American Apparel: Get Rich, Or DieTrying

APP: 发家致富或死于尝试

Summary

总结

1. American Appareltrades at 0.15 x sales and top line is growing.

1. APP有严重的债务负担,需支付高达债务15%的利息费,但与此同时,他的

销售收入依然能够保持增长。

2. The business is mismanaged resulting in a consistenttrack record of losses.

2. 公司管理不善导致了一系列持续性的亏损。

3. The company trades at a discount of between 78% - 755%to competitors.

3. 和其它竞争对手相比,APP现在的价值相当于打了个很大的折扣。

4. Catalyst for change: Activist investor acquired a 13%stake.

4. 改变的催化剂:激进投资者已经获得了APP13%的股份。

American Apparel (APP) has a market cap of $87 million, Anenterprise value of $345 million and revenue of $634 million. According toMorningstar data the company has grown revenue by an average of 22% annualizedover the past 10 years. Admittedly the 5 year track record of 3% annualized ismuch less impressive. American Apparel is a brand which appeals to a hipstercrowd and commands premium prices. The company advertises with "Americanproduct" and "No sweatshops" which is relevant when reviewingoperations. The fact that the company is successfully growing its top line,even while struggling financially, indicates to me that there is a viablebusiness hidden by mismanagement.

美国服饰(APP)现市值为8700万美元(以发稿日股价计算),公司价值为3.45亿美元,公司年营收为6.34亿美元。晨星机构(Morningstar)的数据显示,该公司收入在过去的十年年均增长率为22%。但如果只看最近5年的数据,那区区3%的年收益率就毫无吸引力可言了。APP作为一个潮牌对时尚人群有很大吸引力,因此可以享受到较高的溢价。回顾APP的经营策略,公司以“美国产品”以及“拒绝血汗工厂”作为主要宣传口号。虽然面临财务困难,但事实上APP的品牌价值正在不断增长,以上情况说明,如果之前一直存在的经营不善问题可以得到有效解决,APP的业务还是很有盈利希望的。

This investment ideais not new and quite a few big time investors who see/saw great potential inthe fundamentals of American Apparel have invested their money and subsequentlystood by and watched as the value of their stake evaporated.

许多投资者通过研究APP的基本面发现了它巨大的潜力,因此人们对APP的投资热情经久不衰,但大多数情况下最终的结局都是他们只能站在一旁眼睁睁地看着自己的购买股票价格不断下跌。

Unless otherwisenoted I've consulted the companies most recent annual report. YChart graphs useYCharts own data. My calculations are based onMorningstar data and my owncalculations based on these.

除特别注明的数据外,本文中关于APP公司的数据都来自其最新的年度财报。其中YChart图表使用的是YCharts自己的数据。我的计算是基于Morningstar的数据,而我自己的一些分析也是基于上述提到的各种数据。

What is wrong withAmerican Apparel?

APP到底出了什么问题?

The biggest problemfor American Apparel is simply that it failed to come up with green numbers atthe bottom line in the last 4 years. Sometimes that can be excused, if acompany is growing revenue at breakneck speed and requires ever larger capitalinvestments on its way to world domination for example. American Apparel is notgrowing revenue that fast. Revenue went from $387 million in 2007 to $634million in 2013.

APP面临的最大问题就是它在过去四年一直都没能盈利反而一直处于亏损之中。出现这种情况对于某些特定的公司来说是可以原谅的,例如一些处于高速增长中的公司需要大量资本的不断投入来加速发展以取得市场支配地位。但APP的增长速度并没有那么快,它的年收入仅仅从2007年的3.87亿美元增长到2013年的6.34亿美元。

