来自Seeking α

Summary 总结

Petrobras is the largest company in Latin America and is still reaping good results due to its old divestment strategy and focus on core business. However, the strategy changed completely.

巴西国家石油公司是拉丁美洲最大的公司,由于其旧的撤资战略和对核心业务的关注,该公司仍在收获良好的业绩。然而,策略完全改变了。

The new management's plans for increased investments and the abandonment of the international price parity policy raise skepticism about the company's long-term results.

新管理层增加投资的计划和放弃国际价格平价政策引发了对公司长期业绩的怀疑。

Despite attractive valuation and strong fundamentals, the uncertain actions of the new management and potential political interference pose risks to the investment thesis.

尽管估值具有吸引力和强劲的基本面,但新管理层的不确定行动和潜在的政治干预给投资理论带来了风险。

Investment Thesis 投资论文

I recommend holding Petrobras (NYSE:PBR) shares. The company is the largest in market cap in Latin America, and is still reaping the benefits of its strategy of divestment of non-strategic assets and focus on core business. As a result, Petrobras continues to generate a lot of cash. However, the current management of the Workers' Party plans to carry out a new (and, I believe, dangerous) cycle of investments.

我建议持有巴西国家石油公司(NYSE:PBR)的股票。该公司是拉丁美洲市值最大的公司,并且仍在从其剥离非战略资产和专注于核心业务的战略中获益。因此,巴西国家石油公司继续产生大量现金。然而,工人党的现任管理层计划进行新的(我认为是危险的)投资周期。

The new management put an end to the policy of international price parity (a pillar of the company's turnaround strategy), and with the spike in oil prices, Petrobras already has a 17% lag in international prices. Despite the attractive valuation and momentum, I am skeptical about the medium and long-term results, mainly due to the company not having a good track record of results in investment cycles.

新管理层结束了国际价格平价政策(公司扭亏为盈战略的支柱),随着油价飙升,巴西国家石油公司已经落后国际价格17%。尽管估值和势头强劲,但我对中长期业绩持怀疑态度,这主要是由于该公司在投资周期中没有良好的业绩记录。

Introduction 介绍

Petrobras is a Brazilian company that operates in the exploration and production, refining, generation and sale of energy. The company has the highest market cap 网页链接{in Latin America}, and is one of the largest oil and gas producers in the world, occupying the position of 网页链接{13th largest oil} company in the world by revenue:

巴西国家石油公司是一家巴西公司,从事能源的勘探和生产、精炼、生产和销售。该公司拥有拉丁美洲最高的市值,是世界上最大的石油和天然气生产商之一,按收入计算,在世界第13大石油公司中占据一席之地:

Largest Oil Companies In The World By Revenue In 2023 (US$ billion) (Statista)

2023 年全球收入最大的石油公司(十亿美元)(Statista)

The company has a leading position in the Brazilian market, having produced around网页链接{87% of Brazil's} oil in 2023. Below, we will learn about the most relevant events in its history, and a little more about its business model.

