摘要

$西太平洋合众银行(PACW)$ 的股票承受了巨大的压力,因为人们担心该公司是否有能力维持下去。

在新数据出来之前,这种情况的风险肯定比我认为的要高,但也不像第一共和国银行那样糟糕。

尽管我对该公司持中立态度,但不可否认的是,目前这是一个非常二元的前景,投资者应该保持谨慎。

在市场上寻找帮手?原油价值见解的成员获得独家的想法和指导,以导航任何气候。了解更多信息

达谷

对地区银行的股东来说,5月2日是特别痛苦的一天帕克韦斯特银行公司 (纳斯达克:PACW).消息传出后第一共和国银行 (货物交与承运人价格(Free Carrier-Named Point))被吸收了摩根大通公司。 (JPM)为了结束银行业危机,该公司股价暴跌,收盘下跌近28%。这里的担心是,这个特定的企业可能是下一只掉下来的鞋子。在此之前,管理层发布了最新的收益报告。虽然我肯定不会说这种恐惧是毫无根据的,但我确实相信围绕这个名字的许多恐慌是没有根据的。是的,公司在过去的几个月里面临着巨大的压力。根据最近的季度数据,可能会施加进一步的压力。作为一家规模较小的银行,PacWest Bancorp也更如果它是一个更大的参与者,它会更脆弱,但今天可用的数据表明,它比第一共和国银行崩溃前的状况好得多。

恐惧正在增加

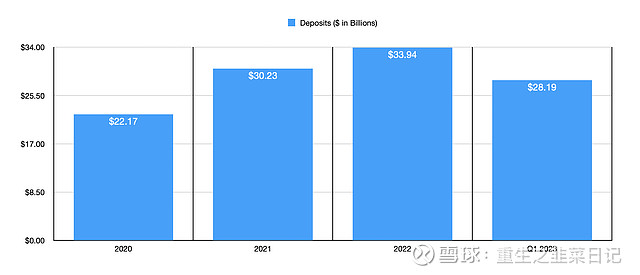

在一个文章前几天我发表了一篇文章,我认为摩根大通收购第一共和银行的决定基本上终结了银行业危机。对于某些人来说,这种说法似乎为时过早。然而,我确实相信我最初的陈述会或多或少地被证明是准确的。这并不是说每家银行都能在当前的动荡中幸存下来。但这确实意味着,我认为,只有那些已经倒闭的大型地区性银行才会倒闭。相比之下,PacWest Bancorp是一家相当小的公司。从该公司的存款中可以看出这一点,截至2005年底,该公司的存款总额为281.9亿美元最近季度。相比之下,第一共和国银行有存款924亿美元。

作者秒埃德加数据

尽管规模有所不同,但不可否认的是,现在人们对PacWest Bancorp在这种环境下的生存能力存在严重担忧。好消息是,为了帮助我们评估这种情况,我们确实有大量的最新数据可以依靠。正如我已经提到的,最近一个季度末的存款是281.9亿美元。这一数字有所下降,但与一个季度前公布的339.4亿美元相比,降幅并不大。当然,真正重要的不是存款总额。相反,重要的是未投保的数量。管理层认为这一数字约为81亿美元。这还不到该公司在2022财年结束时178亿美元存款的一半,也低于2021年底的225亿美元。

在没有联邦存款保险公司干预的情况下,未保险的存款金额是公司账面上造成银行挤兑风险的总额。因此,从基本面的角度来看,该公司是否真的陷入危机,取决于它支付这笔金额的能力,以及它最近为改善资产负债表而借入的资金。如果它能做到这一点,而不出现账面价值的大幅下降,它就能生存下来,甚至继续繁荣下去。如果不能,它注定要步第一共和国银行和其他几家银行的后尘。

