(Chinglish by **Translator)

This is an exploratory information observation today. My information observation methods are divided into three types: 1. Casual browsing, reading every day, reading everything, reading without thinking, but not obsessed with it; 2. Exploratory browsing, reading financial information, reading it once a week and taking notes , but only record the feelings and be a bystander; 3. Master mode, select a tradable variety every month and record it in precise language/text. I will publish a small part of my exploratory information observation records in the Internet community in English. The records of casual mode and master mode will not be published publicly.

global financial markets

A-share market (Mainland China). The A-share market continues to rise after the Chinese New Year. This is the result of politicians taking the initiative to calm market sentiment. Although I wasn't involved in it I was happy to see this.

The stock market has risen for several consecutive trading days, and its price curve shows a pattern of large fluctuations. Investors began to worry again, and their positions did not get rid of losses. Because they suffered serious losses from holding small-cap stocks, their situation did not improve even if the index continued to rise. They just hold on to the stock and wait for the price to rise further, but that's a difficult thing to do. People who wait for others to give them happiness often don’t live a very happy life.

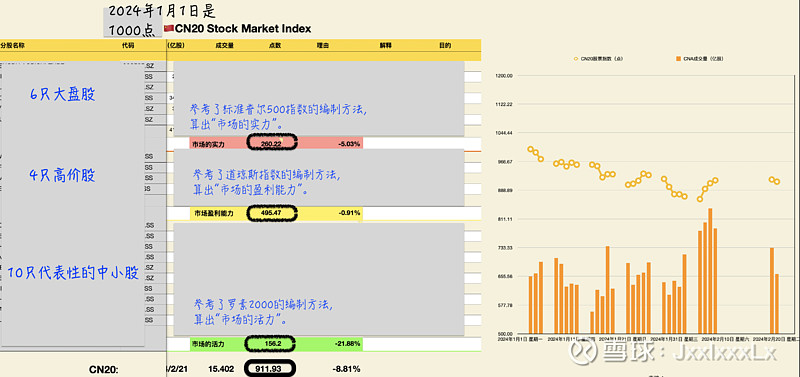

The entire market has not yet returned to the levels seen during the previous decline. In fact, during this crazy period, high-priced stocks and low-priced large-cap stocks in A-shares did not fall. Figure 1.

(This is an index I made myself for my reference.) So you can see that some people are complacent about holding these stocks, thinking that everything is still so well.

Some people still suffered serious losses, while others claimed that they were unscathed. I think most investors are in the same situation as the former, because less than 1% of people in this market can make money.

Going back to the A-share market (Mainland China) itself, I have a few questions: Will high-priced stocks and large-cap stocks make up for the decline, or will small-cap stocks rise? Will it be a good thing or a bad thing for politicians to start paying attention to the market? Will regulators be able to regain their lost credibility?

I have no idea.

Global stock markets. U.S. stocks have stalled their gains recently. Apple suffered a reduction in its holdings from its major shareholder. Large American multinational Internet companies like Apple have recently been involved in some local antitrust lawsuits. In particular, the European Union often sues these large companies. It is expected that as such cases continue to increase, large companies will have to spend more costs to deal with them. However, after more than ten years of growth, the market value and valuation of large companies are quite high. Even if they have a monopoly advantage, they cannot withstand the incoming lawsuits. They must pay the corresponding costs even if they resist. High market value, high valuation, and antitrust lawsuits are the reasons why many people are not optimistic about the prospects of large companies.

Japan's stock market hit new highs. They have once again regained their spot as the world's second-largest financial market, as China's stock market continues to slump.

Global commodity futures markets. During this period, global commodity futures prices did not change much, except for natural gas prices. Natural gas price trends are extreme and it only takes a short time to go from heaven to hell. When futures prices fell below $4, the U.S. natural gas market fell into "hell." The long and short parties strangle each other in various ways in "hell", just like an underground boxing match. Recently, a large number of bulls have been defeated and left the market.

I decided to participate as a bull because it is currently a "vacuum period" in the short-term market. Judging from the price and game matrix, it is indeed a tradable short-term market. So I can use my skills. But this is only a short-term task, so the position should not exceed 20 days, and the profit target should not be too high, even if natural gas is a promising investment commodity. Only when it stabilizes and rebounds is it time to establish medium and long-term orders.

Later, I will explain why natural gas prices fluctuate wildly. But before that, I want to talk about the Red Sea.

Red Sea Convoy Operation

The landscape of the Middle East will change completely with the formal involvement of the European Union. The core control of this area will be controlled by one of the three local parties: the United States, the European Union, and the Middle East. The three of them will first play round after round of games. They also seek help from peripheral actors. Peripheral players are also keen to place bets on the sidelines.

The EU launched a Red Sea convoy and became the third force in the situation. The EU's military strength is lower than that of the United States, but significantly higher than that of the Houthis and the forces behind them. At present, the EU's entry is welcomed by the United States, East Asia, India... He will directly address the problem of smooth shipping.