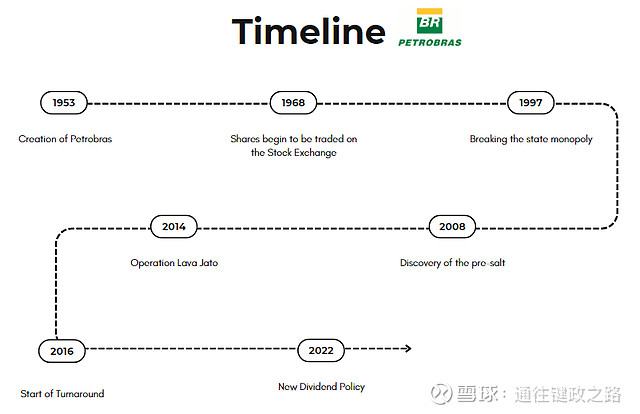

该公司在巴西市场处于领先地位,2023 年生产了巴西约 87% 的石油。下面,我们将了解其历史上最相关的事件,并更多地了解其商业模式。

History and Business Model

历史和商业模式

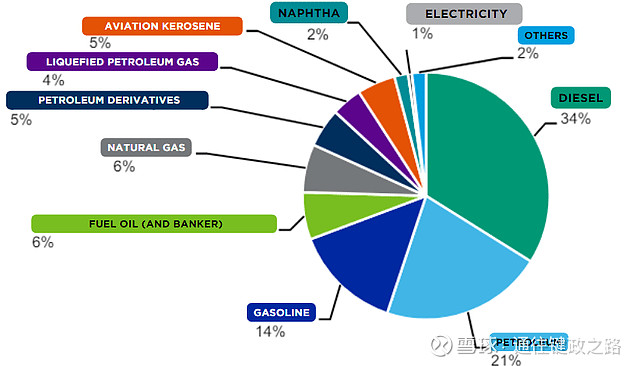

Petrobras was founded in 1953 with the responsibility for studying, extracting, refining and distributing the country's oil from the state monopoly. Currently, among the main products sold by the Company are diesel (34% of consolidated net revenue), oil (21%), gasoline (14%) and fuel oil (6%):

巴西国家石油公司成立于 1953 年,负责研究、提取、提炼和分销该国的石油,使其摆脱国家垄断。目前,公司销售的主要产品包括柴油(占合并净收入的34%)、石油(21%)、汽油(14%)和燃料油(6%):

Revenue Per Product (The Author)

每件产品的收入(作者)

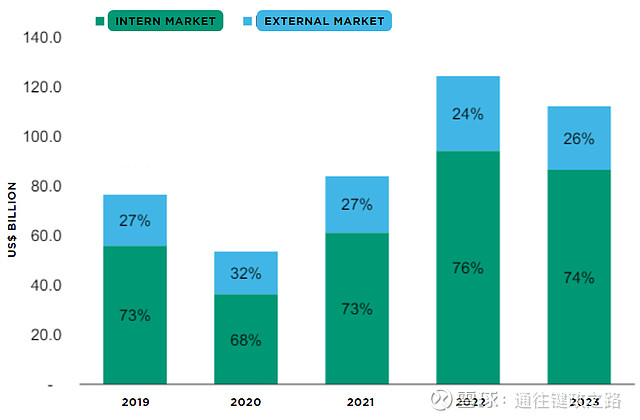

In terms of geographic diversification, despite the concentration of its assets in the national territory, the company's exports correspond to around 1/4 of revenues:

在地域多元化方面,尽管其资产集中在国内,但该公司的出口约占收入的1/4:

Revenue Per Market (The Author)

每个市场的收入(作者)

The company is a giant, it has been through good times and bad, and we will understand its history better through the timeline below.

这家公司是一个巨人,它经历了好时光和坏时光,我们将通过下面的时间线更好地了解它的历史。

Timeline (The Author) 时间线(作者)

For a better understanding of my investment thesis, I will explain in more depth what has happened since 2008:

为了更好地理解我的投资论点,我将更深入地解释自 2008 年以来发生的事情:

2008 - Discovery Of The Pre-Salt

2008 - 发现盐前盐

Lula's first mandate in Brazil began in 2003, and the Brazilian market did very well during the period, as Brazil exported many 网页链接{commodities to China}, which grew its GDP at double digits per year. See the Brazilian stock exchange, represented by EWZ (NYSE:EWZ) below:

卢拉在巴西的第一个任期始于2003年,在此期间巴西市场表现良好,因为巴西向中国出口了许多商品,中国的GDP以每年两位数的速度增长。请参阅以下以 EWZ (NYSE: EWZ) 为代表的巴西证券交易所:

EWZ Performance (Koyfin) EWZ 性能 (Koyfin)

However, Brazil has always had a网页链接{fiscal problem}, and then the pre-salt was discovered in 2008. The 网页链接{pre-salt discovery} was the largest oil discovery in the Western Hemisphere in the decade. And it was believed at the time that oil exports would be responsible for improving the Brazilian fiscal scenario. Let's look at the behavior of Petrobras shares in the period, before talking about the following years until 2014.

然而,巴西一直存在财政问题,然后在 2008 年发现了盐前。盐下发现的是十年来西半球最大的石油发现。当时人们认为,石油出口将负责改善巴西的财政状况。让我们先看看巴西国家石油公司股票在此期间的表现,然后再谈谈接下来的几年,直到2014年。

PBR Performance (Koyfin) PBR 性能 (Koyfin)

2014 - Investment Cycle And Lava Jato

2014 - 投资周期和 Lava Jato

Lula remained president for two terms, and managed to elect his successor in 2010, former president 网页链接{Dilma Rousseff}, also a representative of the Workers' Party. It was then that the Brazilian economy began to enter into crisis.

