Summary

PacWest and other regional banks have been lumped into a generic category of institution which is convenient when discussed in the media.

The tendency to paint broadly ignores the unique attributes and considerations inherent to each regional institution.

We take a broader view and explain why we don't consider PacWest to be in an entirely similar position to its more recently infamous peers.

Uncertainty remains high and outcomes uncertain but we believe, on balance, PacWest is likely to survive although the interim could be painful.

kickers/E+ via Getty Images

PacWest Bancorp (NASDAQ:PACW) has been the subject of extensive commentary (and perhaps even more extensive speculation) over the past month in the aftermath of the failure of Silicon Valley Bank.

We don't propose to relitigate prior arguments for or against the company since, in general, these have been thoroughly discussed and we refrain from writing on situations where we don't believe we have something sufficiently meaningful to add to the conversation. However, we do wish to offer a measure of perspective on PacWest's financial condition in comparison to its more recently infamous peers and explain our view that, in broad terms, PacWest's situation is substantially different - and better - than those of Silicon Valley Financial and First Republic Bank (FRC).

In summary, we briefly review the bank's uninsured deposits, the composition of current assets available to fund withdrawals, the company's regulatory capital ratios under various conditions, the potential impact on operating income of various asset/liability scenarios, and ultimately our view that while the institution faces challenges those challenges are significantly different from other regional institutions and reasonably surmountable.

Uninsured Deposits

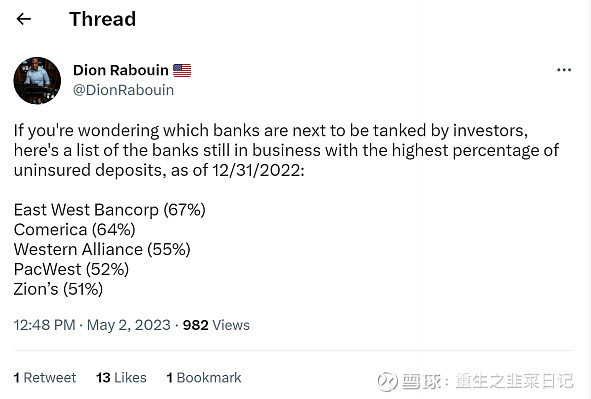

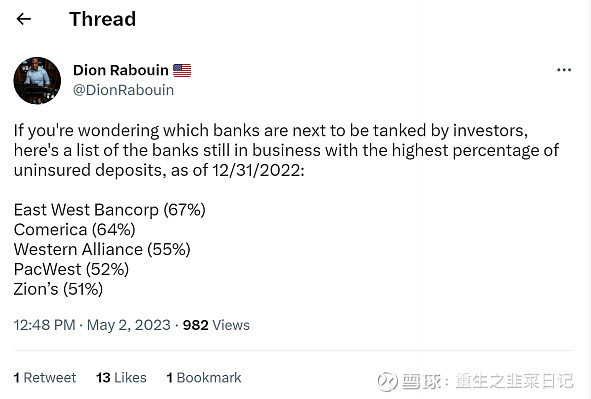

The first step in any assessment in the current environment is considering the bank's deposit base. Deposits - and specifically uninsured deposits - are critical as they have been the focus and the impetus for the bank runs which have led to the liquidity concerns at the regional banks. It's therefore important to have a rough understanding of the deposit situation as a context for the key concerns surrounding most regional banks. However, in the midst of the recent reaction to the takeover of First Republic, there remains a fair amount of dated and inaccurate information circulating in the market such as the following:

Twitter Message (Twitter)

In the event we were wondering which banks are "next to be tanked by investors" - notwithstanding that depositors, not investors, "tank" banks via withdrawals - we'd certainly at least want to be working with readily available current information rather than dated information. We'd like to say this type of woefully misplaced "information" is limited to a small subset of commentators, but in this case, it's coming from a Wall Street Journal reporter with 14,000 followers, many of whom we hope have the general wherewithal not to take this type of clickbait hook, line, and sinker.

