程式由七月的143万人次,增加至八月份的148.8万人次,透过网站使用的七月份145万人次,升至八月份的152万人次,这么关键的电商指标,仍然被很多球友“忽视”。(★注: 我们观察发现一件有趣的事: 1137公司在每月初“营运数据”公告所披露的经营信息,八月份这个“访问数量人次”的统计口径是第一次出现,一月份至六月份的营运数据,相关公告披露的口径是“登入的独立设备数量”,而七月份营运数据没有披露类似相关信息★)

投资股票是着眼公司未来发展的机遇和能力,进入9月份后,公司物流配送时效性,已经逐步恢复正常中。我们相信市场上的专业机构投资者不可能不理解,特别是那几家在8月份仍然持续在二级市场吸筹扫货的国际大投行,更不可能缺失对HKTVmall每月经营波动性的洞察力。因此,对于1137股价动荡回调,我们解读却是主力借机“诱空”洗盘、“PUA”散户,因为市场充斥着大量的恐慌傻白甜资金,“断崖式”股价下挫、并把股价压制在低位震荡折磨,才能令“傻白甜”们因玻璃心脆弱而乖乖交出筹码,慌乱踩踏式出逃就能砸出黄金坑,大机构才有可能吸到便宜的筹码,大机构有了充足的货源之后,股价才有新动能迈向新台阶。因此,我们判断大机构真心看好HKTVmall企业盈利前景的确定性,本轮深度回调后1137股票将会迎来增持契机。(★注: 我们判断依据是“中央结算系统”持股记录的查询结果,我们长期跟踪和观察的主力名单,他们的持股比例总数并没有减少,看不出有撤退的迹象,有兴趣的球友,可以登入港交所官网了解更多详情。★)

“华尔街教父”本杰明·格雷厄姆说过一句名言:“股市短期是投票器,长期是称重机”。我们信仰价值投资,获取阿尔法(α)收益,我们坚信只要底层逻辑行为是对的,我们不必纠结市场何时回来。

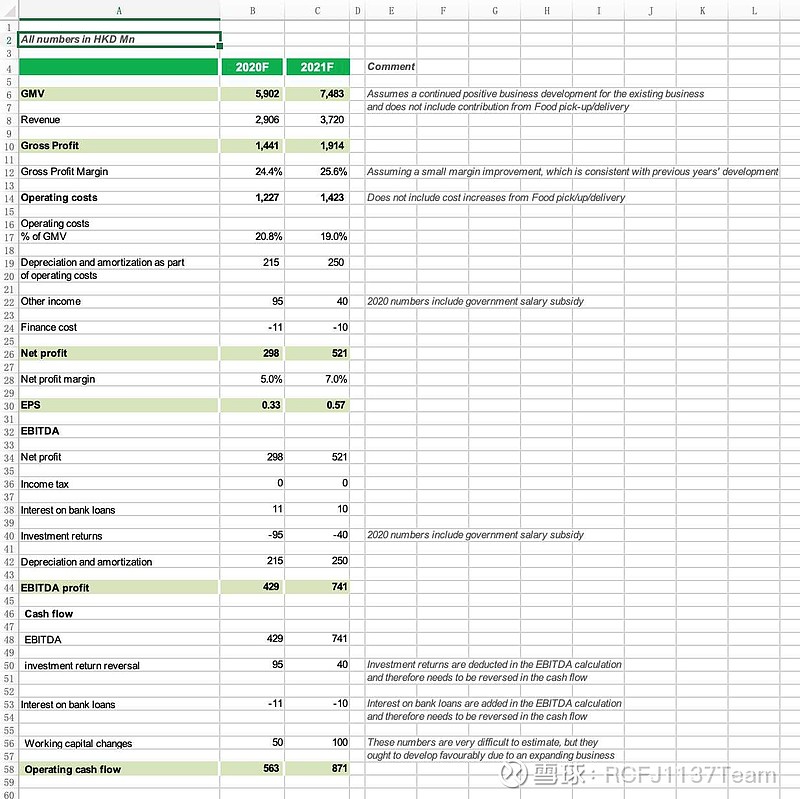

我们对HKTVmall满怀信心,勇气来自于我们自建财务模型分析,我们认为1137公司前景巩固,竞争的优势,已藏在这些性感的数字里。(★注: 我们预测模型仅局限于现有成熟的“实物电商平台”商品零售业务,无法预计“服务电商业务”外卖服务的相关收入贡献★):