卢拉连任两届总统,并在2010年成功选出继任者,前总统迪尔玛·罗塞夫,也是工人党的代表。就在那时,巴西经济开始陷入危机。

During Dilma Rousseff's mandate, Petrobras made 网页链接{heavy investments} in pre-salt oil extraction, and also in other countries. This was a period marked by an 网页链接{increase in investment} capex.

在迪尔玛·罗塞夫(Dilma Rousseff)任职期间,巴西国家石油公司(Petrobras)在盐下油开采以及其他国家进行了大量投资。这一时期的特点是投资资本支出增加。

The company became the 网页链接{most indebted} in the world, and its shares fell sharply. During this period, the Lava Jato operation was also launched, responsible for investigating 网页链接{billions of dollars} in misappropriation of resources in investments made by the company.

该公司成为世界上负债最多的公司,其股价大幅下跌。在此期间,还启动了Lava Jato业务,负责调查公司投资中数十亿美元的资源挪用。

The scandals led to the impeachment of Dilma Rousseff, and then Michel Temer assumed the Brazilian presidency, inserting a new management in Petrobras.

这些丑闻导致迪尔玛·罗塞夫(Dilma Rousseff)被弹劾,然后米歇尔·特梅尔(Michel Temer)担任巴西总统,在巴西国家石油公司(Petrobras)中插入了新的管理层。

2016 - Start Of Turnaround

2016 - 开始扭亏为盈

Under new management, Petrobras was possibly one of the biggest 网页链接{turnaround cases} in the world. The new management had a clear strategy: deleveraging, divestment of 网页链接{non-strategic assets}, and focus on the 网页链接{core business}, oil extraction. Furthermore, the 网页链接{international fuel price} parity policy was created, meaning that Petrobras no longer subsidized fuel prices.

在新管理层的领导下,巴西国家石油公司可能是世界上最大的扭亏为盈的案例之一。新管理层有一个明确的战略:去杠杆化,剥离非战略资产,并专注于核心业务,即石油开采。此外,还制定了国际燃料价格平价政策,这意味着巴西国家石油公司不再补贴燃料价格。

This strategy was used until the end of Jair Bolsonaro's government, and Petrobras evolved from the most indebted company in the world to the third-largest dividend payer in the world.

这一策略一直沿用到雅伊尔·博尔索纳罗(Jair Bolsonaro)政府结束,巴西国家石油公司(Petrobras)从世界上负债最多的公司发展成为世界第三大股息支付者。

2022 - New Dividend Policy

2022 - 新股息政策

Well, Lula and the 网页链接{Workers' Party won} the last elections in Brazil and are back in charge of Petrobras. What has been the evolution since then? Petrobras released a 网页链接{new investment plan} focused on increasing capex, a strategy that has brought major losses and corruption in the past. We will talk more about the investment plan throughout this report.

好吧,卢拉和工人党赢得了巴西的上次选举,并重新掌管巴西国家石油公司。从那时起发生了什么演变?巴西国家石油公司发布了一项新的投资计划,重点是增加资本支出,这一战略在过去带来了重大损失和腐败。我们将在本报告中更多地讨论投资计划。

Will the strategy work now? I'm skeptical about this. Furthermore, the 网页链接{international parity policy} was refuted by the company, and this creates a big problem (one of the pillars of my thesis) that we will see below.

该策略现在行得通吗?我对此持怀疑态度。此外,该公司驳斥了国际平价政策,这造成了一个大问题(我论文的支柱之一),我们将在下面看到。

Petrobras Price Gap 巴西国家石油公司价格差距

When Dilma Rousseff's Government went into crisis, several state-owned companies were网页链接{used to subsidize} prices and improve the Government's popularity. In my opinion, this could happen again.

当迪尔玛·罗塞夫(Dilma Rousseff)的政府陷入危机时,几家国有公司被用来补贴价格并提高政府的声望。在我看来,这种情况可能会再次发生。

There is a polarization in Brazil, just look at the results of the last elections, Lula (left-wing candidate) beat Bolsonaro (right-wing candidate) by just 50.9% of the votes. Furthermore, at the beginning of his third term, Lula is facing a drastic 网页链接{reduction in popularity}. But what is the concrete effect of this on Petrobras?

巴西存在两极分化,看看上次选举的结果,卢拉(左翼候选人)仅以50.9%的选票击败了博尔索纳罗(右翼候选人)。此外,在第三个任期开始时,卢拉面临着人气急剧下降的问题。但这对巴西国家石油公司的具体影响是什么?