Twitter Title (Twitter)

Spicy tweets, perhaps, but still financially irrelevant and only serving to fulfill the very definition of a tweet as a small burst of inconsequential information. Frankly, we'd expect more from Wall Street Journal reporters. It's perhaps indicative of the tarnishing of what was once the gold standard of financial reporting, but that's a separate issue.

Regardless, the actual data point is far less concerning than the dated information above from a few months ago. PacWest, as of March 31, 2023, reported uninsured deposits per the Federal Financial Institutions Examination Council represented a mere 28% of the company's total deposits after a significant runoff (and shift) in deposits during the first quarter. This places the bank's proportion of uninsured deposits roughly in line with, or even below, the respective proportions at most typical community banks. PacWest, prior to the banking meltdown, was an outlier on the uninsured deposit metric, but the significant shifts have resulted in the institution no longer being materially different from any other randomly selected institution on this metric. The only difference, perhaps, is the level of media attention.

However, that said, 28% of deposits still means an estimated $8.1 billion of the company's deposits were uninsured at the end of the first quarter and conceivably remain at risk of withdrawal in a panic. The ongoing speculation about regional banks in general, and PacWest in particular, may amplify the potential for additional withdrawals of uninsured deposits but does not mean it's a certainty.

Still, the company's financial reports suggest that while deposits declined significantly through the end of the first quarter, there was a roughly equivalent shift from uninsured to insured deposits within those figures. PacWest's estimate of uninsured deposits as of December 31, 2022, was $17.8 billion against $34.3 billion in total deposits resulting in uninsured deposits representing 52% of total deposits. In comparison, at the end of the first quarter, uninsured deposits were estimated at $8.1 billion against $28.6 billion in total deposits resulting in the 28% figure. It's notable that while total deposits declined during the first quarter by $5.7 billion - not an insignificant amount - estimated uninsured deposits declined by a larger $9.7 billion suggesting a rather significant shift within the bank to insured from uninsured deposit accounts. It's impossible based on available information to assess the precise factors that contributed to or drove this shift, but it is reasonable to suggest that a large contingent of existing customers modified their accounts to boost their deposit insurance protection, but, importantly, did so while remaining customers of the bank. Ultimately, while uninsured deposits can reasonably reflect the magnitude of withdrawal risk in an institution, it is similarly true that an assumption that all uninsured deposits will flee any institution is likely overly pessimistic.

First Republic, after all, still estimated it held some $19.8 billion in uninsured deposits other than those made by peer institutions (accounting for 27% of total deposits) as of the end of the first quarter and well after the bulk of deposit flight had occurred across the industry.

Financial Position

In any case, let's assume that nearly all uninsured deposits were withdrawn from PacWest. In this scenario, the bank would have sufficient short-term liquidity to cover essentially all of those withdrawals without significantly impairing its regulatory capital ratios even when calculated - as we do - on an adjusted basis that does not conveniently ignore unrealized losses on investment securities.

PacWest reported $6.7 billion in cash on hand as of the end of the first quarter (including $6.3 billion on deposit with Federal Reserve Banks) as a result of an aggressive liquidity campaign in the midst of the turmoil in the banking industry. In combination with slightly more than $7.0 billion of investment securities (at the lower fair market value rather than amortized value), the combination of cash and investment securities are sufficient to cover the withdrawal of nearly all of the bank's remaining uninsured deposits.

Granted, this statement requires some qualification since a meaningful portion of the investment securities portfolio is pledged as security for various advances and loans including those from the recently introduced Bank Term Funding Program. The program, broadly speaking, allows institutions to borrow against the face value rather than the fair value of certain government-issued or sponsored securities. In factoring in the pledged securities, which presumably could not be liquidated without repaying the associated loans, the potential coverage for insured deposits declines somewhat but still represents the vast majority - more than 80% - of uninsured deposits.