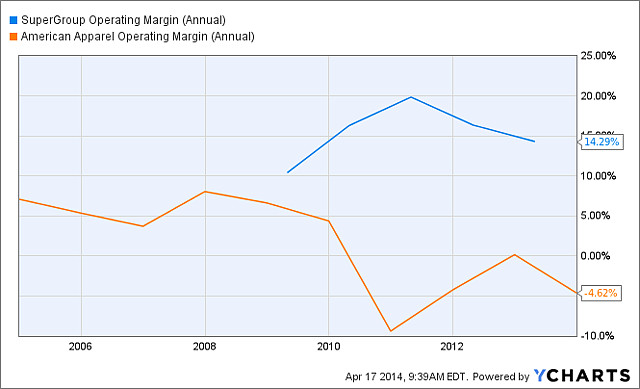

Negative operatingmargins are a big problem right now. In the past the company succeededrealizing positive operating margins even though it chose to manufacture itswares at an 800.000 sq. feet L.A based plant. Supergroup (OTCPK:SEPGY) is a U.S.designer/retailer with comparable revenues and a similar branding/pricingstrategy. I only have a limited number of years of data to compare the two, butpotentially margins could be a lot better at American Apparel. Even though theyare a domestic small scale manufacturer.

对APP来说现在其负的营运利润率是一个大问题。在过去即使APP选择在其位于洛杉矶80万平方英尺的自己专门的报装厂进行生产,它依然可以盈利。Supergroup (在粉单交易市场的一支股票:代号是SEPGY)是一家美国服装设计与零售公司,它与APP有着类似的年收入以及品牌/定价策略。虽然我手头只有很少的数据用来对比这两家公司,但是通过对比我发现Superguoup虽然只是一家规模很小的美国公司,但其潜在的利润仍然比APP要好得多。(如下图所示)

SEPGY Operating Margin (Annual) data by YCharts

图表中SEPGY的年利润率数据来自YCharts

Matt Townsend ofBloomberg interviewed Minho Roth of FiveT Capital, who recently boughtup a private equity offering and is now the 2nd largest stock holder after theCEO:

Bloomberg(彭博社)的Matt Townsend对来自于FiveT Captial机构的Minho Roth先生进行了一次采访,Minho Roth曾以私人名义购买了APP大量的股份,他现在持有的APP股份仅次于CEO排在第二位。

“Then he received anunsolicited pitch for the latest stock offering. In the middle of March, heflew to California to see the distribution center and quiz executives, althoughhe didn't meet the 45-year-old Charney. The visit convinced him that the chainhad fixed its logistics, priming it for a turnaround.”

“然后他收到了一份不请自来的关于APP新增发股份的购买邀请书。于是在今天三月中旬他飞往加州,虽然没有见到APP45岁的CEO Charney, 但他参观了APP新建的分销中心同时视察了公司的运营情况。这次对APP的访问让他确信APP的物流体系已经初步布置成功,而这对于公司变好是一个积极的信号”(以上为采访报道原文)

The company blamedthe move to this new distribution center for $15 million of incrementalexpenses last year. If these incremental expenses do not reoccur this year thatmakes a big difference towards a green bottom line. Minho Roth visitingthe center in person, talking to key executives and buying over 12% of AmericanApparel is a hint the company fixed this leak.

APP被指责在去年为修建这个新配送中心而多花了1500万美元。如果在今年这类额外的开支可以被节省下来的话,对于APP这种处在盈利和亏损边缘的公司具有重要意义。Minho Roth亲自参观了该分销中心,同公司的高管进行了交谈,并购买了超过12%APP的股份,这也暗示APP已经解决了该分销中心的问题。

The company has $268million in debt. Interest expenses over 2013 were $39 million. That translatesinto the company paying an average of about 15% interest on its debt load. Italso just recently raised equity at $0.50 per share.

APP有2.68亿美元的债务负担,仅在2013年债务利息费用就高达3900万美元。这相当于每年APP都要支付的利息费用占到债务总额的15%。APP最近还以0.5美元每股的价格增发了股票。

This debt load iscrushing the company but there is also some good news. If the company can turnthe operation around, it's easier to refinance very high interest rates. Veryhigh interest payments in respect to operating margins are easier to manage ifthey are caused by high interest rates, as opposed to being caused by a highabsolute debt level.

沉重的债务负担正在拖垮这家公司,但对于APP来说还是有一些好消息的。如果该公司能够改善其运营水平,就能很容易再融到高利息的资金。如果想要提高营运利润率,那么再融资产生的高利息支付成本绝对要比极高的债务水平产生所产生的高利息支付成本更好解决。

In addition if thecompany can manage to produce free cash flow, every dollar used to pay off debtreturns a "risk free" 15%. However, note that the company allocatedclose to $80 million dollar in capital expenditures over the past 4 yearinstead of paying down debt. Even though this appears to be an obvious highreturn avenue to allocate capital.

