摘要:

上周天然铀现货市场没有交易的报告,但天然铀长贸市场依然活跃。

- 天然铀现货市场停顿中

- 天然铀长贸市场依然活跃

- 加拿大支持乌克兰发展核电

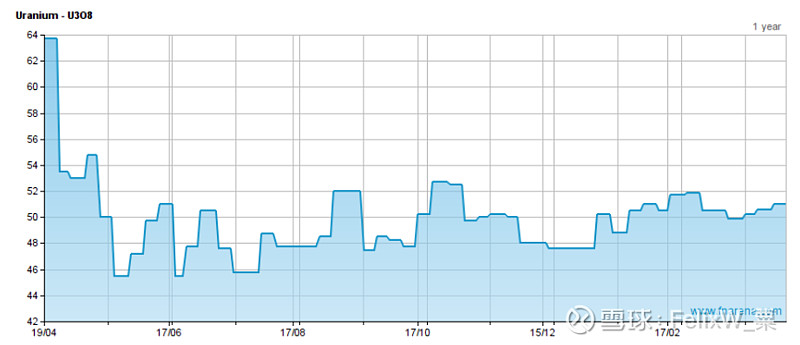

The uranium spot market took a break for Easter but has not since returned. There were no on-market transactions reported last week, while off-market transactions were concluded at the current price.

Industry consultant TradeTech’s weekly spot price indicator is unchanged at US$51.00/lb.

Market participants will gather this week for the annual World Nuclear Fuel Cycle conference in The Hague, where it is expected the stalemate will be broken as buyers and sellers meet face to face.

The market typically goes quiet during such week-long meetings.

While the spot uranium market has been largely inactive in recent weeks, the term uranium market remains quite active, TradeTech reports, as a number of utilities evaluate formal and off-market offers for delivery of uranium in the mid- and long-term delivery windows.

Several buyers are considering purchases that involve mid-term delivery or a combination of mid- and long-term deliveries. Additionally, buyers are considering purchases of uranium contained in a variety of forms — U3O8, UF6, or enriched uranium product (EUP).

TradeTech’s term price indicators remain at US$51.50/lb (mid) and US$53.00/lb (long).

Five Eyes

The “Five Finance Ministers”, being the ministers of the Five Eyes group of the US, Canada, the UK, Australia and New Zealand, met last week to discuss “how best to collectively respond to economic coercion, including how we can work to make our economies more resilient by building our critical supply chains through each other’s economies, and those of trusted partners around the world”.

While there remains no chance of either Australia or New Zealand embracing nuclear power, Australia is a major exporter of uranium. For the uranium market, the meeting underscores the ongoing concern of market participants around a variety of considerations that have the potential to disrupt market deliveries.

Transportation logistics, banking and counterparty risks, and pending legislation in the US are just some of the issues that buyers and sellers in the uranium market are monitoring, TradeTech notes.

Demand-Supply

Canada’s Cameco and Ukraine’s state nuclear entity Energoatom have signed the last agreement needed for the implementation of a program to export all of Ukraine’s uranium production for processing in Canada, to then produce fuel for Ukraine’s nuclear power plants.

A bilateral agreement outlined earlier this year calls for Cameco to meet 100% of Energoatom’s need for natural UF6 from 2024 to 2035 for nine nuclear reactors in Ukraine, not counting the biggest one at this stage (Zaporizhzhia).

Meanwhile, Kazakhstan’s Kazatomprom has delivered uranium to NATO member Romania’s state-owned reactor under an agreement reached last December.

India’s Minister of State confirmed last week the country’s nuclear capacity will increase from 6,780 MWe today to 22,480 MWe by 2031 “on progressive completion of projects under construction and accorded sanction,” and the government has given “in principle” approval for new sites for future reactors.

Also, Germany's final three nuclear power plants closed their doors last week, marking the end of the country's nuclear era that has spanned more than six decades. Nuclear power has long been contentious in Germany.

#碳中和# #核电概念股# #碳中和# $中广核矿业(01164)$ $Cameco Corp(CCJ)$ $铀矿ETF-Global X(URA)$