Herein lies a significant difference between PacWest and recently failed institutions. Unlike First Republic and Silicon Valley, PacWest has both sufficient liquid investment securities to cover uninsured deposits and the ability to sell those securities (in the process realizing associated losses) without significantly impairing its regulatory capital ratios. Arguably, this is the crux of the issue insofar as the regional banks when it comes to concerns about deposit flight.

The core issue insofar as Silicon Valley was that while the institution had a significant amount of investment securities available for liquidation to cover deposit withdrawals (and specifically uninsured deposits), it could not liquidate those securities without realizing losses that would effectively wipe out shareholders' equity and render the bank severely undercapitalized from a regulatory capital perspective. In essence, the bank was caught in a Catch-22 scenario - it couldn't liquidate the investment securities and remain solvent but it also couldn't not liquidate the investment securities and remain solvent. Silicon Valley managed its way into an inescapable regulatory capital paradox.

First Republic's position was a bit different in that the bank did not have anywhere near sufficient investment securities to cover the withdrawal of uninsured deposits (although liquidation would have similarly resulted in realization of significant losses and thus greatly impaired the bank's regulatory ratios). Instead, the limited investment portfolio meant that First Republic had to rely on the liquidation of comparatively illiquid fixed rate residential mortgage loans - which had similar unrealized losses - to fund withdrawals. First Republic faced a severe liquidity crunch in addition to the regulatory capital paradox.

PacWest, however, faces neither of these conditions since, as noted before, the bank has both sufficient liquid investment securities to essentially cover uninsured deposits and the ability to sell those securities (in the process realizing associated losses) without significantly impairing its regulatory capital ratios. The comment bears repeating because of its central importance to our viewpoint.

Regulatory Capital Ratios

PacWest's presentation of capital adequacy ratios makes adjusting the ratios to account for various factors a little more challenging than is the case with other institutions which provide more detailed calculations of their risk-weighted assets and, more specifically, the capital under each regulatory ratio. However, it's still possible to estimate these values and make the corresponding adjustments.

The full presentation of our adjustments is not presented here for brevity, though it may be the subject of a future article. In any event, our estimates indicate that even if PacWest were to sell the entire investment portfolio and recognize the full amount of current unrealized losses through the profit and loss statement and into shareholders' equity for the calculation of regulatory capital ratios, the bank would remain - even if just above - the regulatory ratios required to be considered a well-capitalized institution.

This condition is significantly different than would have been the case, as noted earlier, for such institutions as Silicon Valley, First Republic, and for others such as Republic First (FRBK) about which we have also written based on our view that the latter institution is at significant risk, particularly in the event of significant withdrawals of deposits.

PacWest is in a comparatively healthy financial position even under a distressed scenario relative to peer institutions which have received similar media coverage. In summary, we view PacWest's financial position to be significantly stronger than is often suggested by market and media speculation about the company and regional banks in general due to the significant differences between the institutions and their asset/liability portfolios.

Choppy Seas Ahead

PacWest may be able to weather the immediate concerns, but the immediate future will almost certainly be anything but pacific. The issue here lies not in the company's ability to meet withdrawals and adequately maintain regulatory ratios, but the impact of the actions required to do so on the company's net interest income and overall profitability. In this instance, we find the likely outcomes not entirely dour yet also not exactly comforting.

In order to assess the impact of the company's recent financing moves and the potential outcomes in the event of further significant withdrawals of deposits, we constructed a net interest margin and spread model based on the company's most recent financial statements and current applicable rates to certain known liabilities. In addition, we adjusted average balances to our projection of anticipated future balances to calculate forward expected net interest margins and spreads under various scenarios to determine the bank's sensitivity to potential changes.

We do not present the full extent of our estimates and projections here, but focus on three scenarios:

A stabilized situation which does not see significant additional deposit withdrawals while retaining significant cash liquidity in the near team as a buffer;

A drawdown scenario where substantially all of the company's remaining uninsured deposits are withdrawn and met by using cash on deposit with other financial institutions and sales of certain investment securities; and

The above scenario assuming that all withdrawals are of noninterest-bearing deposits.

