Reshoring of Nuclear Supply Chain Gains Momentum

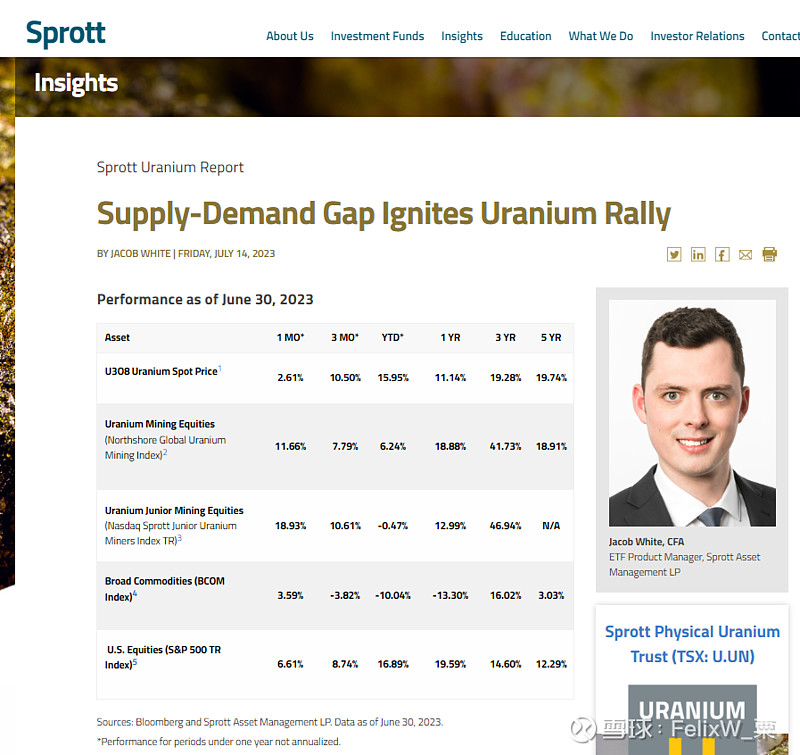

The U3O8 uranium spot price gained 2.61% in June, increasing from US$54.59 to $56.02 per pound as of June 30, 2023. Uranium has posted a healthy 15.95% year-to-date return as of June 30, 2023, and continued to show strength and diversification relative to other commodities, which declined 10.04% in the first half (as measured by the BCOM Index). Over the longer term, uranium has demonstrated even greater resilience within the commodity space. For the five years ended June 30, 2023, U3O8 spot appreciated a cumulative 146.15%1 compared to 16.10% for the BCOM.

The U3O8 uranium spot price began rallying on May 31 after the U.S. Senate Environment and Public Works Committee (EPW) passed the bipartisan Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act. This Act along with the Prohibiting Russian Uranium Imports Act passed on May 24 indicate that it may be only a matter of time before the Russian nuclear fuel supply chain is cut off.

A highlight in June was the World Nuclear Fuel Market 49th Annual Meeting held in Slovenia on June 4-6. "Mind the Gap" was the meeting's theme, which refers to the pressing need for increased uranium production as countries ramp up nuclear power capacity. Attendees addressed the positive momentum within the uranium industry, given the growing demand for uranium, amid supply constraints and the steadily improving sentiment toward nuclear power.

Looming sanctions on Russian uranium are likely to have serious consequences for utilities regarding the security of supplies. Both conversion and enrichment providers need significant term contracts to increase capacity. Market participants, especially in the West, have focused on this conversion bottleneck. In July, ConverDyn, a uranium conversion facility in the U.S., finally restarted after being shuttered since 2017, which represents an important step to reshoring the U.S. nuclear supply chain from Russia. Another key development in the reshoring process was made by Urenco, which announced in early July that it will expand the capacity of its New Mexico enrichment facility by 15%. We believe both of these developments will finally enable an industry shift to overfeeding, ultimately creating greater near-term demand for uranium.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (06/30/2018-06/30/2023)

Uranium Miners Rise Above Macro Turbulence

Uranium mining equities posted strong results in June, climbing 11.66%. The outperformance of mining equities over physical uranium was a reversal of prior months of underperformance, which we believed indicated market dislocation.

Uranium mining equities have been hurt by higher interest rates and macroeconomic headwinds that have impacted many capital-intensive sectors. However, in June uranium stocks were boosted by heightened supply chain concerns, given that the contracting cycle has started and the uranium spot price has been moving higher. While 2022 was the highest uranium contracting year in a decade, utilities are still not yet at the annual replacement rate. As a result, we expect the contracting cycle to accelerate as utilities become more concerned about the long-term security of supply. We believe this may likely lead to higher uranium prices, back to the levels last seen in April 2022 when uranium reached an 11-year high of ~$64.

It is worth noting that this year's uranium term contracting cycle has been dominated by Central and Eastern European utilities that are clearly focused on shifting away from Russia. Surprisingly, U.S. utilities have been less active in 2023 and are contracted to buy less uranium in 2022 versus 2021 (40.5 million pounds U3O8 equivalent versus 46.7 million). While U.S. utilities have historically held lower uranium inventories than the rest of the world, its uncovered uranium requirements for the 2023-2032 decade stand at 179.2 million pounds. This is relatively unchanged from the prior year’s figure of 182.1 million pounds. To meet this need, we are seeing considerable supply being earmarked for future contract deliveries and a growing interest in the capacity of junior uranium miners.

Junior Uranium Miners Lead June’s Uranium Markets’ Rally

Junior uranium miners appreciated 18.93% in June, outperforming large-cap miners considerably. As we have explored in past commentaries, difficult market conditions tend to impact junior uranium miners more significantly, given their lower levels of liquidity and higher volatility. However, as we witnessed in June, junior miners have the potential for greater upside when uranium prices move higher.

We believe the strong performance of uranium miners in June reflects the sector’s increasingly bullish fundamentals and the growing reality that future uranium supplies will have to come from mines restarting operations and new mines in development.

Nuclear Energy is Crucial to the Energy Transition

Looking beyond June's performance, we believe the uranium bull market still has a long way to run and remains intact despite the uncertain macroeconomic environment. We believe conversion and enrichment services price increases have started to boost the uranium spot price. The long-awaited restart of the ConverDyn conversion facility in Illinois is likely to play a key role in the West’s transition away from Russian suppliers. Conversion has been the key bottleneck in the U.S. supply chain. This new capacity will enable the shift from underfeeding to overfeeding, likely increasing additional demand for U3O8.

The essential role of uranium and nuclear energy in fostering global energy security continues to grow in significance. Russia’s invasion of Ukraine sparked a global energy crisis that forced many countries to reimagine their energy supply chains. There has been an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that will likely create incremental demand for uranium. The current uranium price, however, continues to remain below incentive levels to restart tier 2 production, let alone greenfield development.

In past years, Western countries' energy policies have predominantly favored renewable energy to reduce reliance on fossil fuels. However, renewables often suffer from intermittency and low capacity and require offsets with baseload energy sources, such as coal, natural gas or nuclear power plants. As the world continues to add renewable capacity to grids, nuclear energy will have an important role to play, given that it can provide the highest capacity factor.

Figure 2. Uranium Bull Market Continues (1968-2023)

#今日话题# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$