◎【-Y2020F-】预测

=> GMV: 59亿港元

=> 营业收入: 29亿港元

=> EBITDA: 4.29亿港元

=> 净利润: 2.98亿港元

=> EPS: HK$0.33

=> 经营活动现金流净额: 5.63亿港元

◎ 【-Y2021F-】预测

=> GMV: 74.8亿港元

=> 营业收入: 37亿港元

=> EBITDA: 7.41亿港元

=> 净利润: 5.21亿港元

=> EPS: HK$0.57

=> 经营活动现金流净额: 8.71亿港元

(☞☞★关于更为详尽的财务预测分析,请球友查阅本帖下部的英文内容,以及附件图表★)

因此,以2020年9月11日(星期五)收市股价为每股港元$10.34,股价攀升到这个水平,是否依然有进步的空间?

=> 对应Y2020 EPS,约是x31PE;

=> 对应Y2021 EPS,约是x18PE。

如果恒生科技指数成份股的市盈率可以被视为新经济领域公司股票定价之“锚”,那么市场可参考新经济科网股估值PE大概是x45。

我们认为: 1137这个票,具有【确定性】+ 【成长性】 + 【龙头溢价】的“高富帅”气质,值得看高一线,真正的光芒,需要一点点时间和耐心去等待,因为外围市场气氛对二级市场股价短期表现也有很大的制约因素。

另外,我们归集和梳理目前香港本地券商对1137股票的投研报告目标价供球友参考,具体信息摘要如下:

◎ 【越秀证券】,发布日期28Aug2020,评级“买入”,目标价HK$14.50;

◎ 【东英证券】,发布日期28Aug2020,评级“买入”,目标价HK$15.00;

◎ 【信达国际】,发布日期2Sep2020,评级“买入”,目标价HK$13.40。

自从互联网经济产生以来,我们看到商业图景的变迁,消费互联网强调平台逻辑,由需求侧(用户)规模经济主导,边际收益递增的,是赢家通吃的格局,资源和要素均呈现向头部企业聚集的趋势,网络效应和平台效应可以爆发非线性增长,会不断产生互联网科技领域的巨无霸企业。

就1137.HK而言,球友如果认同“目前经济转型期,在本港,电商是条好赛道,HKTVmall也是家好公司,而暂时又没有出现强有力的挑战者”,何必让“估值”限制了我们的想象力,HKTVmall企业价值成长的动力依然澎湃:

☞◎无论是现有“实物电商平台”的进化和跃升;

☞◎还是四个月后的2021年度HKTVmall即将迎来“第二增长曲线”即服务电商业务(餐饮外卖服务);

☞◎亦或是HKTVmall生态版图持续扩展的能见度。

友情提醒,市场传闻“宝尊电商BZUN"即将来港做第二地上市,各位已经投资1137的球友可关注“宝尊”,有助于球友理解“专业的整合式电子商务服务商”的市场价值,这类商业模式被市场定位为“西部淘金路上的卖水者”,大家就明白HKTVmall在海外开辟“电商系统整合提供者(System Integrator)”业务版图,有机会增厚1137企业价值空间,其实并不是奢望。

HKTVmall价值成长的旅程才刚开始,未来海阔天空,乐观一点,积极把握中长期成长逻辑,配置潜力股,布局黄金赛道,不问路途,只赶前程,目标是星辰大海!

(☞☞★关于更为详尽的财务预测分析,请球友查阅本帖下部的英文内容,以及附件图表★)

For the rest of the year, we are expecting average daily orders to average above 32,000, with a peak in October, and that the GMV will reach 5.9 Bn for the full year. This is slightly more optimistic than the company’s guidance and does not take into account any contribution from the food take-away launch, as we, as of today, simply cannot assess the expected revenues from this business segment.

Furthermore, we are assuming slightly higher gross margins in 2H, compared to 1H, as there has been an upward momentum in gross margins now for many years driven by a stronger bargaining position as the platform continues to gain in traffic and volume.

We’re expecting quite a hefty increase in other operating costs, in 2H 2020 compared to 1H 2020, primarily as a result of higher salary costs and costs linked to the new initiatives. According to our estimates, higher salary costs will account for around 50% of the total increase in other operating expenses in 2020, compared to 2019.

Overall, despite the cost increases, we expect the net profit in the second half to nearly double, compared to the net profit in the first half, due to higher GMV, slightly higher margins and a larger booking of the government employment subsidies (other income).