此外,如果公司能够设法产生自由现金流,那么用于偿还债务的每一美元都相当于能得到15%的无风险返还(由于节省了需要支付的占债务总额15%的利息)。然而我们注意到虽然对于APP来说尽量偿还债务似乎是一个明显的高回报资本分配途径,但在过去四年中公司宁可将8000万美元用于资本支出上却没有将哪怕一分钱用于偿还债务。

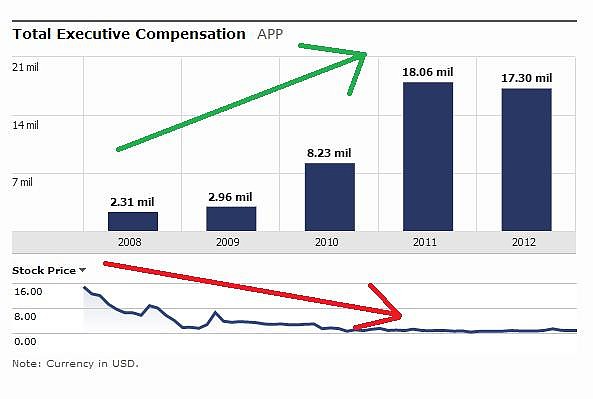

The executivecompensation data by Morningstar put into a graph is not a pretty sight. Whilethe company is raising equity and its stock market value is evaporating, thefounder CEO is being paid an increasing amount of money.

Morningstar提供的关于APP高管薪酬的数据给我们展示了一幅并不美妙的图景。在不停增发股票和市值不断蒸发的情况下,公司却在为创始人兼首席执行官支付越来越高的薪酬。(如下图所示)

The CEO/founder DovCharney has also been sued at least five times. If your willingness to investrevolves around the character of Dov Charney it is advisable to research hisbackground. Wikipedia offers a starting point.

APP的首席执行官兼创始人Dov Charney被起诉过至少五次。如果CEO的人品和性格对于你投资的意愿有所影响的话,那么对他的背景进行一下研究将是明智的。你可以上维基百科看一下他的有关资料。

data: Morningstar

图片数据来源:Morningstar

The 6 directorsexcluding Charney, who is Chairman of the board, arevery well compensated. Total annual compensation for the six comes out at$500,000. A very large amount for the board of a small company. Directorsinclude best-selling author Robert Greene, who wrote "The 48 Laws ofPower" and "The 33 Strategies of War". Mr. Mayer has authoredtwo books as well: "Madam Prime Minister: Margaret Thatcher and Her Riseto Power" and "Gaston's War" and co-authored with Michael S.Sitrick: "How To Turn The Power of the Press to YourAdvantage." Marvin Igelman has been a director of AmericanApparel since July 1, 2011. He used to be director and Chief Strategy Officerof, Canadian based, Poynt Corporation from February 2010 to June 2011. PoyntCorporation went bankrupt in 2012. After a cursory examination of thebiography's of the directors, I'm left with the impression it is possible to fielda stronger line-up at a lower price.

除董事长Charney以外的其它6名董事会董事也都得到了很好的补偿。每年用于支付这6人的薪酬都超过50万美元,这笔钱对于一家小公司的董事会来说实在是有点太多了。董事会成员中包括畅销书作家Robert Greene, 他曾写了“权利的48条法则”以及“战争的33条策略”。同样,另一位董事Mayer先生也写过两本书:“首相撒切尔夫人和她的崛起”和“加斯顿的战争”,同时他还和Michael S.Sitrick一起署名写了名为“如何将新闻界的力量变成你的优势”一书。Marvin Igelman则在2011年7月1号成为APP的董事会成员。他在2010年2月至2011年6月期间曾任位于加拿大的Poynt公司的董事和首席战略官,讽刺的是,Poynt公司在2012年即惨遭破产。在粗略地查看了一下APP董事们的个人简历之后,我认为完全可以通过更低的价格来打造一套更强大的整容。

The company isrenting a knitting facility partly owned by its CEO and Operations Officer. Thecompany paid close to $800K rent for the facility over 2013. I don't like tosee rent-structures like this but it is not uncommon in family companies. I'munable to judge if there is a discrepancy between this rate and the goingmarket rate.