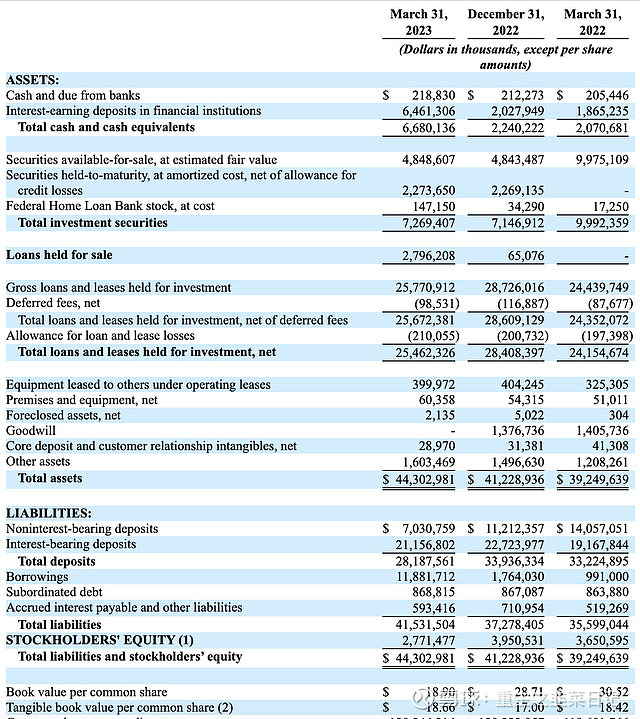

帕克韦斯特银行公司

如果我们看看该公司资产负债表上的现金和现金等价物,以及可供出售的证券,我们最终得出该公司拥有约115.3亿美元。它还有24.2亿美元的证券被分类为持有至到期,包括1.4715亿美元的联邦住房贷款银行股票。自然,出售其账面上总计72.7亿美元的这些证券中的任何一种,都可能导致减记。但这些资产中的大部分被归类为可供出售的事实表明,该公司一直计划在需要时将它们作为流动资产。除此之外,还有28亿美元的待售贷款,以及254.6亿美元的投资贷款和租赁,该公司有大量资产可供使用。然而,问题是销售这些产品会导致亏损,特别是如果公司需要在短期内销售的话。但至少我们知道企业可以支配什么。

帕克韦斯特银行公司

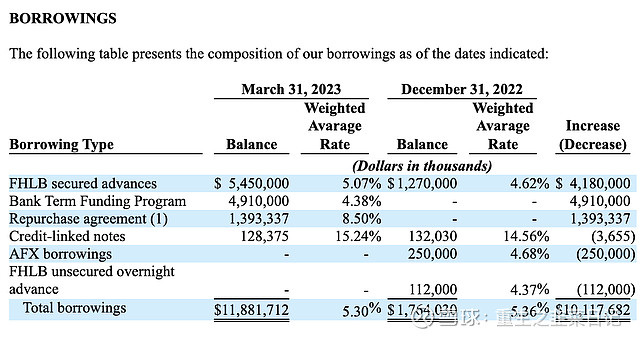

截至最近一个季度末,PacWest Bancorp的借款额为119亿美元。除此之外,还有8.6882亿美元的次级债务。但该公司真正需要担心偿还的是账面上的借款。这有两个原因。首先,这些金额不会在很长一段时间内出现在它的账目上。其次,它们的加权平均利率相当高,为5.30%。相比之下,该公司最近一个季度的资产加权平均回报率为5.35%。如果你觉得洗盘子没问题,考虑一下该公司今年第一季度2.8163亿美元的净利息收入是基于其各种账户的平均余额。当时的借款只有52.9亿美元。因此,仅在这一方面,我们就看到了不止一倍的增长。这意味着,未来,如果该公司不偿还借款,对其底线的影响将会更大。

为了让该公司生存下去,我们需要明白,它必须偿还119亿美元的借款,并能够支付其账面上高达81亿美元的未保险存款。所有这些加在一起,大约需要200亿美元。如果我们只考虑最具流动性的资产,即现金和现金等价物,以及可供出售的证券,我们最终会得到115亿美元。这意味着,在不利用贷款等长期投资的情况下,该公司可以在不增加借款的情况下,用north capital覆盖其未保险存款和借款总额的近58%。对于第一共和国银行来说,这个数字不到13%。最终,这为PacWest Bancorp创造了一个更加安全的局面。但这绝不意味着该公司有可能最终进入破产管理程序。

外卖食品

目前,PacWest Bancorp股票的风险比我在3月下旬写该公司时更高。市场情绪肯定对企业不利,这可能导致资产进一步外逃。这并不是说这项业务将与今年早些时候倒闭的第一共和国银行和其他金融机构命运相同。但它确实造成了一种风险升高的局面。鉴于这些事实,尽管该公司的股票现在看起来确实比我上次写这篇文章时便宜了很多,但我决定将该公司的评级从“买入”下调至“持有”,并声明目前这确实是一个二元前景,可能会继续产生显著的上涨,也可能会像第一共和国银行一样经历彻底的亏损。

Summary

Shares of PacWest Bancorp came under significant pressure after concerns arose about the company's ability to stay afloat.

The picture definitely is riskier than I believed it to be prior to new data coming out, but it is not as bad off as First Republic Bank.

Although I'm taking a neutral stance on the firm, there's no denying that it's a very binary prospect at this time, and investors should be cautious.

Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

da-kuk

May 2nd proved to be a particularly painful day for shareholders of regional bank PacWest Bancorp (NASDAQ:PACW). After news broke that First Republic Bank (FRC) was being absorbed by JPMorgan Chase & Co. (JPM) in a bid aimed at ending the banking crisis, shares of the company plunged, closing down nearly 28%. The fear here is that this particular enterprise could be the next shoe to drop. This follows the most recent earnings release provided by management. While I definitely will not say that this fear is baseless, I do believe that a lot of the panic surrounding this name is unwarranted. Yes, the company has faced a good deal of pressure over the past couple of months. And based on the most recent quarterly data, it is possible that further pressure could be applied. As a smaller bank, PacWest Bancorp is also more vulnerable than if it were a larger player, but the data available today suggests to me that it is in far better shape than First Republic Bank was before its collapse.