In 2021, we again expect GMV to increase and this year there will definitely be a significant contribution from the food delivery. However, as of today, we are unable to make any meaningful estimate for the contribution from that business segment. Therefore our estimated GMV for 2021 does not include any contribution form the food delivery business. Our underlying assumption is that the food delivery business will break-even in 2021, hence it will not impact the estimated net profit.

We expect the e-commerce business to continue its organic growth and we expect monthly average daily orders in the range of 33,000-42,000 for a total GMV of 7.48 Bn. Other operating costs are expected to go up, nevertheless we expect the net profit, excluding government employment subsidies, to more than double.

Please find below a summary of the key financial metrics. For a more detailed presentation, please refer to the attachment.

Y2020F

Gross Merchandise Value (HKD Mn): 5,902

Gross profit (HKD Mn): 1,441

Gross margin (GP/GMV): 24.4%

Other operating costs (HKD Mn): 1,227

Opex/GMV: 20.8%

Net profit (HKD Mn): 298

EPS (HKD): 0.33

EBITDA (HKD Mn) : 429

Operating cash flow (HKD Mn): 563

Y2021F

Gross Merchandise Value (HKD Mn): 7,483

Gross profit (HKD Mn): 1,914

Gross margin (GP/GMV): 25.6%

Other operating costs (HKD Mn): 1,423

Opex/GMV: 19.1%

Net profit (HKD Mn): 521

EPS (HKD): 0.57

EBITDA (HKD Mn): 741

Operating cash flow (HKD Mn): 871

Having tracked HKTV’s financial statements for many years, it is clear that the current year’s profitability is always understated as the company keeps on adding other operational costs in order to accommodate next year’s business level, while the revenues are the current year’s actual numbers. Therefore it would give a clearer picture of the profitability, if the previous year’s other operating cost numbers were used against the current year’s revenues in order to calculate the actual underlying profitability. Under any circumstances, in our opinion, the company keeps a healthy balance between business expansion, cash flow and profitability and it is up to every investor to decide on how to value this. We believe that strictly adhering to a trailing, or forward looking, P/E analysis is not the right way to analyze a fast-growing tech company and from what we can tell, the leading indicators appear to be sales growth and to some degree EBITDA.

Overall we remain very optimistic about the operational development for the following key reasons:

◎ The company’s market position is strengthening day-by-day. In the early days, we were worried that the platform would never take off and reach critical mass. Now we are well above that and can see that nearly no traditional marketing activities are being needed and that the number of products offered keep on increasing. Today, there are nearly 500,000 SKU, mainly driven by an increasing interest among third party merchants, and this number keeps on rising. We haven’t kept any records, but a rough estimate is that the number of SKU have increase by around 50% since the beginning of the year

◎ The launch of the CIti HKTVMall credit card has been very successful as it gives all users, but particularly VIP-members, a very large discount every Thursday (and discounts on all days, but less than on Thursdays). Using these discounts, on top of already very low prices, make the HKTVMall offering unbeatable in terms of value. As a result, existing customers are gradually increasing their on-line consumption and new customers are joining. Developments within the payment space will further tighten the relationship between the customers and HKTVMall

◎ New initiatives such as the open landing page and the food pick-up/delivery will further drive traffic and increase penetration rates. Penetration rates are still very low compared to most listed e-commerce companies

◎ The overseas expansion is likely to result in constructive partnerships with reputable companies and increase the company’s visibility and reputation

As for the share price, there is currently a correction going on in the entire tech-space and the correlation between share price movements are very high. Corporate developments and fundamentals matter less and technical share trading analysis becomes more important. This happens from time to time and it is, on balance, probably a healthy and natural process for investors to assess their allocations and overall risk-tolerance. For the following reasons, we believe that the HKTV stock is in a better position than most:

◎ The company is in the early stages of its development. Overall e-commerce was slow to develop in Hong Kong and is now catching up with the rest of the world. Because of this, the growth potential is higher

◎ The company has many new initiatives in the pipeline which will draw attention to the stock and nearly guarantee future revenue and net profit growth

◎ The company’s growth, margins, balance sheet and outlook are better than comparable companies

◎ The company has the lowest valuation of any similar company which we have been able to locate

◎ The institutional interest and ownership has only recently begun to increase and we believe that this process is far from completed

◎ The company is likely to be included in the HSI High Tech Index in the future

【风险提示: 市场不完美,预测有偏差,投资有风险。】

【免责声明: 上述内容和观点,仅为记录我们的学习,分享我们的心得,不构成所述证券的买卖价格,在任何时候均不构成对任何私人投资建议。对依据或者使用本文章所造成的一切后果,作者均不承担任何法律责任。】