Overall, our projections suggest a range of net interest margins between 1.4% and 2.0% on a going forward basis depending on the specific scenario and result in projected annual net interest income ranging from $420 million to $753 million. This range of values would suggest annual earnings per share in the range of ($1.40) to $0.75 per share with the highest distribution of outcomes concentrated around breakeven in the year ahead. The drivers in the short term, of course, are higher interest costs associated with the short-term borrowing supporting the company's current liquidity. However, in the longer term, the company's existing cost structure is simply not compatible with a smaller balance sheet resulting from the runoff in deposits, assuming that deposits are slow to return to the institution. PacWest will require time to adjust operating expenses to this lower net interest income reality though our projections indicate that the differential is not so large that doing so would prove impossible or so painful that it would impair the core business. In any event, a period of subpar returns on average assets and equity is almost certainly in the company's near to intermediate-term future.

It should be noted, though, that these scenarios all assume, at best, the status quo and no potential for improvement in the bank's financial position or operating expenses.

Imperfections Exist

It should also be noted that all is not ideal at PacWest. In addition to the likelihood of reduced profitability in the near to intermediate term as noted above, the heavy concentration of the company's investment securities towards longer maturities is something of an outlier in the broader community and regional banking sector and has exposed the company to significantly more unrealized losses on investment securities than would have been the case with a more balanced portfolio. We consider this to have been an error on the part of management, not very dissimilar from those made by recently failed institutions. The mitigating factor is that the magnitude of that error was not nearly as large as in those other cases. Moreover, PacWest's losses are largely already reflected as an adjustment to shareholders' equity such that there are not significant unrealized losses "hidden" in the notes to the financial statements via held-to-maturity securities as opposed to available-for-sale securities. PacWest does have a block of held-to-maturity securities but, as noted in the company's financial statements, as these were reclassified from available-for-sale securities a large part of the associated unrealized losses remained in the accumulated other comprehensive loss line on the balance sheet.

Moreover, we have not discussed the company's loan portfolio and credit quality, which is central to the company's future operating results. The potential for additional loan loss reserves in the future should recessionary pressures boost loan delinquencies is real and would potentially aggravate concerns about future profitability. The speculation about the impact of a potential recession on credit quality is an open question and while losses - and reserves - will likely rise, our view is that we're not on the brink of defaults approaching those experienced in the last financial crisis. The composition of the loan portfolio and the company's potential exposure to loan losses (and ability to manage those losses) is a wholly separate issue from the focus of this article and is left to future consideration.

Common Stock Dividend

It's impossible to escape commenting on the company's common stock dividend. A fair amount of commentary has been made about the company's historical tendency to declare the quarterly dividend on the first Monday in May while the company - as of this writing - has yet to declare a quarterly dividend.

In our view, while the dividend should not theoretically be at risk from a purely financial standpoint, we believe it is at risk from a perception standpoint. The significant decline in the company's shares placed the anticipated dividend yield well into the distressed category and a reduction in the dividend, however temporary, would be a reasonable reaction to preserve capital in the face of potentially declining net interest income and net income. Indeed, we anticipate that a reduction in the dividend - perhaps to a penny share - rather than a full elimination would be both expected and prudent in the near term. This would reduce financial cash flow expense by around $120 million a year which may be necessary until the balance sheet can be adjusted sufficiently to ensure long-term profitability in the face of short-term compression in net interest margins.

The reaction to such a reduction in the dividend would likely be quite negative, at least in the short term, even though it would provide additional flexibility for the institution to adjust the core business to a new - and smaller - balance sheet for the foreseeable future.

Conclusion

PacWest is in a difficult position although not to the degree that is broadly perceived in the general media. The regional banks, whatever their specific financial condition and particular situations, are largely treated as a monolithic block or, at least, interchangeable components in the financial system with little differentiation. The lack of a more calibrated and nuanced perspective to each situation results in broad brush generalities which often lead, in turn, to broad brush outcomes.