With the spike in oil prices, Petrobras already has a 网页链接{17% lag} in the international price. Keeping prices out of date with international prices can result in:

随着油价的飙升,巴西国家石油公司已经落后于国际价格17%。使价格与国际价格保持同步可能会导致:

Loss of revenue that could be reinvested in the company or distributed to shareholders as dividends.

可以再投资于公司或作为股息分配给股东的收入损失。

Artificially low prices can lead to greater fuel consumption, further putting pressure on demand.

人为压低价格会导致更大的燃料消耗,进一步给需求带来压力。

Sudden price adjustments can cause volatility in results.

突然的价格调整会导致结果波动。

Investors perceiving interference may reduce their position in the company, which generates a sales flow.

投资者察觉到干扰可能会减少他们在公司的头寸,从而产生销售流。

All of these factors contribute to my skeptical view of the company's thesis. But we must remember that this questionable actions from the new management should take time to have negative effects on the company, given that Petrobras' balance sheet remains quite strong, as we will see below.

所有这些因素都导致了我对公司论点的怀疑。但我们必须记住,鉴于巴西国家石油公司的资产负债表仍然相当强劲,新管理层的这种可疑行为应该需要时间才能对公司产生负面影响,我们将在下面看到。

Petrobras Fundamentals 巴西国家石油公司基本面

Well, when we see this troubled history we can imagine that Petrobras has worse financial indicators than its competitors, right? We will see below. In the following, I will use Seeking Alpha and Koyfin to compare Petrobras with its peers in the world, like Exxon Mobil (NYSE:XOM), Shell (NYSE:SHEL), Chevron (NYSE:CVX), TotalEnergies (NYSE:TTE) and BP (NYSE:BP).

好吧,当我们看到这段麻烦的历史时,我们可以想象巴西国家石油公司的财务指标比其竞争对手差,对吧?我们将在下面看到。在下文中,我将使用 Seeking Alpha 和 Koyfin 将巴西国家石油公司与埃克森美孚 (NYSE: XOM)、壳牌 (NYSE: SHEL)、雪佛龙 (NYSE: CVX)、道达尔能源 (NYSE: TTE) 和 BP (NYSE: BP) 等世界同行进行比较。

Ticker(PBR)(XOM)(SHEL)(CVX)(TTE)(BP)CountryBrazilUSAUKUSAFranceUKMarket Cap$101B$487B$230B$301B$175B$109BRevenue$105B$338B$316B$195B$219B$208BEBITDA$50B$67B$46B$42B$44B$44BEBITDA Margin 息税折旧摊销前利润率48%20%15%21%20%21%Net Income$25B$36B$19B$21B$21B$15Net Income Margin 净利润率24%10%6%11%10%7%ROE33%18%10%13%18%19%Dividend Yield 股息收益率20%3%3.6%3.8%4.5%4.4%Net Debt / EBITDA

净债务/EBITDA0.8x0.2x0.7x0.4x0.4x0.4x

We were surprised again, as the company operates extremely efficiently. Petrobras has the highest Ebitda margin, highest net margin, highest ROE and in the last 12 months has paid 网页链接{excellent dividends}. Despite these excellent numbers, I will further explain my recommendation to hold the shares after checking the company's valuation below.

我们再次感到惊讶,因为该公司的运营效率非常高。巴西国家石油公司拥有最高的EBITDA利润率,最高的净利润率,最高的ROE,并且在过去12个月中支付了出色的股息。尽管有这些出色的数字,但我将在查看下面的公司估值后进一步解释我持有股票的建议。

Valuation Is Favorable 估值有利

In the sector, the EV/EBITDA is a relevant multiple, since EBITDA is a proxy for cash generation. Now let's see how the market prices Petrobras in these multiples using Koyfin:

在该行业,EV/EBITDA是一个相关的倍数,因为EBITDA是现金生成的指标。现在让我们看看市场如何使用 Koyfin 以这些倍数对巴西国家石油公司进行定价:

EV/EBITDA Projected For Oil Companies (Koyfin)

石油公司预计的EV/EBITDA(Koyfin)

Despite presenting excellent numbers, the company trades at the lowest EV/EBITDA multiple among its competitors. If we calculate an average EV/EBITDA for the sector, we arrive at a multiple of 4.6x, and this implies a large upside of 58% in the company's shares.