此外,公司还一直在租用一套CEO和事务主管拥有部分所有权的针织设备。仅在2013年公司就为租用这套设备支付了接近80万美元。虽然这种情况在家族企业中并不罕见,但我实在不喜欢看到APP采用这样的租用业务模式。我无法判断采用这种模式与使用市场上的产品哪种情况生产成本更低。

American Apparelalso pays the father of the CEO architectural consulting and director feesamounting to $238.000, $260.000 and $297.000 for the years ended December 31,2013, 2012 and 2011. The work took place primarily in Canada where he runs hisbusiness. He is a legitimate qualified buildinginspector and advertises his services online. Given there are only 7 AmericanApparel locations in Canada, and the company doesn't own any stores, I suspectthese fees are in excess of what is necessary to conduct business in Canadaresponsibly.

APP还分别在2013年、2012年以及2011年的12月31日向CEO的父亲支付了高达238000、260000及297000的建筑咨询费和董事费。CEO的父亲最早是在加拿大开展建筑咨询业务,他是一个具有合法资质的建筑检查员并在网上宣传他的业务。但鉴于只有7家APP商店位于加拿大,而且公司也没有任何一家商店的产权,我怀疑这部分投入远远超过了APP在加拿大开展业务所必需的费用。

Positives the marketmay have missed

被市场遗漏的积极方面

One interesting poston the American Apparel balance sheet it the valuation allowance of ~$12million against its California credit forwards. If these could be realizedafter all, that's $0.08 cents per share in value right there.

一个关于APP资产负债表中有趣的地方就是它在加州之前的贷款有大约1200万美元的估价备抵。如果该估价备抵可以实现, 将会为APP每股增加0.08美分的价值。

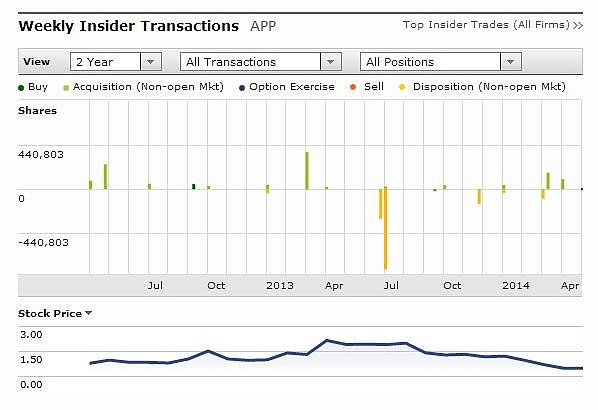

When examininginsider transactions over the past 2 years, as graphed by Morningstar below,they appear to buy and sell at the right moment. Although, you could argue theydidn't sell enough in July 2013. At this time there is some buying taking placeand I view this as a favorable condition, especially given the precarioussituation of the company.

通过研究APP过去2年的公司内部交易数据可以发现APP内部人员似乎都正确的时间段进行了买卖。尽管你可能会说他们在2013年7月卖的还不够多。当时还出现了一些购买行为, 我认为这是由于公司正处于不稳定的状态,此时购买股票可以享受一个优惠的价格。

数据由Morningstar提供

Valuation

估值

It's fairly obviousthat although American Apparel is troubled, it has the potential to be worthmuch more than $0.50 per share. Absolute priority needs to be given to fixingoperating margins and paying down debt or refinancing it at more attractiverates.

公平地讲,虽然APP正处于困境中,但我认为它的股价还是很有希望远远超过0.5美元的。当然前提是必须给予提高营业利润、偿还债务或以更具吸引力的利率发行新债等必要措施以绝对的优先权。

For example if thecompany cuts capital spending, $15 million of incremental expenses the companyclaims to have incurred last year do not occur again and management was somehowable to cut interest rates from 15% to 7.5% then the company would suddenlyproduce a FCF of +$3 million. If the company also cut executive pay by halfthis goes up to $11.5 million. Doing nothing else, that's about $0.10 of FCFper share.