Indeed, the potential for a self-fulfilling outcome certainly exists - the ongoing focus and speculation about stability may well lead to the withdrawal of insured deposits beyond uninsured deposits that would force the company into a liquidity crunch after the securities portfolio is fully liquidated to fund prior withdrawals. However, this strikes us as an exceptional scenario - possible, and perhaps amplified by the ongoing media and public obsession - but not necessary.

PacWest is differentiated from other troubled institutions in that it has a mix of assets and liabilities as well as a balance sheet that permits the company to avoid the liquidity and regulatory capital traps which recently brought down other regional institutions. Never say never, of course, as we may ultimately be proven wrong - the current uncertainty in the banking industry and volatility in the markets could lead to a loss of confidence that would bring down the institution regardless of the underlying financial position. In light of current information, we believe PacWest is in a position to survive the current turmoil and revitalize its operations after a period of adjustment. The potential for a reduced dividend and a measure of capital dilution has led us to avoid the common shares in favor of the company's preferred shares in which we have a position.

摘要

PacWest和其他地区性银行已被归入一个通用类别的机构,这在媒体讨论时很方便。

绘画的倾向在很大程度上忽视了每个地区机构固有的独特属性和考虑因素。

我们从更广阔的角度出发,解释为什么我们不认为PacWest处于与最近声名狼藉的同行完全相似的地位。

不确定性仍然很高,结果也不确定,但我们相信,总的来说,PacWest可能会生存下来,尽管过渡可能会很痛苦。

kicker/E+via Getty Images

西太平洋银行(纳斯达克:PACW)已经成为广泛评论的主题(也许更多广泛的猜测)过去一个月,在硅谷银行破产的余波中。

我们不建议重新注册prior支持或反对该公司的论点,因为一般来说,这些论点已经过彻底的讨论,我们不会在我们不相信我们有足够有意义的东西添加到对话中的情况下写文章。然而,我们确实希望通过与最近声名狼藉的同行进行比较,对PacWest的财务状况提供一种视角,并解释我们的观点,即从广义上讲,PacWest的情况与硅谷金融公司和第一共和国银行(货物交与承运人价格(Free Carrier-Named Point)).

总之,我们简单回顾一下银行的未保险存款,可用于融资的流动资产的构成提款、公司在各种条件下的监管资本比率、各种资产/负债情景对运营收入的潜在影响,以及最终我们的观点,即虽然该机构面临挑战,但这些挑战与其他地区机构有很大不同,并且是可以合理克服的。

未保险的存款

在当前环境下,任何评估的第一步都是考虑银行的存款基础。存款——尤其是无保险存款——至关重要,因为它们一直是银行挤兑的焦点和推动力,导致了地区银行的流动性问题。因此,对存款情况有一个粗略的了解是很重要的,因为它是围绕着大多数地区银行的关键问题的背景。然而,在最近对收购第一共和国的反应中,仍有大量过时和不准确的信息在市场上流传,例如:

推特消息(推特)

如果我们想知道哪些银行是“下一个被投资者搞砸的”——尽管储户,而不是投资者,通过提款“搞垮”银行——我们肯定至少想与之合作现成当前信息而不是过期信息。我们想说,这种可悲的放错地方的“信息”仅限于一小部分评论员,但在这种情况下,它来自一名拥有14,000名粉丝的《华尔街日报》记者,我们希望其中许多人都有足够的资金不要完全接受这种点击诱饵。

推特标题(推特)

也许,辛辣的推文,但仍然与经济无关,只是满足了推文的定义,即一小段无关紧要的信息。坦率地说,我们对《华尔街日报》记者的期望更高。这或许表明曾经的财务报告黄金标准正在失去光泽,但那是另外一个问题。