Fears are mounting

In an article that I published the other day, I made the case that the decision by JPMorgan Chase to acquire First Republic Bank essentially ended the banking crisis. To some at this point, this statement may seem premature. However, I do believe that my original statement will turn out to be more or less accurate. This is not to say that every bank will survive the current turbulence. But it does mean that I believe that the larger regional banks that have collapsed are the only ones that will. By comparison, PacWest Bancorp is a fairly small player. This much can be seen in the deposits that the company has, totaling $28.19 billion as of the end of the most recent quarter. By comparison, First Republic Bank had deposits of $92.4 billion.

Author - SEC EDGAR Data

Regardless of this size difference, it cannot be denied that significant concerns now exist regarding the ability of PacWest Bancorp to survive in this environment. The good news is that we do have a good deal of recent data to rely on in order to help us assess this situation. As I mentioned already, deposits at the end of the most recent quarter were $28.19 billion. This is down, but not all that much from the $33.94 billion reported one quarter earlier. Of course, it's not the total deposit figure that actually matters. Rather, it's the amount that's uninsured that's important. Management pegs this number at about $8.1 billion. That's less than half the $17.8 billion in deposits that the company had at the end of the 2022 fiscal year and is down from the $22.5 billion seen at the end of 2021.

Absent intervention from the FDIC, the uninsured deposit amount is the total amount on the company's books that creates a risk of a bank run. So the question of whether or not the company is truly in crisis from a fundamental perspective depends on its ability to cover this amount, plus recent borrowings that it has taken out aimed at bolstering its balance sheet. If it can do this without a significant deterioration in its book value, it can survive and even go on to thrive from here. If it can't, it's destined to go the way of First Republic Bank and a few other names.

PacWest Bancorp

If we look at cash and cash equivalents on the company's balance sheet, as well as available for sale securities, we end up with about $11.53 billion that the company has. It also has $2.42 billion in securities that are classified as held to maturity, inclusive of $147.15 million of Federal Home Loan Bank stock. Naturally, selling any of these securities that it has on its books, totaling $7.27 billion in all, would likely result in a haircut. But the fact that the majority of these assets are classified as available for sale suggests that the company has been planning to have them as liquid assets if it needs them. Add on top of this another $2.80 billion in loans held for sale, as well as $25.46 billion in loans and leases that are held for investment, and the company has a tremendous amount of assets to work with. The problem, however, is that selling many of these will result in losses, especially if the company needs to make the sales in short order. But at least we know what the business has at its disposal.

PacWest Bancorp

By the end of the most recent quarter, PacWest Bancorp had borrowings of $11.9 billion. This was on top of $868.82 million in subordinated debt. But it's really the borrowings on its books that the company needs to worry about paying back. This is for two reasons. For starters, these are amounts that are not meant to be on its books for a very long time. And second, they carry a rather lofty weighted average interest rate of 5.30%. By comparison, the company's assets during the most recent quarter generated A weighted average return of 5.35%. If a wash seems okay with you, consider that the company's net interest income of $281.63 million during the first quarter of the year was based on the average balance of its various accounts. Borrowings for that time were only $5.29 billion. So we have seen more than a doubling on that front alone. This means that, moving forward, the toll on the company's bottom line will be even greater if it doesn't pay back its borrowings.

In order for the company to survive, we need to understand that it must pay back the $11.9 billion in borrowings, plus be able to cover up to the $8.1 billion and uninsured deposits on its books. All combined, this is about $20 billion that's required. If we take only the most liquid assets being those that involve cash and cash equivalents, as well as available for sale securities, we end up with $11.5 billion. This means that, without tapping into its longer-term investments like its loans, the company has in north capital, without borrowing more, to cover nearly 58% of the sum of its uninsured deposits and borrowings. For First Republic Bank, this number was less than 13%. At the end of the day, this creates a much safer picture for PacWest Bancorp. But it by no means erases the probability that the company could ultimately go into receivership.

Takeaway

Right now, the picture for PacWest Bancorp stock is riskier than it was when I wrote about the company in late March. Market sentiment is most certainly working against the enterprise, which may cause a further flight of assets. This is not to say that the business will share the same fate as First Republic Bank and other financial institutions that collapsed earlier this year. But it does create a situation where risk is elevated. Given these facts, and in spite of the fact that shares of the business do look a lot cheaper now than they did when I last wrote about it, I have decided to downgrade the company from a ‘buy’ to a ‘hold’, with the qualifying statement that this truly is a binary prospect at this moment that could go on to generate significant upside or could experience a complete loss like First Republic Bank did.