Continuing Positive Nuclear Developments

The U3O8 uranium spot price gained 0.35% in July, increasing from US$56.02 to $56.21 per pound as of July 31, 2023.1 Uranium has posted a healthy 16.35% year-to-date return as of July 31, 2023, and continued to show strength and diversification relative to other commodities, which declined 4.85% (as measured by the BCOM Index). Over the longer term, uranium has demonstrated even greater resilience within the commodity space. For the five years ended July 31, 2023, U3O8 spot appreciated a cumulative 118.57% compared to 25.70% for the BCOM.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (7/31/2018-7/31/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 07/31/2023. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Steady Flow of Positive Nuclear Energy News Supports Sector

U.S.

Georgia Power declared that Plant Vogtle Unit 3 has entered commercial operation.6 This is the first newly constructed nuclear unit in the U.S. in over 30 years, and once Unit 4 is online (projected Q4 23-Q1 24) the site will be the largest generator of clean energy in the U.S.

China

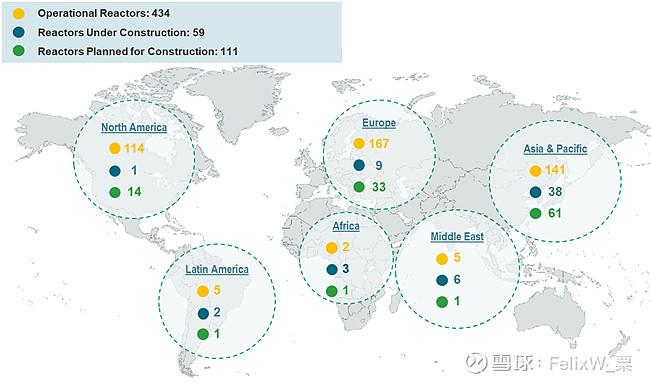

The State Council approved the construction of six nuclear power units representing a ~USD $17 billion investment. Note that China has the largest number of reactors under construction and planned (Figure 2 shows regional data). Although China does not have the most reactors currently operating, it is quickly catching up to the world leaders (93 for the U.S., 56 for France and 55 for China).7

Japan

A nuclear power plant has restarted, which now brings the number of Japanese reactor restarts to 11.8

South Korea

The Ministry of Industry announced it was considering new nuclear power plants.9 Earlier this year, South Korea raised its target share of nuclear power generation in the country to 32.4% by 2030 and 34.6% by 2036 (from 26% in 2021).10

Canada

The Ontario government asked utility Bruce Power for an assessment on adding as much as 4.8 GW (gigawatts) of capacity to its Bruce station. The expansion would make the site the biggest in the world.11

The Ontario government also extended the Pickering Nuclear six-reactor power plant through September 2026.12

UK

The government passed Great British Nuclear targeting new nuclear capacity of 24 GW by 2050.13

Figure 2. 170 New Nuclear Reactors Planned/Under Construction

Source: World Nuclear Association as of 8/1/2023. Included for illustrative purposes only.

U.S. Efforts to Reshore Gain Momentum

The U.S. continues to pass legislation that supports the reshoring of the nuclear fuel supply chain away from Russia. The U.S. Senate (Senate) overwhelmingly passed the Nuclear Fuel Security Act.14 This bipartisan legislation directs the Department of Energy (DOE) to increase domestic nuclear fuel production to ensure a disruption in Russian uranium supply would not affect its operating fleet and the future deployment of advanced reactors.

The Nuclear Security Act follows the passing of the Prohibiting Russian Uranium Imports Act and the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act and may indicate that it may be only a matter of time before the Russian nuclear fuel supply chain is cut off. As it pertains to the U.S., Russian imports of uranium accounted for 12% of uranium purchased in 2022.15 Further, U.S. domestic production of uranium has precipitously fallen (Figure 3). Individual U.S. states that were previously producing uranium are pushing to restart idle capacity. The U.S. fleet of nuclear reactors requires about 50 million pounds of uranium annually, making them almost completely dependent on other countries for supply.

Figure 3. U.S. Uranium Concentrate (U308) Production (2000 - Q1 2023)

Source: EIA. U.S. Energy Information Administration: Form EIA-851A, Domestic Uranium Production Report (Annual), and Form EIA-851Q, 网页链接{Domestic Uranium Production Report (Quarterly)}. P = preliminary data. Withheld data – Q2 2020, Q3, 2020, Q4 2020, Q1 2021 and Q2 2021.

