恒润投资致海王星辰管理层信的中英文版本可见附件。

作为海王星辰的股东,恒润投资已经向张思民董事长提供六条建议。以下是三点关于恒润投资“双十”策略的建议:

1) 加速关闭门店:

通过分析,若在2013年关闭额外的10%的门店,可以使公司的营业利润率从2013年实际的0.9%增加到5.7%,每股收益从$0.01增加到$ 0.08。

2) 减少人员配备:

通过分析,若在2013年减少10%的药剂师,可以使公司的营业利润率从2013年实际的0.9%增加到4.3%,每股收益从$0.01增加到$ 0.03。

3) 同时加速关闭门店以及减少人员配备:

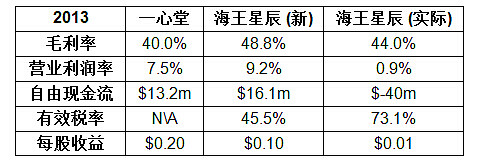

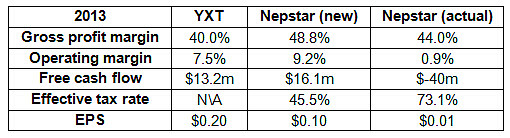

通过同时关闭额外10%门店以及减少10%药剂师,可以使公司营业利润率从2013年实际0.9%增加到9.2%,每股收益从$0.01增加到$ 0.11。

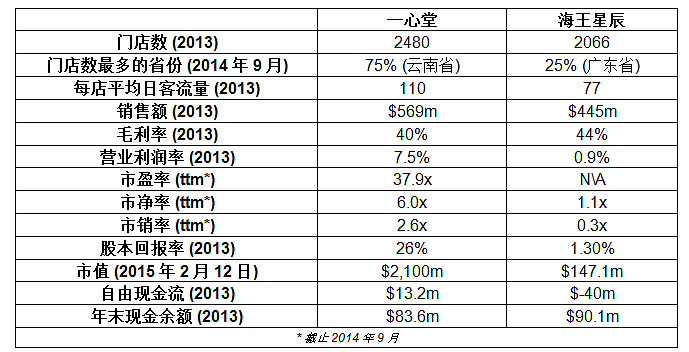

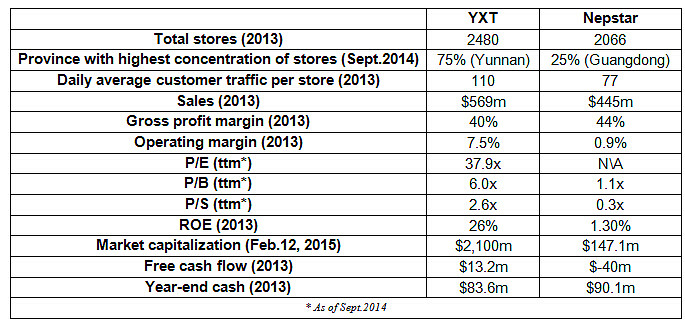

这样的营业利润率是可以达到的,因为国内的同行已经在这一水平上。值得一提的是区域销售药店连锁企业,云南鸿翔一心堂药业(集团)股份有限公司(深证:002727)。作为一家主攻云南地区(75%门店所在地),进行区域销售的连锁药店,有着2400家门店的一心堂在2013年营业利润率达到了7.5%。

一心堂的业绩很好的回馈了股东。自从2014年7月的IPO以来,一心堂的股价已经上升了346%。(¥12.20 – ¥54.4). 此策略建议海王星辰将总部城市深圳作为中心发展。一心堂的优势是明显的:

一心堂与海王星辰相比,其策略带来的优势十分明显:

如果海王星辰采取了恒润投资推荐的“双十”策略,海王星辰的营业利润率将有以下变化:

恒润投资相信很多股东将会赞同我们的建议并且感谢我们希望海王星辰持续发展的动机。我们希望与所有的股东包括海王星辰的管理层为了公司与股东的长期利益,进行合作。为了达到上述提高的结果,恒润投资希望以上建议能很快被考虑并实施。我们希望能够与股东们尽快进行交流。我们同样将会举行公众论坛。我们的目的是让股东们自己回顾海王星辰的过往表现,同时审阅恒润投资的建议。

U.S. Fund Recommends “10-10” Plan for Urgent Nepstar Turnaround

A U.S. fund is encouraging China Nepstar Chain Drugstore (NYSE: NPD) to implement six changes to increase the value of the company after five-straight quarters of losses and a 91% fall from its IPO.

The fund and shareholder, Heng Ren Investments LP, based in Boston, Massachusetts, USA, has written a letter to Nepstar Chairman Mr. Simin Zhang with six recommendations. The following three recommendations focus on Heng Ren’s “10 – 10” plan for Nepstar’s profitability:

1) Accelerate Store Closings – A 10% reduction in stores in 2013 – the latest audited results used for this analysis - would have increased operating margin to 5.7% (vs. 0.9% actually reported in 2013), with earnings per share (EPS) of $0.08 (vs. $ 0.01 reported in 2013).

2) Reduce Staffing Levels – A 10% reduction in pharmacists would have increased the operating margin to 4.3% (vs. 0.9%), with EPS of $0.03 (vs. $ 0.01).

3) Combined “10-10” Store Closings and Staff Cuts – A 10% reduction in stores, combined with a 10% reduction in pharmacists, would have increased operating margin to 9.2% (vs. 0.9%), and EPS of $0.11 (vs. $ 0.01 actual).

Heng Ren’s complete letter to Nepstar can be read in both Chinese and English in the attached files.

A swing to greater profitability is well within Nepstar’s reach. This level of operating margin is achievable because peers in China are already delivering it. One example is regional drug store chain Yunnan Hongxiang Yixintang Pharma Co. Ltd. (Shenzhen: 002727). “YXT” achieved 7.5% operating margin in 2013 with a regional strategy focused on Yunnan Province in southwest China, home to 75% of its 2,400 drug stores.

YXT’s stock price performance has generously rewarded its investors. Since its IPO in July 2014, YXT’s stock (as of February 12) has appreciated by +346% (¥12.20 – ¥54.4). This is a strategy for Nepstar to emulate in southern China near its headquarters in Shenzhen。

The benefits YXT enjoys from its strategy are obvious compared to Nepstar:

If Nepstar would have implemented Heng Ren’s “10-10” plan for turnaround, Nepstar would have compared favorably with YXT:

To achieve these improved results, Heng Ren recommends a strategic review be conducted immediately by Nepstar’s board, and that our recommendations be implemented. Heng Ren intends to begin communicating and meeting with shareholders immediately. They also will consider conducting public shareholder forums. The purpose is to have shareholders review Nepstar’s record for themselves, and consider Heng Ren’s recommendations.

Heng Ren expects many shareholders will be sympathetic to its recommendations and will appreciate the initiative to advise Nepstar on how to generate sustainable profitability. Heng Ren looks forward to collaborating with all shareholders, including Nepstar management, to take actions that are in the best long-term interests of the company and its shareholders.

$九洲大药房(CJJD)$ $西维斯(CVS)$ $来德爱(RAD)$ $沃尔格林(WAG)$ $第一医药(SH600833)$ $国药一致(SZ000028)$ $英特集团(SZ000411)$ $一心堂(SZ002727)$ $海王星辰(NPD)$ $中国ETF-PowerShares Gldn Drago(PGJ)$