摘要:

虽然上周召开了一个全球性的天然铀行业峰会,天然铀市场的活动仍然低迷。

- 天然铀现货市场仍停滞不前。

- 天然铀行业峰会再次强调天然铀供应的紧迫性

- 七国集团成员国联合起来反对普京

Nuclear market participants gathered in The Hague last week for the World Nuclear Fuel Cycle 2023 conference at which speakers considered how the nuclear fuel markets will respond to a market transition that will move away from the oversupply seen in recent years.

A panel discussion, which focused on industry responses to today’s market dynamics, found agreement among presenters that decisions to increase capacity in the front end of the fuel cycle will need to be made soon, industry consultant TradeTech reports.

While the conference brought buyers and sellers together, these global conferences typically stymie market activity with participants away from their desks. That said, activity in the spot market has remained limited for some time amid general financial market volatility.

The spot market has seen few formal on-market transactions in recent weeks. One transaction was completed in the spot market last week at the currently reported price level. Although market activity remains limited, TradeTech reports both buyers and sellers did verbally express an increased interest in initiating discussion around potential transactions in the coming weeks.

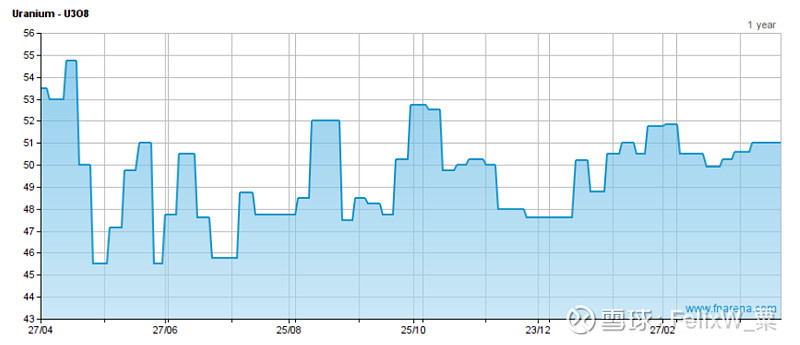

TradeTech’s weekly spot price indicator rose US25c to US$51.25/lb.

Despite a largely inactive spot market in recent weeks, buying interest remains high in the term uranium market. Several utilities are currently evaluating both formal and off-market offers for delivery of uranium in the mid- and long-term delivery windows.

TradeTech’s term price indicators remain at US$51.50/lb (mid) and US$53.00/lb (long term).

Geeing up the market

Five of the G7 nations — Canada, France, Japan, the UK, and the US – last week announced an alliance to develop shared supply chains for nuclear power. According to the UK government, the new agreement seeks to “displace Putin from the international nuclear energy market”.

The alliance was formed on April 16 as part of the two-day Nuclear Energy Forum held alongside G7 meetings in Sapporo, Japan.

According to a joint statement from the five countries, they have “identified potential areas of collaboration on nuclear fuels to support the stable supply of fuels for the operating reactor fleets of today, enable the development and deployment of fuels for the advanced reactors of tomorrow, and achieve reduced dependence on Russian supply chains.”

Sanctions

TradeTech further reports that as the European Commission works on an eleventh sanctions package against Russia since its invasion of Ukraine, some EU member states support targeting the country’s nuclear industry.

EU ambassadors have met with the EC in closed-door briefings to discuss details of the next round of sanctions. The next package will focus on combating the circumvention of existing restrictions, particularly for spare parts and equipment Moscow deploys on the battlefield.

Poland and the Baltic States last week reportedly presented an updated proposal to the EC for a new set of sanctions against Russia, but Hungary has previously stated its intention to block any sanctions related to nuclear power as it has a contract with Russia to build and finance a two-unit expansion of its Paks Nuclear Power Plant.

#今日话题# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$