Uranium Miners Continue to Grow Contract Books

Uranium mining equities posted positive results in July, rising 2.75%. This marks the second consecutive month of outperformance of uranium mining equities over physical uranium, which is a reversal of several prior months of underperformance, which we believed indicated a market dislocation. This outperformance was primarily driven by the larger uranium miners in July. Both NAC Kazatomprom JSC (Kazatomprom), the world’s largest producer of uranium, and Cameco Corporation (Cameco), the world’s largest publicly traded uranium company, were given a lift and increased sales guidance for 2023.16

Cameco in particular continued to be a leader among uranium miners with its July month-end stock price hitting highs not seen in over 12 years.17 Cameco performed well into month end, ahead of its earnings call on August 2, 2023, which delivered mixed results. On the one hand, Q2 2023 results were below the market’s expectations, but the forward guidance continued to improve. Cameco’s revenue outlook for 2023 was increased by 7% to between $2.4 - $2.5 billion on the back of higher forecasted sales (not production). The company also increased its long-term contracting commitments requiring annual delivery of an average of 28 million pounds over the next five years (compared to 26 million the prior quarter).18 Cameco’s results reflect an accelerating uranium contracting cycle with over 118 million pounds contracted thus far this year (this compares to 2022’s full-year figure of 125 million pounds, which was the highest in a decade). We believe it is only a matter of time before utilities return to replacement rate purchasing, signifying a greater potential of future demand for uranium.

The increase in uranium’s demand outlook has triggered a supply response in the form of uranium mine restarts. For Cameco, its response in 2023 is to scale up its McArthur River mine; it restarted in late 2022 with guidance initially of 15 million pounds of production by 2024 and then revised in February 2023 to 18 million pounds. Although this represents the largest uranium mine restart, global uranium mine production is still well short of the world’s uranium reactor requirements. This deficit further underscores the need for further restarts and new mines in development (Figure 4).

Figure 4. World Uranium Production Not Meeting Nuclear Reactor Requirements (1945-2020)

Source: OECD-NEA/IAEA, World Nuclear Association as of 12/31/2022. Included for illustrative purposes only.

Junior Uranium Miners Shaken by Political Events

Junior uranium miners fell in July by 1.44%, weighed down by geopolitical unrest and other supply chain disruptions. On July 26, a coup d’état occurred in Niger in which President Mohamed Bazoum was detained, and the presidential guard commander general proclaimed himself the leader of a new military junta. The junta has escalated anti-French rhetoric and allegedly said it was suspending exports of uranium to France.19 Niger is the seventh-largest producing country of uranium (Figure 5) but delivered 25% of the EU’s 2022 supplies.20 Niger and France are also directly linked through Orano SA (Orano). Orano is a French-headquartered private uranium mining company, with the second-largest uranium production of any company in 2022, and a large uranium mine in Niger. Orano has stated that operations are continuing.

In terms of publicly listed companies, both Global Atomic Corporation and GoviEx Uranium Inc. have interests in Niger and have also stated that normal business is being conducted.21 Investor perception of the event has told a different story, with Global Atomic's stock price plummeting, potentially signaling an expectation of a delay in the start of the new mine in Niger, Dasa. GoviEx Uranium has also sold off, albeit less precipitously. This situation highlights the vulnerabilities of the uranium supply chain due to its concentrated production and may result in uranium price spikes.

Figure 5. The World's Largest Uranium Producing Countries in 2022

Source: World Nuclear Association. Data as of 12/31/2022.

Peninsula Energy Ltd. was also hurt after Uranium Energy Corp (UEC) terminated a processing agreement. As a result, Peninsula Energy announced a “significant” delay in the restart of its Lance project.22

As discussed earlier, restarting idle uranium mines is key to meeting rising demand and diversifying supply. To that end, UEC announced it is taking steps to move its Christensen Ranch ISR (In-Situ Recovery) Project out of care and maintenance toward resuming production and that it had advanced development in its past producing Palangana ISR Project and its Burke Hollow ISR Project.23,24 CEO Amir Adnani further stated that, “With demand increasing for uranium supply from stable geopolitical jurisdictions and U.S. national security objectives, we foresee an increasingly urgent need for domestic uranium supply. The fundamental drivers of supply and demand, including pending legislation to ban Russian uranium imports to the United States, are translating into rising uranium prices that have accelerated UEC's production readiness program.”

#今日话题# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$