尽管数据出色,但该公司的EV/EBITDA倍数是竞争对手中最低的。如果我们计算该行业的平均EV/EBITDA,我们得出的倍数为4.6倍,这意味着该公司的股价有58%的大幅上涨空间。

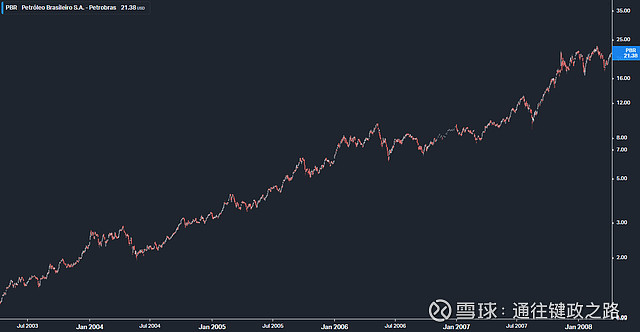

However, it is necessary to remember that although the company is generating a lot of cash, its management has changed and is making several 网页链接{questionable decisions}. Furthermore, the company will go through a new cycle of investments, and in its last major 网页链接{investment cycle} (with a history of corruption by the Workers' Party), the company had a drop of almost 90% of its shares:

但是,有必要记住,尽管该公司正在产生大量现金,但其管理层已经发生了变化,并做出了一些有问题的决定。此外,该公司将经历一个新的投资周期,在上一个主要投资周期(有工人党腐败的历史),该公司的股票下跌了近90%:

Petrobras' Performance In The Last Major Investment Cycle (Koyfin)

巴西国家石油公司在上一个主要投资周期中的表现(Koyfin)

Because I believe that the risk-return ratio is not attractive, but recognize that Petrobras' financial balance sheet is robust, I recommend that investors hold their shares. Now, let's see what the Seeking Alpha tools tell us.

因为我认为风险回报率没有吸引力,但认识到巴西国家石油公司的财务资产负债表是稳健的,我建议投资者持有他们的股票。现在,让我们看看 Seeking Alpha 工具告诉我们什么。

Petrobras - Seeking Alpha Quant & Factor Grades

巴西国家石油公司 - 寻求阿尔法量化和因子等级

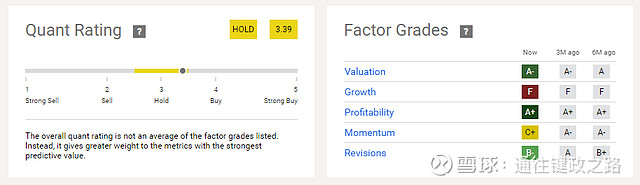

According to Seeking Alpha, Petrobras has excellent valuation, profitability and reviews scores:

根据 Seeking Alpha 的数据,巴西国家石油公司拥有出色的估值、盈利能力和评论得分:

Quant Rating & Factor Grades (Seeking Alpha)

量化评级和因子等级(寻求阿尔法)

However, it has a poor rating for growth, which corroborates my thesis that the intentional lag in prices compared to the international price of oil is negative for the company. Additionally, the quant tool points to a hold recommendation, which also supports my thesis for the shares.

然而,它的增长评级很差,这证实了我的论点,即与国际石油价格相比,价格的故意滞后对公司不利。此外,量化工具指向持有建议,这也支持我对股票的论点。

Latest Earnings Results 最新财报

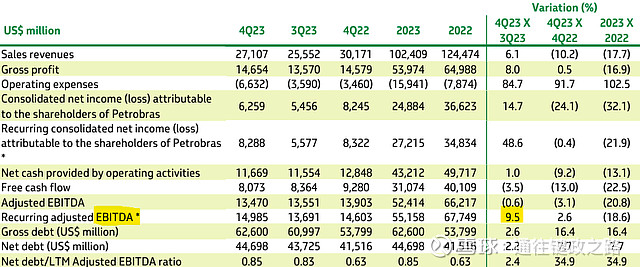

网页链接{The results} from an operational point of view remain stable, the adjusted EBITDA of $15 billion increased 9.5% q/q, due to greater oil production in Brazil, lower costs of $7.8/boe, as well as still resilient refining margins, more than offset lower crude oil prices (-3% q/q).