举例来说,如果公司可以削减资本开支,像去年饱受批评的那笔1500万美元的额外开支如果今年不再出现,同时管理部门可以将应支付利息率从15%降低到7.5%,那么公司就可以马上产生300万美元的自由现金流。同时如果公司能将高管们的薪酬削减一半的话就又可以节省1150万美元。如果可以做到以上几点,即使不采取其它措施,也可以每股带来0.1美元的自由现金流。

From my researchinto the company's situation it has become clear that there are indeed a lot ofproblems at American Apparel but they can also be fixed.

通过上述对公司状况的研究,我们可以清楚地发现APP的确存在很多的问题,但是这些问题都是可以被解决的。

Of vital importanceis the fact that revenue has continued growing throughout a period withproblems. This indicates there is real unflagging demand in the market for thecompany's product. Operating margins are much easier to fix than revenuetrouble due to declining sales.

对APP来说最重要的一点是公司在如此困难的时期还能保持年收入的持续增长。这说明市场对于APP的产品具有真实而持续的需求。比起由于销量下降而导致的收入减少这种大麻烦,APP现在所面临的问题还是容易解决的。

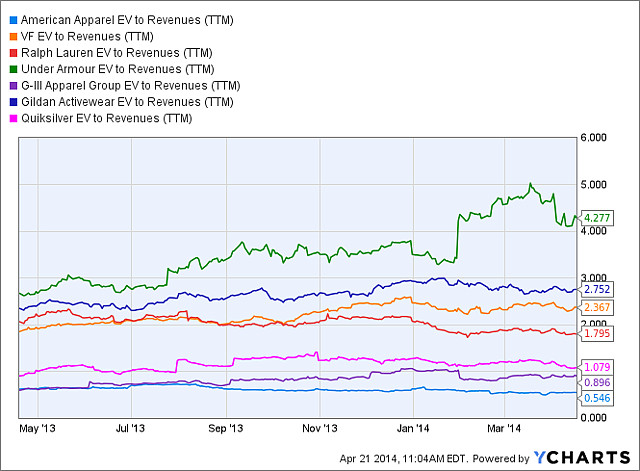

To give investors abetter idea of what American Apparel could be worth if the company ismaneuvered out of its precarious position you can compare it to a range ofcompeting companies. EV/Cash Flow is an often used metric to compare companies,because this doesn't work as well with distressed companies; EV/Revenue hasbeen used instead. Unfortunately the Supergroup data wasn't available or itwould have been included.

对于“如果能够通过努力摆脱现在的困境APP的价值将会有多大”这个问题,为了给投资者一个更直观的印象,我将APP和它的一些主要竞争对手做了一个对比。EV/Cash Flow(企业价值/现金流)是一个用于对比公司好坏的常用指标,但并不适合用于那些陷入困境的公司,因此我使用了EV/Revenue(企业价值/年收入)来代替。遗憾的是我没有得到Superguoup公司的相关数据,否则我也会把它加入对比列表。

Of these sixselected competitors the closest one, G-III Apparel Group (GIII) trades 78% higher on a EV to revenuebasis. Under Armour (UA) is the highest ranked competitor by this metric and a similar valuationwould mean an 755% increase of American Apparel's current valuation. The chartshows that successfully maneuvering the company out of trouble will likelyresult in a gain that is in excess of 100%.

在图中参与对比的6家公司中与APP最接近的是G-III 服饰公司,它的公司价值/年收入要比APP高了78%.Under Armour公司是图中得分最高的公司,其比值比APP足足高了755%. 该图表也说明了如果APP能够解决现存的一系列问题,那么其公司价值/年收的数值将至少得到1倍的提升。

APPEV to Revenues (TTM) data by YCharts

APP的企业价值以及收入(连续12个月)的数据来源于YCharts

Worst case scenario

最糟糕的情况

An investment inAmerican Apparel is highly speculative. My position is that it is feasibleoperations are turned around. Especially if an investor could acquire a large %of shares or rally institutional investors behind reforms, large rewards can bereaped in a limited number of years.

投资APP是一件高度投机的事。我的看法是对APP来说扭转其经营不善的状况是大有可能 的。特别是如果一个投资者能够获得APP大量股份或者能够将其他机构投资者团结起来去引导公司改革,那么应该用不了几年就有希望获得丰厚的回报。

However it should benoted that in a worst case scenario the stock is going to be worth zero.American Apparel has a very large debt load, literally negative book value andan active management which maneuvered the company into a very tough spot.

