Uranium Spot Outperforms

The U3O8 uranium spot price gained 6.01% in April, increasing from US$50.70 to $53.74 per pound as of April 30, 2023. Uranium has posted a healthy 11.24% year-to-date return as of April 30, 2023, and continued to show strength and diversification relative to other commodities, which declined 7.53% YTD (as measured by the BCOM Index). Over the longer term, uranium has demonstrated even greater resilience within the commodity space. For the five years ended April 30, 2023, U3O8 spot appreciated a cumulative 155.92% compared to 16.43% for the BCOM.

The U3O8 uranium spot price, which has been range bound between $48 to $51 for several months, broke out following the World Nuclear Fuel Cycle 2023 (held in The Hague, Netherlands, on April 18-20). The uranium spot prices reacted positively to bullish comments by China about its plans to grow its nuclear energy capacity (from 5% of its electricity to 18% by 2060). Yang Changli, the Chairman of China General Nuclear Power Group Co., one of China’s top nuclear energy firms, expects a massive surge of atomic plants in the coming decades to help the country meet its decarbonization goals. At a recent industry event, Changli announced that China’s nuclear fleet is likely to grow to 400 gigawatts by 2060, accounting for about 18% of the country’s generation.

The sentiment among global uranium fuel buyers is that supply remains tight, and concerns over the security of supply are not dissipating. Utilities are facing several challenges, including the growing threat of sanctions against Russian uranium and fuel services and the potential risks of shipping uranium from the world’s largest producer, Kazakhstan, via Russia.

Growing Importance of National Security

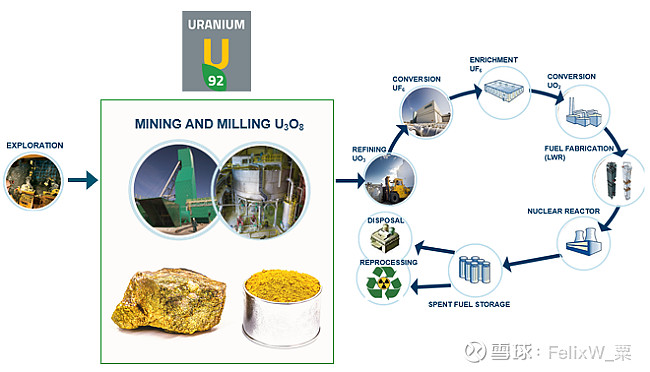

We believe nations are competing to acquire and control access to critical materials as supplies become increasingly vital to economic competitiveness and national security. Uranium is especially crucial in its dual role of supplying clean energy and high baseload capacity. Since Russia invaded Ukraine, the West has been re-examining its energy supply chains and questioning Russia’s role as one of the world’s top energy exporters. Considering the uranium fuel cycle (Figure 2), Russia accounts for a small portion of U3O8 production at 6% of the world’s total, but it controls about 27% of the global uranium conversion capacity and 39% of fuel enrichment. Although sanctions have yet to be imposed on Russian uranium production or conversion and enrichment services, and legacy contracts are being honored, utilities have not signed any new contracts with Russian entities. In addition, utilities have been focused primarily on sourcing conversion and enrichment before looking at U3O8. In April, nuclear powers within the Group of Seven (G7) nations pledged to end Russia’s dominance over global atomic fuel markets.7 One key bottleneck in Western conversion capacity is the reopening of ConverDyn in the U.S. ConverDyn shut down in 2017, mostly because of Russian competition, and the planned reopening this year is taking longer and costing more than anticipated, and is slated to start with half of its former capacity.

Figure 1. Physical Uranium & Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (4/30/2018-4/30/2023)

Source: Bloomberg and Sprott Asset Management. Data as of 04/30/2023. Gold is measured by GOLDS Comdty Spot Price; S&P 500 TR is measured by the SPX; Uranium miners measured by the Northshore Global Uranium Mining Index (URNMX index); BCOM is the Bloomberg Commodity Index; US Agg Bond Index is measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD (LBUSTRUU Index); the U.S. Dollar is measured by DXY Curncy and the U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from TradeTech LLC. Included for illustrative purposes only. Past performance is no guarantee of future results.

Macro Headwinds Impact Uranium Miners

Uranium mining equities, in contrast to physical uranium, fell 0.69% in April and are off 2.34% year-to-date, buoyed by January’s stellar performance. Like physical uranium, uranium mining equities have had notable long-term results, having gained a cumulative 122.67% for the five years ending April 30, 2023.

