BUFFETT PARTNERSHIP. LTD.

610 KIEWIT PLAZA

OMAHA, NEBRASKA 68131

TELEPHONE 042-4110

January 24, 1968

Our Performance in 1967

By most standards, we had a good year in 1967. Our overall performance was plus 35.9% compared to plus 19.0% for the Dow, thus surpassing our previous objective of performance ten points superior to the Dow. Our overall gain was $19,384,250 which, even under accelerating inflation, will buy a lot of Pepsi. And, due to the sale of some longstanding large positions in marketable securities, we had realized taxable income of $27,376,667 which has nothing to do with 1967 performance but should give all of you a feeling of vigorous participation in The Great Society on April 15th.

The minor thrills described above are tempered by any close observation of what really took place in the stock market during 1967. Probably a greater percentage of participants in the securities markets did substantially better than the Dow last year than in virtually any year in history. In 1967, for many, it rained gold and it paid to be out playing the bass tuba. I don't have a final tabulation at this time but my guess is that at least 95% of investment companies following a common stock program achieved better results than the Dow - in many cases by very substantial amounts. It was a year when profits achieved were in inverse proportion to age - and I am in the geriatric ward, philosophically.

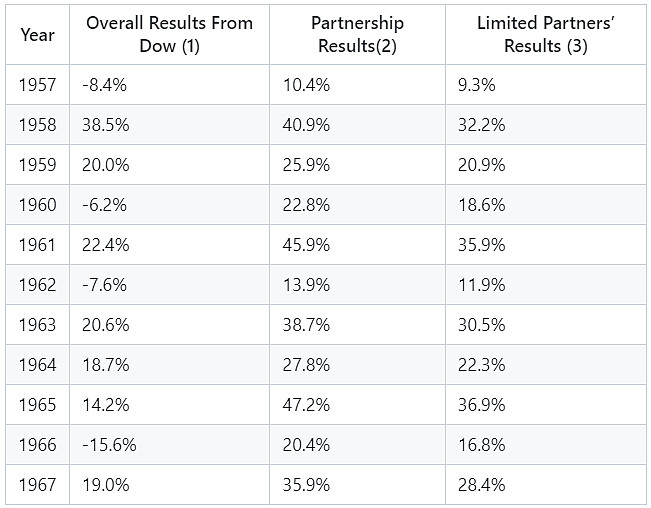

The following summarizes the year-by-year performance of the Dow, the Partnership before allocation (one quarter of the excess over 6%) to the general partner, and the results for limited partners:

(1) Based on yearly changes in the value of the Dow plus dividends that would have been received through ownership of the Dow during that year. The table includes all complete years of partnership activity.

(2) For 1957-61 consists of combined results of all predecessor limited partnerships operating throughout the entire year after all expenses, but before distributions to partners or allocations to the general partner.

(3) For 1957-61 computed on the basis of the preceding column of partnership results allowing for allocation to the general partner based upon the present partnership agreement, but before monthly withdrawals by limited partners.

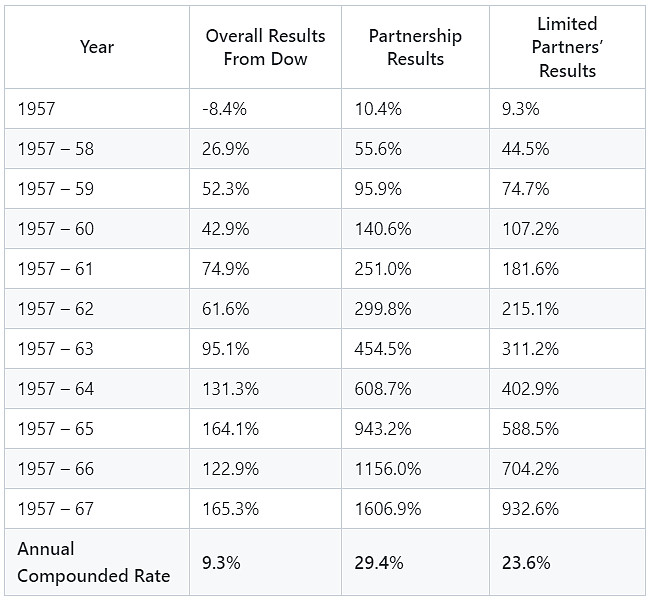

On a cumulative or compounded basis, the results are:

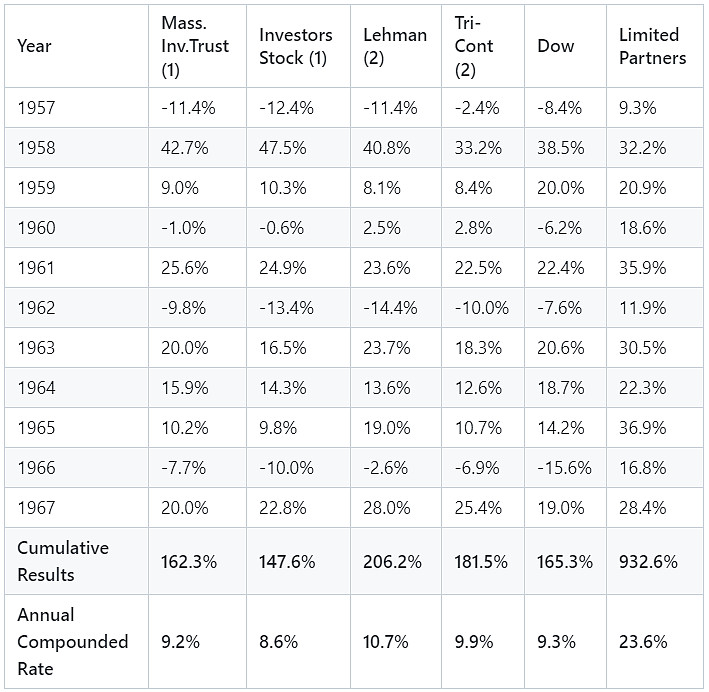

Investment Companies

On the following page is the usual tabulation showing the results of what were the two largest mutual funds (they have stood at the top in size since BPL was formed - this year, however, Dreyfus Fund overtook them) that follow a policy of being, typically, 95-100% invested in common stocks, and the two largest diversified closed- end investment companies.

(1) Computed from changes in asset value plus any distributions to holders of record during year.

(2) From 1967 Moody's Bank & Finance Manual for 1957-1966. Estimated for 1967.

Last year I said:

“A few mutual funds and some private investment operations have compiled records vastly superior to the Dow and, in some cases, substantially superior to Buffett Partnership, Ltd. Their investment techniques are usually very dissimilar to ours and not within my capabilities.”

In 1967 this condition intensified. Many investment organizations performed substantially better than BPL, with gains ranging to over 100%. Because of these spectacular results, money, talent and energy are converging in a maximum effort for the achievement of large and quick stock market profits. It looks to me like greatly intensified speculation with concomitant risks -but many of the advocates insist otherwise.

My mentor, Ben Graham, used to say. “Speculation is neither illegal, immoral nor fattening (financially).” During the past year, it was possible to become fiscally flabby through a steady diet of speculative bonbons. We continue to eat oatmeal but if indigestion should set in generally, it is unrealistic to expect that we won’t have some discomfort.

Analysis of 1967 Results

The overall figures given earlier conceal vast differences in profitability by portfolio category during 1967.

We had our worst performance in history in the “Workout” section. In the 1965 letter, this category was defined as, “...securities with a timetable. They arise from corporate activity -- sell-outs, mergers, reorganizations, spin-offs, etc. In this category, we are not talking about rumors or inside information pertaining to such developments, but to publicly announced activities of this sort. We wait until we can read it in the paper. The risk does not pertain primarily to general market behavior (although that is sometimes tied in. to a degree). but instead to something upsetting the applecart so that the expected corporate development does not materialize.”

The streets were filled with upset applecarts - our applecarts - during 1967. Thus, on an average investment of $17,246,879, our overall gain was $153,273. For those of you whose slide rule does not go to such insulting depths, this represents a return of .89 of 1%. While I don't have complete figures. I doubt that we have been below 10% in any past year. As in other categories, we tend to concentrate our investments in the workout category in just a few situations per year. This technique gives more variation in yearly results than would be the case if we used an across-the-board approach. I believe our approach will result in as great (or greater) profitability on a long-term basis, but you can't prove it by 1967.