然而,必须说明的是投资APP最糟糕的情况将会是股票价格归零。因为APP有巨额的债务负担、负的账面价值以及一帮闲不住的经常把公司搞得一团糟的管理层。

American Appareloffers an asymmetric risk/reward opportunity because the stock can turn into aseven-bagger but the downside risk is massive. There is no parachute, you canlose the full 100% of your investment. In the aggregate it's my estimateexpected value is significantly higher than that offered by an investment intothe market in general.

APP提供了一个不对称的风险/回报机会,因为虽然其股价有可能上涨7倍但下跌的风险也是非常巨大的。如果你决定对APP进行投资,那么你将没有降落伞并有可能失去你所有的本金。总的来说,我对投资APP的预期期望值会比投资市场中其它股票要高很多。

The large debtposition also creates an additional risk that is easily overlooked. It'spossible that creditors with large positions also have large equity positions.This can lead to a situation where the creditor/equity holder has prioritiesthat are very different from that of the equity holder. This is especially truewith a company that is skating close to the edges of bankruptcy like AmericanApparel.

APP巨额的债务负担同样会产生一个容易被我们忽视的额外风险。APP的债权人有可能同时拥有公司大量的股份。这将导致一种非常可怕的情况那就是债权人股东比一般的股东具有更高的优先级。这种可能性是客观存在的,尤其对于APP这种在破产边缘游走的公司。

Catalyst

催化剂

In the Bloombergarticle linked earlier in this report there are hints of possible catalysts:

在本文开头提到的彭博社的那篇文章暗示了一些可能的引起APP改变的催化剂:

FiveT Capital mostlyinvests in small companies and has taken an activist role in troubledbusinesses. The firm categorizes its stake in American Apparel as non-passive,saying in a filing that it may talk to other shareholders or the company aboutstrategy, management changes and transactions.

FiveT Capital经常会投资一些小公司,并在其困境反转过程中发挥积极作用。FiveT Capital将其拥有的APP股份列为非被动的类型,在一份文件中说他们可能会与其它APP股东或者直接与公司管理层讨论关于公司的经营策略、管理改革以及事物处理等方面的内容。

Roth said he'salready sharing ideas with Charney. FiveT will focus on helping AmericanApparel improve its finances, possibly by seeking to lower the interestrate on the retailer's debt.

FiveT Capital的Roth说他已经和APP的CEO一起探讨了一些观点。FiveT 将会着眼于通过降低其债务的利率的方法来帮助APP改善其财务状况。

One example ofFiveT's past activism came in 2011 when it built a stake in TheStreet Inc. (TST), a money-losing financial newswebsite. It acquired 6.3 percent of the shares and sent a letter to the companycalling for a review of its strategy. Around that time, TheStreet CEO DarylOtte announced plans to step down from the job.

A management changewould be welcomed by me and although Roth is at this stage merely "sharingideas" with Charney it's possible these talks are not fruitful.

下面我举一个FiveT利用其积极的行动从而影响公司的例子。FiveT在2011年在收购了一家名为TheStreet Inc.(股票代号TST)的正处于亏损之中的新闻网站的6.3%的股份之后,就立刻给公司写了一封信要求公司提供一份说明其经营策略的文件,而在不久之后该公司的CEO Daryl Otte便宣布辞职。虽然现在Roth仅仅处于和Charney互相探讨的阶段,也许这些探讨也不会太富有成效,但我依然非常希望FiveT可以利用其影响力来引导一场APP的管理的变革。

FiveT being open totalk to other shareholders also increases the possibility of a change of power.The five largest shareholders hold 27% ofthe shares. CEO Charney owns 27% of the shares himself. At American Apparel'scurrent market cap of $86 million there are many, many activist funds in theU.S that could easily buy a 10% stake in the company. An investment in AmericanApparel could be especially attractive to these type of funds.

FiveT正在与其它APP的股东们进行的公开性的讨论同样会进一步增加APP的改革力量。APP最大的5个股东一共占有27%的股份,而CEO Charney自己也拥有27%。在APP现市值只有8600万美元的情况下,有很多激进的基金公司都可以很容易地买到APP10%的股份。投资APP对于此类公司来说将格外具有吸引力。