从运营角度来看,业绩保持稳定,调整后的EBITDA为150亿美元,环比增长9.5%,原因是巴西石油产量增加,成本降低至7.8美元/桶油当量,以及炼油利润率仍然具有弹性,抵消了原油价格下跌(环比下降3%)。

Results (IR Company) 结果 (IR Company)

But what caught attention were not the operational results. In line with your new investment plan, the company chose to retain $8.8 billion in its recently 网页链接{created capital} reserve and approve the distribution of only $2.8 billion, which together with repurchases of $550 million during the quarter total $3.4 billion (yield of 3.2 %). Although it is in line with its remuneration policy, it is still a big disappointment considering the latest dividend distributions.

但引起人们注意的不是运营结果。根据您的新投资计划,公司选择在其最近创建的资本储备中保留 88 亿美元,并仅批准分配 28 亿美元,加上本季度回购的 5.5 亿美元,总计 34 亿美元(收益率为 3.2%)。虽然符合其薪酬政策,但考虑到最新的股息分配,仍然令人大失所望。

My view is skeptical about the company, however let's look at the risks to the thesis, which could cause the company's shares to continue to appreciate.

我的观点是对该公司持怀疑态度,但是让我们看看论文的风险,这可能会导致该公司的股票继续升值。

Potential Threats To The Thesis

对论文的潜在威胁

In recent years, Guyana has seen 网页链接{strong GDP growth} due to oil extraction, with large reserves found in its territory. Currently, a large part of Brazilian production comes from the field basin in网页链接{eastern Brazil}, however the company has started work to explore oil in the 网页链接{Equatorial Margin}, a territory in the north of Brazil and close to Guyana.

近年来,圭亚那因石油开采而实现了强劲的GDP增长,在其领土上发现了大量储量。目前,巴西产量的很大一部分来自巴西东部的油田盆地,但该公司已开始在赤道边缘勘探石油,赤道边缘是巴西北部靠近圭亚那的领土。

Recently the company announced that it 网页链接{found oil} in the Equatorial Margin, and this could be the beginning of a new and large oil discovery in Brazilian territory, and could bring great appreciation to the shares.

最近,该公司宣布在赤道边缘发现了石油,这可能是巴西境内新的大型石油发现的开始,并可能为股票带来极大的升值。

The company's corporate governance was significantly improved with the 网页链接{State-Owned Companies Law}. The law establishes rules for the functioning of committees and councils, with the aim of improving practices within companies controlled by the Brazilian state.

通过《国有公司法》,公司的公司治理得到了显著改善。该法律为委员会和理事会的运作制定了规则,旨在改善巴西国家控制的公司内部的做法。

Finally, despite reducing dividend payments, the company continues to pay 网页链接{generous dividends}, which is a great attraction for investors, and there is a possibility that these payments will continue to occur in the medium term. The risks of investing in Petrobras are diverse, with several pros and cons, and it is important that the investor examines them before deciding to invest in the company.

最后,尽管减少了股息支付,但该公司继续支付丰厚的股息,这对投资者来说是一个很大的吸引力,并且这些支付有可能在中期继续发生。投资巴西国家石油公司的风险是多种多样的,有利有弊,投资者在决定投资该公司之前对其进行检查非常重要。

The Bottom Line 底线

Petrobras' valuation has a 37% discount compared to the average of its competitors when we analyze the EV/EBITDA multiple. Additionally, the company has the best ROE among its competitors.

当我们分析EV/EBITDA倍数时,巴西国家石油公司的估值与其竞争对手的平均水平相比有37%的折扣。此外,该公司在其竞争对手中拥有最好的 ROE。

However, there is a clear reason for the discount compared to competitors. The company still has good results due to the strategy used by previous management, which focused on strategic divestments and focus on the core business.

但是,与竞争对手相比,折扣是有明确原因的。由于前任管理层采用的策略,该公司仍然取得了良好的业绩,该战略专注于战略撤资并专注于核心业务。

On the other hand, the new management appointed by the Workers' Party takes several decisions to increase the company's investments. In the past, the strategy was responsible for making the company the most indebted in the world and having a drop of almost 90% in its share prices.

另一方面,工人党任命的新管理层做出了几项决定,以增加公司的投资。过去,该战略使该公司成为世界上负债最多的公司,其股价下跌了近 90%。

Based on this analysis, my recommendation is to hold the shares, as the risk-return ratio does not seem ideal to indicate a purchase, despite the company's extremely discounted valuation.

基于这一分析,我的建议是持有股票,因为尽管该公司的估值非常折让,但风险回报率似乎并不理想,表明购买。