Our investment in controlled companies was a similar drag on relative performance in 1967, but this is to be expected in strong markets. On an average investment of $20,192,776 we had an overall gain of $2,894,571. I am pleased with this sort of performance, even though this category will continue to underperform if the market continues strong during 1968. Through our two controlled companies (Diversified Retailing and Berkshire Hathaway), we acquired two new enterprises in 1967. Associated Cotton Shops and National Indemnity (along with National Fire & Marine, an affiliated company). These acquisitions couldn't be more gratifying. Everything was as advertised or better. The principal selling executives, Ben Rosner and Jack Ringwalt, have continued to do a superb job (the only kind they know), and in every respect have far more than lived up to their end of the bargain.

The satisfying nature of our activity in controlled companies is a minor reason for the moderated investment objectives discussed in the October 9th letter. When I am dealing with people I like, in businesses I find stimulating (what business isn't ?), and achieving worthwhile overall returns on capital employed (say, 10 - 12%), it seems foolish to rush from situation to situation to earn a few more percentage points. It also does not seem sensible to me to trade known pleasant personal relationships with high grade people, at a decent rate of return, for possible irritation, aggravation or worse at potentially higher returns. Hence, we will continue to keep a portion of our capital (but not over 40% because of the possible liquidity requirements arising from the nature of our partnership agreement) invested in controlled operating businesses at an expected rate of return below that inherent in an aggressive stock market operation.

With a combined total of $37,439,655 in workouts and controls producing an overall gain of only $3,047,844, the more alert members of the class will have already concluded we had a whale of a year in the "Generals - Relatively Undervalued" category. On a net average investment of $19,487,996, we had an overall gain of $14,096,593, or 72%. Last year I referred to one investment which substantially outperformed the general market in 1964, 1965 and 1966 and because of its size (the largest proportion we have ever had in anything - we hit our 40% limit) had a very material impact on our overall results and, even more so, this category. This excellent performance continued throughout 1967 and a large portion of total gain was again accounted for by this single security. Our holdings of this security have been very substantially reduced and we have nothing in this group remotely approaching the size or potential which formerly existed in this investment.

The "Generals - Private Owner" section produced good results last year ($1,297,215 on $5,141,710 average investment), and we have some mildly interesting possibilities in this area at present.

Miscellaneous

We begin the new year with net assets of $68,108,088. We had partners with capital of about $1,600,000 withdraw at yearend, primarily because of the reduced objectives announced in the October 9th letter. This makes good sense for them, since most of them have the ability and motivation to surpass our objectives and I am relieved from pushing for results that I probably can't attain under present conditions.

Some of those who withdrew (and many who didn't) asked me, "What do you really mean?" after receiving the October 9th letter. This sort of a question is a little bruising to any author, but I assured them I meant exactly what I had said. I was also asked whether this was an initial stage in the phasing out of the partnership. The answer to this is, “Definitely, no”. As long as partners want to put up their capital alongside of mine and the business is operationally pleasant (and it couldn't be better), I intend to continue to do business with those who have backed me since tennis shoes.

Gladys Kaiser has joined us and is doing the same sort of top-notch job that we have long received from Donna, Bill and John. The office group, spouses and children have over $15 million invested in BPL on January 1, 1968, so we have not had a need for NoDoz during business hours.

Within a few days, you will receive:

1. A tax letter giving you all BPL information needed for your 1967 federal income tax return. This letter is the only item that counts for tax purposes.

2. An audit from Peat, Marwick, Mitchell & Co. (they have again done an excellent job) for 1967, setting forth the operations and financial position of BPL, as well as your own capital account.

3. A letter signed by me setting forth the status of your BPL interest on January 1, 1968. This is identical with the figures developed in the audit.

Let me know if anything in this letter or that occurs during the year needs clarifying. My next letter will be about July15th, summarizing the first half of this year.

Cordially,

Warren E. Buffett