有消息指,天然铀买家们准备在西方夏季假期结束后开始收购天然铀。

- 天然铀现货市场成交量仍然不大,预计9月份将回升

- 全球各国计划建造的核电机组数量仍在增加

- 全球天然铀主要产区之一的尼日尔,局势没有得到改善

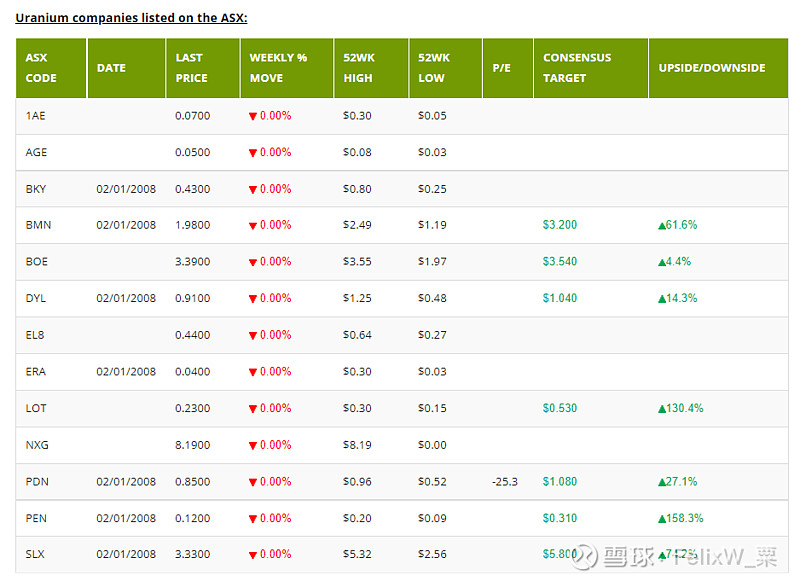

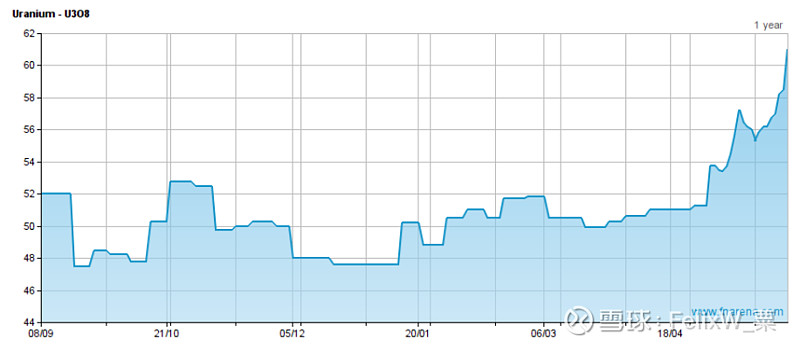

The spot uranium price continued to tick up last week on transactional activity, industry consultant TradeTech reports. Two on-market transactions and three off-market transactions were concluded.

TradeTech’s weekly spot price indicator has risen US25c to US$58.50/lb.

Sellers are growing increasingly bullish due to expectations for demand to increase next month after the end of the summer holiday period, TradeTech notes. Although total volumes traded remain relatively small, buyers are showing an increased willingness to pay higher prices in order to secure material in advance of what is expected to be an active period for the market in September and October.

Two term market transactions were reported last week. TradeTech’s term price indicators remain at US$57.25/lb (mid term) and $57.750/lb (long).

Overreacting

The future role of small modular reactors (SMR), which has become a notable nuclear industry topic, was again in the news last week as the Canadian government approved C$74m in federal funding for SMR development in the province of Saskatchewan.

The funding includes C$24m from the proceeds of Canada's pollution pricing system, which will support work to advance the project.

In Poland, Polskie Elektrownie Jadrowe has submitted an application to the provincial government in Pomerania which seeks a location decision for the country's first nuclear power plant.

Saudi Arabia is reportedly considering a bid by the state-owned China National Nuclear Corp to build it a nuclear power plant near the border with Qatar.

Saudi officials said they would prefer to accept a bid form Korea Electric Power Corp to build the plant's reactors and involve US operational expertise, but do not want to agree to the proliferation controls the US government generally requires, adding that Crown Prince Mohammed bin Salman is prepared to move ahead with CNNC if talks with the US fail.

Geopolitics

The uranium market received positive news from Kazakhstan’s Kazatomprom, which said last week that deliveries from its Inkai Joint Venture with Canada’s Cameco via the Trans-Caspian route are on track.

However, the situation in Niger is deteriorating.

While the Economic Community of West Africa States remains determined to pursue a peaceful resolution to the coup, on Friday the military junta issued a letter requesting that France’s Ambassador leave the country within 48 hours, stating the French government’s actions were “contrary to the interest of Niger”.

The junta has authorised the militaries of Burkina Faso and Mali to intervene in the event of any military action by ECOWAS to restore President Bazoum to office.

To date, French uranium companies operating in Niger have reported no change to business as usual. The EU has also suggested it has plenty of uranium to cover any loss of supply.

#今日话题# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$