Affected by this news, the European spot futures of Shanghai's container shipping index rose sharply by 4.6% that day, and are currently quoted at 2189 points. This news is positive for European inflation and Chinese exports. Since the attack on merchant ships by Houthi armed forces in Yemen, the EU's imports have been hindered. At the same time, the corresponding exports from East Asia, especially China, have faced the same experience. Passing merchant ships have to change their routes around the Cape of Good Hope in Africa to successfully reach their destinations, or risk crossing the Gulf of Aden. Logistics companies have to pay multiple times for insurance and fuel costs. After being passed on, the crisis spread to the global goods trading market. Therefore, the launch of the Red Sea convoy operation by the European Union is a positive event globally.

But the Houthis and their allies will not stop their attacks. They saw the appeasement attitude of Americans through the events of the Russo-Ukrainian war and the Palestinian-Israeli conflict. They believe the EU shares the same attitude. So they continue to attack. Second, because the Houthi armed forces occupy a geographical advantage, it is naturally easier than opponents coming from afar. The third and most important reason is that the supporters behind them have sufficient strength and firm determination.

Iran is the main backer of the Houthis in Yemen. As its financial backer, Iran has enjoyed the dividends of a wave of rising crude oil prices in recent years. At the same time, it has gradually adapted and mastered how to circumvent Western countries' sanctions against it, so they have lived well in recent years. As the main rival of the United States in the Middle East, Iran has a strong desire for war. Also, Iran is not the only country supporting the Houthis.

The most important issue for Americans at this time is the election, not anything else. You can see that Ukraine has adopted a defensive strategy and they look disappointed that they are not getting more support from the United States. You can also see the United States' hesitant moves on the Palestinian-Israeli issue. These will lose the United States' own international influence and credibility, a strong foundation.

There are also a large number of off-site bettors, who are in addition to the game between the three major players in the United States, the Middle East, and the European Union. These participants have their own goals and cannot agree on them.

Therefore, it is impossible to quickly and completely solve the problems in this region. This is not just a matter of competing on paper, but also a matter of attitude and tactics.

What you need to know more is that the above are only superficial reasons. The deeper reason is actually the question of who controls the future. If any party gains control here, its international prestige will be significantly enhanced, and it may even have the opportunity to become a future hegemon - like the position the United States currently occupies.

How market fluctuations occur

Recently I have been paying attention to US natural gas futures prices. Interesting as to why it fluctuates so wildly. Why it confuses investors.

Coming up, I will use the wave perspective to understand the way I know the price movement.

❶ Sine Wave. Ideally, the basic supply and demand curve is flat and smooth, just like a set of sine waves. It is formed by the laws of nature.

❷ Square wave, market bias. However, the reality is that market participants hold expectations and positions, which are commonly referred to as "biases", which are formed due to policy changes, productivity levels, and cultural preferences. Draw this kind of prejudice using a curve, and you get a ladder, a set of square waves; that is to say, the expression of prejudice is in the form of a staircase or a square wave. It can also be said that prejudice is formed step by step. Under the interaction of basic needs and prejudices, after Fourier addition calculation, a new set of curves will be obtained.

❸ Triangular wave, leverage. Following this, the curve becomes steeper and sharper, like a set of triangle waves, because with the addition of credit, leverage, derivatives and other factors. It is formed due to risk-reward ratio, game matrix, and structural fragility.

❹ Formation of market price. Ultimately, the market price is formed under the joint action of three groups of factors. It is worth noting that there is not always a series relationship between the three groups of elements, but also a parallel relationship and a quadrant link relationship. Therefore, even if there are only three basic elements, the results of their arrangement and combination are ever-changing; there is an old Chinese saying: The three give birth to all things.

I will show you natural gas futures prices as an example to explain the process of price formation——

The basic, real-time supply and demand curve is flat and smooth, as shown by the mark "❶" in the figure.

The supply and demand curve is distorted, stretched or squeezed by the bias of the participants, so the market time becomes long or short, as shown by the mark "❷" in the picture。Prejudice is presented in a stepped way because people's concept of time is stepped, such as day by day, week by week, month by month, quarter by quarter, year by year, etc.

People will invest in credit, leverage and derivatives to satisfy people's desires, which will raise or lower the price space, as shown by the mark "❸" in the picture. As a result, the market has become extreme, so you can see "negative oil prices", "monster stocks worth hundreds of yuan", etc.

So, you can see now that natural gas futures prices are forming this way.

It is reasonable to explain the way market conditions operate in the form of "waves". I think this is some kind of underlying logic. Prices are formed by a set of basic supply and demand curves, plus a set of participant biases, plus a set of levers that promote or offset each other. Participant bias can stretch or shrink the market's performance time, which makes it difficult for people to find good investment opportunities; leverage can increase or compress the market's fluctuation space, which makes it difficult for people to find good trading prices.

I'm good at using this method to identify good and bad markets and define the state of the market. At the same time, I often use this method to measure market tradability. You need to have an agnostic philosophical thinking ability in the actual application of this method. At the same time, even if you are very confident, very talented, and very rich, your winning rate and return rate will not be significantly improved by fully using this method. Discipline, the most basic quality of an investor, is what you must have. You will always have to rely on discipline to survive and your personality to win. This method of mine is perfect for improving my judgment while maintaining my discipline requirements as an investor, because I always know what I am doing and what I can do.

I intend to end this topic as soon as possible, because it is difficult to clearly convey to readers what is going on in my mind, and it is impossible for readers to make a lot of money immediately by doing so. It may even be boring to readers. of.