不管怎样,实际的数据远不如上面几个月前的数据重要。截至2023年3月31日,PacWest根据联邦金融机构考试委员会报告的未保险存款仅占该公司第一季度存款大幅流失(和转移)后总存款的28%。这使得该银行的未保险存款比例与大多数典型社区银行的相应比例大致相当,甚至更低。在银行业崩溃之前,PacWest是未保险存款指标的异常值,但这一重大转变已经导致该机构在这一指标上不再与任何其他随机选择的机构有实质性区别。唯一的区别,也许是媒体关注的程度。

然而,尽管如此,28%的存款仍然意味着该公司估计有81亿美元的存款在第一季度末没有保险,可以想象仍然存在恐慌中被提取的风险。对地区性银行,尤其是PacWest的持续猜测,可能会放大额外提取未保险存款的可能性,但并不意味着这是必然的。

不过,该公司的财务报告显示,尽管第一季度末存款大幅下降,但在这些数字中,从无保险存款到有保险存款的转移大致相当。PacWest估计,截至2022年12月31日,未保险存款为178亿美元,而总存款为343亿美元,因此未保险存款占总存款的52%。相比之下,在第一季度末,未保险存款估计为81亿美元,而存款总额为286亿美元,因此这一数字为28%。值得注意的是,尽管第一季度存款总额下降了57亿美元——这不是一个小数目——但估计未保险存款下降了更大的97亿美元,这表明了一个相当重要的转变在…之内银行从未投保的存款账户中投保。根据现有信息,不可能评估促成或推动这一转变的确切因素,但有理由认为,大量现有客户修改了他们的账户,以增强他们的存款保险保护,但重要的是,在保留银行客户的情况下这样做。最终,尽管未保险的存款可以合理地反映一个机构的提款风险的大小,但所有未保险的存款将逃离任何机构的假设可能过于悲观,这也是事实。

毕竟,第一共和国,仍然估计它举行截至第一季度末,除了同业机构的存款(占总存款的27%)之外,约有198亿美元的未保险存款,而在此之前,整个行业已经发生了大量存款外逃。

财务状况

无论如何,让我们假设几乎所有未保险的存款都是从PacWest取出的。在这种情况下,该银行将有足够的短期流动性来覆盖所有这些提款,而不会严重损害其监管资本比率,即使是在调整后的基础上计算(如我们所做的那样),也不会轻易忽略投资证券的未实现损失。

PacWest报告称,由于在银行业动荡期间开展了积极的流动性活动,截至第一季度末,手头现金为67亿美元(包括存放在美联储银行的63亿美元)。加上略高于70亿美元的投资证券(以较低的公平市价而非摊余价值计算),现金和投资证券的组合足以支付该行几乎所有剩余未保险存款的提款。

当然,这种说法需要一些限定条件,因为投资证券组合中有相当一部分被抵押作为各种预付款和贷款的担保,包括最近引入的银行定期融资计划。从广义上讲,该计划允许机构以某些政府发行或赞助的证券的面值而非公允价值进行借贷。考虑到质押证券(不偿还相关贷款可能无法变现),受保存款的潜在覆盖范围有所下降,但仍占未受保存款的绝大部分(超过80%)。

这就是PacWest和最近倒闭的机构之间的显著区别。与First Republic和硅谷不同,PacWest拥有充足的流动性投资证券来覆盖未保险的存款和出售这些证券(在实现相关损失的过程中)而不严重损害其监管资本比率的能力。可以说,就地区性银行而言,这是问题的症结所在,因为它们担心存款外逃。

核心问题是硅谷尽管该机构有大量可用于清算的投资证券来支付存款提款(特别是未保险的存款),但它无法在没有实现损失的情况下清算这些证券,这将有效地抹去股东权益,并从监管资本的角度使银行资本严重不足。从本质上讲,该银行陷入了一个“第22条军规”的境地——它不能清算投资证券并保持偿付能力,但它也不能不清算投资证券并保持偿付能力。硅谷设法陷入了不可避免的监管资本悖论。