April saw continued fallout from the banking crisis, which negatively impacted equity markets. Economic slowdown, recession fears, and poor liquidity and trading volumes exerted additional pressure. This tough macro environment has been especially difficult for lower-liquidity assets, such as small-capitalization equities. As a result, smaller-cap equities generally underperformed their larger-cap counterparts in April and year-to-date. This dynamic played out among uranium miners, with Cameco Corporation gaining on the month and NAC Kazatomprom JSC (Kazatomprom) performing relatively better than junior uranium miners. Tough market conditions tend to impact junior uranium miners more significantly, given their lower levels of liquidity and higher volatility. These qualities, however, give junior miners the potential for greater upside in uranium bull markets. Despite the selling pressure in April, junior uranium miners continued to make progress with production restarts, uranium contracting with utilities and exploration programs.

Uranium Contracting Success Continues

Cameco, the largest publicly listed uranium producer by market capitalization, has had tremendous contracting success recently. In 2022, there were approximately 114 million pounds of total long-term contracts per UxC, and we believe this figure is understated given that Cameco alone accounted for 80 million pounds

In April, Cameco announced it had extended its long-term exclusive nuclear fuel supply arrangement with Bruce Power (Canada’s only private-sector nuclear generator) for an additional 10 years to 2040. The agreement is estimated to represent an additional $2.8 billion in business. Cameco also finalized its agreement with Energoatam, Ukraine's state-owned nuclear energy utility, to provide all of Ukraine’s nuclear fuel needs from 2024 to 2036, estimated at 40-67 million pounds of U3O8 equivalent. Finally, Cameco signed a 10-year supply contract with Westinghouse Electric Company to support Bulgaria’s UF6 needs. Nuclear power accounts for more than 30% of Bulgaria’s electricity supply, and with this agreement, Cameco will deliver an estimated 2.2 million KgU as UF6 (or 5.7 million pounds U3O8 equivalent).

We believe the uranium price has considerable upside potential, which should support uranium miners. The uranium price will likely be supported by low available-for-sale uranium inventories, the tight supply discussed earlier and the considerable supply already earmarked for future contract deliveries (as displayed by Cameco).

Figure 2. The Uranium Fuel Cycle

Source: Sprott Asset Management.

Nuclear Energy is Crucial to the Energy Transition

The performance of uranium miners in April did not reflect the sector’s increasingly bullish fundamentals. Looking beyond the short-term performance, we believe the uranium bull market still has a long way to run. We believe conversion and enrichment services price increases will likely cascade to the uranium spot price and support uranium miners. The imminent restart of the Converdyn conversion facility may likely play a key role in the West’s transition away from Russian suppliers. Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market.

Nuclear energy and uranium’s critical role in energy security may likely be paramount going forward. Russia’s invasion of Ukraine sparked a global energy crisis that forced many countries to reimagine their energy supply chains. In past years, Western countries’ energy policies have predominantly favored renewable energy to reduce reliance on fossil fuels. However, renewables often suffer from intermittency and low capacity and require offsets with baseload energy sources, such as coal, natural gas or nuclear power plants. Of these, nuclear power has the highest baseload capacity. We believe ongoing supply chain risks may likely cause utilities to seek out the base load reliability of nuclear power.

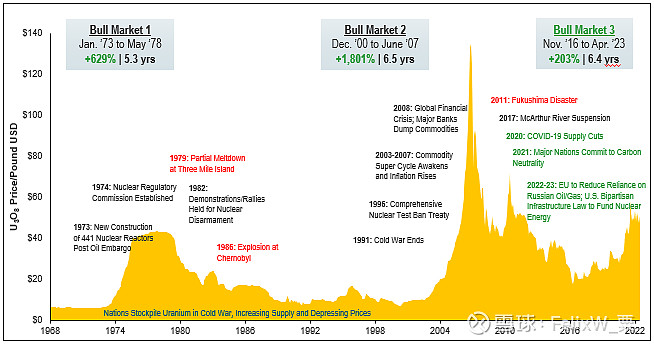

We believe the uranium bull market remains intact despite the uncertain macroeconomic environment. There has been an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are likely to create incremental demand for uranium. However, the current uranium price still remains below incentive levels to restart tier 2 production, let alone greenfield development.

Figure 3. Uranium Bull Market Continues (1968-2023)

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 4/30/2023.

#今日话题# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$