第一共和国的立场有点不同,因为该银行没有足够的投资证券来支付未保险存款的提取(尽管清算同样会导致重大损失的实现,从而大大削弱该银行的监管比率)。相反,有限的投资组合意味着,First Republic不得不依赖流动性相对较低的固定利率住宅抵押贷款(也有类似的未实现亏损)的清算来为提款提供资金。第一共和国面临严重的流动性危机另外监管资本悖论。

然而,PacWest并不面临这些条件,因为,如前所述,该银行既有足够的流动性投资证券来覆盖基本上没有保险的存款和出售这些证券(在实现相关损失的过程中)而不严重损害其监管资本比率的能力。这个评论值得重复,因为它对我们的观点至关重要。

监管资本比率

PacWest的资本充足率的列报使得调整比率以考虑各种因素比其他机构更具挑战性,其他机构提供更详细的风险加权资产计算,更具体地说,是每个监管比率下的资本。然而,仍然有可能估计这些值并做出相应的调整。

为了简洁起见,这里没有完整地介绍我们的调整,尽管它可能是以后文章的主题。在任何情况下,我们的估计表明,即使PacWest出售整个投资组合,并通过损益表确认当前未实现损失的全额,并计入股东权益以计算监管资本比率,该银行将保持——即使只是略高于——被视为资本充足机构所需的监管比率。

如前所述,这种情况与硅谷、第一共和国等机构以及第一共和国(FRBK)关于这个我们也有书面的基于我们的观点,后一种机构面临重大风险,尤其是在存款被大量提取的情况下。

即使与受到类似媒体报道的同行机构相比,PacWest的财务状况仍相对健康。总之,我们认为PacWest的财务状况明显强于市场和媒体对该公司和地区银行的猜测,因为这些机构及其资产/负债组合之间存在显著差异。

前方波涛汹涌的大海

PacWest或许能够渡过眼前的难关,但几乎可以肯定的是,不久的将来,PAC west将不再太平。这里的问题不在于公司满足提款和充分维持监管比率的能力,而是这样做所需的行动对公司的净利息收入和整体盈利能力的影响。在这种情况下,我们发现可能的结果并不完全令人沮丧,也不完全令人欣慰。

为了评估该公司最近融资举措的影响以及在进一步大量提取存款的情况下的潜在后果,我们基于该公司的最近的财务报表以及某些已知负债的当前适用利率。此外,我们将平均余额调整为我们对预期未来余额的预测,以计算各种情况下的远期预期净息差和利差,从而确定银行对潜在变化的敏感度。

我们在此不提供我们的估计和预测的全部范围,而是集中在三种情况:

稳定的情况,不会出现大量额外的存款提取,同时在near团队中保留大量现金流动性作为缓冲。

提款情景,基本上所有公司剩余的未保险存款被提取,并通过使用其他金融机构的存款现金和出售某些投资证券来满足;和

上述情景假设所有提款都是无息存款。

总体而言,我们的预测表明,根据具体情况,未来的净息差范围为1.4%至2.0%,预计年净利息收入范围为4.2亿美元至7.53亿美元。这一数值范围意味着每股年收益在1.40美元至0.75美元之间,未来一年的最高收益分布集中在盈亏平衡附近。当然,短期的驱动因素是与支持公司当前流动性的短期借款相关的更高的利息成本。然而,从长期来看,假设存款返回机构的速度较慢,公司现有的成本结构根本无法与存款流失导致的较小资产负债表相兼容。PacWest将需要时间来调整运营费用,以适应这一较低的净利息收入现实,尽管我们的预测表明,这一差异不会大到无法实现,也不会大到损害核心业务的程度。无论如何,几乎可以肯定的是,在该公司近中期的未来,平均资产和股本回报率将出现一段时间的低迷。

但是,应该注意的是,这些情景都是在最好的情况下假设银行的财务状况或运营费用没有改善的可能性。

不完美存在

还应指出的是,PacWest并非一切都很理想。除了上述中短期盈利能力下降的可能性之外,公司的投资证券高度集中于长期,这在更广泛的社区和区域银行业中是一种异常现象,使公司在投资证券上面临比更平衡的投资组合更多的未实现损失。我们认为这是管理层的一个错误,与最近倒闭的机构所犯的错误没有太大不同。减轻处罚的因素是,这一错误的程度远不如其他案件中的大。此外,PacWest的亏损在很大程度上已经反映为对股东权益的调整,因此财务报表附注中没有通过持有至到期证券而非可供出售证券“隐藏”的重大未实现亏损。PacWest确实有一批持有至到期证券,但正如该公司的财务报表中所指出的,由于这些证券是从可供出售证券重新分类的,因此大部分相关的未实现损失仍留在资产负债表的累计其他综合损失行中。

此外,我们还没有讨论公司的贷款组合和信贷质量,这对公司未来的经营业绩至关重要。如果衰退压力增加贷款拖欠,未来增加贷款损失准备金的可能性是真实的,这可能会加剧对未来盈利能力的担忧。关于潜在衰退对信贷质量的影响的猜测是一个悬而未决的问题,尽管损失(和储备)可能会上升,但我们认为,我们并没有处于接近上次金融危机所经历的违约边缘。贷款组合的构成和公司潜在的贷款损失风险(以及管理这些损失的能力)与本文的重点完全是两码事,留待以后考虑。

普通股股息

评论公司的普通股股息是不可能的。关于该公司的历史已经有了相当多的评论申报倾向季度股息在五月的第一个星期一,而该公司-在撰写本文时-尚未宣布季度股息。

我们认为,虽然从纯财务角度来看,股息理论上不应有风险,但从认知角度来看,我们认为股息有风险。该公司股票的大幅下跌将预期股息收益率纳入困境类别,减少股息,无论多么短暂,都是面对潜在净利息收入和净收入下降时保护资本的合理反应。事实上,我们预计,在短期内,减少股息——也许减少到每股1美分——而不是完全取消股息是可以预期的,也是明智的。这将每年减少约1 . 2亿美元的财务现金流支出,这可能是必要的,直到资产负债表能够得到充分调整,以确保在净息差短期压缩的情况下保持长期盈利能力。

对这种股息削减的反应可能会相当负面,至少在短期内是如此,尽管这将为该机构提供额外的灵活性,以便在可预见的未来调整核心业务,使其适应新的规模更小的资产负债表。

结论

PacWest处境艰难,尽管还没有达到一般媒体普遍认为的程度。区域银行,无论其具体的财务状况和具体情况如何,在很大程度上被视为一个整体,或者至少是金融系统中没有什么差别的可互换的组成部分。对每种情况缺乏一个更精确和细致入微的视角导致了泛泛而谈,这反过来又导致了泛泛而谈的结果。

事实上,自我实现的结果的可能性肯定存在——对稳定性的持续关注和投机很可能导致除无保险存款之外的有保险存款的提取,这将迫使公司在证券组合被完全清算以资助之前的提取后陷入流动性紧缩。然而,这在我们看来是一个例外的情况——有可能,也许被媒体和公众的持续关注放大了——但没有必要。

PacWest与其他陷入困境的机构不同,它拥有混合的资产和负债以及资产负债表,这使得该公司能够避免流动性和监管资本陷阱,这些陷阱最近导致了其他地区性机构的破产。当然,永远不要说永远,因为我们最终可能会被证明是错误的——当前银行业的不确定性和市场的波动性可能会导致信心的丧失,从而导致该机构破产,而不管其基本财务状况如何。根据目前的信息,我们认为PacWest能够在当前的混乱中生存下来,并在经过一段时间的调整后重振其运营。股息减少的可能性和资本稀释的措施使我们避开普通股,转而选择我们持有的公司优先股。